Trump has pledged to “unleash” American oil and gas and these 22 US stocks have developments that are poised to benefit.

Columbia Banking System Investment Narrative Recap

To be a Columbia Banking System shareholder today, you generally need to believe in the long-term earnings power and ongoing regional growth of U.S. community banking, particularly in the Western states. The recent positive market reaction tied to big-bank earnings and the Federal Reserve’s shift in tone may provide short-term support for sentiment and funding margins, but it does not fundamentally resolve the company’s outsized exposure to regional economic swings or the integration challenges from its ongoing merger activity, both of which remain key risks in the near term.

Recent news of the completed Pacific Premier merger and the appointment of its directors to Columbia’s board stands out right now, directly tied to the core catalyst of rapid footprint expansion and broader market access. This development could support higher deposit and loan growth, but successful execution remains crucial as the company works to realize expected efficiency gains and revenue synergies.

However, it’s important to remember that even as sentiment shifts, Columbia’s results are still heavily influenced by Western U.S. economic trends and…

Read the full narrative on Columbia Banking System (it’s free!)

Columbia Banking System’s narrative projects $3.5 billion revenue and $1.3 billion earnings by 2028. This requires 22.8% yearly revenue growth and a $771.5 million earnings increase from $528.5 million today.

Uncover how Columbia Banking System’s forecasts yield a $28.77 fair value, a 20% upside to its current price.

Exploring Other Perspectives COLB Community Fair Values as at Oct 2025

COLB Community Fair Values as at Oct 2025

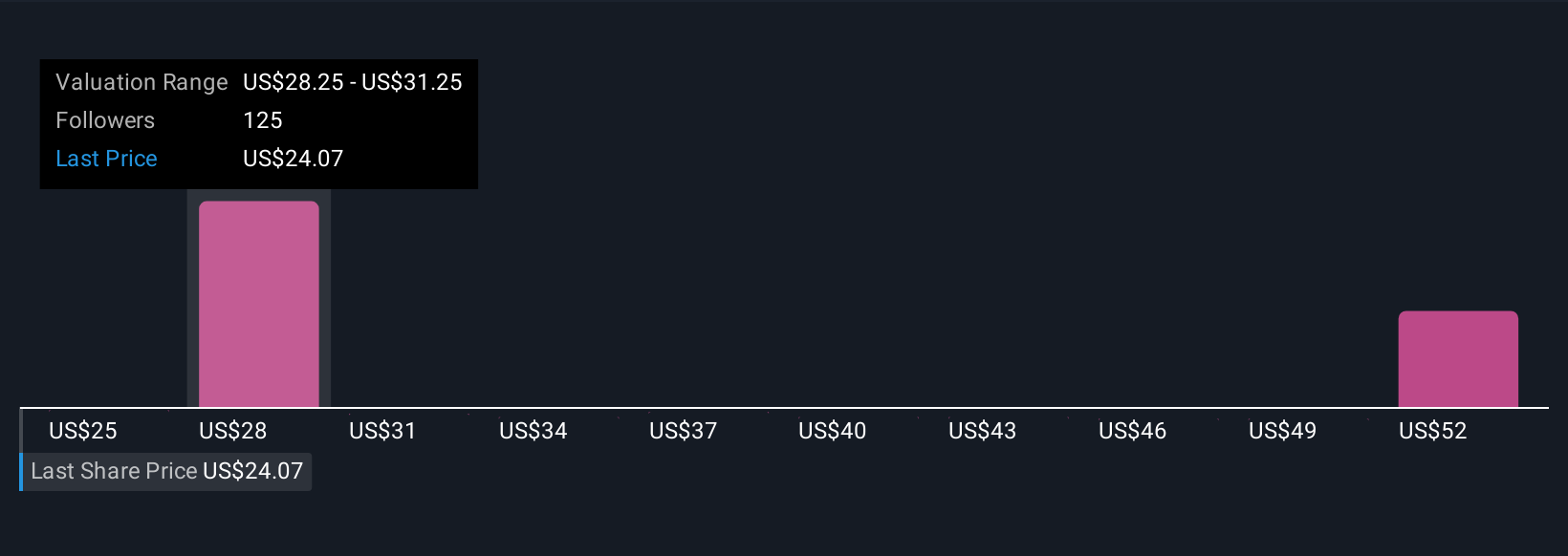

Eighteen individual investors in the Simply Wall St Community estimate Columbia’s fair value from US$25.25 to US$55.25. Many are currently weighing the Pacific Premier acquisition’s role in boosting future growth against ongoing regional risk factors, underscoring the importance of considering multiple points of view.

Explore 18 other fair value estimates on Columbia Banking System – why the stock might be worth over 2x more than the current price!

Build Your Own Columbia Banking System Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don’t delay:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com