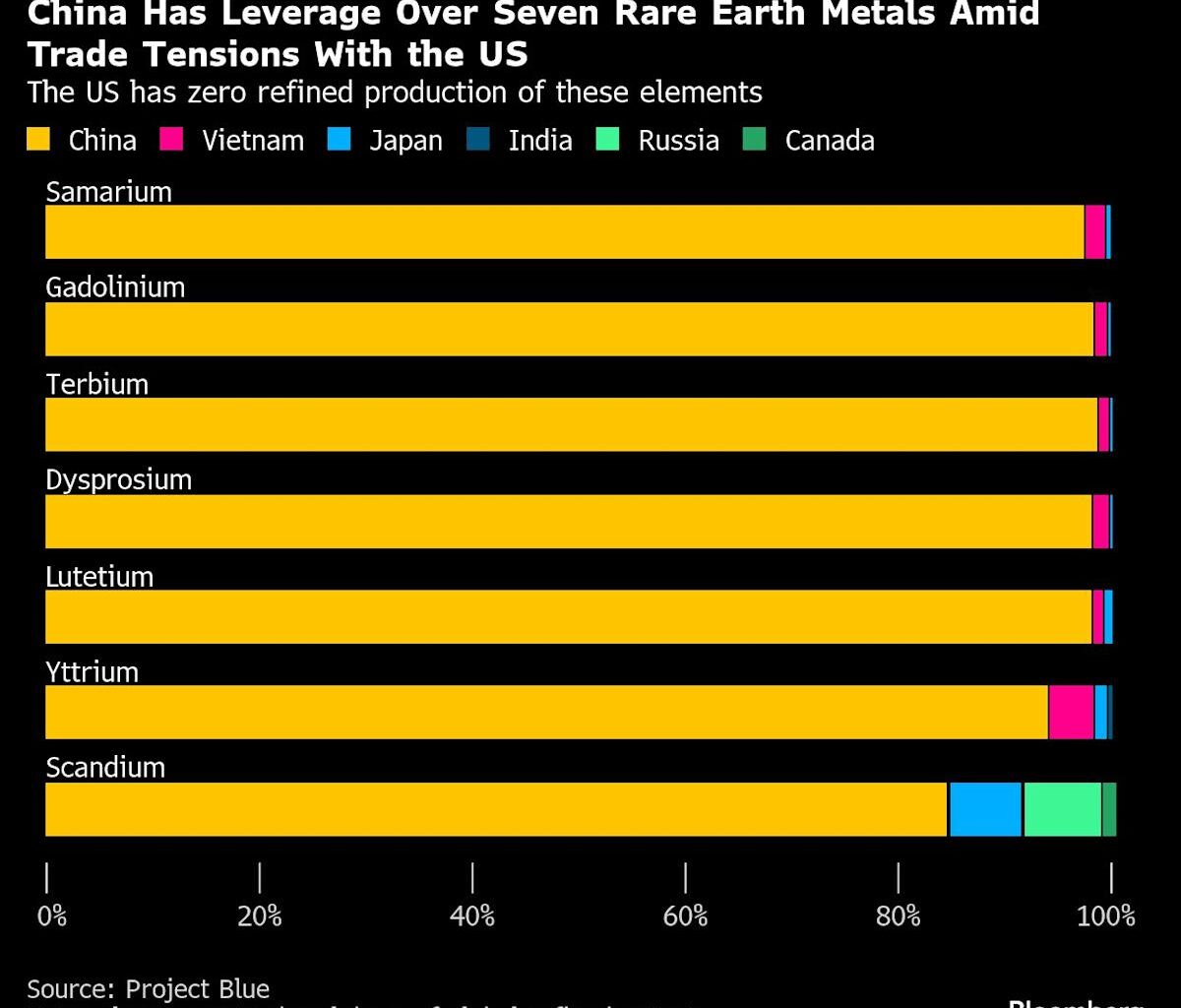

(Bloomberg) — China’s sweeping new restrictions on rare earth exports jolted governments and set off a race to secure alternative supplies, in a stark demonstration of Beijing’s global clout and growing risks for companies.

The rules announced last week require overseas firms to obtain Chinese government approval before exporting products containing even trace amounts of certain rare earths that originated in China. They prompted threats of punitive measures from Washington even as both sides signal an openness to talks, and pushback from the European Union.

Most Read from Bloomberg

US President Donald Trump on Tuesday said he might stop trade in cooking oil with China, ostensibly to retaliate against Beijing’s refusal to buy American soybeans. He previously threatened to impose an additional 100% tariff on goods from China by Nov. 1 and raised the prospect of canceling his meeting with Chinese leader Xi Jinping in South Korea later this month.

The European Union “should have a tough response,” Danish Foreign Minister Lars Lokke Rasmussen, whose country chairs the EU’s rotating presidency, said Tuesday. EU Economy Commissioner Valdis Dombrovskis charged China with “using trade interdependencies for political gain,” speaking in Washington as global finance chiefs gathered for fall meetings of the International Monetary Fund and World Bank.

While the degree of disruption will hinge on how broadly the new rules will be applied, the move has already energized companies and policymakers alike to look for potential counter-measures, and eventual alternatives to China’s critical inputs.

“We will not let these export restrictions and monitoring go on,” US Treasury Secretary Scott Bessent said in a Fox Business interview Monday. “They have pointed a bazooka at the supply chains and the industrial base of the entire free world.”

The American official said he expected to get coordinated support from Europe and India, along with other democratic governments in Asia — an apparent reference to nations such as Japan and South Korea. Dombrovskis said he expects discussions this week at a meeting of the Group of Seven in Washington.

In India, automakers and parts suppliers have begun accelerating testing of ferrite-based magnets as a less efficient but geopolitically safer substitute for the heavy rare earths they previously relied on, according to people familiar with the matter. For now, they have enough inventory until December, the people said.