The recent declines on Wall Street and renewed fears of a trade war with China triggered a sharp selloff in Bitcoin. Since August 10, the total cryptocurrency market capitalization has fallen by over $600 billion.

This large-scale deleveraging could act as a “reset” for the market’s internal structure.

However, Bitcoin began the new week with strong gains, rebounding to nearly $111,000, riding a wave of global optimism across equities and other risk assets.

Ethereum is also recovering losses, breaking above the key $4,000 resistance level.

A different volatility profile and the absence of systemic buyers—such as central banks in the gold market—mean that BTC has underperformed gold so far this year.

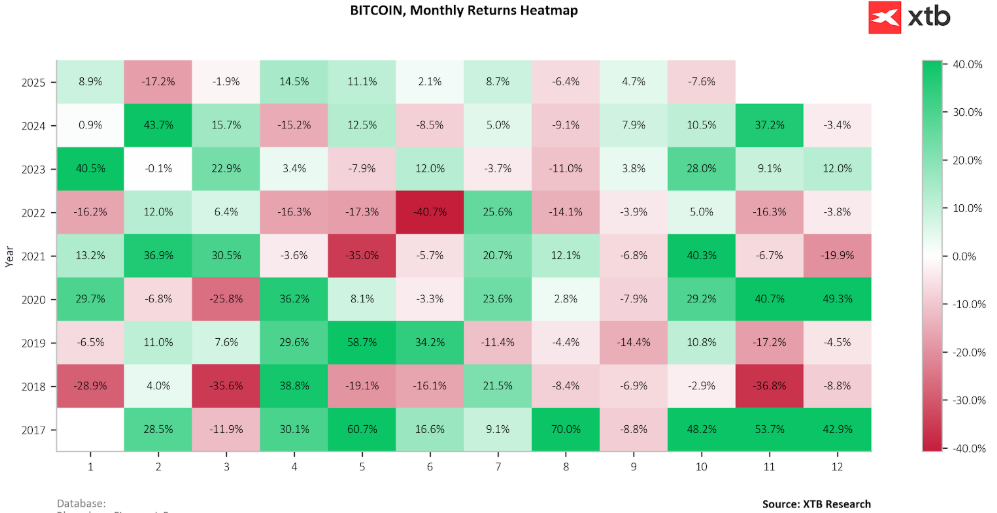

If Bitcoin were to close October at its current level, it would mark its weakest October in eight years, signaling a clear seasonality disruption. Despite having its worst week since March, Bitcoin’s renewed buying momentum has pushed it back above $110,000.

Derivatives Market and Leverage Reset

The put-to-call ratio on the Deribit options exchange rose to 1.33, signaling persistent demand for downside hedging and overall market caution.

Following the recent panic in the crypto market, a significant number of leveraged Bitcoin positions were liquidated, leading to a sharp price drop.

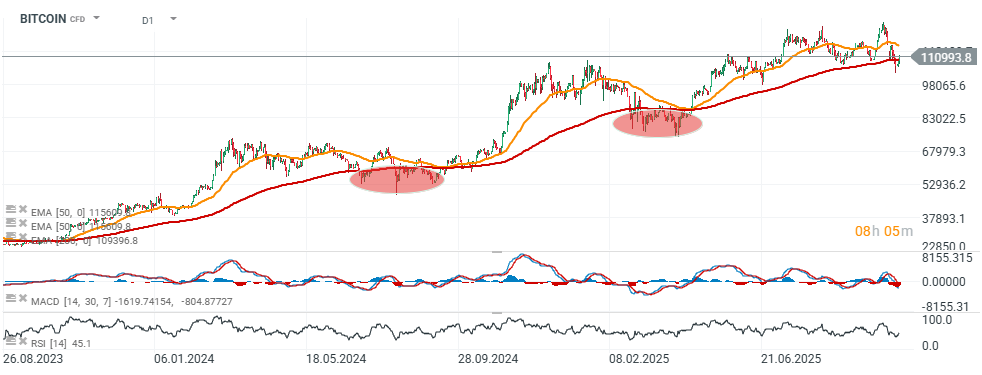

BTC fell further, slipping below its 200-day EMA for the first time since April 2025.

Both in the spring and summer, Bitcoin briefly fell below this technical level, which supports the notion of an “open-ended future” for the trend.

However, this time the initial selloff has been notably more abrupt than before.

Until the market regains confidence in the sustainability of Wall Street’s rally—and in U.S.-China trade relations—Bitcoin may struggle to regain leadership among risk assets.

On the other hand, BTC has quickly reclaimed the 200-day EMA, now trading about 7% higher from its local lows.

Source: xStation5

XTB Research

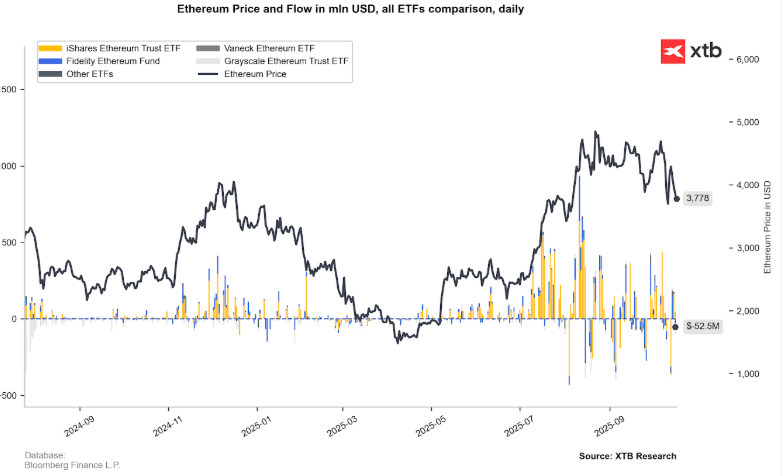

ETF Flows and Institutional Holdings

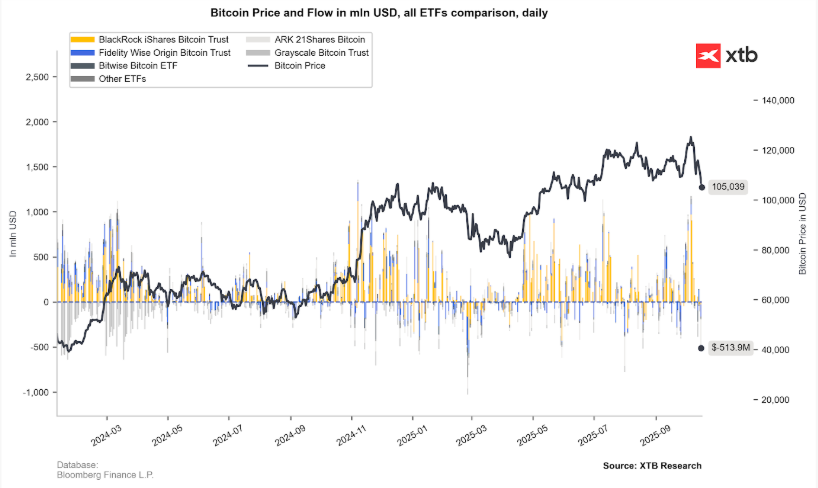

In recent weeks, inflows into Bitcoin and Ethereum ETFs have slowed, but this appears to be merely a correction following massive earlier inflows. In both cases, the net balance of ETF activity remains positive, continuing to support the underlying price fundamentals. BlackRock’s iShares Bitcoin Trust (IBIT) currently holds over 800,000 BTC, representing about 4% of Bitcoin’s total eventual supply (data as of Thursday, October 16).

Source: XTB Research, Bloomberg Finance L.P.

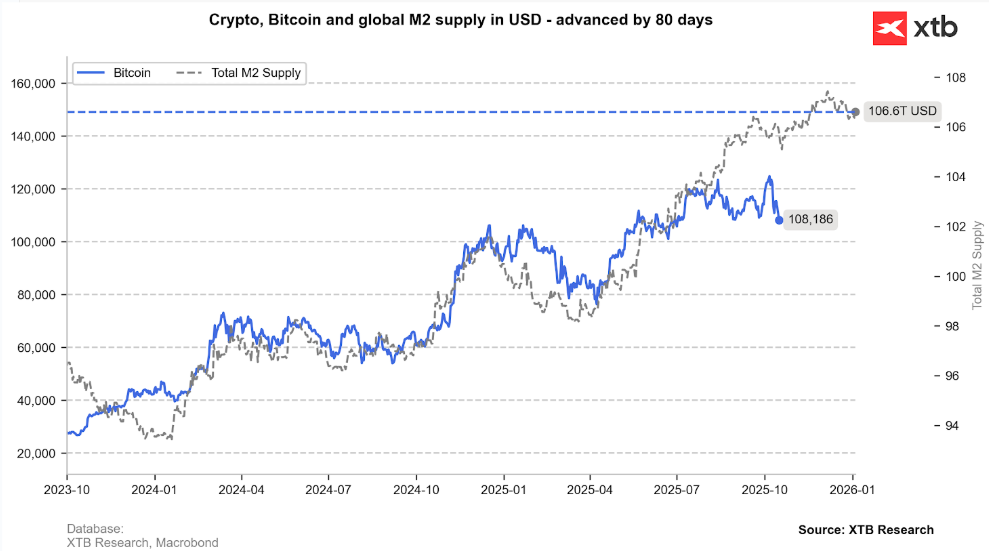

Liquidity, Money Supply, and Macro Outlook

All indications suggest that the global M2 money supply will continue to rise. In theory, an increase in M2 means more liquidity, which could boost demand for Bitcoin. However, the impact depends on where this additional liquidity flows.

If new money remains locked within fiscal deficits or government bonds, rather than reaching the real economy, the M2 expansion alone may not be a sufficient catalyst for risk assets — including Bitcoin.

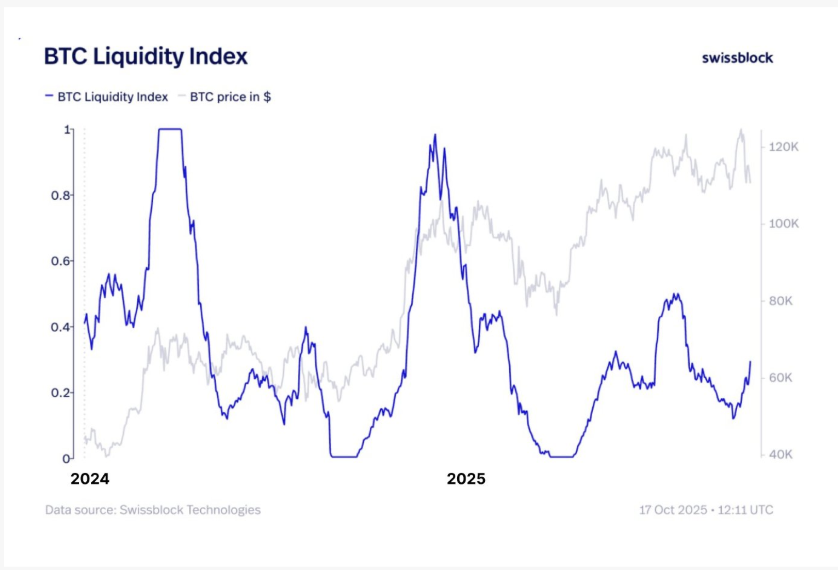

Meanwhile, the Swissblock Bitcoin Liquidity Index, which tracks on-chain activity, exchange flows, and spot demand, has risen again, pointing to an environment favorable for price growth.

Source: XTB Research,Macrobond

Source: Swissblock Technologies