Seagate Technology Holdings (STX) is attracting renewed investor attention after a wave of analyst upgrades citing two key drivers: rising demand for AI infrastructure and ongoing shortages in data storage hardware. These factors are expected to support stronger pricing and healthier margins for the company.

See our latest analysis for Seagate Technology Holdings.

Behind the positive analyst buzz, Seagate’s share price momentum has been nothing short of remarkable. The stock has climbed over 160% year-to-date as investors react to surging AI hardware demand and persistent supply constraints. This surge is reinforced by a stellar 1-year total shareholder return of 106% and a five-year total return north of 400%. This suggests that long-term holders are seeing significant rewards as industry trends turn in Seagate’s favor.

If you’re tracking transformational moves in tech, this could be a compelling time to explore innovation’s next frontiers with See the full list for free.

The question now is whether Seagate’s rapid price appreciation has left shares undervalued given its growth outlook, or if the market has already factored in all future gains, leaving little room for additional upside.

Most Popular Narrative: 10.3% Overvalued

According to the most widely followed narrative, Seagate’s last close price of $225.40 is well above the latest fair value estimate of $204.35, pointing to a notable disconnect between current market optimism and longer-term expectations. The narrative’s assumptions reveal what could be fueling this valuation gap.

Seagate is ramping up its HAMR-based Mozaic drives, which represent a technological breakthrough. The transition to these drives is expected to lead to sustained and profitable growth, impacting both revenue and net margins positively.

Want to see why analysts think premium pricing will persist? The narrative pivots on a bold timeline for future profit growth and margin expansion. The most surprising detail is how fast major technology changes are expected to drive fundamental shifts in Seagate’s long-term earnings power. Discover the full mix of revenue and margin forecasts driving this decisive valuation call.

Result: Fair Value of $204.35 (OVERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, trade policy uncertainties and future tax changes could challenge Seagate’s bullish outlook. These factors may make the growth narrative less certain.

Find out about the key risks to this Seagate Technology Holdings narrative.

Another View: Multiples Signal a Different Story

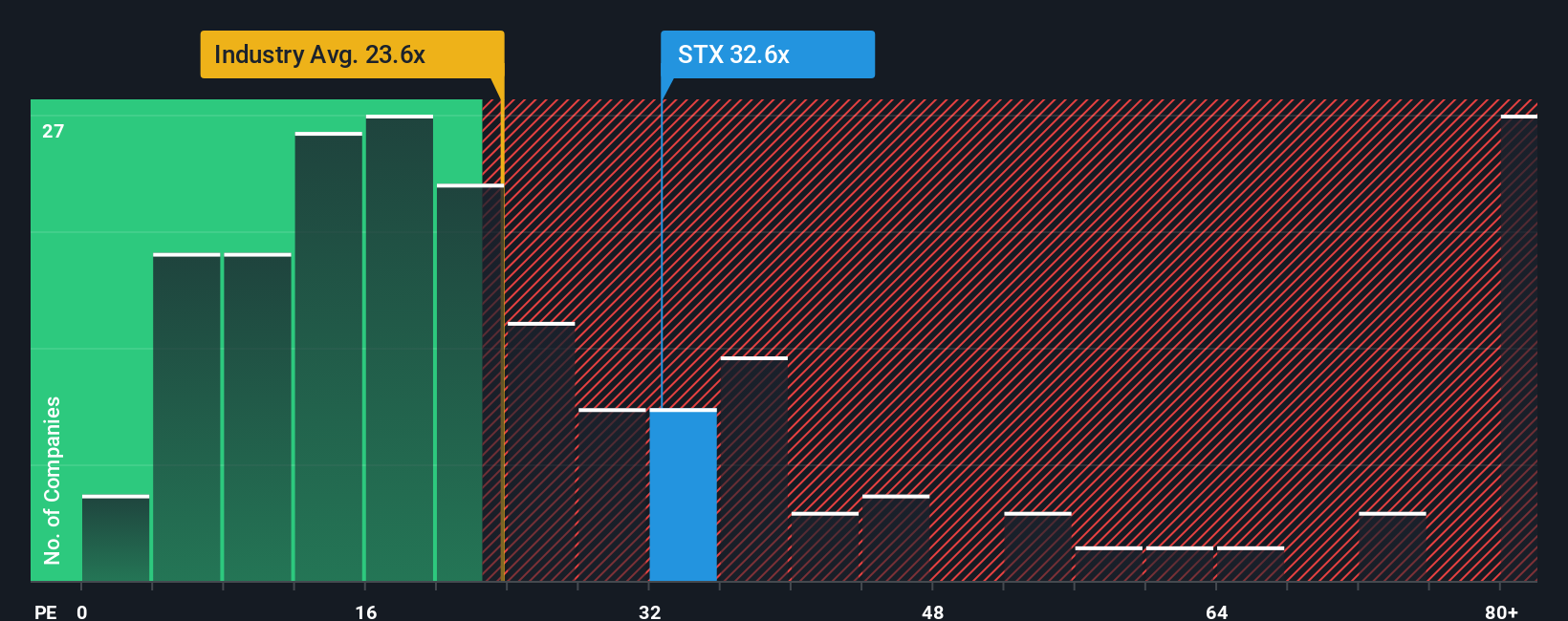

Looking at valuation through the lens of price-to-earnings, Seagate trades at 32.6x. This is notably higher than both its global tech industry peers (23.6x) and the peer average (21x). Even when compared to its own fair ratio of 35.1x, the current multiple indicates a premium that is approaching market expectations. This gap could suggest valuation risk if market sentiment shifts. Which view will investors trust when deciding what has already been priced in?

See what the numbers say about this price — find out in our valuation breakdown.

NasdaqGS:STX PE Ratio as at Oct 2025 Build Your Own Seagate Technology Holdings Narrative

NasdaqGS:STX PE Ratio as at Oct 2025 Build Your Own Seagate Technology Holdings Narrative

If you want a fresh perspective or believe the numbers tell a different story, dive in and build your own take on Seagate. Do it your way.

A great starting point for your Seagate Technology Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Get ahead of the crowd and upgrade your portfolio with unique insights powered by the Simply Wall Street Screener. Why let opportunity slip by when smart, targeted moves could put you one step ahead?

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com