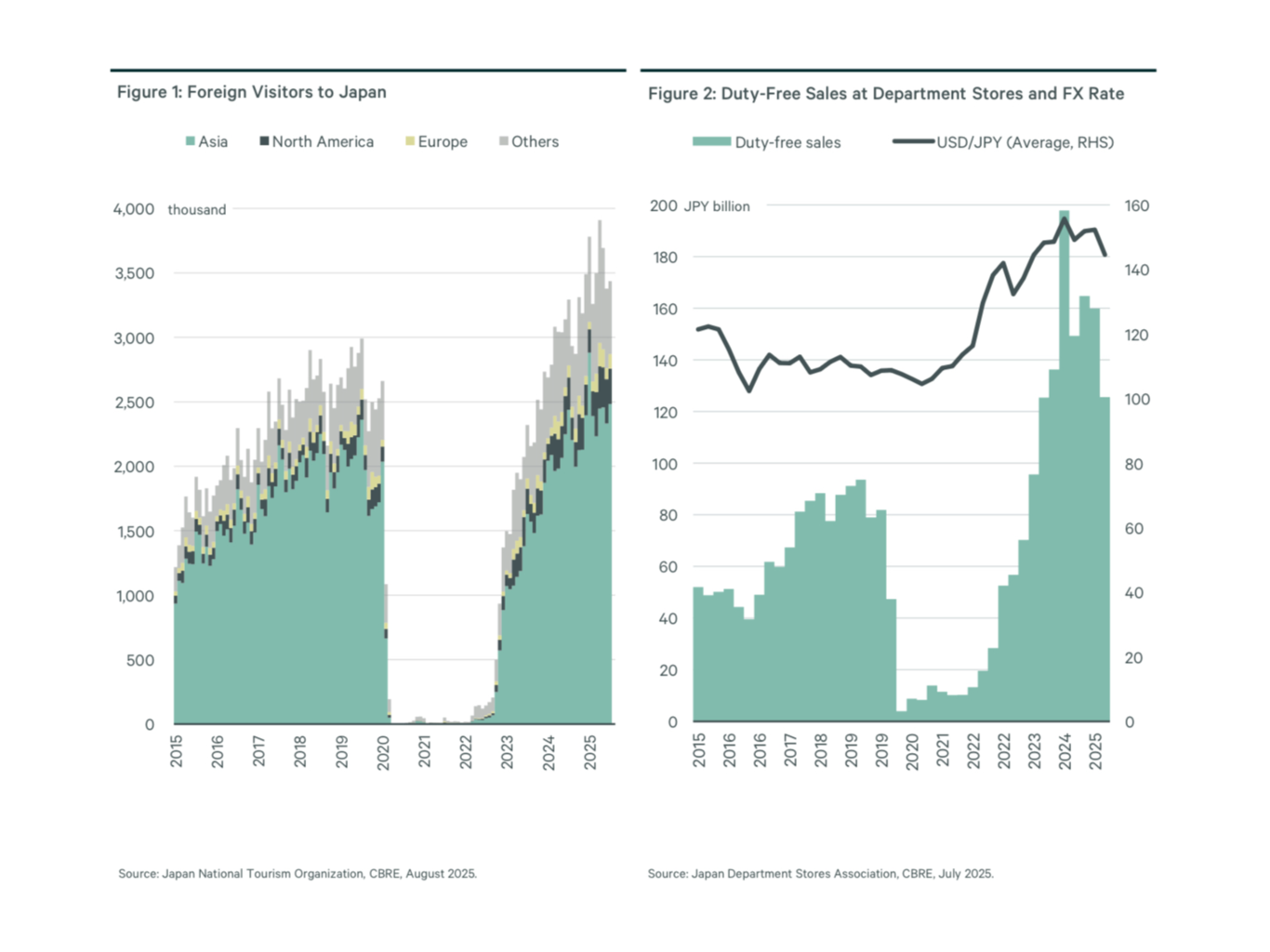

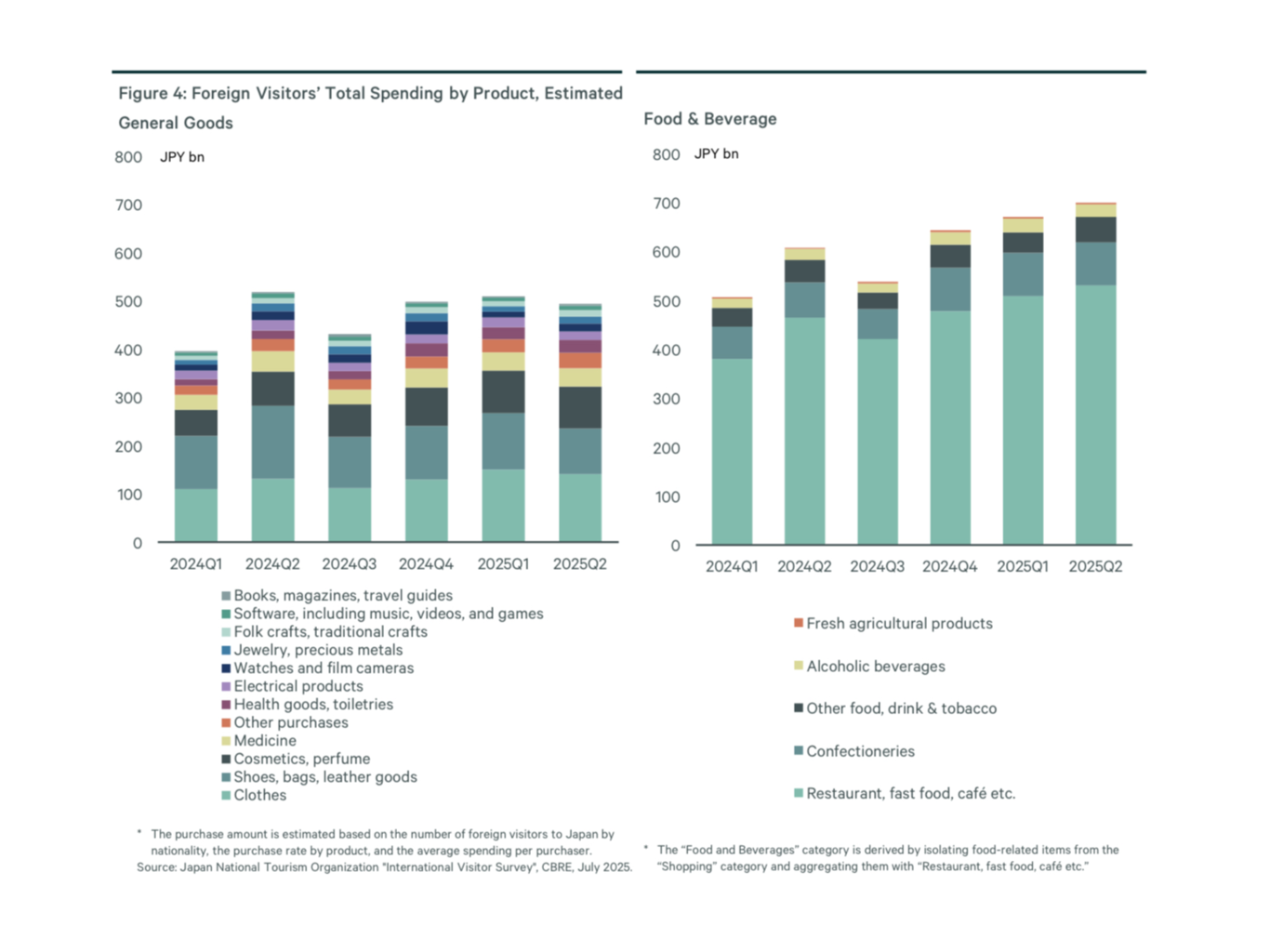

Inbound overseas tourist consumption in Japan, which has driven the country’s post-pandemic recovery and growth of the high street market, is evolving. Starting in Q1 2025, sales figures for duty-free goods released by the Japan Department Stores Association have recorded two consecutive q-o-q decreases. The stronger Yen appears to have contributed to falling sales, particularly among high-value items in the categories of “shoes, bags, leather goods”, “jewelry, precious metals”, and “watches and cameras”.

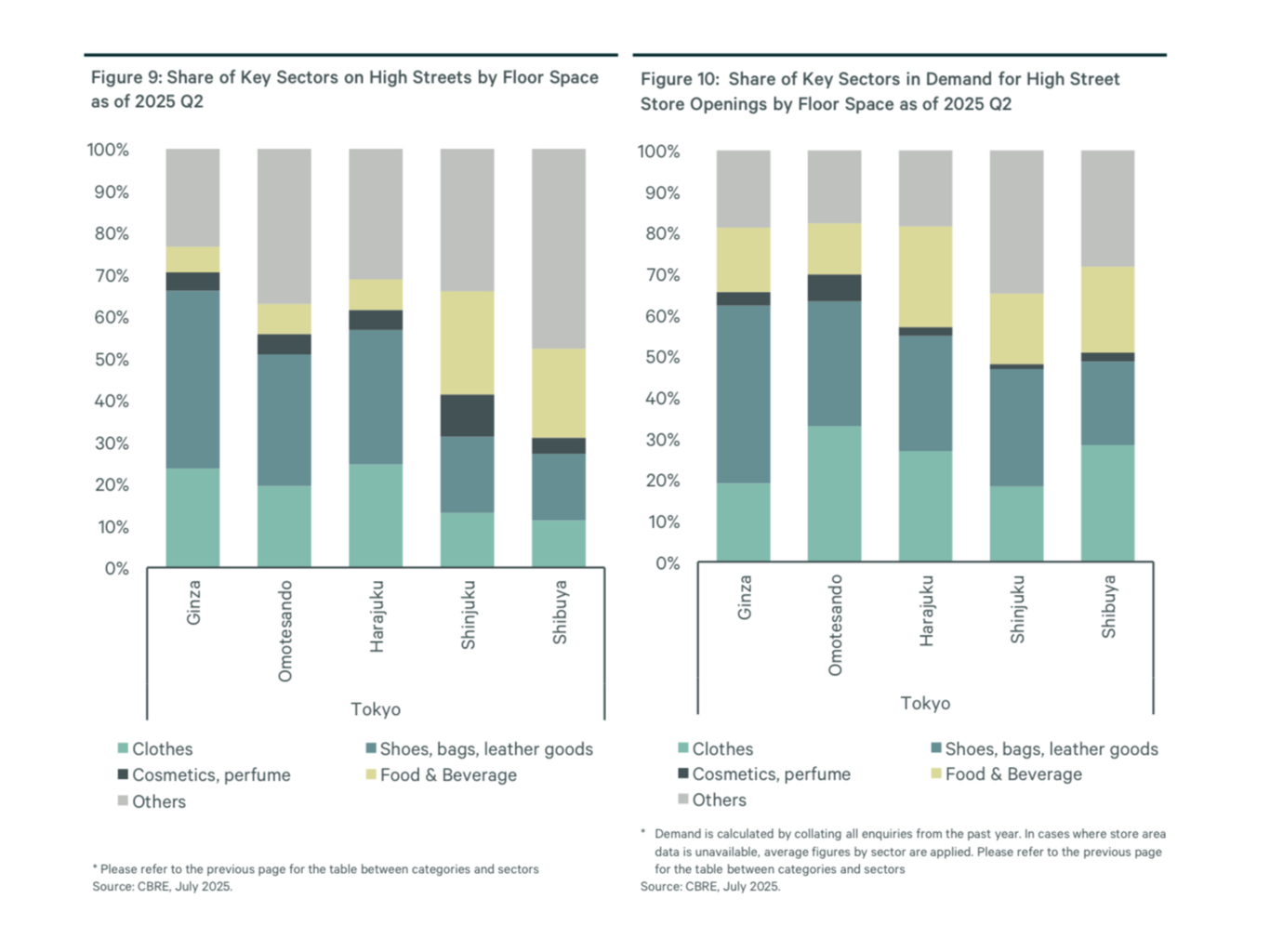

Inbound tourist consumption is transitioning to the “everyday items” and “experiences” categories. In Q2 2025, consumption by foreign visitors fell from the previous year for “shoes, bags, leather goods”, but rose y-o-y for “clothes”, “cosmetics and perfume”, and “food and beverages”.

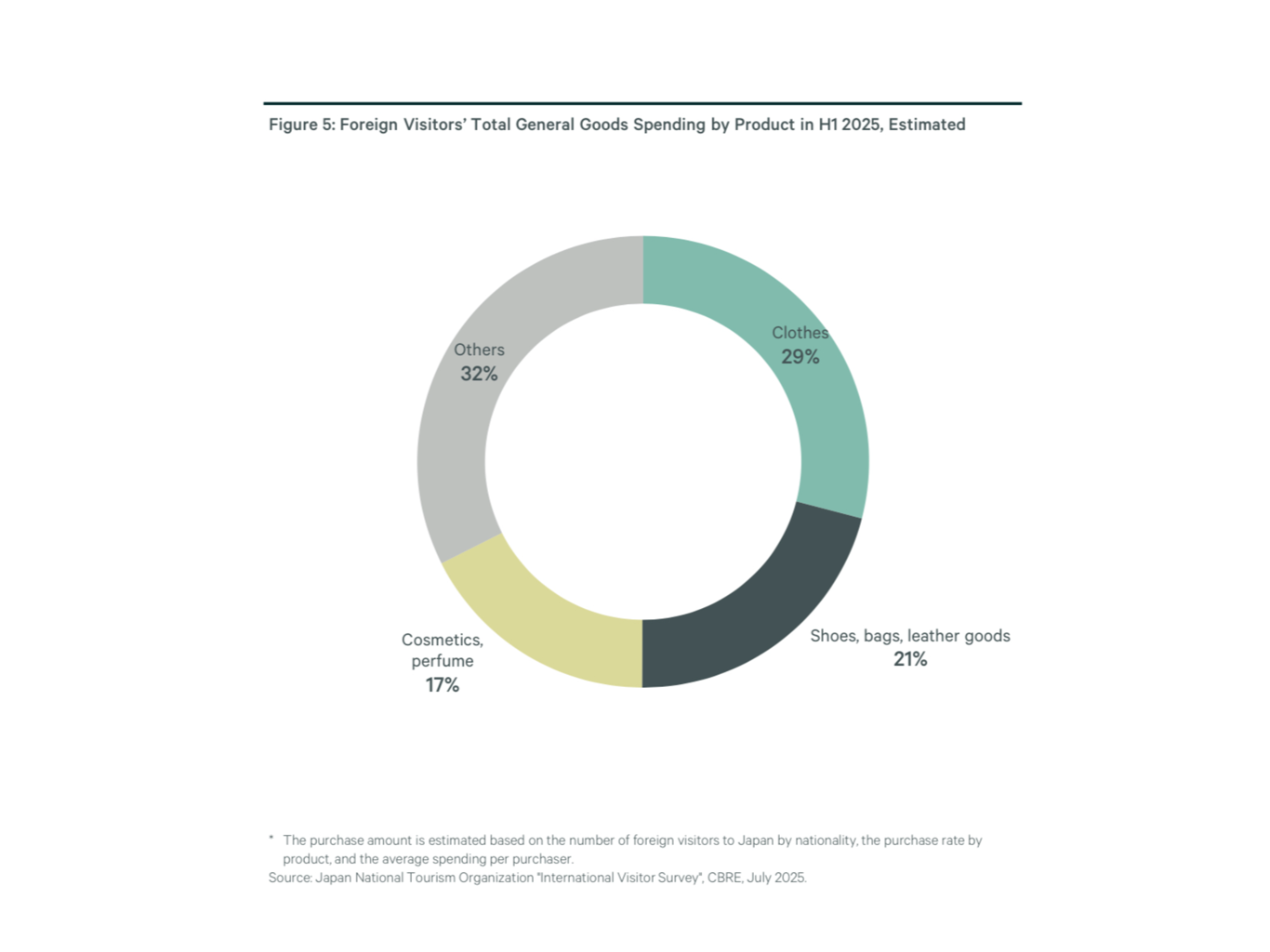

While such changes in inbound consumption patterns may be affecting street-level high street retail sales figures, owners are maintaining a positive view with respect to store sales. CBRE’s surveys show most building owners still anticipate sales figures for the 2025 calendar year to outstrip those of 2024.

This is a reflection of the strong appeal that high street locations have for visiting tourists. Shinsaibashi and Ginza boast the highest proportion of floor space dedicated to stores in sectors preferred by foreign tourists. Harajuku has seen the highest proportion of new openings since 2023, making it the go-to destination for the latest trends and fashions. Opening stores which align with evolving tourist consumption trends is key to further enhancing high street appeal.

Find Retail Viewpoint: Japan High Street Retail: Resilient Appeal Amid Evolving Inbound Spending here.