Data source: Federal Reserve Bank of St. Louis (FRED)

- Productivity: Nonfarm Business Sector: Output per Hour of All Persons (OPHNFB)

- Real Median Wages: Real Median Usual Weekly Earnings of Full-Time Workers (LES1252881600Q)

Visualization created in R using:

fredr, tidyverse, lubridate, scales, showtext, patchwork

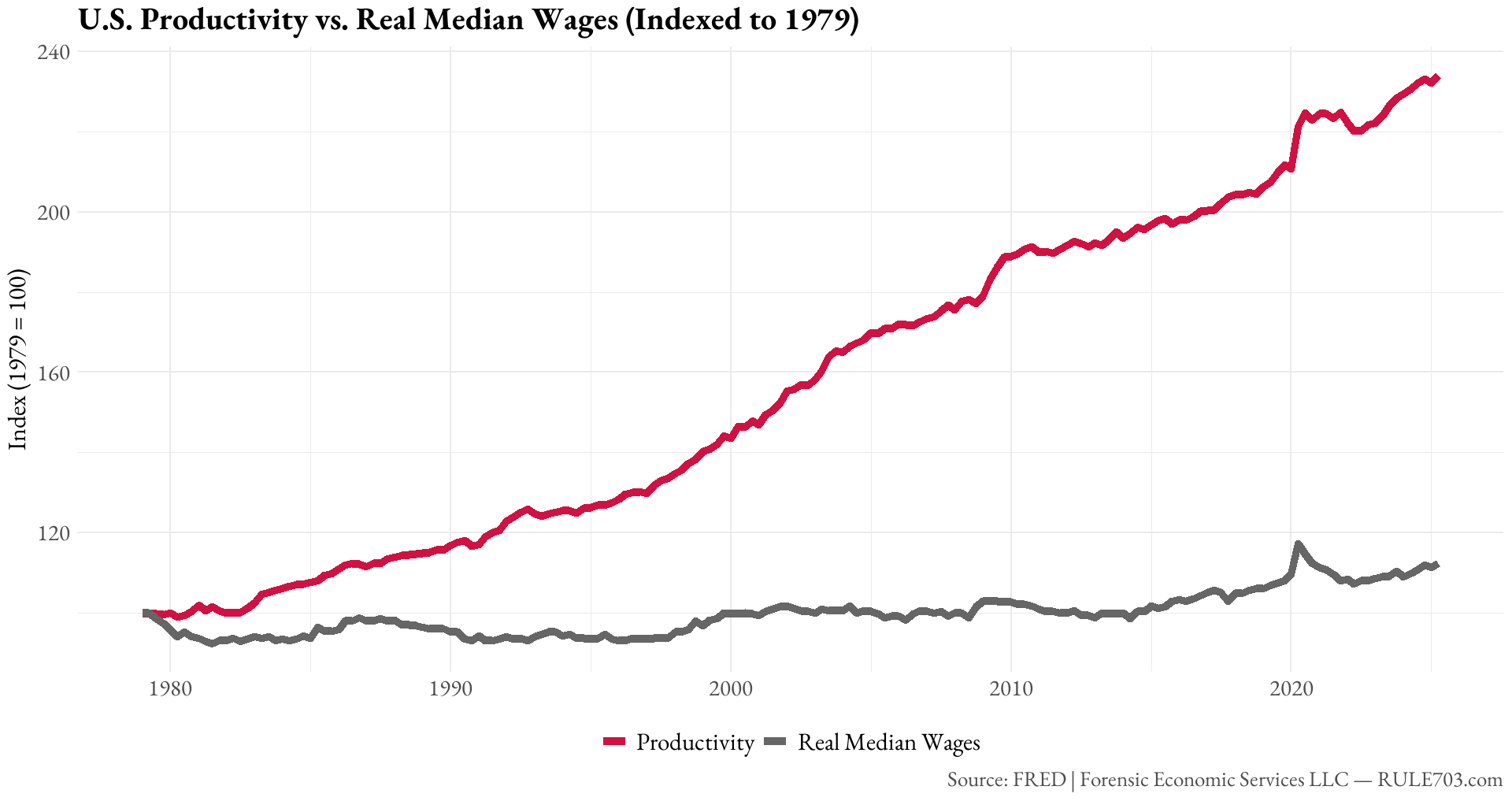

Over the past four decades, U.S. productivity has more than doubled, while real median wages have barely moved. The gap between worker output and pay began long before AI — suggesting structural or policy factors play a larger role.

Posted by forensiceconomics

42 comments

I always wonder what this means.. do people expect their wages to go up because their productivity does?

Even when much of this productivity can be related to better and better tools to do the job? Tools that cost companies billions (globally) a year to provide to their employees?

just in case people don’t know … “real” median wages takes inflation into account. So this indicates that Median wages have increased faster than inflation, appearing to have accelerated pretty nicely since 2015.

I know many will respond with objections or with the fact that housing has gone up more quickly or whatever, and you’re welcome to do so … I’m just providing a bit of context to the chart.

How is “Productivity” actually measured though

Guys, im sorry to say that the retirement age is going up and we’re reducing benefits. We just can’t afford it!

This analysis has been done a few times and has methodological issues. See https://www.piie.com/blogs/realtime-economic-issues-watch/growing-gap-between-real-wages-and-labor-productivity

That one graph describes the fall of the American Empire.

This graph gets passed along a lot and it’s a famous chart-crime.

1) What deflator did you use on productivity? Was it the same deflator you used for wages or are you comparing apples to oranges?

2) Benefits as a share of total compensation has increased substantially since 1970. The cost of healthcare is being used to deflate the wages, but the value of the healthcare benefit is not included

3) Are you using median worker productivity or average worker productivity? Why would you use average for one line but median for the other?

The answer to all of these questions is “I used the easiest thing”, but when you actually go make an apples to apples comparison (say by using nominal values or the same inflation adjustment, using median personal income, and average wage or median productivity) **more than 50% of this “gap” vanishes**!

Is the productivity also “real” or inflation adjusted? Or is this just a fancy graph basically showing us the difference between adjusting or not adjusting for inflation?

Is that Ron Reagan’s music??

There is a finite amount of wealth, and this is what happens when billionaires hold a significant portion of it.

You know what’s interesting? The gap between the two lines is basically the wealth of the shareholders.

It’s because of the inflated labor pool from illegal aliens and visas. Labor has no leverage because companies have an unlimited global pool to choose from.

They hate to see we work so much harder and more efficiently now. Greed is destroying everything

Am I reading this right that productivity rose in 2020 because most of the useless people were given time off work?

Why does anybody believe those two things should be comparable? Increased “worker productivity” doesn’t mean that workers are just working harder.

If you work on an assembly line and it’s your job to tighten nuts with a wrench, you might tighten 1000 nuts a day. The day your employer gives you a pneumatic driver, that might go to 2000. Now, you’re TWICE as productive as you were. But, that’s not because you’re working twice as hard. Heck, your work is probably easier with the better tool.

This graph looks like the 1920s graph between productivity and wages. The only reason this up coming recession won’t be as bad as the 30s depression is there are some social safety nets. Which unfortunately conservatives are trying to get rid of.

Capital investment is the missing factor in your productivity. Your labor alone isn’t what’s keeping productivity soaring.

In simple economics terms: Q = K * L

Also this methodology has been criticized.

Can you do the same for france please ? 🙏

It’d be interesting to compare this to CEO pay ratios

Fox News be like hmmm it must be immigrants stealing all the wages

Machines and robots, baby!

One doesn’t have much to do with the other. The easiest example to look at is farm work during the Industrial Revolution.

Maybe a farmer had 10 farm workers who he paid $1 a day each back in the day. Then he buys a tractor and a cotton gin and now he only has 2 workers and gets the same amount of work done.

In this scenario if the workers were to get 5 times more money because they’re 5 times more productive, why would the farmer bother spending a year or two’s worth of profits on new equipment? This mechanism means that productivity more or less can only increase more than wages do.

So what happens instead? Do you think that all the greedy farmers with a few acres of land got fabulously wealthy in the late 1800s? Not really. After a decade or so every farmer had new mechanical equipment. If a farmer tried to sell his crops for the same price he always had, all of the other farmers are going to undersell him and he won’t be able to sell anything. The prices will go down and down every year until the farmer is making a similar profit margin as he did before he bought the farm equipment. (At some specific profit margin there will be an equal number of people trying to get into the business as getting out, so price stabilized there.)

And this benefits society greatly. The farmers didn’t become zillionaires overnight; instead society stopped spending the majority of their salary on food and they had more money for other things. Society rapidly developed at this time thanks largely to food becoming cheap. We still see this today. Food is basically cheaper than ever (or at least it was pre-Covid), technology routinely comes down in price, the same cost of entertainment has severely increased production value, other purchases like clothes or airplane tickets are far cheaper than they’ve ever been. These are the things that increased productivity give us, not increased wages.

Should compare the delta with the delta of gini

[https://fred.stlouisfed.org/series/SIPOVGINIUSA](https://fred.stlouisfed.org/series/SIPOVGINIUSA)

is it time for a General Strike yet?

How the fuck did productivity spike up in 2020? I thought no one was working then.

Isn’t this a pretty misleading chart?

The two lines are “deflated” (i.e. adjusted for inflation) by different “deflators”. The productivity time series uses the “Nonfarm Business Sector: Value-Added Output Price Deflator for All Workers”, while the median wages series is deflated with the Consumer Price Index for All Urban Consumers.

The problem is that the two “deflators” measure different things [and therefore show “inflation” growing at different rates](https://fred.stlouisfed.org/graph/?g=1N1TX). Since 1979,

* the “Value-Added Output Price Deflator for All Workers” has grown by 223%

* and CPI-U has grown by 364%

CPI-U has grown much faster than the “Value-Added Output Price Deflator for All Workers”, which means it makes dollars values in the past look much higher than the deflator used by the productivity measurement.

Here is how the above chart looks when [both nominal time series are deflated by the productivity measurement’s deflator](https://fred.stlouisfed.org/graph/?g=1N1V7):

https://preview.redd.it/8ngqzgvv4yuf1.png?width=1320&format=png&auto=webp&s=51f0ffe8b9746f15b84cc983ba5ab3121365b956

Real median wages has grown by 61% since 1979, not 12%. That is still 2x the 134% growth in the labor productivity measure, but the gap is much smaller than the 11x implied by the original chart.

I realize that it’s just what it’s called. But I feel like “productivity” in this situation is misleading. The implication being that the employees are working harder or more effectively and creating higher output so they should make more money.

Employees in most cases aren’t working harder. Advances in manufacturing are just making it so an employee can output more with the same amount of work or less.

It’s going to be an unpopular opinion but that just technically means people are becoming less valuable because less of them are needed to do the same amount of work. So…wouldn’t it make sense that wages not only stay the same but “should” actually be going down?

Wait, are you comparing nominal “productivity” to real wages? Please tell me not…

Obviously this is very simple so there are numerous unknowns which require more data to conclude standard of life has gone down, or that some unfairness is in play.

For instance if utilities go up, the productivity of employees can rise but their wages remains static. Same for things like rent, materials, etc etc.

Just saying this data alone is too small a part of the picture to conclude anything meaningful beyond it’s explicit form.

This is what happens when you outsource all your industry and have an underclass of illegals bring down wages

No surprise.

1% Billionaires have become centibillionaires. while 99% are stuck paying rents ( a few who are a little better off still stuck with 30Y mortgages).

isn’t it unbelievable that with so much contribution by the working class, everyone should already be ‘able to own’ a home, a basic necessity ?

Does this account for inflation?

The area between the lines is nearby called the “Gulf of Get Fucked, Peasants.”

I know everyone will hate to hear it, but the majority of that productivity increase comes from technological changes and increased capital.

Labor has improved efficiency and skill, undoubtedly, but comparatively, the improvements are far less than that generated from non labor factors in production.

https://wtfhappenedin1971.com/

there is an inherent assumption in this chart that one should keep up with the other. if you extend the chart back further, it might but otherwise not sure why one should have an opinion on the jaws.

Nixon went to China.

Clinton let them into the WTO.

Not to mention even earlier increased competition from Japan.

We’ve been offshoring the high paying manufacturing jobs, or facing price competition and a need to increase productivity just to be competitive without raising wages for decades.

And it’s not just manufacturing. How often does anyone get an annual raise which even keeps pace with inflation without getting a promotion or changing companies? But if the raises were higher, even more jobs would go to Asia.

AI will displace those offshored jobs first, although lower complexity jobs across the board continue to be under pressure.

almost like everything i was told was a lie…

The structural factor is that companies spend a lot more on machinery and automation as a percentage of their productivity than they did in 1979.

Hourly wages does not account for other benefits like employer provided health insurance. When total compensation is charted against productivity, it paints an entirely different picture:

https://fred.stlouisfed.org/graph/fredgraph.png?g=1N23x&height=490

Okay so obviously this sucks. But real wages means inflation adjusted correct? But there’s no “productivity inflation“ for that productive measure. So some of this could be just from that no? Like clearly only having a 10% in real wages in 35 years is shocking and not a good sign at all. But this feels like comparing an inflationary value with a non inflationary value.

So, what argument is this attempting to make exactly? Productivity didn’t go up because people are working 2.5 times harder than they were in 1979, it went up because companies continually invest in tools/systems to improve said productivity. Instead of being in a field picking vegetables by hand, now you’re driving a 1 million dollar combine that does it all for you. Why would your pay be based on the productivity increase that the combine provided?

We sent people to the moon using slide-rules. Would we have paid them more to do the same thing with an electronic calculator?

Comments are closed.