In short

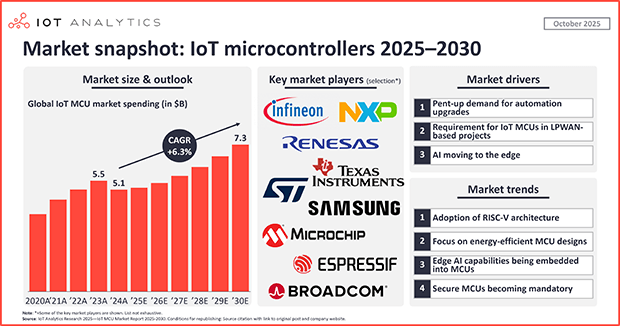

The IoT MCU market reached $5.1 billion in 2024, according to IoT Analytics’ IoT Microcontrollers Market Report 2025–2030 (published October 2025).

This marks a small year-over-year contraction in the market; however, the IoT MCU market has begun to rebound in 2025 and is expected to grow at a CAGR of 6.3% until 2030, reaching $7.32 billion.

IoT Analytics has identified 4 notable trends in the IoT MCU market:

1. The adoption of the RISC-V architecture

2. Energy efficiency becomes a primary design principle

3. Edge AI capabilities are being embedded directly into MCUs

4. Secure MCUs and hardware roots of trust are becoming mandatory in IoT devices

Why it matters

For IoT MCU vendors: The IoT MCU market is rebounding and the technology is changing. Vendors must stay apprised of current trends to stay competitive in a highly concentrated market.

For OEMs/end users using IoT MCUs: IoT MCUs are becoming more open, energy-efficient, intelligent, and secure. Keeping up with technological trends and key vendors may prove valuable.

In this article

IoT MCUs: Powering the next wave of connected intelligence

Global microcontroller unit (MCU) market nears $30 billion by 2030. In 2024, spending on MCUs reached $23.2 billion, according to IoT Analytics’ 91-page IoT MCU Market Report 2025–2030 (published October 2025). This market, comprised of IoT and non-IoT MCUs, is expected to grow at a CAGR of 3.9% until 2030, when IoT Analytics forecasts the market to reach $29.4 billion. This growth occurs against the backdrop of the massive scaling of connected technology, as the global installed base of IoT-connected devices is forecast to exceed 40 billion devices by 2030.

MCUs are the invisible backbone of modern electronics. Today, MCUs are embedded in billions of devices that perform control, sensing, and communication tasks across industries. By integrating processing, memory, and input/output peripherals on a single low-power chip, MCUs are made for applications ranging from household appliances and wearables to vehicles and industrial machinery. Their efficiency, cost-effectiveness, and compact design make them vital for powering the growing array of connected, automated, and intelligent systems.

IoT MCUs are the brains of connected IoT devices. Unlike traditional MCUs, IoT MCUs are designed for use in connected devices and typically combine processing and control capabilities with integrated or supported communication interfaces. As IoT deployments expand, these connected MCUs are becoming central to enabling low-power, always-on applications, from smart meters and industrial sensors to connected cars, and driving the next wave of intelligence across distributed networks.

Insights from this article are derived from

IoT Microcontrollers Market Report 2025-2030

A 91-page report detailing the IoT microcontroller unit (MCU) market, including market sizing, market shares of key vendors, leading technological trends, with an overview of the broader IoT semiconductor market.

Already a subscriber? View your reports and trackers here →

IoT MCU market snapshot

Global IoT MCU market 2020–2030

IoT MCU market on a growth trajectory toward $7 billion. According to the market report, the global IoT MCU market reached $5.1 billion in 2024, a 9% drop from 2023. This contraction was driven by broad inventory digestion across the supply chain. However, market analysis of 1H2025 shows a clear turnaround, with IoT MCU revenue up 1.8% YoY as demand recovered and lead times and pricing stabilized. Analysis in the report forecasts steady growth of 6.3% CAGR until 2030, with the market reaching $7.32 billion.

Key drivers for IoT MCU growth:

Pent-up demand for automation upgrades: In 2023 and 2024, the industrial IoT market experienced a slowdown in growth, the slowest since IoT Analytics began covering IoT markets in 2014, and the hardware segments (including the automation and semiconductor subsegments) were the hardest hit. As a result, many companies deferred hardware upgrades. However, according to IoT Analytics’ Global IoT Enterprise Spending (Q1 2025 Update), 2025 is expected to see accelerated growth. Companies are expected to act on the pent-up demand for automation upgrades, largely dependent on MCU-based PLCs, IPCs, and gateways, and this is expected to propel IoT MCU market growth.

LPWAN-based projects requiring IoT MCUs: LPWAN chipsets are forecasted to grow 8% YoY in 2025, supported by NB-IoT and LoRaWAN rollouts. Transportation, smart cities, and building and infrastructure are the fastest-growing segments, while smart metering delivers the largest volumes. Government smart metering mandates, including India’s target of 250 million installations by 2027 and ongoing programs in Europe, are triggering large-scale deployments. Each LPWAN device requires an MCU as a host for the communication modules, ensuring sustained demand.

AI moving to the edge, where the MCUs are: AI integration into MCUs, further discussed below, enables always-on inference at the edge. IoT Analytics sees edge AI as a potential next big thing for industrial AI, and the maturation of dedicated edge computing hardware, such as MCUs, is helping make edge AI a realizable goal for manufacturers.

Asia, specifically China, is the epicenter of market growth. The geographic center of the IoT MCU market is firmly shifting toward Asia. Based on the market numbers found in the IoT Microcontrollers Market Report 2025–2030’s accompanying Excel sheet, all regions experienced the 2024 market contraction, and Asia is expected to see the most recovery in 2025. Specifically propelling this growth is China.

Behind this growth in China are several recent large investments in energy infrastructure projects where IoT MCUs will play vital roles. For example, in January 2025, China’s State Grid announced it would invest a record $88 billion into the country’s power grid, with a focus on optimizing the power grid and strengthening distribution infrastructure.

Looking ahead, China’s market is forecasted to remain the fastest-growing through 2030.

4 technology shifts the IoT MCU market

Technology shift 1: The adoption of the RISC-V architecture

RISC-V has become a strategic priority. The US–China technology conflict has elevated the RISC-V (“risk-five”) instruction set architecture (ISA) from a technical option to a strategic imperative. In March 2025, as a response to U.S. export controls on advanced chips and proprietary intellectual property, China’s Ministry of Industry and Information Technology (MIIT) and other government bodies officially encouraged domestic IoT chipmakers to adopt the RISC-V instruction set architecture by 2027. This represents the world’s first national policy specifically requiring RISC-V adoption at scale, cementing its status as a strategic national priority. When a major market like China embraces RISC-V on a massive scale, it inevitably expands the ecosystem for all vendors, accelerates the maturation of software and development tools, and stimulates cross-border investment in the architecture.

RISC-V offering flexible alternative to proprietary chips. Even without official policies on its use, vendors are already increasingly embracing RISC-V as a flexible, cost-effective, and power-efficient alternative to proprietary chips. Unlike proprietary architectures like ARM, which require licensing pre-designed cores, RISC-V operates on an open, royalty-free model. This empowers companies to design and customize processor cores for specific workloads without incurring licensing fees, thereby reducing their reliance on a few dominant suppliers and offering greater design freedom.

RISC-V adaptability fueled MCU adoption in autos. The automotive sector has become a key area for MCU innovation. RISC-V is being increasingly adopted to power the shift toward software-defined vehicles (SDVs) and intelligent mobility, as its adaptability is ideal for developing tailored processors for critical in-vehicle systems, such as safety, connectivity, and AI-driven features.

Recent RISC-V-based examples include:

Renesas: In March 2024, Japan-based semiconductor manufacturer Renesas launched its R9A02G family of 32-bit MCUs, which are built on an in-house RISC-V core and targeted at diverse IoT, industrial, and consumer applications.

Microchip: In July 2024, US-based semiconductor manufacturer Microchip introduced its PIC64GX RISC-V MCU family, which leverages a 64-bit RISC-V subsystem to enhance power efficiency and security by reducing exposure to side-channel threats.

Infineon: In November 2024, Germany-based semiconductor manufacturer Infineon introduced RISC-V options within its AURIX TC4x family to support the move to SDVs with scalable and secure platforms.

ECARX: In May 2025, China-based automotive solutions company ECARX unveiled its EXP01 processor, a RISC-V-based design that achieved the highest level of automotive functional safety (ASIL-D). Ziyu Shen, Chairman and CEO of ECARX, noted that RISC-V’s “open architecture drives faster innovation and optimizes costs.”

“EXP01 marks a critical step in our mission to deliver highly reliable open-architecture computing platforms for the automotive industry. […] RISC-V’s open architecture drives faster innovation and optimizes costs, directly aligning with our goal to keep automakers at the forefront of technological change with cost-effective solutions. With our MCU roadmap and deepening collaborations, we are well-positioned to lead the intelligent mobility revolution powered by RISC-V.”

Mr. Ziyu Shen, Chairman and CEO of ECARX (source)

Technology shift 2: Energy efficiency becomes a primary design principle

MCU innovation centering on energy efficiency. MCU design is now hyper-focused on ultra-low power consumption to enable long-life, battery-powered IoT deployments. As IoT deployments expand into power-constrained environments, MCU vendors are integrating advanced power management features like deep sleep modes and adaptive voltage control to drastically cut energy use. This focus on efficiency directly translates to lower operational costs and enables entirely new business models based on “deploy-and-forget” devices with multi-year battery lives.

Energy-efficient MCU examples include:

STMicroelectronics: In November 2024, Switzerland-based semiconductor manufacturer STMicroelectronics announced its STM32WL33, an ultra-low-power wireless system-on-chip (SoC) targeting smart metering, smart building, and industrial IoT applications. The chip can achieve current levels as low as 4.2 µA in wideband receive-only mode, and when paired with certain optimized sensors, the battery life of these chips can extend to 15 years.

NXP: In January 2025, Netherlands-based semiconductor manufacturer NXP introduced its MCX L series, a new generation of ultra-low-power microcontrollers built on a 40 nm ULP process and featuring Adaptive Dynamic Voltage Control (or ADVC). By dynamically tuning the core voltage, the MCX L series is reportedly highly energy-efficient, reducing power consumption by up to 50%.

Technology shift 3: Edge AI capabilities are being embedded directly into MCUs

The STM32N6 Discovery Kit with a CMOS sensor running a person detection application (source)

The STM32N6 Discovery Kit with a CMOS sensor running a person detection application (source)

Advanced AI and machine learning capabilities are moving from the cloud to the chip, enabling real-time inference on smarter devices. The integration of AI at the edge is transforming MCUs into intelligent decision-making hubs. This shift enables vendors to add significant value by moving up the software stack and capturing revenue from AI-driven applications that reduce latency, enhance data privacy, and lower dependency on cloud infrastructure.

Examples of edge AI on MCUs include:

These technological advancements must operate within a complex global environment shaped by powerful geopolitical and economic forces.

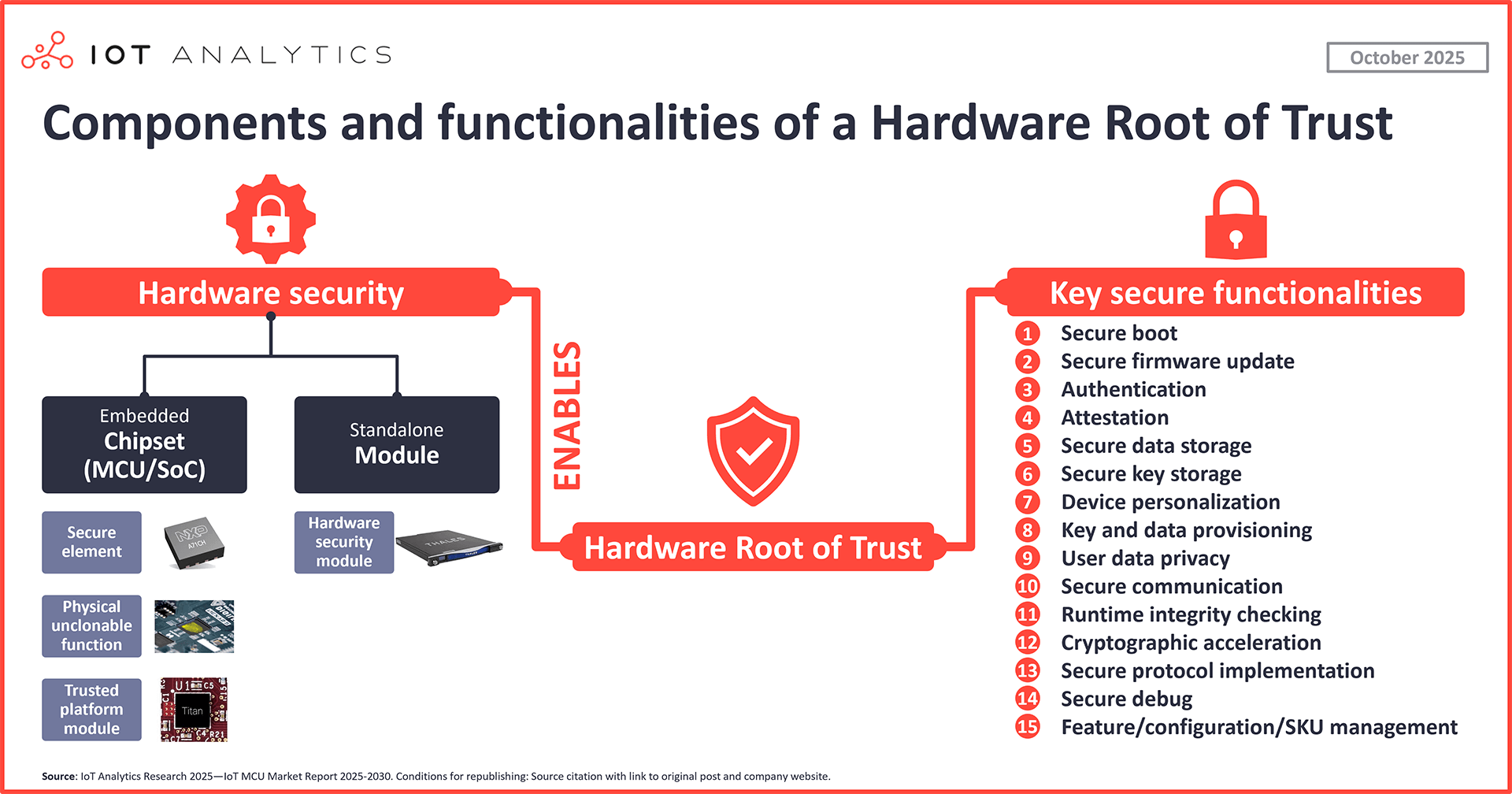

Technology shift 4: Secure MCUs and hardware roots of trust are becoming mandatory in IoT devices

Diagram showing how hardware security elements help enable a hardware root of trust and its 15 key functionalities

Hardware-based security emerging as critical foundation for IoT. As deployments scale, devices must protect sensitive data, prevent cloning, and ensure integrity from chip to cloud. This has led to growing use of secure MCUs and dedicated hardware security modules such as Secure Elements (SEs) or Trusted Platform Modules (TPMs) to estaHardware-based security emerging as critical foundation for IoT. As deployments scale, devices must protect sensitive data, prevent cloning, and ensure integrity from chip to cloud. This has led to growing use of secure MCUs and dedicated hardware security modules such as Secure Elements (SEs) or Trusted Platform Modules (TPMs) to establish a hardware root of trust (HRoT).

A secure MCU integrates functions such as secure boot, device authentication, encrypted data storage, and attestation directly into the microcontroller, creating a trusted execution environment isolated from general operations. SEs and TPMs provide similar protections as standalone vaults. Together, they anchor device trustworthiness, enabling secure firmware updates, protecting user privacy, and defending against malware and software-level attacks.

The adoption of secure MCUs and HRoT solutions is accelerating as IoT vendors recognize that hardware security is no longer optional but a baseline requirement.

Examples of integrated hardware security include:

NXP: In January 2025, NXP announced that its MCX L series (mentioned above) would incorporate NXP’s EdgeLock secure element.

Infineon: In November 2024, Infineon’s AURIX TC4x announcement (also mentioned above) included that the first member of the MCU family, the TC4Dx, fulfills the latest cybersecurity standards according to ISO/SAE21434, including post-quantum cryptography support.

Analyst opinion

Vendors pivot to RISC-V to regain control and resilience. IoT MCUs are crossing a threshold where architecture choice, on-device intelligence, and baked-in security now define competitiveness. RISC-V is creating real pull against ARM as vendors seek control and supply resilience amid US–China tech tensions and China’s national guidance.

MCUs evolving into on-device AI enablers, a pivotal shift toward intelligent edge computing. Local AI reduces reliance on the cloud, improves latency, strengthens privacy, and enables real-time decision-making in distributed systems. MCU vendors are embedding lightweight AI accelerators and optimized tool chains to support new industrial and consumer use cases. Many MCU players are leveraging TinyML to upgrade legacy low-power nodes into intelligent endpoints. The combination of CPU and NPU architecture is becoming increasingly favorable, enabling efficient distribution of computing resources between general processing and AI inference and extending AI functionality to endpoints that were previously constrained by cost and power.

Secure-by-design MCUs will win the next cycle. Security has moved from a feature to a regulatory requirement. The EU Cyber Resilience Act and US Executive Order 14028 promote designs that ship with built-in protection across both hardware and software. The result is a new baseline: secure, AI-capable MCUs will set the pace for IoT and early automotive designs.

IoT MCU market growth (Insights+)

The Insights+ Subscription unlocks exclusive facts & figures. You will gain access to:

Additional analyses derived directly from our reports, databases, and trackers

An extended version of each research article not available to the public

Full report access not included. For enterprise offerings, please contact sales: sales@iot-analytics.com

Companies mentioned in this article—along with their products—are used as examples to showcase market developments. No company paid or received preferential treatment in this article, and it is at the discretion of the analyst to select which examples are used. IoT Analytics makes efforts to vary the companies and products mentioned to help shine attention to the numerous IoT and related technology market players.

It is worth noting that IoT Analytics may have commercial relationships with some companies mentioned in its articles, as some companies license IoT Analytics market research. However, for confidentiality, IoT Analytics cannot disclose individual relationships. Please contact compliance@iot-analytics.com for any questions or concerns on this front.

More information and further reading

Related publications

You may also be interested in the following reports:

Related articles

You may also be interested in the following articles:

Sign up for our research newsletter and follow us on LinkedIn to stay up-to-date on the latest trends shaping the IoT markets. For complete enterprise IoT coverage with access to all of IoT Analytics’ paid content & reports, including dedicated analyst time, check out the Enterprise subscription.