See our latest analysis for nVent Electric.

This year, the momentum is hard to miss. nVent Electric’s share price has climbed over 45% year-to-date, contributing to a striking 33% total shareholder return over the past twelve months. With quarterly gains rolling in and notable long-term performance, investors are clearly responding to both steady business growth and renewed confidence in the company’s outlook.

If you’re curious which other stocks are showing strong momentum and leadership, now is a perfect time to broaden your horizons and discover fast growing stocks with high insider ownership

With nVent Electric continuing to post impressive performance numbers, the key question now is whether the recent rally has left shares undervalued or if the market has already priced in much of the company’s growth potential.

Most Popular Narrative: 5% Undervalued

With nVent Electric’s fair value estimated at $104.59 compared to a last close of $99.33, the most widely followed narrative highlights potential upside that could be worth monitoring.

nVent’s ongoing portfolio transformation toward high-growth, higher-margin infrastructure verticals, driven by acquisitions (Trachte, EPG) and the expansion of data solutions, has increased exposure to secular growth markets such as data centers, power utilities, and renewables. This supports both revenue growth and margin expansion.

Want to know which future growth engines power this price target? The core assumptions focus on continued expansion, margin improvements, and a move into markets where demand is consistently strong. Looking for further details? The next area of interest could be found in the numbers that support this optimistic valuation.

Result: Fair Value of $104.59 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, sector volatility and the risk of integration setbacks from recent acquisitions could quickly alter nVent Electric’s growth trajectory if conditions change.

Find out about the key risks to this nVent Electric narrative.

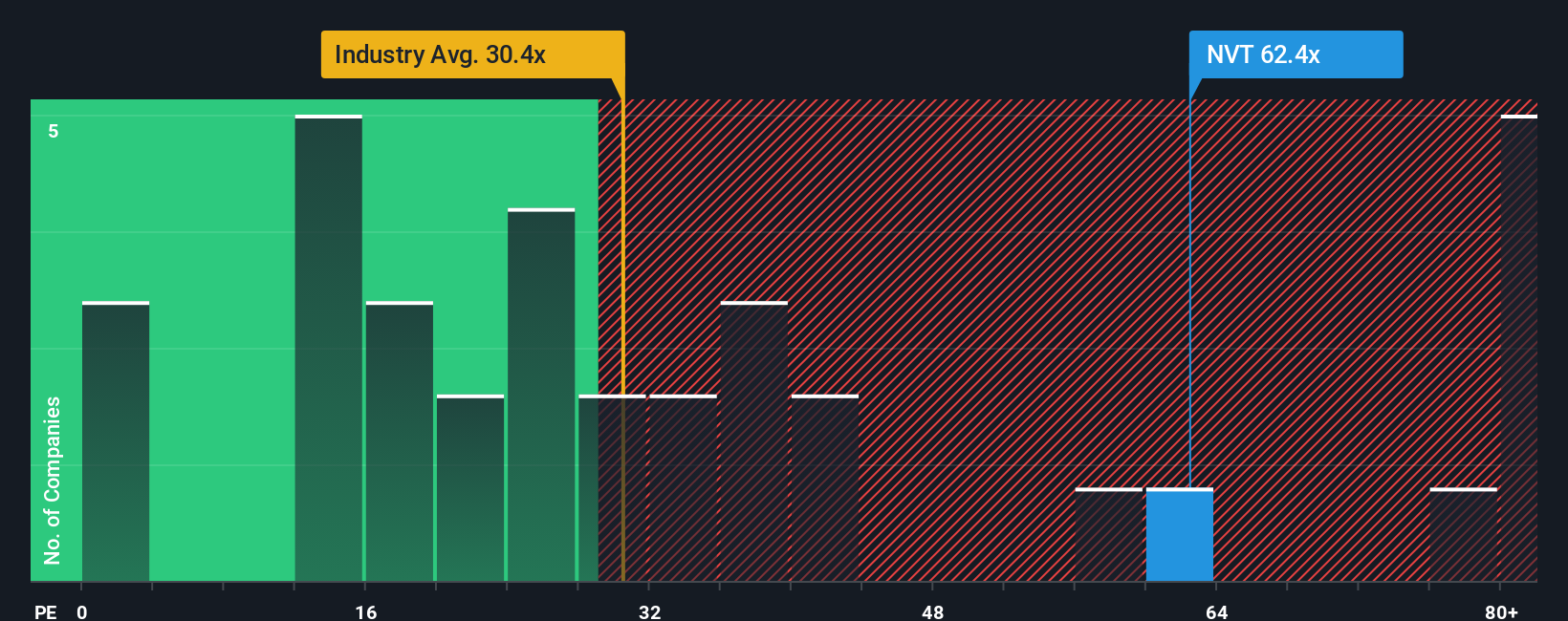

Another View: Market Ratios Suggest a Rich Valuation

Looking through another lens, the current share price reflects a price-to-earnings ratio of 62.4 times, which stands noticeably higher than both the U.S. Electrical industry average of 30.4 times and the peer group’s average of 28.9 times. The fair ratio, based on broader market analysis, sits at 34.8 times. This wide gap suggests that investors today may be paying a steep premium for nVent Electric’s growth story, raising the practical risk that much of the optimism is already priced in. Could the market cool on the stock if results disappoint?

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:NVT PE Ratio as at Oct 2025 Build Your Own nVent Electric Narrative

NYSE:NVT PE Ratio as at Oct 2025 Build Your Own nVent Electric Narrative

If you have a different perspective or want to dig deeper into the numbers on your own, you can easily put together a personalized narrative in just a few minutes, and Do it your way.

A great starting point for your nVent Electric research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Sharpen your stock-picking skills and catch the next big winner before the crowd. Don’t miss the chance to zero in on unique investment opportunities using Simply Wall Street’s powerful screeners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com