Dollar firmed modestly as markets transitioned into early US session. Despite the resilience, it remain skeptical whether the greenback could stage a breakout. While Dollar continues to outperform the struggling Yen, its strength against other currencies is refrained. Against Loonie, the greenback is losing traction as oil prices stabilize. Similarly, Dollar remains range-bound versus Euro Sterling, and Swiss Franc, indicating a lack of fresh catalysts.

A lineup of Fed officials is due to speak later today, including Governors Michelle Bowman and Stephen Miran, who are expected to strike a dovish tone. However, given the elevated uncertainty surrounding growth, tariffs, and fiscal disruptions, other policymakers are unlikely to offer any clear signal on the timing of the next rate cut.

The U.S. government shutdown has entered its seventh day, with Senate Republicans again failing to advance a funding bill. The standoff requires at least eight Democratic votes to clear the procedural hurdle, but negotiations remain deadlocked. The White House has toughened its rhetoric. NEC Director Kevin Hassett said President Donald Trump may soon “take sharp measures” if Congress continues to block funding, warning that extended shutdown could lead to large-scale government layoffs.

Focus is now turning to New Zealand, where the RBNZ meets early Wednesday. A rate cut is fully priced in, but the size is uncertain. Weak domestic data and subdued business confidence have kept pressure on policymakers to act decisively to restore momentum.

A majority of economists surveyed by Bloomberg (15 of 25) anticipate a 25bps cut to 2.75%, while the rest forecast a 50bps reduction to 2.50%. Given the Q2 GDP contraction, some analysts believe the MPC could opt for a larger move to front-load easing. With uncertainty high and a number of possible outcomes, Kiwi is set for heightened volatility.

For the week so far, Dollar is staying on the top of the performance ladder, followed by Loonie, and then Aussie. Yen is sitting at the bottom, followed by Euro, and then Sterling. Swiss Franc and Kiwi are positioning in the middle.

In Europe, at the time of writing, FTSE is up 0.23%. DAX is up 0.13%. CAC is up 0.21%. UK 10-year yield is up 0.007 at 4.748. Germany 10-year yield is up 0.013 at 2.736. Earlier in Asia, Nikkei rose 0.01%. Hong Kong and China were on holidays. Singapore Strait Times rose 1.14%. Japan 10-year JGB yield rose 0.001 to 1.681.

Australia Westpac consumer sentiment slumps to firmly pessimistic level, RBA November cut not assured

Australian consumer sentiment dropped -3.5% mom to 92.1 in October, according to the Westpac-Melbourne Institute survey, erasing all gains seen between May and August when rate cuts briefly lifted confidence. The index has returned to “firmly pessimistic” territory, signaling renewed caution among households.

Westpac said consumers were unsettled by recent inflation updates, with partial indicators suggesting annual price growth has edged back toward the top of the RBA’s 2–3% target range. Signs of stronger consumer demand and a reviving housing market have also stoked speculation that the RBA may not ease policy as quickly as previously expected.

With the RBA meeting scheduled for November 3–4, Westpac noted that a rate cut is “far from assured, though not off the table.” The bank added that the longer the RBA holds off on further easing, the greater the likelihood of deeper cuts later.

NZIER sees two more RBNZ cuts despite signs of inflation pick-up

The New Zealand Institute of Economic Research maintained its forecast for two additional 25bps cuts by the RBNZ at the October and November meetings, despite a mild uptick in inflation pressures during Q3.

In its latest Quarterly Survey of Business Opinion (QSBO), NZIER said a net 11% of firms raised prices, compared with 1% reporting price cuts in the previous quarter, suggesting that cost pressures are firming again. NZIER expects annual CPI inflation to rise slightly above 3% in the near term but sees it drifting back toward the 2% midpoint of the RBNZ’s target range as excess capacity continues to weigh on domestic demand.

Business sentiment, however, softened, with 15% of firms expecting economic improvement, down from 26% in Q2, while 14% reported weaker trading activity in their own businesses. The survey also pointed to declining hiring and investment intentions, as 23% of firms cut staff and a majority plan to reduce capital spending over the coming year.

The mixed picture—firmer inflation but softer demand—supports NZIER’s view that the RBNZ will deliver further easing to stabilize growth, even as it remains alert to temporary inflation volatility.

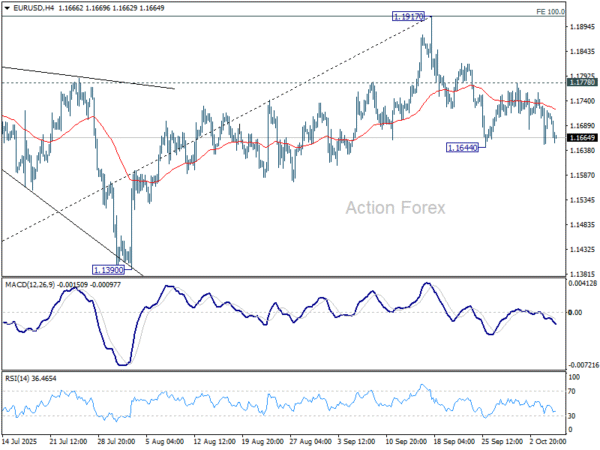

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1668; (P) 1.1699; (R1) 1.1747; More…

EUR/USD is still holding in range above 1.1644 and intraday bias remains neutral. Further decline is mildly in favor as long as 1.1778 resistance holds. On the downside, break of 1.1644 and sustained trading below 55 D EMA (now at 1.1679) will indicate medium term topping at 1.1917, on bearish divergence condition in D MACD. Further fall should then be seen to 1.1390 support. Nevertheless, break of 1.1778 resistance will retain near term bullishness and bring retest of 1.1917 high instead.

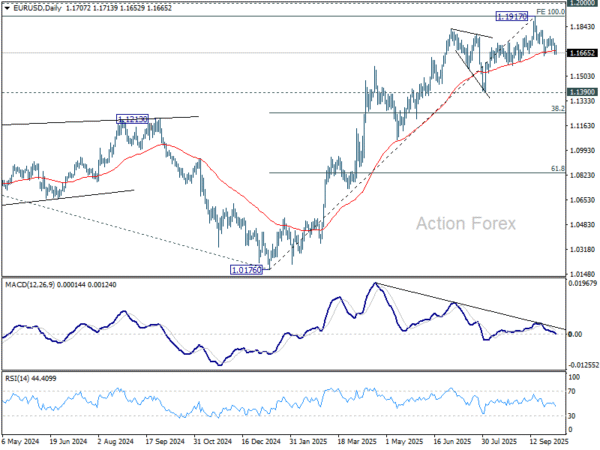

In the bigger picture, rise from 1.0176 (2025 low) is seen as the third leg of the pattern from 0.9534 (2022 low). 100% projection of 0.9534 to 1.1274 from 1.0176 at 1.1916 was already met. For now, further rally will remain in favor as long as 1.1390 support holds, and firm break of 1.2000 psychological level will carry larger bullish implications. However, firm break of 1.1390 will suggest that rise from 1.0176 has already completed and bring deeper fall to 55 W EMA (now at 1.1265).