Oct 19, 2025

IndexBox has just published a new report: United Kingdom – Whey – Market Analysis, Forecast, Size, Trends and Insights.

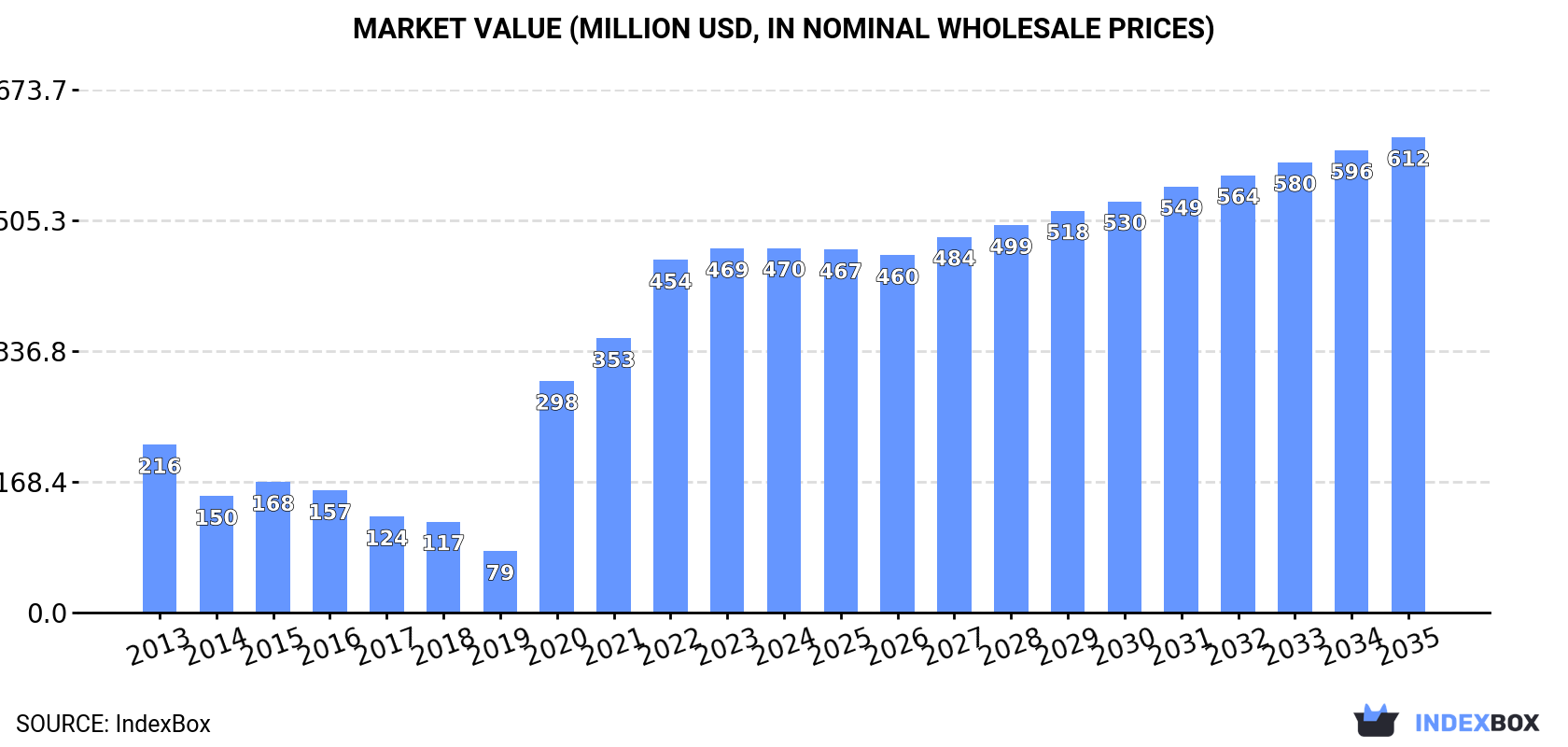

The UK whey market is forecast to grow steadily, with consumption projected to reach 319K tons and market value to hit $612M by 2035, driven by increasing demand. In 2024, consumption was 249K tons, ending a four-year rising trend, while the market size was $470M. Domestic production remained stable at 245K tons. Imports surged to 65K tons, primarily from Ireland, while exports rebounded to 61K tons, with the Netherlands, Ireland, and China as key destinations. Import prices averaged $1,846 per ton, and export prices were $2,167 per ton.

Key Findings

UK whey market value is forecast to grow at a CAGR of +2.4%, reaching $612M by 2035Consumption in 2024 was 249K tons, ending a four-year upward trendIreland is the dominant import source, constituting 61% of total import volumeExports rebounded to 61K tons in 2024 after four years of declineAverage import price was $1,846 per ton, while export price was $2,167 per tonMarket Forecast

Driven by increasing demand for whey in the UK, the market is expected to continue an upward consumption trend over the next decade. Market performance is forecast to accelerate, expanding with an anticipated CAGR of +2.3% for the period from 2024 to 2035, which is projected to bring the market volume to 319K tons by the end of 2035.

In value terms, the market is forecast to increase with an anticipated CAGR of +2.4% for the period from 2024 to 2035, which is projected to bring the market value to $612M (in nominal wholesale prices) by the end of 2035.

ConsumptionUnited Kingdom’s Consumption of Whey

ConsumptionUnited Kingdom’s Consumption of Whey

In 2024, consumption of whey decreased by -0.3% to 249K tons for the first time since 2019, thus ending a four-year rising trend. In general, the total consumption indicated slight growth from 2013 to 2024: its volume increased at an average annual rate of +1.4% over the last eleven years. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, consumption increased by +71.2% against 2017 indices. Over the period under review, consumption hit record highs at 275K tons in 2016; however, from 2017 to 2024, consumption remained at a lower figure.

The size of the whey market in the UK reached $470M in 2024, flattening at the previous year. This figure reflects the total revenues of producers and importers (excluding logistics costs, retail marketing costs, and retailers’ margins, which will be included in the final consumer price). Over the period under review, consumption, however, posted buoyant growth. Whey consumption peaked in 2024 and is likely to see gradual growth in years to come.

ProductionUnited Kingdom’s Production of Whey

In 2024, the amount of whey produced in the UK reached 245K tons, remaining constant against 2023. Over the period under review, production showed a relatively flat trend pattern. The growth pace was the most rapid in 2018 with an increase of 45% against the previous year. Over the period under review, production reached the peak volume at 259K tons in 2016; however, from 2017 to 2024, production failed to regain momentum.

In value terms, whey production declined to $481M in 2024 estimated in export price. In general, production posted resilient growth. The pace of growth appeared the most rapid in 2020 with an increase of 239%. Whey production peaked at $485M in 2023, and then contracted in the following year.

ImportsUnited Kingdom’s Imports of Whey

In 2024, purchases abroad of whey increased by 16% to 65K tons, rising for the third year in a row after two years of decline. Over the period under review, total imports indicated prominent growth from 2013 to 2024: its volume increased at an average annual rate of +6.5% over the last eleven years. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, imports increased by +41.6% against 2021 indices. The pace of growth was the most pronounced in 2015 when imports increased by 70%. Imports peaked in 2024 and are likely to continue growth in the near future.

In value terms, whey imports skyrocketed to $120M in 2024. The total import value increased at an average annual rate of +3.1% over the period from 2013 to 2024; however, the trend pattern indicated some noticeable fluctuations being recorded throughout the analyzed period. As a result, imports reached the peak and are likely to continue growth in the immediate term.

Imports By Country

In 2024, Ireland (40K tons) constituted the largest supplier of whey to the UK, with a 61% share of total imports. Moreover, whey imports from Ireland exceeded the figures recorded by the second-largest supplier, the Netherlands (8.7K tons), fivefold. The third position in this ranking was taken by Germany (6.1K tons), with a 9.4% share.

From 2013 to 2024, the average annual growth rate of volume from Ireland amounted to +15.1%. The remaining supplying countries recorded the following average annual rates of imports growth: the Netherlands (+5.2% per year) and Germany (-2.3% per year).

In value terms, Ireland ($63M) constituted the largest supplier of whey to the UK, comprising 53% of total imports. The second position in the ranking was held by the Netherlands ($17M), with a 14% share of total imports. It was followed by Austria, with a 12% share.

From 2013 to 2024, the average annual growth rate of value from Ireland amounted to +11.5%. The remaining supplying countries recorded the following average annual rates of imports growth: the Netherlands (-4.7% per year) and Austria (+134.7% per year).

Import Prices By Country

In 2024, the average whey import price amounted to $1,846 per ton, surging by 14% against the previous year. Overall, the import price, however, recorded a perceptible descent. The pace of growth was the most pronounced in 2014 an increase of 27%. As a result, import price reached the peak level of $3,364 per ton. From 2015 to 2024, the average import prices remained at a lower figure.

There were significant differences in the average prices amongst the major supplying countries. In 2024, amid the top importers, the country with the highest price was Austria ($6,520 per ton), while the price for France ($952 per ton) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by Austria (+15.5%), while the prices for the other major suppliers experienced more modest paces of growth.

ExportsUnited Kingdom’s Exports of Whey

In 2024, overseas shipments of whey were finally on the rise to reach 61K tons after four years of decline. Overall, total exports indicated a pronounced expansion from 2013 to 2024: its volume increased at an average annual rate of +2.2% over the last eleven-year period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. The pace of growth appeared the most rapid in 2014 when exports increased by 79%. As a result, the exports attained the peak of 85K tons. From 2015 to 2024, the growth of the exports remained at a somewhat lower figure.

In value terms, whey exports skyrocketed to $132M in 2024. In general, exports enjoyed a remarkable increase. The pace of growth appeared the most rapid in 2019 with an increase of 79% against the previous year. The exports peaked in 2024 and are expected to retain growth in the immediate term.

Exports By Country

The Netherlands (14K tons), Ireland (7.2K tons) and China (7K tons) were the main destinations of whey exports from the UK, together comprising 46% of total exports. France, Germany, Denmark, South Africa, Poland, Singapore, New Zealand and Belgium lagged somewhat behind, together accounting for a further 27%.

From 2013 to 2024, the biggest increases were recorded for New Zealand (with a CAGR of +122.5%), while shipments for the other leaders experienced more modest paces of growth.

In value terms, the largest markets for whey exported from the UK were the Netherlands ($13M), Ireland ($13M) and China ($9M), with a combined 27% share of total exports. France, Denmark, Germany, Singapore, South Africa, Poland, New Zealand and Belgium lagged somewhat behind, together accounting for a further 19%.

Among the main countries of destination, New Zealand, with a CAGR of +83.8%, saw the highest growth rate of the value of exports, over the period under review, while shipments for the other leaders experienced more modest paces of growth.

Export Prices By Country

The average whey export price stood at $2,167 per ton in 2024, declining by -2.4% against the previous year. In general, export price indicated a pronounced increase from 2013 to 2024: its price increased at an average annual rate of +2.9% over the last eleven-year period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, whey export price increased by +63.4% against 2018 indices. The most prominent rate of growth was recorded in 2022 when the average export price increased by 35%. The export price peaked at $2,220 per ton in 2023, and then reduced slightly in the following year.

Prices varied noticeably by country of destination: amid the top suppliers, the country with the highest price was Denmark ($2,851 per ton), while the average price for exports to Belgium ($824 per ton) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was recorded for supplies to Ireland (+2.3%), while the prices for the other major destinations experienced more modest paces of growth.