These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Discover why before your portfolio feels the trade war pinch.

Seagate Technology Holdings Investment Narrative Recap

To consider Seagate Technology Holdings as a potential investment, you need to believe in the sustained growth of mass capacity storage demand, especially as cloud and AI infrastructure expand. The recent analyst upgrades and higher earnings forecasts underscore momentum from breakthrough HAMR technology, which may continue to fuel earnings growth in the near term. While these upgrades strengthen confidence in Seagate’s market position, the primary risk remains competitive pressure from alternative storage technologies, which could still impact margins if adoption rates shift rapidly.

Of Seagate’s announcements, its July launch of the 30TB Exos M and IronWolf Pro drives stands out. This directly connects to analyst optimism as these HAMR-based products target hyperscale and enterprise customers, aligning with investor expectations that growth in data-centric demand will be a catalyst for the company’s revenue and earnings trajectory.

By contrast, investors should also consider the risks if competing storage solutions begin gaining share more quickly than expected, as this is information that…

Read the full narrative on Seagate Technology Holdings (it’s free!)

Seagate Technology Holdings’ narrative projects $12.0 billion revenue and $2.5 billion earnings by 2028. This requires 9.5% yearly revenue growth and a $1.0 billion earnings increase from $1.5 billion today.

Uncover how Seagate Technology Holdings’ forecasts yield a $192.00 fair value, a 15% downside to its current price.

Exploring Other Perspectives

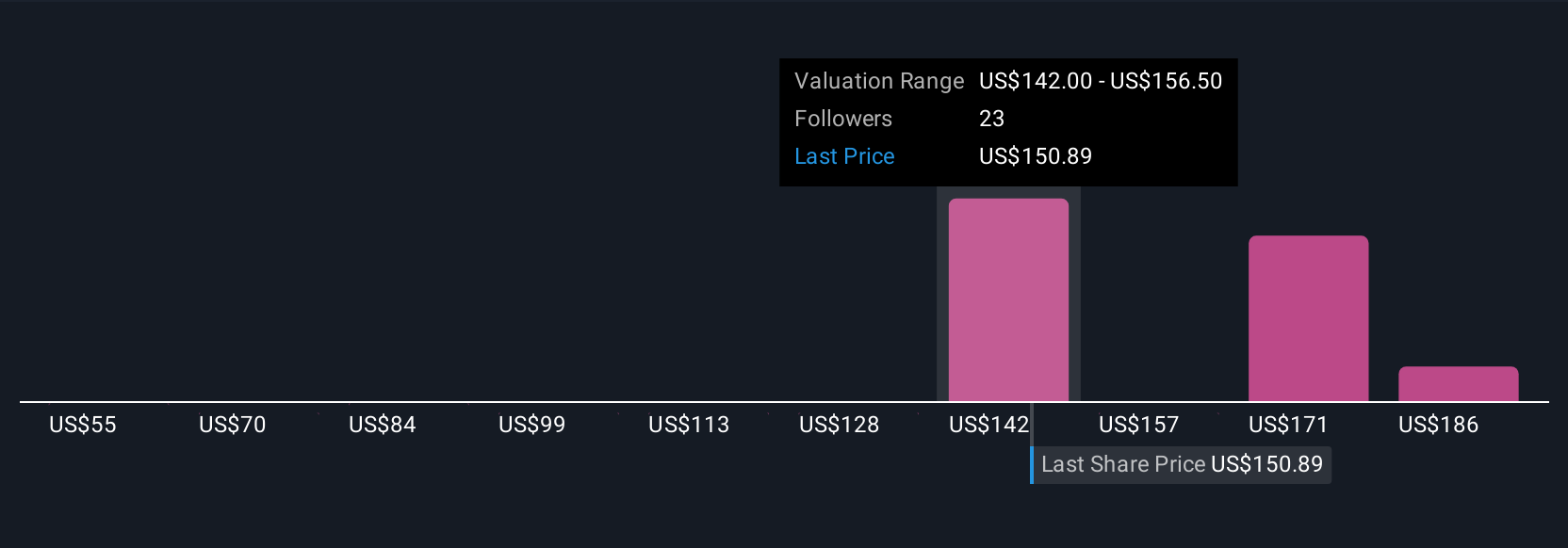

Five members of the Simply Wall St Community submitted fair value targets for Seagate, spanning from US$55 to US$231.77 per share. While enthusiasm around HAMR technology drives forecasts higher in some analyses, others caution that ongoing competition from SSDs remains a key factor shaping future performance.

Explore 5 other fair value estimates on Seagate Technology Holdings – why the stock might be worth less than half the current price!

Build Your Own Seagate Technology Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com