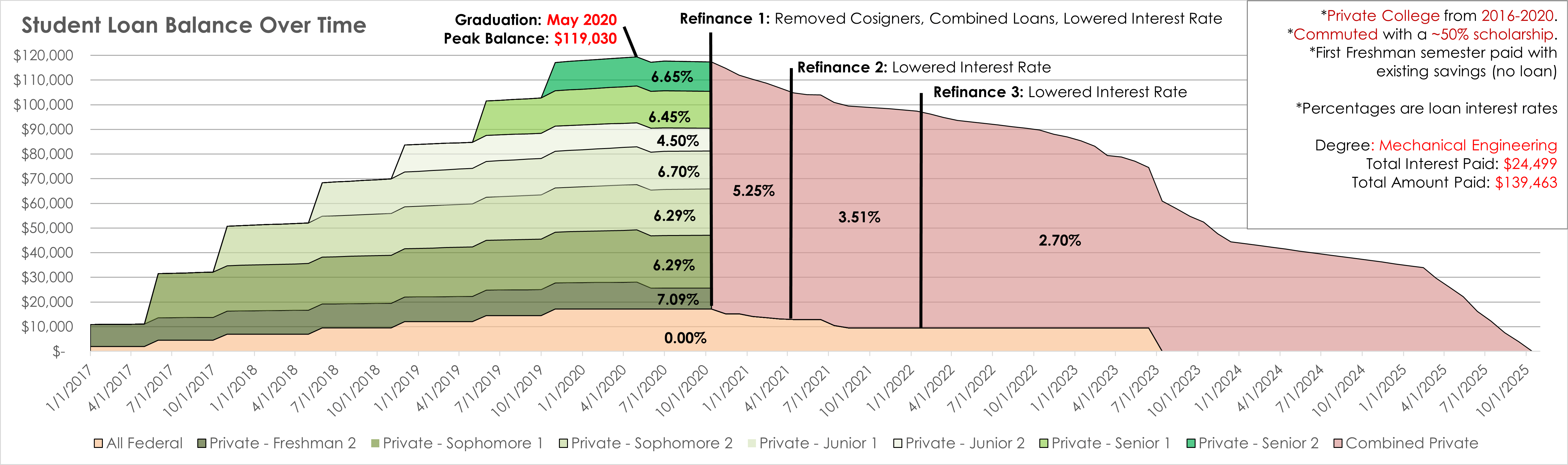

Source: My personal student loan balance during and after college. Created using excel. Finally paid off the last of it this week. Some more info below, feel free to ask any questions.

FEDERAL LOANS: All my federal loans are shown as one for clarity. They were frozen until graduation, then were frozen again because of Covid. I paid off most of them as a lump sum right before they were about to unfreeze.

PRIVATE COLLEGE?: The state schools near me were out of commuting range and gave me almost no aid, making the costs comparable to the private school I chose. Commuting was difficult but the school is a well known prestigious engineering school. I did feel out of place as most of my classmates were upper class and had their parents money to spend.

HOW?: At the end of 2022 I moved back in with my parents after a breakup. I pay them cheap rent ($500). I job hopped, got promoted, and have worked heavy overtime to double my salary since. I was/am extremely strict with my spending and lived like a hermit.

WORTH IT?: I don't regret it but can't say I'm happy I paid that much. I have a great income and am in a good financial place now, but I truly feel like I threw away the last few years to pay off the loan, at the expense of everything else in my life.

Oh and I still get mail from the school asking for "donations" 😂

Posted by DiabolicDiabetik

![[OC] My Student Loan Balance Over Time](https://www.europesays.com/wp-content/uploads/2025/10/15dyehjafjtf1-1920x1024.png)

24 comments

Required comment (same info as post description):

Source: My personal student loan balance during and after college. Created using excel. Finally paid off the last of it this week. Some more info below, feel free to ask any questions.

FEDERAL LOANS: All my federal loans are shown as one for clarity. They were frozen until graduation, then were frozen again because of Covid. I paid off most of them as a lump sum right before they were about to unfreeze.

PRIVATE COLLEGE?: The state schools near me were out of commuting range and gave me almost no aid, making the costs comparable to the private school I chose. Commuting was difficult but the school is a well known prestigious engineering school. I did feel out of place as most of my classmates were upper class and had their parents money to spend.

HOW?: At the end of 2022 I moved back in with my parents after a breakup. I pay them cheap rent ($500). I job hopped, got promoted, and have worked heavy overtime to double my salary since. I was/am extremely strict with my spending and lived like a hermit.

WORTH IT?: I don’t regret it but can’t say I’m happy I paid that much. I have a great income and am in a good financial place now, but I truly feel like I threw away the last few years to pay off the loan, at the expense of everything else in my life.

Oh and I still get mail from the school asking for “donations” 😂

Out of curiosity, why so many private loans? Were more Federal loans not available because of family income or something?

Granted this was a while before you went to college, but I managed to have ~50% of the undergrad and 100% of the grad (after applicable scholarships) paid for from unsubsidized federal loans. I don’t think it changed much in the end, except it made refinancing a much harder decision.

That said, $25k in interest is really not that bad. Very well done!

Great chart. And congratulations on paying off the loans 👏

Shouldn’t you have had a 0% interest for much of that time?

Good job. My undergrad loans 10 years ago were around $15k….I started paying double what they wanted each month to keep interest at bay and didn’t need anything else major at the time. Then I went to grad school from 2019-2021

My total loans ballooned to over $50k but covid hitting meant loans were frozen for the next few years. By then my wife and I saved some every month just for this….and in 2023 I did a one time lump sum to pay off all $50k at once right before loan repayments were about to really start.

It felt great, but in hindsight I wish I did a few things differently and didn’t have the loans.

Man, student loan interest rates are usurious. Congratulations on your hard work in a bad system.

Any tips for recreating this spreadsheet? Did you grab a template from someplace or make this from scratch? Very impressive and congrats

Do you factor in the cost of refinancing?

$119,000 in 5 years. $320/month (not including any interest escalation).

You absolutely rock OP!

OP, very pretty xls chart. Would love to grab the xls file if you don’t mind DMing it to me. Thanks and congratulations!

Lol the ghost of donation mails will never fail to catch you anywhere, anytime. Emails, mailers and phone calls!

ME BS here too. Great job on paying that shit off so quick. Impressive. I graduated in ‘05 from Oregon State with about 30k of debt (all federal) and took like 10 years to pay that off haha! But I wasn’t diligent at all.

Man this is awesome. I’m working on doing something similar for all my debts right now. Got a 5-6 year plan that would have me debt free and in a really nice spot. Goal is to then buy some land in cash a couple years after and build our dream home on it, funding a substantial amount of it by selling/renting our current house.

5 years is a long time to build up unexpected expenses… but I’m hoping to minimize as much as possible while not feeling like we are living like hermits 😂

You’re telling me this school costs $240k for a 4 year degree and that doesn’t include room and board because you commuted?

Congrats for paying the loans off, genuinely. But do you think it really helped your lifetime earnings to go to that school vs any other public state school where an engineering degree may cost less than half of that?

I’d love to see a ‘total spent’ over the course of all this.

Wait, not love, but… grimace

Ok, what bank/lending org did you use to refinance cause I’m still at 6.7% w/ over $180k left to pay (dental school)….

Paying rent to your parents is wild… Is that common in America?

So that’s what they mean by a mountain of debt

Did you go to BU by chance?

Great work. I’m in the same boat and it’s nice to hear that your hard work paid off.

holy crap man how much money do you make rn

120k of loans when you commuted and had a 50% scholarship is CRAZY to me 😭😭 but bravo for paying it all off 👏🏻👏🏻 and go live a little! Stop being a hermit! Don’t need to spend a lot, but let yourself enjoy time with friends, hobbies, seeing what your area has to offers

That’s an amazing achievement in that time frame. Well done on your sacrifice. Take some of that freed income to live and adventure while you’re still young, it’s not all about the money.

Very, very nice job with this chart! And congrats – looks like you’re crushing it financially.

Comments are closed.