If you’re wondering whether Cheniere Energy is a buy, hold, or sell right now, you’re not alone. With the stock closing at $218.96 and posting a 21.3% gain over the past year, investors are understandably curious about where this liquefied natural gas giant fits in their portfolio. The last month or so was not exactly smooth sailing, with Cheniere down 3.7% over 7 days and off 7.0% in 30 days. However, such short-term bumps have often been the prelude to longer-term growth for this company’s shares. Consider the five-year performance, which is up a striking 368.0%. Those are the kind of numbers that catch your eye, especially with energy markets continually evolving and global demand for LNG on the rise.

Recently, industry news about U.S. export capacity expansions and shifting international energy partnerships has put a spotlight on companies like Cheniere, with investors recalculating not just risk, but potential reward. In terms of valuation, Cheniere stands out by passing 6 out of 6 checks for being undervalued and earning a perfect value score of 6. That is not something you see every day.

But what, exactly, makes a stock “undervalued” across these different metrics? Let’s break down the key approaches analysts use, before exploring an even more insightful way to judge Cheniere’s true worth.

Approach 1: Cheniere Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting those amounts back to today using a risk-adjusted rate. This gives investors a sense of what the business is really worth, irrespective of current market sentiment.

Cheniere Energy’s latest twelve-month Free Cash Flow stands at $3.13 billion. Analysts project steady growth, with Free Cash Flow expected to reach around $4.73 billion by 2029 and nearly $6.15 billion by 2035. Estimates beyond 2029 rely on long-term assumptions and are extrapolated based on current trends and expert forecasts.

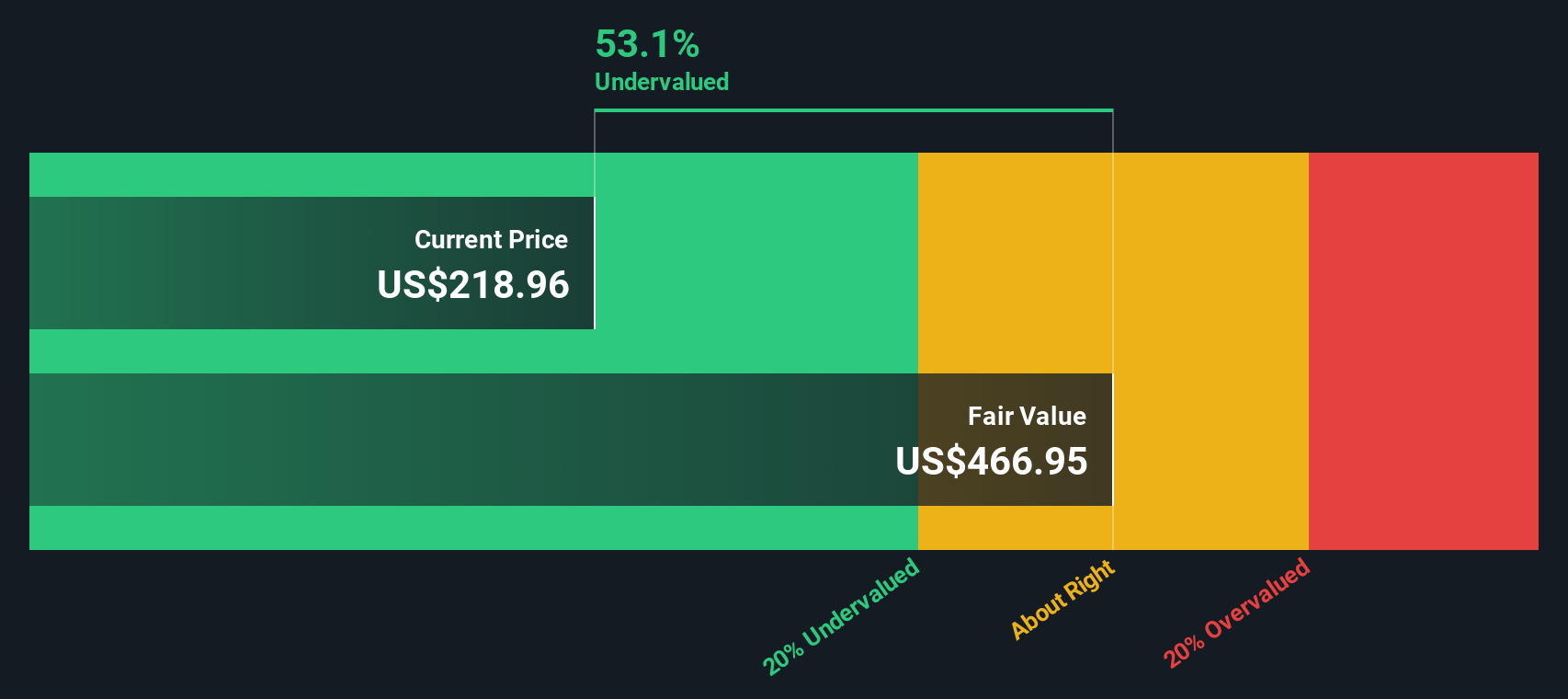

According to the DCF model (specifically, a 2 Stage Free Cash Flow to Equity approach), the intrinsic value of Cheniere’s stock is calculated at $466.95 per share. With the current stock price at $218.96, this analysis suggests the stock is trading at a 53.1% discount to its intrinsic value. This indicates a substantial margin of safety for investors considering a position in the company.

Result: UNDERVALUED

LNG Discounted Cash Flow as at Oct 2025

LNG Discounted Cash Flow as at Oct 2025

Our Discounted Cash Flow (DCF) analysis suggests Cheniere Energy is undervalued by 53.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Cheniere Energy Price vs Earnings (P/E Ratio)

The price-to-earnings (P/E) ratio is one of the most popular valuation tools for profitable companies like Cheniere Energy, because it directly relates the company’s share price to its actual earnings. It offers a straightforward sense check of whether the stock is expensive or cheap compared to its profit generation.

Importantly, what counts as a “normal” P/E ratio depends not just on the company’s current profits, but also on growth expectations, perceived risks, and how these factors compare to the broader industry. Faster-growing, lower-risk companies usually command higher P/E ratios, while slower growth or more volatile earnings justify lower ones.

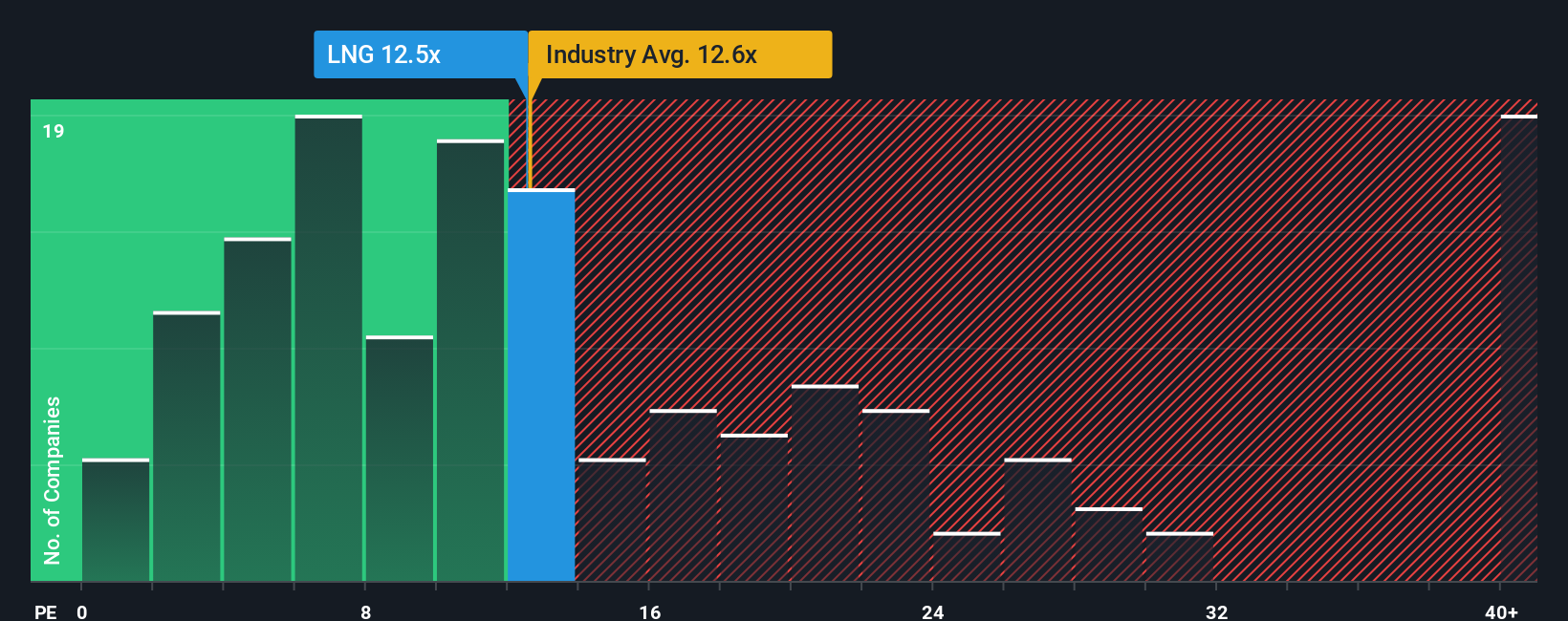

Cheniere Energy’s current P/E ratio is 12.5x, which is just below the oil and gas industry average of 12.6x and noticeably under the peer group average of 14.7x. Rather than focusing solely on these benchmarks, Simply Wall St’s proprietary Fair Ratio also incorporates growth forecasts, profit margins, market cap, and the specific risks facing Cheniere. For Cheniere Energy, the Fair Ratio is 16.0x, indicating what a rational investor might willingly pay for its earnings given all these factors.

Comparing Cheniere’s current P/E of 12.5x with the Fair Ratio of 16.0x suggests there may still be room for upside. According to this metric, the market is not fully reflecting Cheniere’s strengths and outlook, so there appears to be a margin of undervaluation.

Result: UNDERVALUED

NYSE:LNG PE Ratio as at Oct 2025

NYSE:LNG PE Ratio as at Oct 2025

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cheniere Energy Narrative

Earlier we mentioned there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a simple, approachable way to express your unique outlook on a company, combining your story about Cheniere Energy with your assumptions for revenue, profit margins, and future fair value, all in one coherent forecast. Narratives connect the dots between why you believe the business will succeed or struggle, how those beliefs translate into numbers, and what you think is a fair price for the stock.

On Simply Wall St’s Community page, Narratives make it easy for anyone, from new investors to seasoned pros, to build and share their own view of Cheniere, see how it stacks up against others, and quickly compare underlying logic. By comparing your Narrative’s fair value against the current share price, you can decide more confidently whether to buy, hold, or sell. Narratives stay up to date automatically as new earnings reports or news are released, so your investment thesis remains relevant and timely.

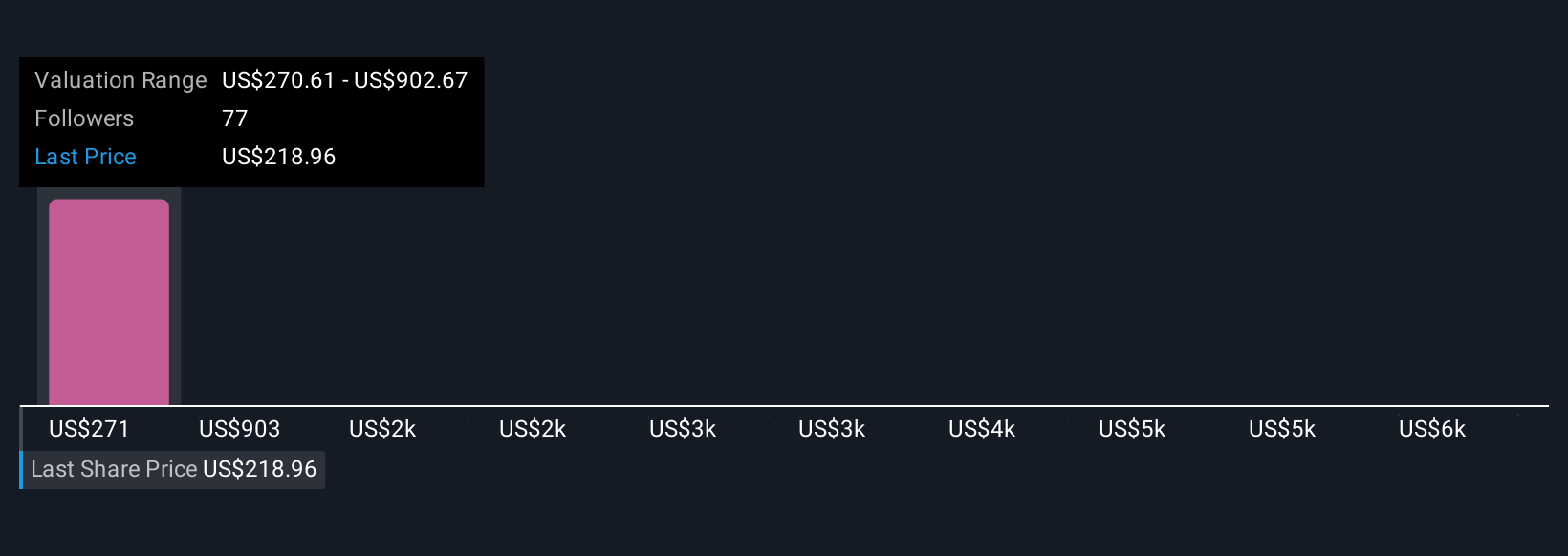

For example, some investors might build a bullish Narrative for Cheniere, focusing on the expansion of LNG capacity, robust supply contracts, and top-line growth, resulting in a high fair value near $295. Others, more cautious, might highlight decarbonization policies and supply risks, and see a much lower fair value close to $240. Narratives give you the flexibility to test, refine, and act on your own perspective alongside a community of millions of investors.

Do you think there’s more to the story for Cheniere Energy? Create your own Narrative to let the Community know!

NYSE:LNG Community Fair Values as at Oct 2025

NYSE:LNG Community Fair Values as at Oct 2025

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com