If you have been eyeing Organon stock lately, you are definitely not alone. Many investors are wondering whether the recent slide offers a golden entry point or merely signals more turbulence ahead. The past three years have been anything but kind to shareholders, with the price tumbling over 50% and the one-year return clocking in at a hefty -44.6%. Even in just the last seven days, Organon has dipped another 5.4%. What keeps this stock on watchlists is the fact that these dramatic moves are happening against a backdrop of shifting risk sentiment in the broader healthcare sector as investors recalibrate their appetite for value and defensive plays.

Organon’s current price of $9.38 undeniably reflects skepticism, but it may also open the door for bargain hunters. The company earns a value score of 5 out of 6 based on our rigorous checklist for undervaluation. That means it checks the box in five important areas where it appears cheap relative to peers or underlying fundamentals. With that in mind, it is worth digging into the methodologies behind these valuation signals and how Organon stacks up on each. In addition, there is an even more insightful way to assess its long-term potential that we will discuss at the end.

Why Organon is lagging behind its peers

Approach 1: Organon Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a core method used to estimate a company’s intrinsic value by projecting its future free cash flows and discounting them back to today’s dollars. This approach gives insight into what the business is truly worth if it can deliver on those expected cash flows over time.

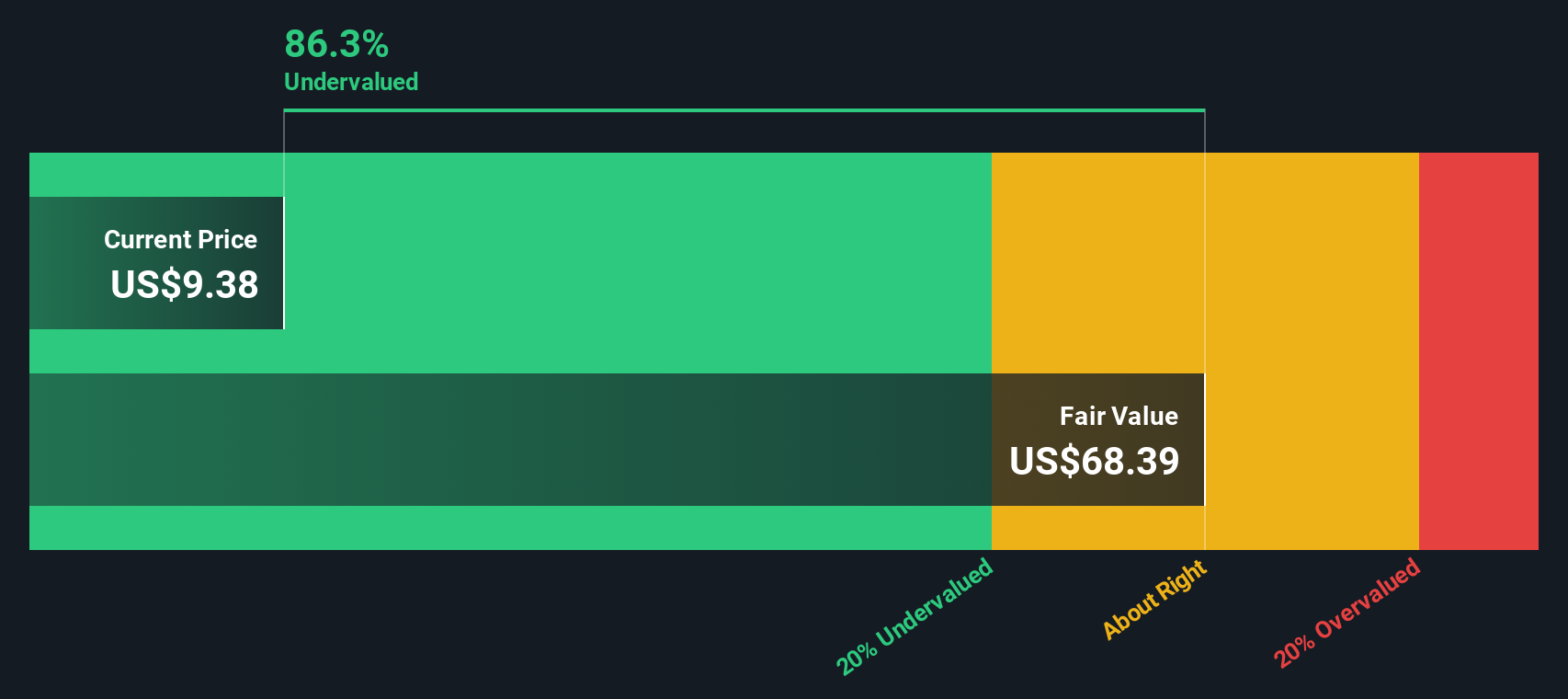

For Organon, the current Free Cash Flow (FCF) stands at $482 million. According to analyst estimates and extrapolations, this figure is set to grow steadily, reaching around $1.28 billion by 2029. The full set of cash flow projections over the next decade show a gradual increase, with estimates provided by multiple analysts for the near-term years and longer-term values extended by the valuation platform.

Based on this DCF model, the estimated intrinsic value of Organon’s shares is $68.39. This is substantially higher than the current trading price of $9.38, which suggests that the stock is trading at an 86.3% discount to its calculated fair value using this methodology.

Result: UNDERVALUED

OGN Discounted Cash Flow as at Oct 2025

OGN Discounted Cash Flow as at Oct 2025

Our Discounted Cash Flow (DCF) analysis suggests Organon is undervalued by 86.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Organon Price vs Earnings (PE Ratio)

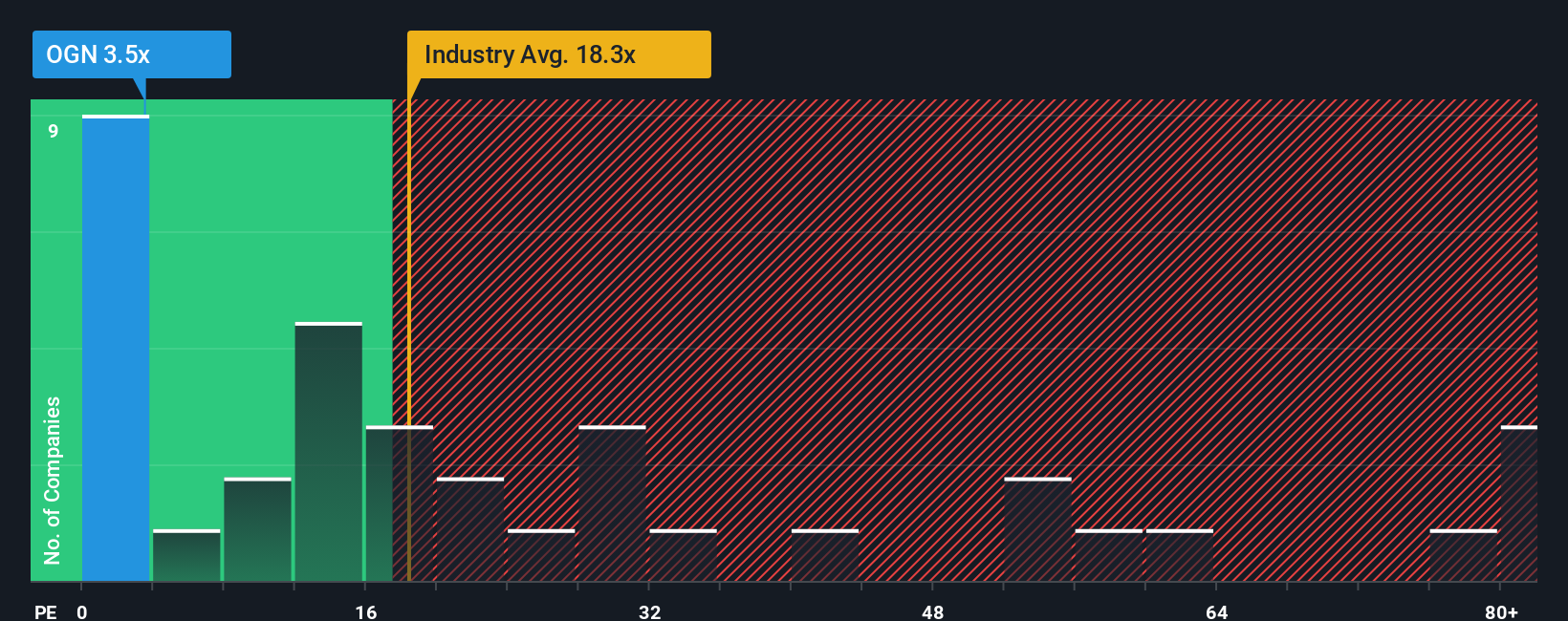

The Price-to-Earnings (PE) ratio stands out as one of the most widely used valuation multiples for profitable companies like Organon. It offers a straightforward view: how much investors are willing to pay for each dollar of earnings the company generates. For mature businesses, the PE ratio is especially relevant since it directly ties the company’s share price to actual profit.

However, what counts as a “normal” PE ratio is not one size fits all. Expectations for future earnings growth, perceived business risk, and industry dynamics can all cause investors to accept higher or lower PE multiples. Rapidly growing or lower-risk companies often command higher PE ratios, while those facing slower growth or greater uncertainties see lower ones.

Organon’s current PE ratio sits at 3.5x. To put this in perspective, the average PE among similar pharmaceutical companies is 18.3x and Organon’s peers currently average 34.6x. Clearly, the company is trading at a considerable discount using this basic measure. Yet, these broad comparisons do not always account for Organon’s unique characteristics.

This is where the Simply Wall St “Fair Ratio” comes into play. The Fair Ratio, at 19.6x for Organon, estimates the PE multiple the company should trade at given its specific earnings growth trajectory, sector, profit margins, market cap, and risk profile. This metric is more comprehensive than a simple industry or peer comparison, layering in multiple factors to deliver a more tailored benchmark for valuation.

With Organon’s current PE at 3.5x and the Fair Ratio at 19.6x, the shares look undervalued based on this approach. The gap between actual PE and Fair Ratio suggests the market is pricing in far more risk or slower growth than the underlying metrics support.

Result: UNDERVALUED

NYSE:OGN PE Ratio as at Oct 2025

NYSE:OGN PE Ratio as at Oct 2025

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Organon Narrative

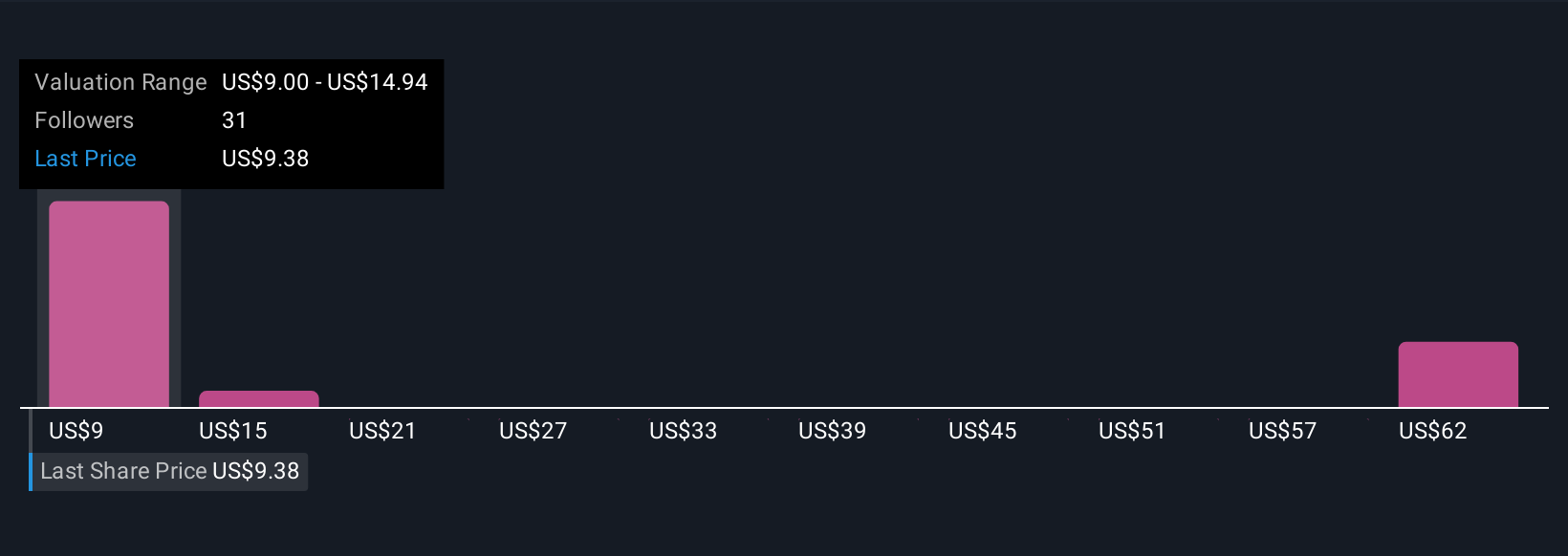

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, accessible way to capture your personal view of a company by connecting its story, financial forecasts, and an estimated fair value, all in one place. Narratives let you frame your expectations for Organon’s revenues, earnings, and margins, and then instantly see how those assumptions compare to the current share price.

This approach is easy and dynamic; you can create and share Narratives on Simply Wall St’s Community page, and millions of investors use them to see, debate, and refine their perspectives. Narratives automatically update when new news or earnings data appears, making your investment decision-making process both current and customizable. For example, while one investor might craft a bullish Narrative with a projected fair value of $18 based on optimism about new product launches and market expansion, another might see lingering risks and assign a more cautious target of $9. Narratives give you the tools to decide when the stock offers true value and when it is time to reconsider, all built on your unique story and analysis.

Do you think there’s more to the story for Organon? Create your own Narrative to let the Community know!

NYSE:OGN Community Fair Values as at Oct 2025

NYSE:OGN Community Fair Values as at Oct 2025

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com