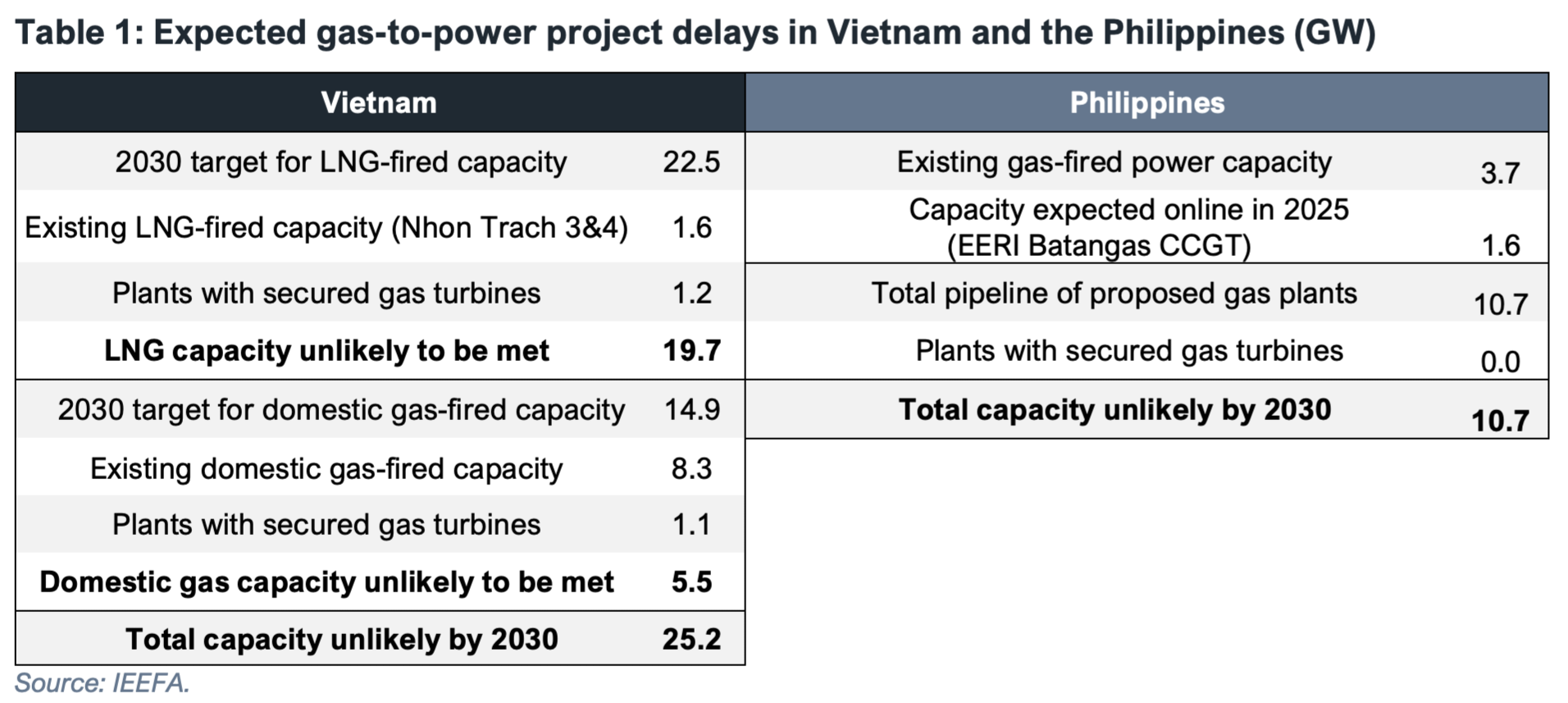

Plans to build significant new gas-fired power capacity in the Philippines and Vietnam are running headfirst into a global gas turbine shortage, likely extending multi-year project delays and putting both countries off-track to meet gas-to-power development targets.

Existing gas projects in Vietnam and the Philippines have relied exclusively on turbines from Siemens Energy, Mitsubishi Heavy Industries (MHI), and GE Vernova — the world’s three largest gas turbine manufacturers that together have accounted for roughly 90% of the global market over the last decade. Despite recent announcements to boost manufacturing capacity1, all three companies are currently reporting extensive backlogs and delivery timelines of up to eight years.

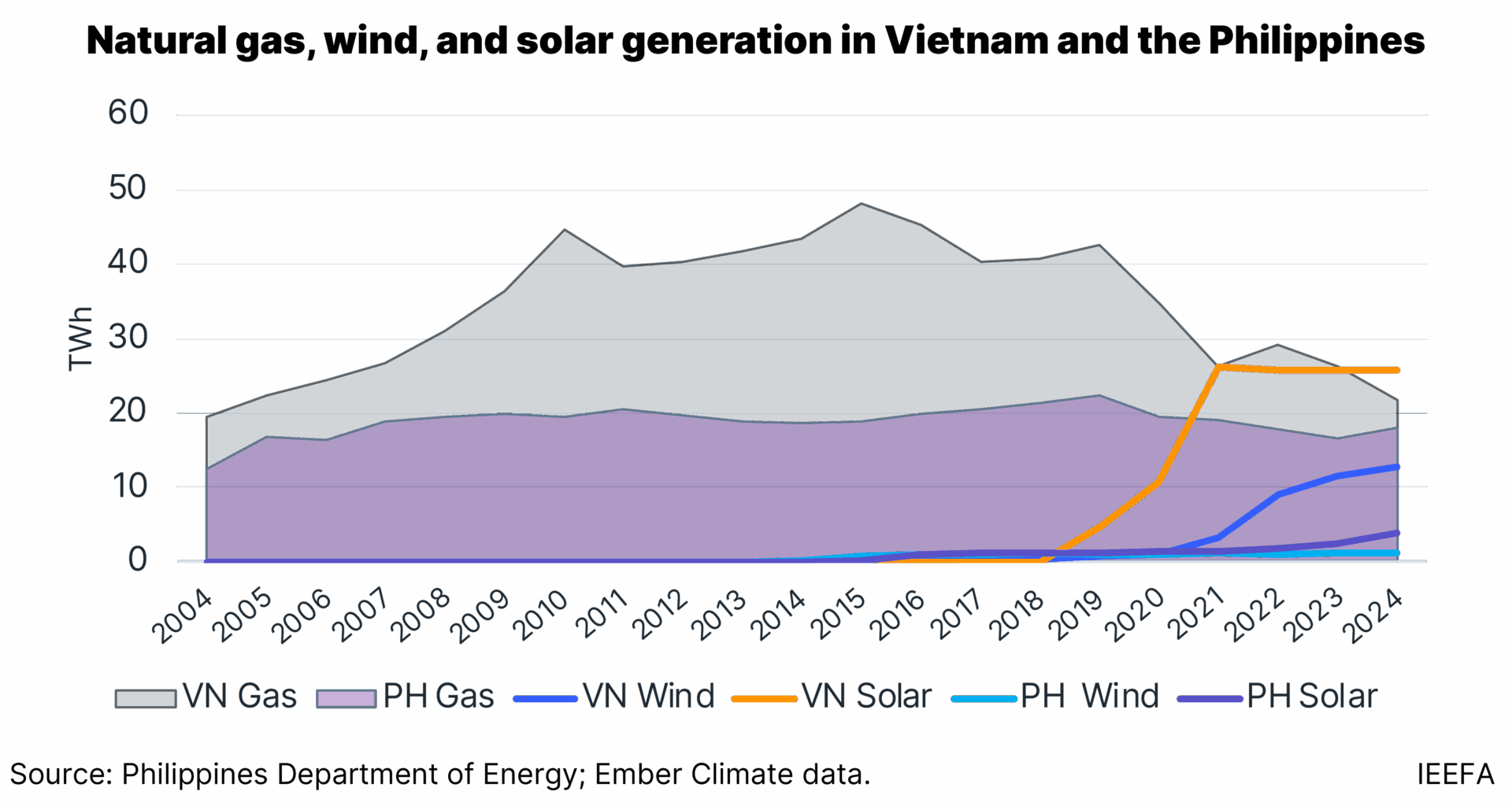

Ongoing shortages are frequently discussed in a Western context, with little coverage of the implications for emerging Asian economies. However, for the 35.9 gigawatts (GW) of gas projects still in early development stages in Vietnam and the Philippines (Table 1), turbine backlogs will likely increase project costs, and add to an already lengthy list of regulatory, legal, and financial challenges facing gas-to-power project developers. The Institute for Energy Economics and Financial Analysis (IEEFA) expects that no new liquefied natural gas (LNG) fired power plants will come online in the Philippines this decade. While two projects in Vietnam have likely secured turbines, they still lack key contracts necessary for financial close.

1 Bloomberg. Mitsubishi Heavy to Double Turbine Capacity as Demand Soars. 31 August 2025.