Tue, 14th Oct 2025

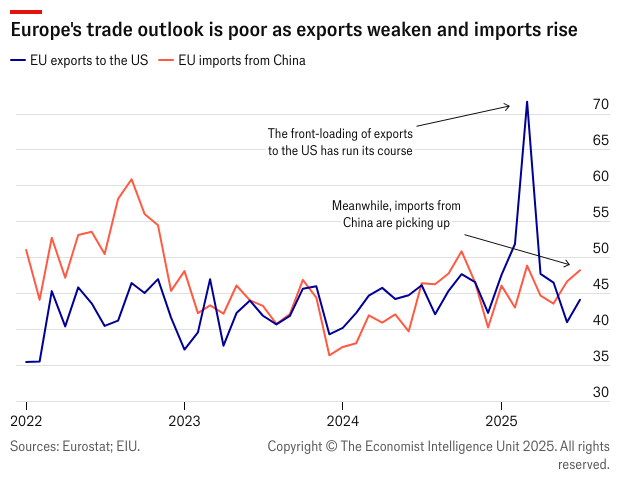

Europe faces a lacklustre growth outlook as rapid changes in US trade policy and the US-China trade war have raised uncertainty, damaging business and consumer sentiment, and weighing on investment. Blanket 15% US import tariffs on goods (including cars, chips and pharmaceuticals), and 50% tariffs on metals, will damage European export growth, with Germany the worst affected. Export growth was boosted by a front-loading trend in early 2025, to beat the imposition of tariffs, but this has now come to an end. That said, consumer spending will be supported in 2026 by lower inflation and interest rates, with a number of factors–US tariffs, the strong euro and a rise in Chinese imports–contributing to disinflation.

Despite efforts by the US to cajole Ukraine into peace, a deal is still a distant prospect. Future Russian aggression against Europe is a risk that is being taken more and more seriously, with growing moves to fund and develop European security without reliance on long-standing US security guarantees. Europe’s efforts to support Ukraine will also step up in 2026, although in the context of fiscal strains, ageing demographics and rising support for populist parties, the cost of this is likely to become an increasingly divisive issue.

The analysis and forecasts presented in this article are drawn from EIU’s Country Analysis service. This comprehensive solution offers essential insights into the political and economic outlook of nearly 200 countries, empowering businesses to manage risks and develop effective strategies.