Report Overview

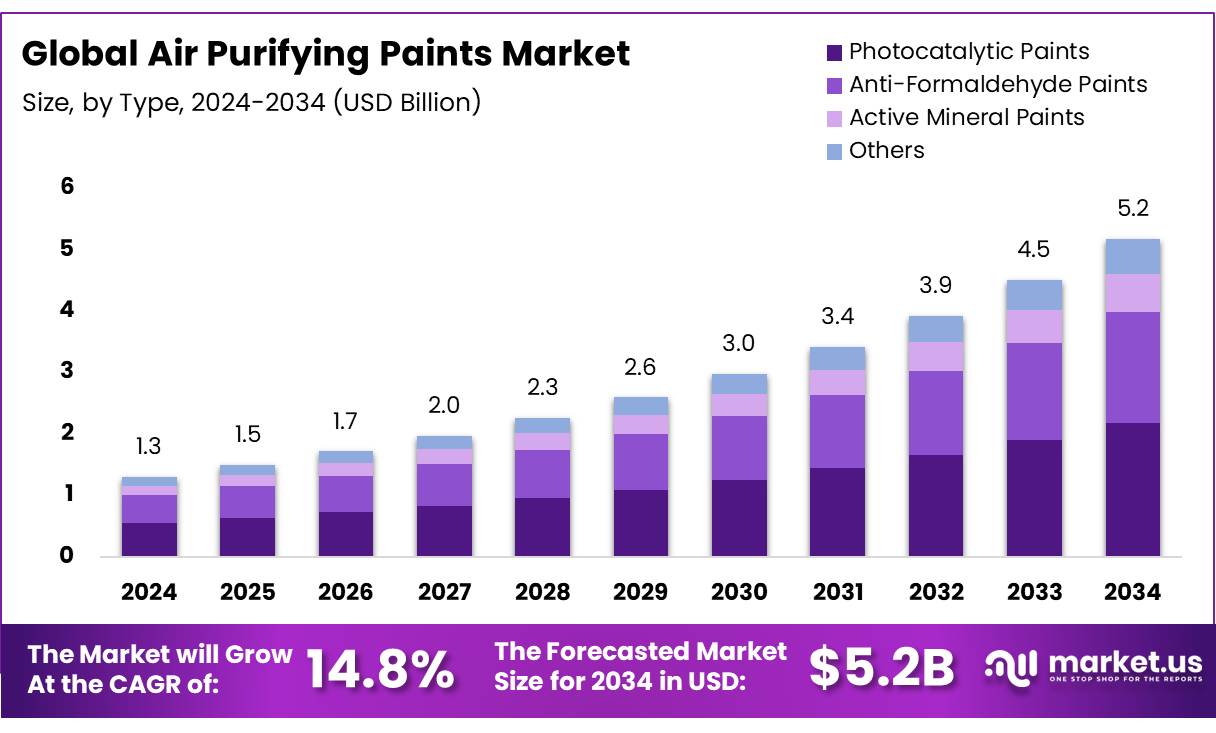

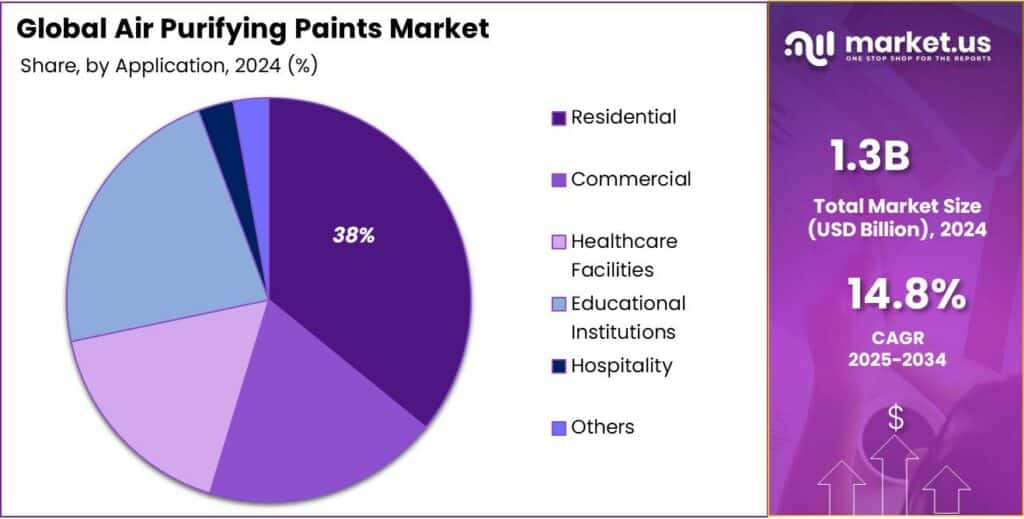

The Global Air Purifying Paints Market size is expected to be worth around USD 5.2 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 14.8% during the forecast period from 2025 to 2034.

Air-purifying paints are functional coatings formulated to reduce airborne contaminants through mechanisms such as adsorption, chemical neutralization and photocatalytic oxidation; titanium dioxide (TiO₂)-based photocatalytic systems are the most widely studied, being able to oxidize nitrogen oxides (NOx) and volatile organic compounds (VOCs) under ultraviolet irradiation.

The development of these coatings has been driven by the intersection of indoor-air quality concerns and demand for low-emission building materials; ambient outdoor air pollution alone was estimated to cause 4.2 million premature deaths worldwide in 2019, while the combined burden of ambient and household air pollution has been associated with approximately 7 million premature deaths annually.

The industrial scenario is characterised by a convergence of regulatory pressure, construction sector activity and materials innovation. Building operations accounted for roughly 30% of global final energy consumption and about 26% of energy-related CO₂ emissions in recent IEA assessments, which has focused policymaker and industry attention on healthier, lower-emission building envelopes and interior materials.

In the United States, the Environmental Protection Agency (EPA) has allocated $117.5 million for air pollution monitoring under the Inflation Reduction Act, supporting community monitoring and expanding Tribal monitoring capacity. Additionally, the Clean Air Act facilitates partnerships among federal, state, local, and tribal governments to implement programs that reduce pollution, including the use of innovative materials like air purifying paints.

Key Takeaways

Air Purifying Paints Market size is expected to be worth around USD 5.2 Billion by 2034, from USD 1.3 Billion in 2024, growing at a CAGR of 14.8%.

Photocatalytic Paints held a dominant market position, capturing more than a 42.1% share.

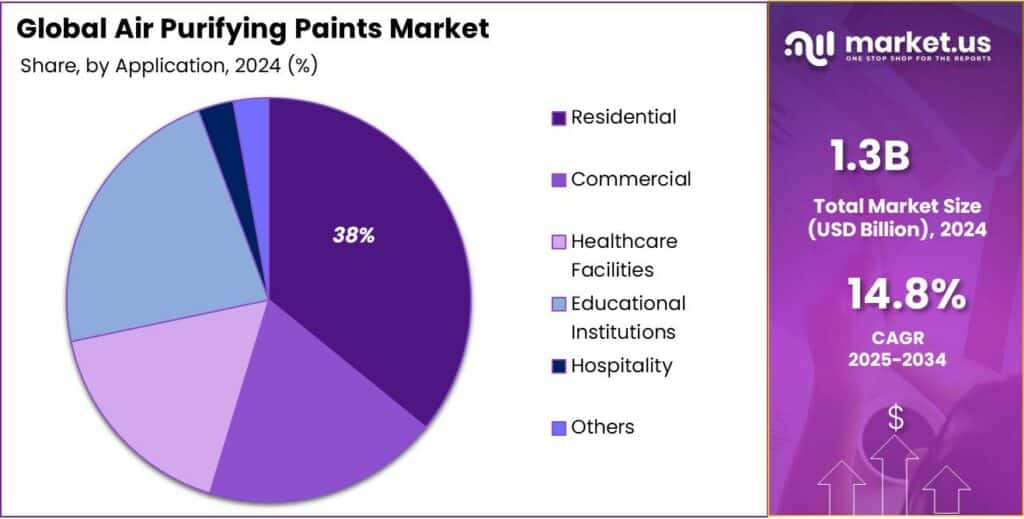

Residential applications held a dominant market position, capturing more than a 38.2% share.

Offline channels held a dominant market position, capturing more than a 73.5% share of the global air purifying paints market.

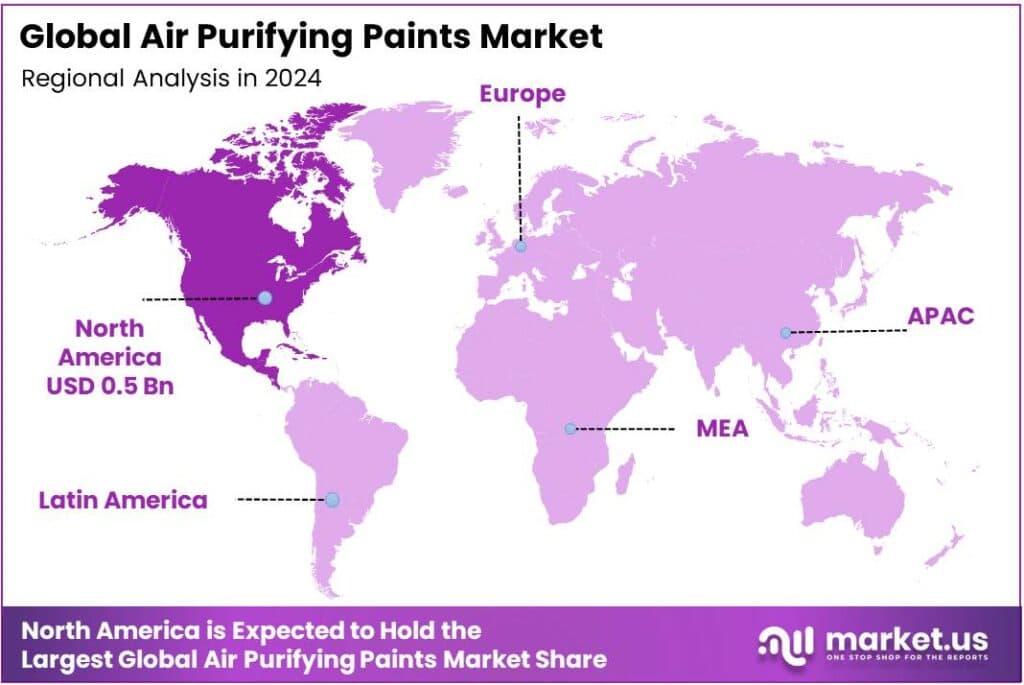

North America held a dominant position in the global air purifying paints market, capturing more than a 45.9% share, translating to approximately USD 0.5 billion.

By Type Analysis

Photocatalytic Paints dominated with 42.1% in 2024 owing to proven pollutant-removal performance and growing specification in public-sector projects.

In 2024, Photocatalytic Paints held a dominant market position, capturing more than a 42.1% share. This leadership can be attributed to the technology’s demonstrated ability to degrade nitrogen oxides and volatile organic compounds under ambient conditions, which has driven specification in institutional and commercial refurbishments. Adoption was favoured where long-term indoor air quality improvement was required, notably in healthcare, education and transportation hubs, as procurement guidelines and building owners prioritized passive, low-maintenance IAQ interventions.

The industrial scenario has been characterized by incremental formulation improvements and expanded product availability from established coatings manufacturers. Photocatalytic systems were increasingly formulated for standard application processes, enabling easier integration into renovation programmes and new builds. Performance assurances and longer durability under real-world lighting conditions were emphasized by suppliers, which supported uptake by specifiers seeking reliable, maintainable solutions rather than short-term laboratory claims.

By Application Analysis

Residential segment dominates with 38.2% in 2024 driven by rising indoor air quality awareness and sustainable home improvement trends.

In 2024, Residential applications held a dominant market position, capturing more than a 38.2% share of the global air purifying paints market. The growth in this segment was primarily driven by increasing consumer awareness regarding indoor air pollution and its health effects, especially in urban regions where households experience higher exposure to volatile organic compounds (VOCs) and fine particulates. Homeowners were increasingly turning toward low-VOC and self-cleaning paints to maintain cleaner indoor environments, reduce odors, and mitigate harmful emissions.

Government initiatives promoting healthier living spaces and energy-efficient housing further encouraged adoption in residential construction and renovation projects. Incentives and green-building certifications such as LEED and BREEAM incorporated indoor air quality as a critical performance measure, prompting developers and consumers to prefer air-purifying coatings. The post-pandemic focus on home health and sustainability also strengthened consumer preference for eco-friendly paint solutions with long-term air purification benefits.

By Distribution Channel Analysis

Offline distribution dominates with 73.5% in 2024 owing to strong retail presence and consumer preference for in-person product selection.

In 2024, Offline channels held a dominant market position, capturing more than a 73.5% share of the global air purifying paints market. The dominance of this segment was primarily supported by the extensive network of retail outlets, hardware stores, and specialty paint shops that continue to be the preferred purchasing points for both residential consumers and professional contractors. Buyers in this category often rely on physical inspection of color, texture, and finish quality before making purchase decisions, which has sustained the strength of brick-and-mortar sales.

The offline segment also benefited from strong partnerships between paint manufacturers and authorized distributors, allowing for better product demonstrations, expert consultation, and trust-based purchasing — factors that remain critical in the coatings industry. Paint professionals and contractors prefer established offline distribution due to bulk availability, timely delivery, and after-sales service, particularly in renovation and large-scale construction projects.

Key Market Segments

By Type

Photocatalytic Paints

Anti-Formaldehyde Paints

Active Mineral Paints

Others

By Application

Residential

Commercial

Healthcare Facilities

Educational Institutions

Hospitality

Others

By Distribution Channel

Emerging Trends

Integration of Smart Technologies in Air Purifying Paints

A notable advancement in the air purifying paints sector is the integration of smart technologies aimed at enhancing the functionality and efficiency of these products. Manufacturers are increasingly adopting innovations such as nanotechnology, photocatalytic materials, and self-cleaning properties to improve the performance of air purifying paints. These technologies enable the paints to actively neutralize pollutants like volatile organic compounds (VOCs), nitrogen oxides (NOₓ), and particulate matter, thereby contributing to healthier indoor air quality.

The adoption of these advanced technologies is driven by growing consumer awareness of indoor air quality and the health risks associated with exposure to pollutants. As a result, there is an increasing demand for building materials that not only meet aesthetic and functional requirements but also contribute to the purification of indoor air. This trend aligns with broader global efforts to promote sustainability and reduce the environmental impact of construction materials.

Governments and environmental organizations are also recognizing the importance of improving indoor air quality. For instance, the U.S. Environmental Protection Agency (EPA) has announced grants and funding opportunities for projects and programs related to air quality, including indoor air initiatives. These grants support efforts to develop and implement strategies that enhance air quality in various settings, including residential and commercial buildings.

Drivers

Health Burden from Indoor & Ambient Air Pollution

One of the foremost forces steering demand for air purifying paints is the heavy health burden posed by indoor and outdoor air pollution. When people breathe polluted air in homes, workplaces, or cities, the impacts can be severe—ranging from respiratory diseases to heart problems—and air purifying coatings offer a passive way to reduce exposure to harmful pollutants without requiring complex systems.

According to the World Health Organization (WHO), about 2.1 billion people still cook using open fires or inefficient stoves powered by biomass, coal or kerosene. This reliance leads to high indoor pollutant levels and contributes to the estimated 3.2 million deaths per year in 2020 from household (indoor) air pollution. In addition, the combined impact of ambient (outdoor) and household air pollution is linked to 6.7 million premature deaths annually.

These numbers have led governments and public health bodies to issue guidelines and regulations aiming to reduce pollutant exposures. For example, WHO’s data portal reports that 99% of the world’s population live in places where ambient air quality exceeds WHO guideline limits. Parts of this are specifically fueled by air pollutants such as fine particulate matter (PM₂.₅) and nitrogen oxides (NOₓ), which are common targets for air purifying coatings due to their toxicity and prevalence.

To mitigate these risks, trusted organizations are urging safer living environments, cleaner cooking technologies, cleaner fuels, and stricter emissions standards. WHO’s indoor air quality guidelines, for example, address household fuel combustion and emphasize reducing exposure in low- and middle-income countries, where disease burden is highest.

Restraints

High Cost and Performance Uncertainty Hinder Wider Adoption

One of the key restraints facing the air purifying paints market is the high upfront cost and uncertain real-world performance of these products. Many manufacturers charge a premium for the active components, and consumers often hesitate because lab claims do not always translate reliably under everyday environmental conditions such as low light or variable humidity.

To put this in context, building operations already consume about 30% of global final energy consumption. Reducing this energy use effectively requires not just high-cost add-ons but robust, proven technologies. When paint manufacturers ask for significant extra price over conventional paints, customers—especially in residential or low-margin commercial projects—find the cost difficult to justify, particularly if lifetime durability or pollutant removal under real use are not guaranteed.

Especially in emerging economies, affordability becomes a central issue. With many households still struggling to meet basic housing cost burdens, paying more for paints—even those promising health or environmental benefits—is often beyond budget. Subsidies or incentives are less often available for coatings than for larger building systems like insulation, HVAC, or clean stoves. This contrasts with government initiatives aimed at cleaner fuels: for example WHO reports that about 2.1 billion people cook using open fires or simple stoves that create air pollution in their homes.

Opportunity

Government Incentives and Policy Support

A significant growth opportunity for the air purifying paints market lies in the increasing support from government incentives and policy frameworks aimed at improving indoor air quality and promoting sustainable building practices.

Governments worldwide are recognizing the importance of addressing indoor air pollution, which is a leading environmental health risk. For instance, the World Health Organization (WHO) has issued guidelines emphasizing the need to transition to cleaner household fuels and technologies to reduce indoor air pollution. These guidelines recommend against the use of unprocessed coal and kerosene and advocate for the adoption of cleaner alternatives such as liquefied petroleum gas, biogas, natural gas, ethanol, or electricity, particularly in low- and middle-income countries.

In line with these guidelines, WHO has developed the Clean Household Energy Solutions Toolkit (CHEST) to assist countries in implementing strategies that promote clean household energy. This toolkit includes tools for developing household energy action plans, setting national standards, and raising awareness about household air pollution and potential solutions.

Furthermore, the International Energy Agency (IEA) reports that buildings account for about 30% of global final energy consumption and more than half of electricity consumption. This highlights the significant impact that building materials and finishes, such as air purifying paints, can have on overall energy efficiency and indoor air quality.

Regional Insights

North America Leads with 45.90% Market Share in Air Purifying Paints

In 2024, North America held a dominant position in the global air purifying paints market, capturing more than a 45.9% share, translating to approximately USD 0.5 billion in market value. This leadership is attributed to a combination of stringent environmental regulations, heightened consumer awareness regarding indoor air quality, and a robust green building sector. The United States and Canada are at the forefront of this trend, characterized by widespread adoption of advanced construction materials and a proactive approach to public health and sustainability.

The region’s commitment to environmental standards is evident in its regulatory frameworks that encourage the use of low-emission building materials. For instance, the U.S. Environmental Protection Agency (EPA) has established guidelines and programs to promote the use of environmentally friendly products in construction. These initiatives have spurred the development and adoption of air purifying paints that contribute to improved indoor air quality.

Key Regions and Countries Insights

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

PPG’s Copper Armor Interior Paint is an EPA-registered anti-viral and anti-bacterial paint that utilizes the intrinsic antimicrobial properties of copper to kill 99.9% of viruses and bacteria on the painted surface. This innovative, non-chemical approach offers a durable solution for maintaining cleaner indoor environments.

AkzoNobel’s Dulux Ambiance All AirClean is a paint solution designed to absorb harmful air pollutants such as formaldehyde by converting them into harmless water molecules. In certified tests under the Chinese Standard JC/T 1074-2021, it was shown to remove more than 80% of formaldehyde from the air, offering a proactive solution to improve indoor air quality.

Benjamin Moore’s Eco Spec® is a zero-VOC paint designed to help maintain good indoor air quality. It features zero VOCs and zero emissions, even after tinting, making it an eco-friendly choice for consumers seeking to improve indoor air quality without compromising performance and quality.

Top Key Players Outlook

Sherwin-Williams

PPG Industries

AkzoNobel

Asian Paints

Nippon Paint

Benjamin Moore

Jotun Group

Berger Paints

Kansai Paint

Tikkurila

Recent Industry Developments

In 2024, Sherwin-Williams maintained its position as the most valuable paint brand globally, with a brand value of $7.6 billion.

In 2024, Benjamin Moore continued to lead in the air-purifying paint sector with its Eco Spec® line, which is independently certified as asthma and allergy friendly® by the Asthma and Allergy Foundation of America and Allergy Standards Ltd.

Report Scope