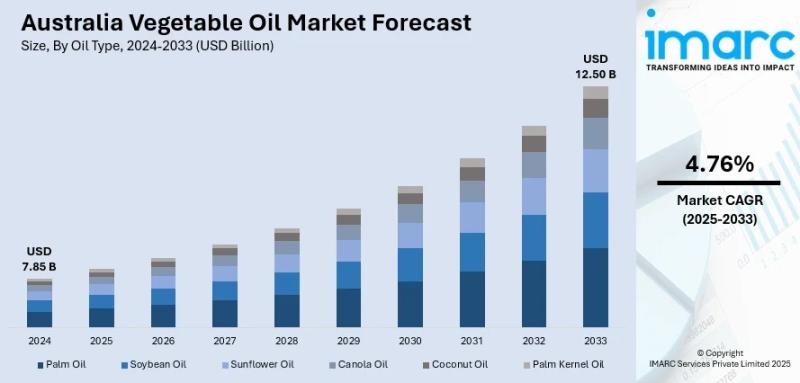

The latest report by IMARC Group, titled “Australia Vegetable Oil Market Report by Oil Type (Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil), Application (Food Industry, Biofuels, Others), and Region 2025-2033,” offers a comprehensive analysis of the Australia vegetable oil market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia vegetable oil market size reached USD 7.85 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.50 Billion by 2033, exhibiting a CAGR of 4.76% during 2025-2033.

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 7.85 Billion

Market Forecast in 2033: USD 12.50 Billion

Market Growth Rate (2025-2033): 4.76%

Australia Vegetable Oil Market Overview

The Australia vegetable oil market is experiencing steady growth driven by growing consumer preference for heart-healthy, clean-label oils across retail and food processing segments, domestic oilseed cultivation and export-oriented refining systems supporting stable supply, expanding industrial applications in biodiesel, cosmetics, and animal feed, shifting culinary habits driven by multicultural population embracing diverse cuisines, strong agricultural production and domestic processing capacity creating competitive advantages, and government support for sustainable agriculture and export market access. The market expansion is supported by rising consumer demand for omega-rich and functionally enhanced oils, plant-based and flexitarian diet adoption, sustainability and organic certification preferences, and premium cold-pressed and extra-virgin product development. Enhanced vertical integration across oilseed-to-oil supply chains, renewable energy adoption in processing facilities, and bioeconomy diversification opportunities are positioning Australia’s vegetable oil market for sustained growth and export market leadership.

Australia’s vegetable oil industry demonstrates strong competitive positioning as a leading global canola producer and processor with world-class refining infrastructure in New South Wales and Victoria, complemented by diverse oilseed cultivation including sunflower, cottonseed, and safflower for raw material flexibility. The market maintains critical importance in supporting both domestic food consumption and international export demand with particular strength in Asian and European markets valuing Australian oil quality, non-GMO certification, and sustainable production practices. The proliferation of health-conscious consumer preferences, multicultural culinary influences, plant-based food innovation, and industrial bioeconomy applications is creating favorable market conditions, requiring substantial investments in processing facility modernization, renewable energy integration, and premium product development. Australia’s strategic focus on sustainable agriculture, clean-label food production, and environmental stewardship, combined with strong government support and export market access, makes it an increasingly important market for vegetable oil innovation and sustainable bioeconomy development.

Request For Sample Report:

https://www.imarcgroup.com/australia-vegetable-oil-market/requestsample

Australia Vegetable Oil Market Trends

• Health-oriented oil preference acceleration: Significant shift toward premium oils including canola, olive, sunflower, and avocado oils with consumers prioritizing low saturated fat, omega-rich fatty acids, and clean-label formulations supporting sustainable wellness and cardiovascular health.

• Domestic oilseed integration expansion: Strengthened vertical integration across oilseed cultivation through export-quality refining with Australian canola highly valued internationally for low erucic acid levels and non-GMO certification supporting competitive market positioning.

• Culinary diversity and ethnic influence growth: Rising multicultural cuisine adoption including Asian, Mediterranean, and Middle Eastern cooking driving diverse vegetable oil usage patterns for specialty flavor profiles and cooking methods meeting varied consumer preferences.

• Premium and specialty oil development: Growing market for cold-pressed, extra-virgin, organic, and spray-free certified oils commanding premium pricing with consumers valuing superior quality, origin traceability, and clean-label production methods.

• Plant-based and functional food integration: Expanding applications in vegetarian, vegan, and flexitarian products with avocado, flaxseed, and grapeseed oils incorporated into dairy-free spreads, meat substitutes, and health-focused preparations.

• Sustainability and renewable energy adoption: Integration of renewable energy systems with Riverina Oils November 2024 solar facility demonstrating commitment to decarbonization and sustainable production aligning with environmental responsibility trends.

Market Drivers

• Health consciousness and nutrition awareness: Growing consumer preference for nutritionally superior oils with health benefits supporting cardiovascular wellness, reduced disease risk, and alignment with Mediterranean and plant-based dietary patterns.

• Domestic production and processing capacity: Strong agricultural economy producing canola, sunflower, and cottonseed providing reliable raw material supply with domestic refining facilities enabling value-added processing and quality control.

• International trade and export opportunities: Global demand for sustainably produced, non-GMO, and environmentally friendly Australian vegetable oils particularly in Asia-Pacific, Japanese, and European markets supporting export expansion.

• Multicultural consumer base and dietary diversity: Australia’s diverse population adopting international cuisines creating sustained demand for varied cooking oils meeting authentic preparation methods and specialized flavor requirements across ethnic communities.

• Plant-based diet expansion: Rising vegetarian, vegan, and flexitarian diet adoption driving demand for plant-derived oils in both culinary and functional food applications supporting market growth across demographic segments.

• Government support and regulatory frameworks: Government promotion of sustainable agriculture, renewable energy integration, and favorable trade agreements enabling market expansion, infrastructure investment, and export competitiveness maintenance.

Challenges and Opportunities

Challenges:

• Import competition pressure from major suppliers including Argentina (44,350 tons) and Malaysia (42,205 tons) creating pricing pressures and requiring differentiation through quality, sustainability, and brand positioning strategies

• Climate variability and agricultural uncertainties including drought, rainfall patterns, and pest pressures affecting oilseed cultivation yields and potentially creating supply chain instability and pricing volatility

• Commodity price fluctuations with global vegetable oil markets subject to international supply-demand dynamics, currency movements, and speculation potentially impacting profitability and planning predictability

• Regulatory compliance complexity with food safety standards, organic certifications, non-GMO verification, and export requirements creating operational burdens and compliance costs affecting competitiveness

• Sustainability certification requirements and traceability demands creating additional costs and operational complexity while requiring transparent supply chain documentation and verification systems

Opportunities:

• Premium product development focusing on cold-pressed, extra-virgin, boutique, and specialty oils positioning Australian brands in high-value markets commanding premium pricing and supporting direct-to-consumer sales strategies

• Bioeconomy diversification into biodiesel, biodegradable lubricants, bioplastics, and industrial applications leveraging vegetable oils beyond food uses while supporting renewable energy and circular economy objectives

• Export market expansion particularly in Asia-Pacific regions valuing Australian quality, sustainability credentials, and non-GMO certifications supporting international brand development and market penetration

• Value-added processing and private-label development enabling domestic manufacturers to increase margins, build brand equity, and compete effectively in premium retail and foodservice channels

• Functional food and nutraceutical integration incorporating specialty oils into health supplements, medical foods, and therapeutic preparations meeting growing consumer demand for science-backed nutritional products

Australia Vegetable Oil Market Segmentation

By Oil Type:

• Palm Oil

• Soybean Oil

• Sunflower Oil

• Canola Oil

• Coconut Oil

• Palm Kernel Oil

By Application:

• Food Industry

• Biofuels

• Others

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-vegetable-oil-market

Australia Vegetable Oil Market News (2024-2025)

• November 2024: Riverina Oils, major Australian canola oil producer, commenced solar-powered operations at Bomen, NSW facility through partnership with Flow Power, featuring 2.8 MW solar PV and 2.6 MVA inverter supporting annual production of 80,000 tons refined vegetable oil and 120,000 tons canola meal.

• 2024: Health-oriented oil preferences intensified with consumers prioritizing oils with low saturated fat, omega fatty acids, and clean-label certifications driving premium segment growth and product reformulation across food manufacturing.

• 2024: Domestic oilseed cultivation expanded with diversification into sunflower and safflower alongside leading canola production enhancing raw material flexibility and supporting sustainable farming practices.

• 2024: Import volumes reached 90,557 tons between January-September 2023 with Argentina (44,350 tons) and Malaysia (42,205 tons) as major suppliers, while domestic processing capacity strengthened competitive positioning.

• 2024: Plant-based diet growth accelerated with increasing demand for specialty oils including avocado, flaxseed, and grapeseed oils incorporated into dairy-free spreads, meat substitutes, and functional health foods.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Oil Type and Application Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=38441&flag=F

Q&A Section

Q1: What drives growth in the Australia vegetable oil market?

A1: Market growth is driven by health consciousness and nutrition awareness supporting cardiovascular wellness preferences, domestic production and processing capacity enabling quality control and value addition, international trade opportunities for sustainable oils, multicultural consumer base adopting diverse cuisines, plant-based diet expansion, and government support for sustainable agriculture and export market development.

Q2: What are the latest trends in this market?

A2: Key trends include health-oriented oil preference acceleration emphasizing clean-label formulations, domestic oilseed integration expansion strengthening vertical supply chains, culinary diversity and ethnic influence growth creating varied oil demands, premium and specialty oil development commanding premium pricing, plant-based and functional food integration, and sustainability and renewable energy adoption in processing operations.

Q3: What challenges do companies face?

A3: Major challenges include import competition pressure from Argentine and Malaysian suppliers affecting pricing dynamics, climate variability and agricultural uncertainties impacting yields, commodity price fluctuations affecting profitability, regulatory compliance complexity with food safety and certification requirements, and sustainability certification demands creating operational and cost burdens.

Q4: What opportunities are emerging?

A4: Emerging opportunities include premium product development focusing on specialty and boutique oils, bioeconomy diversification into biodiesel and bioplastics, export market expansion in Asia-Pacific regions, value-added processing and private-label development increasing margins, and functional food and nutraceutical integration supporting health-oriented product development.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

This release was published on openPR.