Atlas Energy Solutions shares came under renewed focus after RBC Capital downgraded the stock, citing worries over sand supply and demand trends in the Permian as well as ongoing logistics headwinds. The downgrade follows recent earnings that missed EPS forecasts but exceeded revenue expectations.

See our latest analysis for Atlas Energy Solutions.

Over the past year, Atlas Energy Solutions has faced persistent headwinds, with a year-to-date share price return of -54.11% and a one-year total shareholder return of -45.07%. After a sharp decline in recent months, sentiment remains cautious as investors digest mixed earnings and watch for signs of a turnaround.

If shifting momentum in energy stocks has you curious about other fast-moving opportunities, this might be the perfect moment to discover fast growing stocks with high insider ownership.

With Wall Street downgrades mounting and recent price declines, investors may wonder if Atlas Energy Solutions is now trading at a significant discount, or if the market has already factored in future risks and muted growth. Could this be a buying opportunity, or is everything priced in?

Most Popular Narrative: 25.6% Undervalued

With Atlas Energy Solutions last closing at $10.55, the consensus narrative estimates a fair value of $14.18, suggesting a significant potential upside if long-term assumptions hold. This valuation leans heavily on the prospects for margin expansion and resilient logistics-driven growth as sector dynamics shift.

Ongoing contraction of supply capacity in the in-basin sand market, alongside the exit and idling of high-cost competitors, is expected to shift industry dynamics in favor of Atlas. Higher pricing power and improved utilization of assets like Dune Express could lead to future margin expansion and revenue growth as completion activity rebounds.

Curious about what lions-share earnings expectations and razor-thin margin projections fuel this fair value? Find out why analysts believe this valuation hinges on big profit leaps and a drastic future earnings multiple—numbers that could redefine Atlas’s market narrative.

Result: Fair Value of $14.18 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, persistent weakness in Permian activity or continued low sand prices could quickly challenge assumptions of a swift margin recovery for Atlas.

Find out about the key risks to this Atlas Energy Solutions narrative.

Another View: Valuation from a Market Multiple Perspective

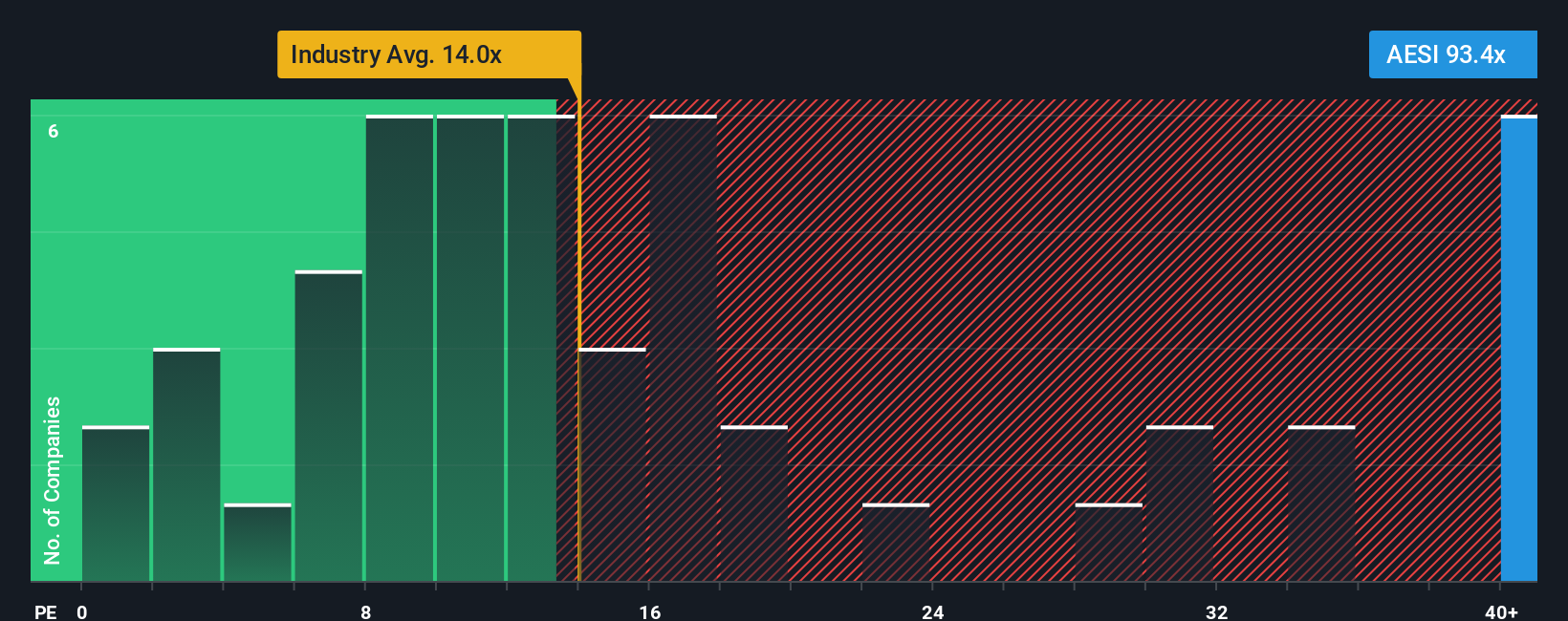

Looking through the lens of traditional market multiples provides a different dimension. Atlas Energy Solutions trades at a price-to-earnings ratio of 93.4x, which is much higher than both its industry peers at 14x and the estimated fair ratio of 32.5x. This significant gap indicates meaningful valuation risk if investor sentiment shifts or industry expectations reset.

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:AESI PE Ratio as at Oct 2025 Build Your Own Atlas Energy Solutions Narrative

NYSE:AESI PE Ratio as at Oct 2025 Build Your Own Atlas Energy Solutions Narrative

If you think the story here goes deeper or want to reach your own conclusions, you can dive into the data and craft your own view in just a few minutes. Do it your way.

A great starting point for your Atlas Energy Solutions research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of market trends by taking advantage of carefully screened opportunities that spotlight breakout technologies and reliable returns. Your next great investment move is just a click away.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com