Since the lows of April 8, stock markets have performed positively, despite the uncertainty generated by US trade policy. From that date until Oct. 10, the Morningstar Global Markets Index rose by 23.9% in EUR. During this period, the Morningstar US Market Index gained 23.1%, while the Morningstar Europe Index, rose by 21.1%. There were significant differences between countries within the European market. For example, the Morningstar Spain Index and the Morningstar Italy Index rose by more than 30%, while the Morningstar France Index rose by just 16.5%.

After such divergent performances, one should assess whether now is a good time to invest in equities, either directly or through a fund or ETF, and which segments of the market are the most attractive in terms of valuation.

The valuation of the different markets is calculated using the price to fair value ratio determined by Morningstar’s equity research team.

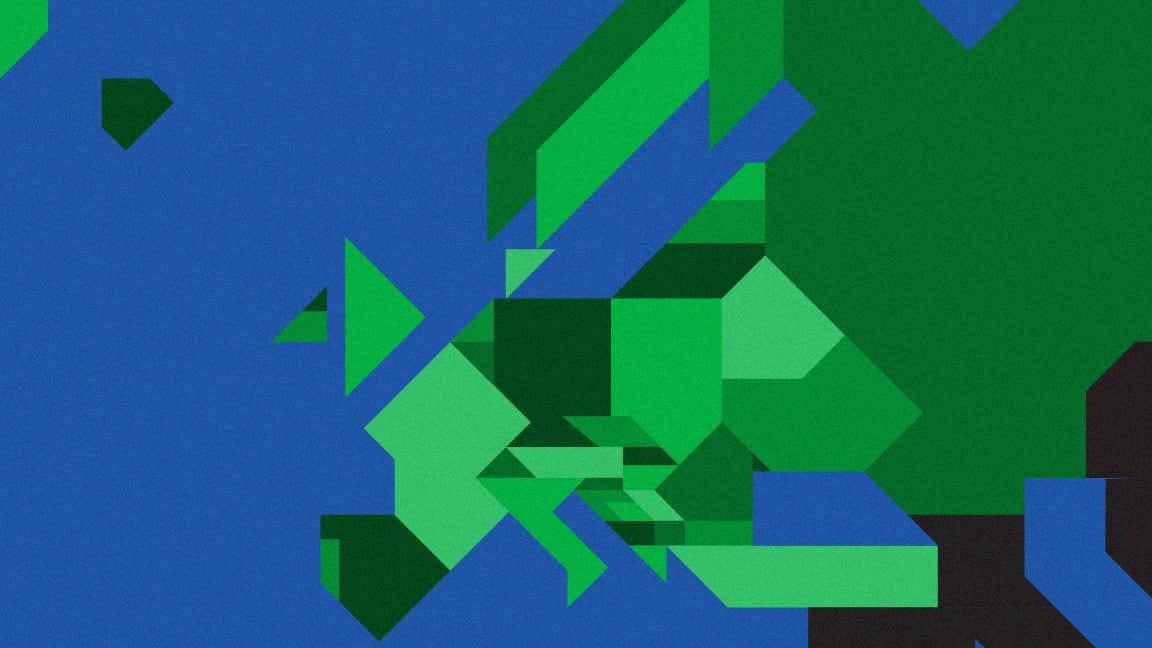

European Stocks Cheaper Than US Peers

The consequence of this difference in returns between the US and European markets in recent months is that Europe has become cheaper than the US in terms of valuation. At the stock market low in early April, both markets were trading at a discount to fair value of more than 15%. The situation has since shifted, with the US market trading at a price to fair value of 1.03, indicating that it is sightly overvalued. The European market, meanwhile, is trading at a valuation of 0.95, indicating that it is 5% undervalued. The Morningstar Global Markets Index, meanwhile, has a price-to-fair value ratio of 1.00.

Focusing on investment styles within the universe of European companies, it is evident that the valuation gap between value and growth styles has narrowed considerably since the beginning of the year. They are currently trading at very similar price-to-fair value ratios, with growth at 0.95 and value at 0.94.

As for the valuations of large European companies versus small ones, there is also a narrowing in valuations between the two. Large European companies, as mentioned above, are trading at a price-to-fair value ratio of 0.95, while small companies are trading at a valuation of 0.93.

Danish Stocks Are Cheapest, Spain’s the Most Expensive

Between European countries, meanwhile, valuations vary drastically. The cheapest stock market is Denmark, undervalued by 20%. Its main stock, Novo Nordisk NOVO B, which accounts for 41% of the Morningstar Denmark Index, is trading at a price-to-fair value ratio of 0.77.

At the other, expensive end of the valuation ranking are the Italian and Spanish markets. The Morningstar Italy Index is trading at a 3% overvaluation, while the Morningstar Spain Index has a price-to-fair value ratio of 1.08, meaning it is overvalued by 8%. In the case of these two indices, the overvaluation is explained by the heavy weighting of the financial sector.

Looking at the valuations of the different European sectors, there is only one, the financial sector, that is clearly overvalued, with a price-to-fair value ratio of 1.06. Spain’s largest bank, Banco Santander SAN is trading at a premium of 22%, while Italy’s largest bank, Unicredit UCG, is trading at a premium of 13%.

The real estate sector is the cheapest, with an undervaluation of more than 20%, followed by the consumer defensive sector, which is trading at a price-to-fair value ratio of 0.88. Companies such as Nestlé NESN and Unilever ULVR stand out in terms of valuation. Nestlé is trading at a discount of 18%, and Unilever is at an 11% discount.

How to Interpret the Price-to-Fair Value Ratio

All stocks under coverage by Morningstar’s equity analyst team receive a fair value estimate; the analysts forecast a company’s future cashflows to arrive at an estimate of the company’s intrinsic worth.

If the fair value estimate for the stock, based on the analysts’ estimate of the company’s intrinsic worth and the number of shares outstanding, is $100 per share but the stock is trading at only $90 per share, then its price-to-fair value ratio is 0.90. If the stock is trading at $110 per share, its price-to-fair value ratio would be 1.1. A price-to-fair value ratio below 1 suggests the stock is trading at a discount to its fair value, while a ratio above 1 suggests it is trading at a premium to its fair value.

The author or authors do not own shares in any securities mentioned in this article. Find out about

Morningstar’s editorial policies.