AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part – they are all under $10b in market cap – there’s still time to get in early.

CNX Resources Investment Narrative Recap

To be a shareholder of CNX Resources, you need confidence in the company’s ability to sustain free cash flow and benefit from new gas demand, even as analysts warn about the sensitivity of earnings to natural gas prices. The recent news of cautious analyst ratings and minor target price adjustments reflects near-term uncertainty, but does not appear to fundamentally change the main short-term catalyst: realizing increased natural gas demand from emerging markets such as AI-driven data centers. The largest immediate risk remains weaker cash flow if gas prices stay low.

Among recent announcements, CNX’s update on maintaining positive free cash flow for a 22nd consecutive quarter and increasing its lower-end production guidance stands out. These achievements reinforce CNX’s operational consistency, which is particularly important as investors weigh risks related to commodity pricing and the ability to capture incentives like the 45Z tax credit, a factor closely tracked in analyst commentaries.

In contrast, investors should keep in mind that recent analyst caution reflects real risk if…

Read the full narrative on CNX Resources (it’s free!)

CNX Resources is projected to achieve $2.3 billion in revenue and $859.1 million in earnings by 2028. This outlook assumes annual revenue growth of 8.9% and a $703.4 million increase in earnings from the current level of $155.7 million.

Uncover how CNX Resources’ forecasts yield a $31.57 fair value, in line with its current price.

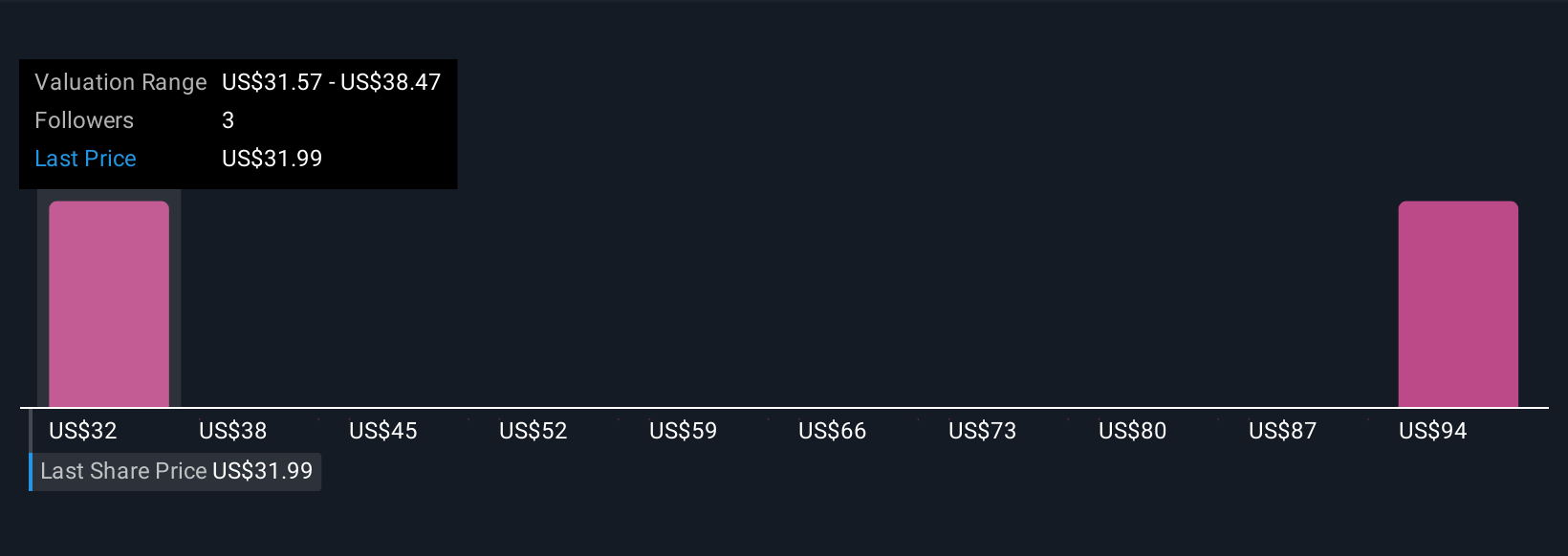

Exploring Other Perspectives CNX Community Fair Values as at Oct 2025

CNX Community Fair Values as at Oct 2025

The Simply Wall St Community has submitted two fair value estimates for CNX Resources ranging from US$31.57 to US$100.55 per share. While some see significant upside, many market participants remain focused on the uncertainty of translating policy incentives and anticipated demand shifts into durable earnings growth.

Explore 2 other fair value estimates on CNX Resources – why the stock might be worth just $31.57!

Build Your Own CNX Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don’t delay:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com