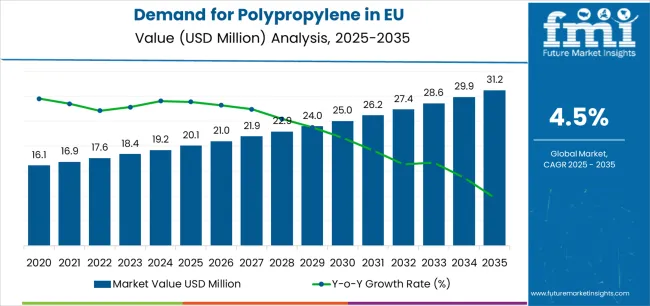

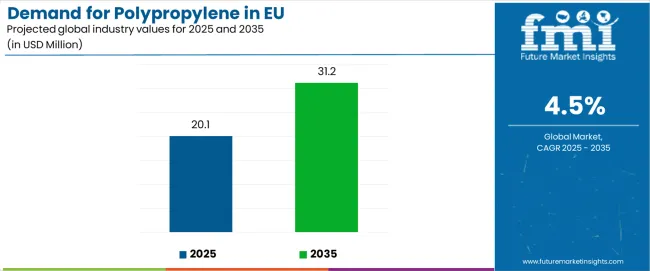

The demand for polypropylene in the European Union is projected to grow from USD 20.1 million in 2025 to USD 31.2 million by 2035, advancing at a CAGR of 4.5%. While the trajectory suggests steady expansion, the outlook remains sensitive to several risks and uncertainties that could influence growth dynamics, profitability, and competitiveness in the medium to long term. A structured risk and sensitivity assessment highlights how raw material dependence, regulatory changes, and global trade fluctuations could reshape the industry trajectory.

Volatility in raw material pricing remains the most significant risk, as polypropylene is derived from petrochemical feedstocks such as propylene, which are directly linked to crude oil and natural gas markets. Any abrupt fluctuations in crude benchmarks can lead to margin compression for producers, especially when cost pass-through to downstream buyers in packaging, automotive, and construction is limited. Price volatility also complicates long-term contract negotiations, leaving manufacturers exposed to profit erosion during periods of cost spikes.

Supply disruptions form another sensitivity vector, as polypropylene production and logistics are heavily dependent on integrated refineries and polymer facilities concentrated in select regions. Geopolitical tensions affecting energy pipelines, strikes in logistics hubs, or natural disasters affecting refining capacity can disrupt stable supply. The European Union’s import reliance on feedstock compounds this risk, as external shocks in the Middle East or North America may ripple into European production costs and availability. Currency fluctuation adds another layer of uncertainty, particularly for import-dependent countries in the bloc. A weaker euro against the US dollar inflates feedstock import costs, while a stronger euro may pressure export competitiveness of EU-based polypropylene producers. Currency volatility also complicates hedging strategies for multinational corporations, leaving margins vulnerable to unexpected swings.

Substitution risk is emerging as well, with alternative materials such as biodegradable plastics, recycled resins, and advanced composites gaining traction. Regulatory preferences and customer adoption of eco-friendly solutions in packaging and consumer goods can gradually displace polypropylene’s role, particularly in single-use applications. Sensitivity is pronounced in fast-moving consumer goods, where policy pressures and brand commitments to circular materials may accelerate substitution. Regulatory tightening or outright phase-outs remain an influential factor. The EU’s focus on circular economy and restrictions on plastic waste disposal could directly affect demand for virgin polypropylene. Extended producer responsibility, taxation on non-recycled content, and stricter packaging directives may reduce overall usage intensity. Any accelerated policy shift beyond baseline assumptions could materially lower the projected CAGR.

Quick Stats for Polypropylene in EU

Polypropylene in EU Value (2025): USD 20,098.3 million

Polypropylene in EU Forecast Value (2035): USD 31,210.1 million

Polypropylene in EU Forecast CAGR: 4.5%

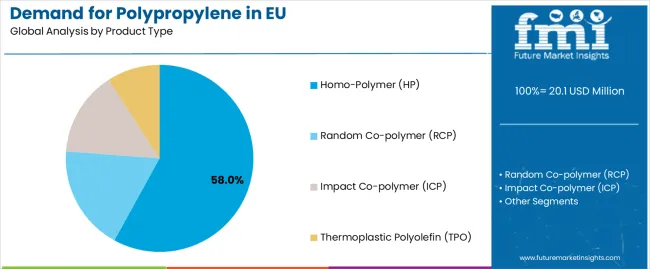

Leading Product Type in Polypropylene in EU: Homo-Polymer/HP (58.0%)

Key Growth Countries in Polypropylene in EU: Rest of Europe, Spain, and Netherlands

Top Application Segment in Polypropylene in EU: Packaging (35.0%)

Demand for Polypropylene in EU: Key Takeaways

Metric

Value

Estimated Value in (2025E)

USD 20.1 million

Forecast Value in (2035F)

USD 31.2 million

Forecast CAGR (2025 to 2035)

4.5%

Why is the Demand for Polypropylene Growing in EU?

Industry expansion is being supported by the versatile performance characteristics of polypropylene across diverse applications and the corresponding demand for cost-effective, lightweight polymer materials with proven processing capabilities across injection molding, extrusion, and thermoforming operations. Modern packaging converters, automotive manufacturers, and industrial molders rely on polypropylene as an essential thermoplastic providing excellent chemical resistance for packaging applications, superior impact strength for automotive components, and appropriate stiffness-to-weight ratios for consumer durables, driving demand for materials that consistently deliver required mechanical properties, processing characteristics, and regulatory compliance necessary for food-contact packaging, automotive safety requirements, and medical device applications. Even modest variations in polymer properties, including melt flow rate, impact strength, or additive packages, can significantly impact processing efficiency and final product performance across critical applications.

The growing requirements for sustainable plastic solutions and increasing recognition of polypropylene’s recyclability advantages compared to multi-material packaging structures are driving demand from converters with appropriate circular economy commitments and established recycling partnerships. Regulatory authorities are increasingly establishing clear guidelines for plastic packaging recyclability, extended producer responsibility requirements, and recycled content mandates to maintain circular material flows and ensure environmental compliance. Technical research and commercial validation studies are providing evidence supporting advanced polypropylene grades including high-melt-strength variants, clarified random copolymers, and recycled content formulations, requiring specialized catalyst technologies and standardized quality control protocols for optimal mechanical properties, appropriate transparency characteristics, and consistent processing behavior supporting demanding packaging, automotive, and industrial applications.

Segmental Analysis

Sales are segmented by product type, end-user (application), distribution channel, nature, and country. By product type, demand is divided into homo-polymer (HP), random co-polymer (RCP), impact co-polymer (ICP), and thermoplastic polyolefin (TPO). Based on end-user (application), sales are categorized into packaging, automotive, building and construction, healthcare, electrical and appliances, textiles, and consumer durables and others. In terms of distribution channel, demand is segmented into direct to converters/OEMs, distributors/traders, and online/marketplace channels. By nature, sales are classified into virgin PP and recycled/circular PP. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

By Product Type, Homo-Polymer (HP) Segment Accounts for 58% Market Share

The homo-polymer (HP) segment is projected to account for 58% of EU polypropylene sales in 2025, declining slightly to 56% by 2035, establishing itself as the dominant product type across European markets. This commanding position is fundamentally supported by homo-polymer PP’s excellent stiffness characteristics for rigid packaging applications, superior heat resistance for automotive under-the-hood components, and cost-effective production through standard propylene polymerization without comonomer requirements. The homo-polymer format delivers exceptional versatility, providing packaging converters, automotive molders, and industrial manufacturers with high-performance materials that facilitate injection molding, blow molding, and fiber spinning operations essential for diverse polypropylene applications.

This segment benefits from established polymerization infrastructure, comprehensive grade portfolios serving diverse applications, and extensive utilization across rigid packaging including caps and closures, food containers, and industrial packaging requiring stiffness and chemical resistance. Additionally, homo-polymer PP offers performance advantages across critical applications, including high-temperature automotive components, fiber production for textiles and nonwovens, and injection-molded articles requiring dimensional stability and surface finish quality.

The homo-polymer segment is expected to decline slightly to 56.0% share by 2035, demonstrating modest erosion as specialty copolymers and thermoplastic polyolefins capture incrementally larger shares through applications demanding enhanced impact properties or transparency characteristics throughout the forecast period.

Excellent stiffness and heat resistance supporting rigid packaging and automotive applications

Cost-effective production through standard polymerization processes

Broad application versatility across packaging, automotive, and industrial sectors

By End-User (Application), Packaging Segment Accounts for 35% Market Share

.webp.webp)

Packaging end-user applications are positioned to represent 35% of total polypropylene demand across European markets in 2025, declining slightly to 34% by 2035, reflecting the segment’s dominant position as the primary application within the overall industry ecosystem. This substantial share directly demonstrates that packaging represents the largest single end-use sector, with food packaging converters, consumer goods manufacturers, and industrial packaging producers utilizing polypropylene for flexible films, rigid containers, caps and closures, and intermediate bulk containers essential for product protection, distribution efficiency, and shelf-life extension.

Modern packaging converters increasingly rely on polypropylene delivering excellent moisture barrier properties, appropriate transparency for product visibility, and superior chemical resistance protecting packaged contents while meeting food-contact regulatory requirements. The segment benefits from continuous material innovation focused on improving recyclability through mono-material structures, enhancing transparency through clarifying agents, and developing grades supporting lightweighting initiatives reducing material consumption and transportation costs.

The segment’s slight share decline reflects proportional growth across diversifying end uses, with packaging applications maintaining their leading position while automotive and healthcare sectors expand their relative contributions throughout the forecast period.

Dominant application sector driven by food and consumer goods packaging

Versatile performance across flexible films, rigid containers, and closures

Material innovation supporting recyclability and sustainability objectives

What are the Drivers, Restraints, and Key Trends of the EU Polypropylene Market?

EU polypropylene sales are advancing steadily due to sustained packaging sector consumption, ongoing automotive production requiring lightweight solutions, and growing healthcare applications. However, the industry faces challenges, including feedstock price volatility affecting polymer economics, tightening plastics regulations requiring recyclability improvements, and potential demand cyclicality from automotive sector exposure. Continued focus on circular economy solutions, advanced grade development, and application innovation remains central to industry development.

Expansion of Circular Economy Infrastructure and Recycled Content Integration

The rapidly accelerating development of polypropylene recycling infrastructure including mechanical recycling facilities, advanced sorting technologies, and chemical recycling plants is fundamentally transforming European polymer markets from linear to circular material flows, creating sustained demand for recycled PP while establishing collection and reprocessing capabilities supporting waste valorization. Advanced recycling technologies featuring compatibilizer-enhanced mechanical recycling improving mixed PP quality, solvent-based purification enabling food-contact recycled PP, and chemical recycling producing virgin-equivalent feedstocks from mixed plastic waste enable polymer producers and converters to incorporate recycled content while maintaining performance specifications. These circular economy investments prove particularly transformative for packaging applications, where extended producer responsibility regulations mandate recycled content utilization, and for automotive applications, where lightweighting synergizes with recycled material adoption supporting corporate sustainability targets.

Integration of Advanced Grades Supporting Automotive Lightweighting and Electrification

Modern polypropylene producers systematically develop advanced grades including long-fiber reinforced compounds, high-flow injection molding resins, and thermally stable formulations addressing automotive industry requirements for vehicle lightweighting, interior quality enhancement, and electric vehicle component production. Strategic integration of specialty additives including impact modifiers, UV stabilizers, and thermal management additives; reinforcement technologies utilizing glass fibers or natural fibers improving stiffness and dimensional stability; and processing optimizations enabling thin-wall molding and complex part geometries enable automotive suppliers to substitute metal components with polypropylene alternatives delivering weight reduction while maintaining safety and durability requirements. These advanced materials prove essential for automotive applications including battery pack housings requiring flame retardance, interior panels demanding low-VOC emissions, and exterior components necessitating weatherability and impact resistance.

Growing Emphasis on Regulatory Compliance and Extended Producer Responsibility

European packaging regulations increasingly mandate recyclability design principles, recycled content incorporation, and extended producer responsibility participation requiring converters to demonstrate packaging sustainability and contribute to collection and recycling infrastructure development. This regulatory pressure enables polymer producers to differentiate offerings through recyclability-optimized grades eliminating difficult-to-separate multi-material structures, recycled content formulations meeting mandated incorporation levels, and technical documentation supporting EPR compliance reporting. Regulatory compliance proves particularly important for packaging applications, where failure to meet recyclability standards or recycled content mandates creates market access barriers and reputational risks for brand owners and converters.

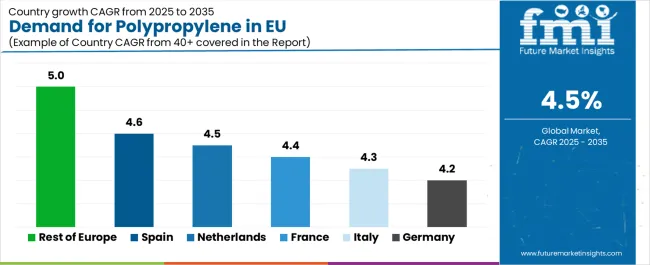

Demand Analysis of Polypropylene in the EU by Key Countries

Country

CAGR %

Rest of Europe

5.0%

Spain

4.6%

Netherlands

4.5%

France

4.4%

Italy

4.3%

Germany

4.2%

EU polypropylene sales demonstrate robust growth across major European economies, with the Rest of Europe leading expansion at 5.0% CAGR through 2035, driven by expanding manufacturing capacity and growing end-use sectors. Spain maintains strong positioning through packaging industry growth and automotive development. Netherlands benefits from petrochemical industry concentration and logistics infrastructure. France leverages automotive manufacturing strength and diversified packaging sector. Italy maintains consistent growth through broad manufacturing base. Germany demonstrates steady advancement reflecting mature market characteristics. Overall, sales show strong regional development reflecting sustained packaging demand, ongoing automotive production, and expanding circular economy infrastructure across EU markets.

Germany Leads European Sales with Established Polymer Infrastructure

Revenue from polypropylene in Germany is projected to exhibit steady growth with a CAGR of 4.2% through 2035, driven by Europe’s largest polymer-consuming economy, comprehensive automotive manufacturing sector, and diversified packaging industry serving food and consumer goods markets. Germany’s internationally recognized manufacturing capabilities and established polymer conversion infrastructure are creating sustained demand for polypropylene across packaging, automotive, and industrial applications.

Major packaging converters, automotive suppliers including tier-one component manufacturers, injection molders, and industrial manufacturers source polypropylene from domestic producers including Borealis operations and international suppliers ensuring material availability and quality consistency. German demand benefits from substantial automotive production requiring interior components and under-the-hood applications, comprehensive packaging sector serving food and industrial markets, and established injection molding industry supporting consumer durables and technical components.

Europe’s largest polypropylene market driven by automotive and packaging sectors

Comprehensive manufacturing infrastructure supporting diverse polymer applications

Established circular economy initiatives driving recycled PP adoption

France Demonstrates Strong Growth with Automotive and Packaging Focus

Revenue from polypropylene in France is expanding at a CAGR of 4.4%, substantially supported by substantial automotive manufacturing sector, diversified packaging industry, and growing healthcare applications including medical devices and pharmaceutical packaging. France’s balanced industrial structure and established polymer conversion capabilities are systematically driving stable polypropylene demand across multiple end-use sectors.

Major automotive manufacturers and tier suppliers, packaging converters, healthcare product manufacturers, and consumer goods companies source polypropylene from European producers and import operations ensuring adequate material availability. French demand particularly benefits from automotive industry presence requiring polymer components for vehicle production, packaging sector serving food and consumer markets, and healthcare industry utilizing polypropylene for medical devices and sterile packaging applications.

Substantial automotive sector driving interior and technical component demand

Diversified packaging industry serving food and consumer goods applications

Healthcare sector utilizing polypropylene for medical devices and packaging

Italy Maintains Consistent Growth with Diversified Manufacturing

Revenue from polypropylene in Italy is growing at a steady CAGR of 4.3%, fundamentally driven by diversified manufacturing base including automotive components, packaging conversion, and consumer durables production. Italy’s broad industrial structure and established polymer processing capabilities are supporting sustained polypropylene consumption across varied applications.

Major packaging converters serving food industry, automotive component suppliers, injection molding operations, and consumer goods manufacturers source polypropylene from European suppliers ensuring material availability for production operations. Italian demand particularly benefits from substantial packaging sector serving food exports and domestic consumption, automotive component manufacturing supporting European vehicle production, and consumer durables including appliances and furniture utilizing polypropylene components.

Diversified manufacturing base supporting broad polypropylene applications

Substantial packaging sector serving food and consumer goods markets

Automotive component manufacturing supporting European supply chains

Spain Focuses on Packaging Growth and Automotive Expansion

Demand for polypropylene in Spain is projected to grow at a CAGR of 4.6%, substantially supported by expanding packaging industry, growing automotive manufacturing sector, and increasing polymer conversion capacity. Spanish industrial development and manufacturing expansion are positioning polypropylene as an essential material input across growing end-use sectors.

Major packaging converters, automotive component suppliers, and industrial manufacturers source polypropylene from European producers and import operations ensuring adequate material availability for expanding production. Spanish demand benefits from packaging industry growth supporting food exports and domestic consumption, automotive sector expansion including new production facilities, and growing polymer conversion capacity serving domestic and export markets.

Expanding packaging industry supporting food and consumer goods sectors

Growing automotive manufacturing capacity driving component demand

Increasing polymer conversion infrastructure supporting market development

Netherlands Emphasizes Petrochemical Infrastructure and Logistics Hub

Demand for polypropylene in the Netherlands is expanding at a CAGR of 4.5%, fundamentally driven by concentrated petrochemical industry presence including polymer production facilities, logistics hub positioning supporting European distribution, and polymer conversion operations serving Benelux markets. Dutch petrochemical concentration and strategic logistics capabilities are creating focused polypropylene demand supporting both domestic conversion and European trade flows.

Netherlands demand significantly benefits from domestic polymer production facilities ensuring material availability, advanced port infrastructure facilitating polymer imports and exports, and polymer conversion operations serving packaging, automotive, and industrial applications. The country’s petrochemical industry concentration creates substantial polymer handling and distribution activities supporting regional supply chains.

Concentrated petrochemical industry including polymer production facilities

Strategic logistics positioning supporting European polymer distribution

Polymer conversion operations serving Benelux and European markets

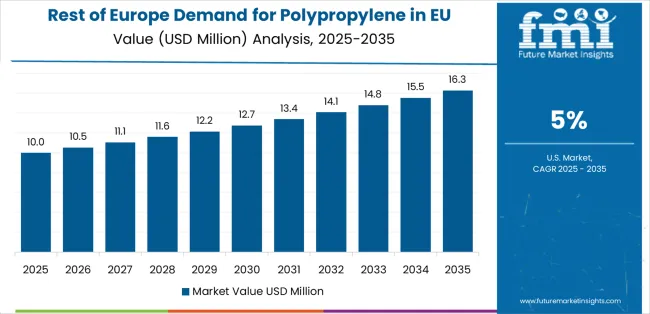

Rest of Europe Demonstrates Strong Growth with Emerging Manufacturing

Revenue from polypropylene in the Rest of Europe region is expanding at a CAGR of 5.0%, substantially supported by expanding manufacturing capacity, growing packaging sectors, and increasing automotive production across diverse European markets outside major economies. Regional industrial development and polymer conversion expansion are creating sustained polypropylene demand across varied applications.

Industrial consumers across Rest of Europe markets, including packaging converters, automotive suppliers, injection molders, and consumer goods manufacturers, source polypropylene from regional producers and European distribution networks ensuring material availability. Rest of Europe demand reflects expanding packaging industry supporting food and consumer goods sectors, automotive production growth across various markets, and polymer conversion capacity development supporting regional manufacturing expansion.

Expanding manufacturing capacity across diverse European markets

Growing packaging sectors supporting regional food and consumer goods industries

Increasing automotive production creating component material demand

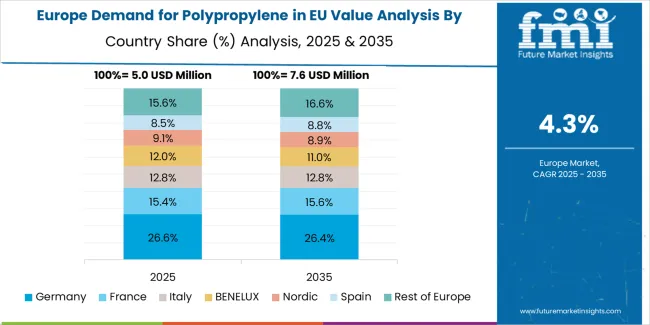

Europe Market Split by Country

EU polypropylene sales are projected to grow from USD 20.1 million in 2025 to USD 31.2 million by 2035, registering a CAGR of 4.5% over the forecast period. The Rest of Europe region is expected to demonstrate the strongest growth trajectory with a 5.0% CAGR, supported by expanding manufacturing capacity, growing packaging sector, and increasing automotive production. Spain follows with a 4.6% CAGR, attributed to packaging industry growth and automotive sector development.

The Netherlands demonstrates a 4.5% CAGR, reflecting the petrochemical industry’s presence and logistics hub positioning. France shows a 4.4% CAGR, supported by the automotive manufacturing and packaging sectors. Italy exhibits a 4.3% CAGR, driven by a diversified manufacturing base. Germany demonstrates a 4.2% CAGR, reflecting mature market characteristics and established polymer consumption.

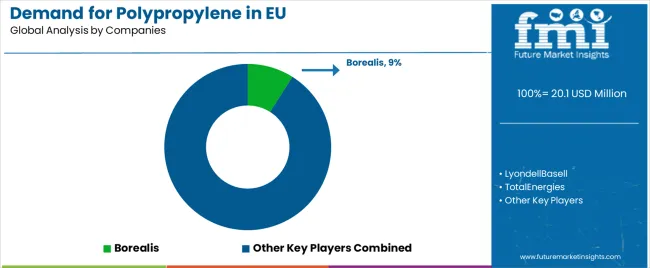

Competitive Landscape

EU polypropylene sales are defined by competition among major integrated petrochemical companies, specialized polymer producers, and regional compounders serving packaging, automotive, and industrial applications. Companies are investing in production capacity expansion addressing growing demand, advanced catalyst technology development enabling specialized grades, mechanical and chemical recycling infrastructure supporting circular economy objectives, and technical service programs to deliver reliable, high-performance, and increasingly sustainable polypropylene solutions. Strategic relationships with major packaging converters and automotive suppliers, application development support optimizing material selection and processing, and circular economy initiatives supporting recycled content integration are central to strengthening market position.

Major participants include Borealis with an estimated 9% share, leveraging its strong EU production assets, comprehensive automotive and packaging grade portfolios, and circular polypropylene initiatives including mechanical recycling and chemical recycling partnerships. Borealis benefits from integrated European petrochemical operations, advanced Borstar catalyst technology enabling specialized grades, and established relationships with major converters and automotive OEMs.

LyondellBasell holds approximately 8% share, emphasizing its extensive EU production footprint, leading catalyst technologies including Spheripol process, and comprehensive grade offerings serving packaging, automotive, and industrial applications. LyondellBasell’s success in serving diverse end-use markets through technical innovation and global scale creates competitive positioning, supported by established European manufacturing presence and advanced polymer development capabilities.

TotalEnergies accounts for roughly 6.5% share through its integrated European petrochemicals operations, comprehensive polymer production facilities, and relationships with major European converters and automotive manufacturers. The company benefits from petrochemical integration ensuring feedstock security, diversified grade portfolio, and technical service supporting converter optimization and application development.

SABIC (EU operations) represents approximately 5.5% share, supporting growth through European manufacturing presence, automotive industry relationships particularly for technical compounds, and specialty grade development addressing demanding applications. SABIC leverages chemical industry expertise, automotive material specialization, and global technology capabilities supporting European market participation. Other companies and regional producers collectively hold 71% share, reflecting the fragmented nature of European polypropylene sales.

Key Players

Borealis

LyondellBasell

TotalEnergies

SABIC

Regional polymer producers and compounders

Scope of the Report

Item

Value

Quantitative Units

USD 31.2 million

Product Type

Homo-Polymer (HP), Random Co-polymer (RCP), Impact Co-polymer (ICP), Thermoplastic Polyolefin (TPO)

End-User (Application)

Packaging, Automotive, Building & Construction, Healthcare, Electrical & Appliances, Textiles, Consumer Durables & Others

Distribution Channel

Direct to Converters/OEMs, Distributors/Traders, Online/Marketplace

Nature

Virgin PP, Recycled/Circular PP

Forecast Period

2025-2035

Base Year

2025

Historical Data

2020-2024

Countries Covered

Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe

Key Companies Profiled

Borealis, LyondellBasell, TotalEnergies, SABIC, Regional producers

Report Pages

180+ Pages

Data Tables

50+ Tables and Figures

Additional Attributes

Dollar sales by product type, end-user (application), distribution channel, nature, and country; regional demand trends across major European markets; competitive landscape analysis with established petrochemical companies and polymer producers; converter preferences for various polymer grades and performance characteristics; integration with packaging conversion, automotive manufacturing, and industrial molding applications; innovations in catalyst technology, recycling processes, and advanced grades; adoption across direct converter procurement and distributor channels.

Key Segments Product Type:

Homo-Polymer (HP)

Random Co-polymer (RCP)

Impact Co-polymer (ICP)

Thermoplastic Polyolefin (TPO)

End-User (Application):

Packaging

Automotive

Building & Construction

Healthcare

Electrical & Appliances

Textiles

Consumer Durables & Others

Distribution Channel:

Direct to Converters/OEMs

Distributors/Traders

Online/Marketplace

Nature:

Virgin PP

Recycled/Circular PP

Countries:

Germany

France

Italy

Spain

Netherlands

Rest of Europe

The global demand for polypropylene in eu is estimated to be valued at USD 20.1 million in 2025.

The market size for the demand for polypropylene in eu is projected to reach USD 31.2 million by 2035.

The demand for polypropylene in eu is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in demand for polypropylene in eu are homo-polymer (hp), random co-polymer (rcp), impact co-polymer (icp) and thermoplastic polyolefin (tpo).

In terms of end-user (application), packaging segment to command 35.0% share in the demand for polypropylene in eu in 2025.