(Bloomberg) — Malaysian Prime Minister Anwar Ibrahim plans to cut more subsidies and improve tax collection to narrow the budget deficit next year, as he grapples with lower petroleum-related revenue and dimming economic prospects.

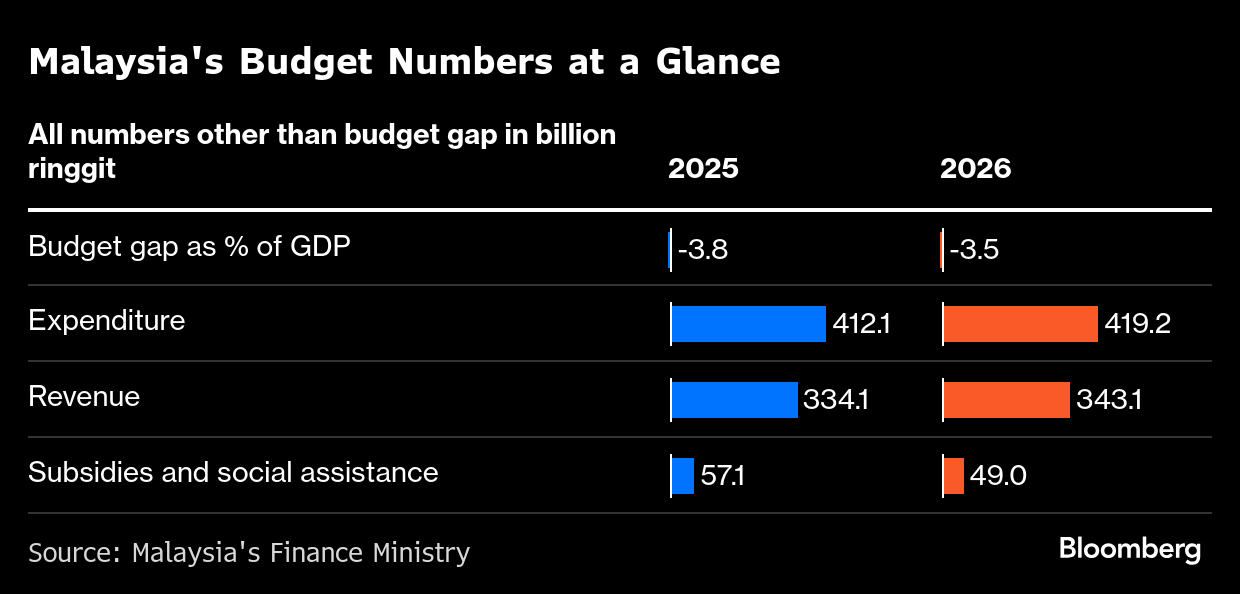

The government proposes 419.2 billion ringgit ($99.3 billion) of spending next year, according to a Finance Ministry report published as Anwar started his budget presentation. That’s 1.7% higher than estimated state spending for 2025, which was revised down from last year’s official forecast. Additional spending from entities including government-linked companies will push the budget size to 470 billion ringgit, according to Anwar

Anwar, who is also finance minister, plans to narrow the deficit to 3.5% of gross domestic product from 3.8% this year, according to the report. His budget needs to balance lower petroleum-related contributions, which have roughly halved as a percentage of state revenue since 2009, and the threat of a slowdown due to global risks.

“We choose a winding, difficult and long path, namely the path of reform, strict fiscal discipline, and institutional strengthening because only that path can guarantee that this country can be saved in the long term,” Anwar told lawmakers.

Anwar said Malaysia would prioritize fostering growth in the semiconductor, energy and digital sectors in 2026, and announced 550 million ringgit of investments in local chip firms, including via sovereign wealth fund Khazanah Nasional Bhd.

Khazanah will also partner global firms in downstream rare earth processing, he said. The fund last week denied a report that it was in talks with China about processing rare earths in Malaysia.

Some 700 million ringgit will be earmarked for tourism, with the country aiming for 47 million visitors and revenue of 329 billion ringgit.

The government expects growth to moderate to 4%-4.5% next year, from a projected expansion of 4%-4.8% in 2025. Gross exports are forecast to increase by 2.8% in 2026, slower than the 3.3% estimated for this year, as Malaysia contends with US levies.

“Although recent clarity on the US tariff policies offers some reprieve, yet the risks of sector-specific and reciprocal measures still loom and may disrupt the global trading system further and weigh on growth,” Anwar wrote in the preface of the Economic Outlook 2026 report.

Anwar is looking to convince investors he’s serious about fiscal discipline as the country weathers the tariff storm. So far, it appears to be on a stable footing — Malaysia has the highest credit rating in emerging Southeast Asia, and the ringgit’s roughly 6% rise makes it the best-performing currency in the region this year.

Malaysia remains committed to slashing its spending on subsidies and social assistance, with the allocation set to fall 14% to 49 billion ringgit next year, according to the report. The decline will be mainly due to lower commodity prices and subsidy rationalization efforts, including the recent move to float petrol prices for foreigners since the end of September.

Subsidy rationalization will save 15.5 billion ringgit a year for Malaysia, Anwar told parliament.

Those reductions contrast with stimulus being rolled out in neighboring Indonesia and Thailand, which are acting amid widespread signs of concern at the cost of living.

At the same time, Malaysia’s increased efficiency in tax collection and ongoing fiscal reforms will help total revenue grow 2.7% to 343.1 billion ringgit next year, according to the report.

Anwar confirmed plans to introduce a carbon tax on iron, steel and energy industries next year, without giving details. Other key tax revenue measures have included the recent expansion of the sales and service tax, and the adoption of digitalization through e-invoicing, leading to improved tax compliance.

That could help compensate for falling petroleum-related revenue, which is set to keep shrinking.

“As part of the government’s commitment to reduce reliance on commodity-based revenue due to its price volatility,” petroleum as a portion of its total income is forecast to further contract to 12.5% from 17% last year, according to the report. In 2009, the share was 41.3%.

Dividends from national oil and gas company Petroliam Nasional Bhd., or Petronas, are expected to drop 38% to 20 billion ringgit, from 32 billion ringgit in 2025.

Still, Anwar is planning to increase allocations for the transport and trade and industry sub-sectors, after cutting back in 2025. New projects include more connections between the Malaysian and Indonesian borders and the development of an air traffic control center in Sabah state.

(Adds detail from Anwar’s speech starting in second paragraph.)

©2025 Bloomberg L.P.