Oil prices edged higher over the past week, after a bullish OPEC+ move while expanding strategic oil stocks in China have continued removing extra barrels from global markets, even though Thursday saw some paring of those gains on the Israel-Hamas ceasefire talks.

Previously, there was speculation that OPEC+ was considering accelerating the return of the April 2023 tranche of voluntary output cuts from 137 thousand barrels per day (kb/d), which would result in a 12-month process, to 500kb/d, which would remove the remaining tranche in just three months. OPEC+ quickly moved to quash the rumours through a press release, urging “media outlets to exercise accuracy and responsibility in their reporting in order to avoid fuelling unnecessary speculation in the oil market”. Still, oil prices fell more than 5% to an intra-day trading low of $64.00/bbl by 2 October.

However, the markets largely reacted positively after the eight producers that make up OPEC+ met virtually on Sunday, and with little fanfare announced 137kb/d more barrels to be added to the market in November. The bullish move has reversed the oil price selloff, with Brent crude changing hands at $66.10/bbl at 11.00 am ET while WTI crude traded at $62.35. As expected, OPEC+ outlined the proposed compensation cuts for overproduced volumes by six members, led by Iraq, which has proposed an immediate 130 kb/d adjustment from August 2025 through January 2026, before slowing to 122 kb/d in June 2026. Commodity analysts at Standard Chartered have noted that Iraq will do most of the heavy lifting in OPEC+’s latest round of unwinding, with the country’s cuts alone nearly enough to neutralize the increase by the rest of the members.

Further, Kazakhstan will not only increase its total compensation but will also accelerate its delivery. Previously, Kazakhstan had backloaded its compensation schedule, proposing to cut by only 35k b/d in December 2025, before increasing to 100 kb/d in January 2026, 300 kb/d in February, 450 kb/d in March, 490 kb/d in April, 550 kb/d in May, and 650 kb/d in June 2026 for a total of 2.63 mb/d. StanChart has predicted that Iraq’s compliance will be critical for setting market sentiment around the legitimacy of compensation cuts.

That said, the oil price recovery has been weak, with any Middle East development creating volatility, as we saw on Thursday. This is yet another indicator of the bearish sentiment that has pervaded the markets for much of the year.

Oil prices remain below a swathe of key moving averages, including 20-day at $67.09/bbl, 50-day at $67.40/bbl, 100-day at $68.06/bbl and 200-day at $69.83/bbl. However, another bullish catalyst could support higher prices.

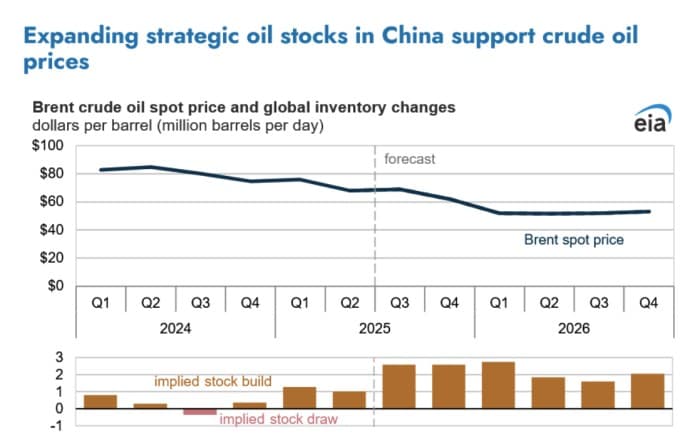

According to estimates by the U.S. Energy Information Administration (EIA), China’s crude inventories increased by ~900,000 barrels per day (b/d) between January and August this year, effectively removing barrels from the global markets. China has been limiting the downward price pressure that would otherwise result from growing inventories, keeping the Brent crude prices trading in a tight range.

Source: EIA

Europe’s gas inventories have continued climbing, rising by 0.59 billion cubic metres (bcm) w/w to 96.81 bcm on 5 October, or 82.88% of the technical maximum fill. The injection rate has, however, slowed down, with last week’s clip coming in at half the five-year average rate for the same period, of 1.156 bcm. StanChart has now lowered its end-of-injection-season maximum forecast by 1 bcm to 98.3 bcm on 2 November. Meanwhile, Europe’s gas prices have largely stabilized, with European natural gas futures trading at €32.1 per megawatt hour on Wednesday, down from a six-week high of €33.3 on Tuesday with ample inventories offsetting rising demand expectations. However, forecasts of colder weather around mid-October are set to increase heating demand, with temperatures in Germany and France predicted to be 2°C below seasonal norms.

Natural gas prices in the United States have recovered from recent lows, with Dutch Title Transfer Facility (TTF) natural gas rallying from this year’s low of 30.735 per megawatt hour (MWh) on 1 October to a 25-day high of EUR33.27/MWh on 6 October, driven by Russian strikes on Ukrainian infrastructure coupled with Qatar suspending all maritime navigation due to a GPS fault on 4 October. There has been an increase in cases of GPS ‘spoofing’, a significant navigational hazard in the Strait of Hormuz and the Arabian Gulf in the current year, prompting QatarEnergy to suspend navigation in its channels. GPS spoofing involves transmitting fake GPS signals to a receiver, tricking it into calculating a false position or time. Unlike jamming, which blocks signals, spoofing is a malicious act of deception where a spoofer, often using a Software Defined Radio (SDR), broadcasts signals that look authentic but lead the receiver astray. This can cause serious problems in various applications, from aircraft and maritime navigation to autonomous systems and personal devices.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com: