The uncertain macroeconomic outlook continues to create strong selling pressure on Bitcoin.

A week after the escalating US-China trade war, the weakness in regional bank stocks has further rattled investor confidence. The Bitcoin price fell to $103,500 on Friday, down over 18% from its all-time high.

Concerns over credit and liquidity now loom large, as rising defaults and tightening funding conditions threaten to spread stress beyond banks into broader markets.

However, prominent analysts anticipate that mounting recessionary pressures will compel the US Federal Reserve to cut interest rates more aggressively, halt Quantitative Tightening, and inject fresh liquidity into the financial system.

This is a highly bullish scenario for risk assets, including Bitcoin. While buying the dip remains a sound strategy, analysts advise doing so only after successful retests of key support levels or confirmed breakouts above resistance to minimize downside risk.

Why Is Bitcoin Price Down Today?

As has been the case throughout this bull cycle, macroeconomic and geopolitical factors have played a key role in derailing Bitcoin’s upward trajectory.

The US-China trade tensions appear to be easing slightly after US President Donald Trump signalled that the recently imposed 100% tariffs on Chinese goods may not be permanent. Trump is also expected to meet Chinese President Xi Jinping later this month on the sidelines of the APEC conference.

However, the weakness in regional banking stocks put the spotlight on the credit and liquidity risks facing the US economy. Banks such as Zions, First Republic, and PacWest fell sharply after disclosing losses tied to commercial real estate and auto loans.

JPMorgan CEO Jamie Dimon cautioned that “when you see one cockroach, there are probably more,” suggesting that the recent loan losses could be an early sign of deeper credit troubles ahead.

The recent spike in repo market activity has fueled liquidity concerns across Wall Street. Banks and dealers have increasingly tapped the Fed’s Standing Repo Facility to secure short-term funding, signalling tighter cash conditions.

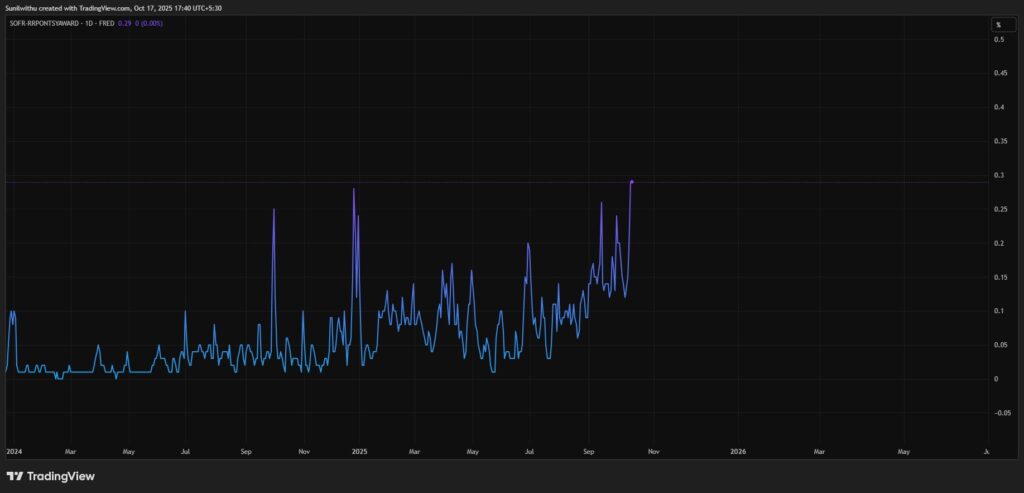

The widening SOFR-RRP spread, a key gauge of funding stress, shows that overnight lending rates are rising faster than the Fed’s benchmark, a clear sign that liquidity in the banking system is tightening.

Analysts warn that shrinking reserves and higher funding costs could pressure risk assets like stocks and Bitcoin.

Bitcoin Price Prediction: When To Buy The Dip?

Despite the credit and liquidity concerns, prominent analysts remain bullish, especially with the US Federal Reserve expected to engage in emergency market-supporting actions.

The CME FedWatch is now fully pricing in two 25-basis-point rate cuts this year, bringing the Federal target rate to 350-375.

Meanwhile, Fed Chair Jerome Powell has indicated that the central bank’s Quantitative Tightening program is set to end soon. Macroeconomist Andreas Steno Larsen claims that the Fed will soon step in to provide liquidity to financial markets.

The Fed will probably get involved on the liquidity side sooner than they think (no, not a QE program)

— Andreas Steno Larsen (@AndreasSteno) October 17, 2025

US Treasury Secretary Scott Bessent has also nudged the central bank to use quantitative easing occasionally to support the stock market.

Investors should look to buy the dip. However, interested buyers should wait for a successful retest of the 50-week Exponential Moving Average, which has been the key support level for Bitcoin throughout the bull market.

Top analysts continue to give Bitcoin price predictions, with $150k emerging as a consensus price target.

Bitcoin Hyper Tipped As the Best Low-Cap Altcoin To Buy

Smart money investors rarely go all in on Bitcoin. Instead, they diversify into high-beta Bitcoin plays, altcoins that move in tandem with BTC but tend to amplify its gains during bullish phases, often delivering even larger percentage returns.

For instance, Bitcoin Hyper (HYPER), the newest BTC layer-2 coin, has raised over $24 million in presale funding, owing to strong whale demand.

Major whales have been making headline allocations in Bitcoin Hyper’s presale rounds; one recent transaction reportedly exceeded $500,000.

The project is pitched as a canonical bridge plus L2 built atop Bitcoin: users lock BTC in the bridge and are issued wrapped BTC equivalents on the L2. Under the hood, Bitcoin Hyper combines ZK rollups with Solana Virtual Machine (SVM) or modular execution layers to support smart contracts and high throughput while anchoring final settlement back to Bitcoin’s mainnet.

The design claims to preserve Bitcoin’s security guarantees but offers transaction speeds in the thousands per second and dramatically lower fees.

HYPER’s strong early demand isn’t surprising. The top layer-2 coins tend to reach multibillion-dollar valuations, with even Bitcoin’s Stacks reaching a peak valuation of $5 billion.

Smart money investors are among Bitcoin Hyper’s early buyers, with many calling it one of the best low-cap altcoins to invest in.