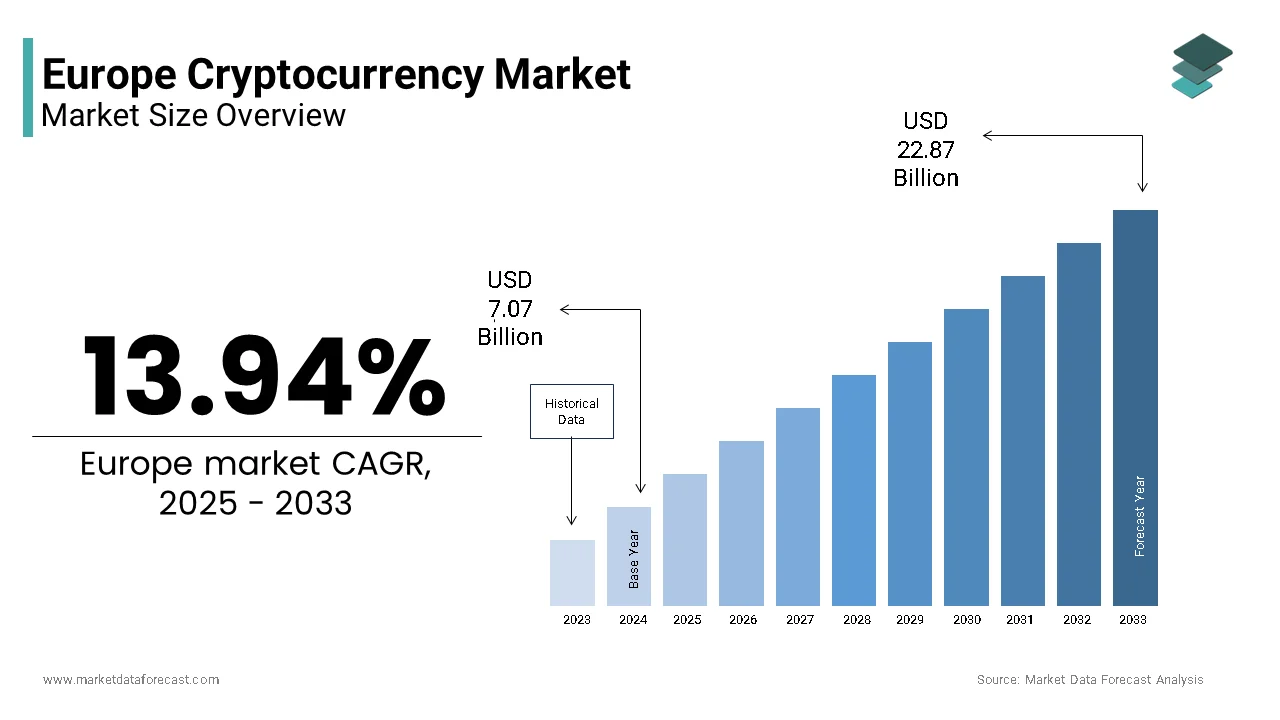

Europe Cryptocurrency Market Size

The Europe cryptocurrency market size was valued at USD 7.07 billion in 2024, and is projected to reach USD 22.87 billion by 2033 from USD 8.05 billion in 2025, growing at a CAGR of 13.94%.

A cryptocurrency is a digital or virtual currency that uses cryptography for security and operates through a decentralized network rather than a central authority such as a government or bank. Unlike speculative narratives often dominating global discourse the European landscape is increasingly defined by institutional integration technological experimentation and policy-driven maturation. Crucially, the Markets in Crypto Assets Regulation finalized in 2023 establishes a unified licensing framework across 27 member states, which positions Europe not as a frontier of unregulated speculation but as a jurisdiction forging structured coexistence between legacy finance and cryptographic protocols. This evolving ecosystem blends technological ambition with prudential oversight shaping a distinct trajectory within the global digital asset arena.

MARKET DRIVERS Accelerated Institutional Adoption of Blockchain Infrastructure

European financial institutions and corporations are increasingly embedding blockchain and cryptocurrency capabilities into core operations, which signals a shift from retail speculation to enterprise utility and propels the growth of the Europe cryptocurrency market. According to sources, many large European banks had initiated blockchain pilot projects and experiments by this time, particularly for central bank digital currencies (CBDCs). The institutional anchoring reduces market volatility by anchoring value to real world use cases such as supply chain provenance or fractional asset ownership. As per sources, regulated security token offerings grew year on year, which indicats growing comfort with tokenized equities and debt instruments. Such integration transforms cryptocurrency from a peripheral asset into a functional layer of Europe’s financial architecture.

Rising Demand for Privacy Preserving and Sovereign Digital Identity Solutions

European citizens are increasingly seeking digital tools that align with the region’s strong data protection ethos, particularly in the wake of repeated centralized data breaches and surveillance concerns, and as a result, this drives the expansion of the Europe cryptocurrency market. Cryptocurrency and associated self sovereign identity protocols offer cryptographic alternatives where users control private keys rather than relying on third party authentication. The European Commission’s 2023 Digital Identity Framework explicitly endorses blockchain based verifiable credentials as a component of the EU Digital Identity Wallet now being rolled out across member states. Projects like EBSI European Blockchain Services Infrastructure have onboarded over 20 member states to issue tamper proof academic and professional credentials using zero knowledge proofs. This convergence of regulatory support technological readiness and public demand positions privacy oriented crypto applications not as fringe tools but as essential components of Europe’s next generation digital public infrastructure.

MARKET RESTRAINTS Fragmented Implementation of the MiCA Regulatory Framework

The business in Crypto Assets Regulation is a unified EU law yet its practical enforcement remains uneven across member states, which restricts the growth of the Europe cryptocurrency market. This creates compliance uncertainty for market participants. According to sources, MiCA entered into force in June 2023, with different parts taking effect on a staggered schedule. The provisions concerning asset-referenced tokens and e-money tokens applied from June 30, 2024. The full framework, including the rules for crypto-asset service providers (CASPs), applied from December 30, 2024. Moreover, the fragmentation contradicts MiCA’s original intent of creating a single market for digital assets and instead fosters regulatory arbitrage affects consumer protection and deters long term investment. Harmonized supervision has not yet been achieved. As a result, the European crypto market will operate under a patchwork regime that limits scalability and institutional confidence.

Persistent Energy Consumption Concerns Amid Green Policy Mandates

Environmental sustainability remains a constraint for the expansion of the Europe cryptocurrency market. This is due to the region’s stringent climate commitments and public sensitivity to energy use. According to the European Environment Agency the EU aims to reduce net greenhouse gas emissions by 55 percent by 2030 compared to 1990 levels a target incompatible with energy intensive proof of work consensus mechanisms. A common misconception about crypto’s energy waste persists despite Bitcoin mining’s migration outside Europe after the 2022 energy crisis. This societal and policy burden forces developers to prioritize proof of stake or other low energy alternatives but also discourages innovation in areas where computational intensity is unavoidable such as zero knowledge proof generation or decentralized AI training thereby narrowing the technological scope of Europe’s crypto ecosystem.

MARKET OPPORTUNITIES Integration of Tokenized Real World Assets into Traditional Finance

Tokenization of real world assets generates new opportunities for the growth of the Europe cryptocurrency market. This integration is because of its dense concentration of regulated financial institutions and mature capital markets. The European Commission’s 2024 Financial Integration Review identifies asset tokenization as a strategic priority to enhance liquidity in illiquid markets and broaden investor access. Furthermore, the Banque de France completed a wholesale central bank digital currency trial in 2023 enabling instant settlement of tokenized government bonds. These developments transform cryptocurrency infrastructure from a speculative layer into a foundational utility for modernizing Europe’s capital formation processes creating durable demand beyond volatile trading activity.

Expansion of Central Bank Digital Currency Pilots and Interoperability Testing

The European Union’s coordinated approach to central bank digital currency development offers a potential opportunity for the expansion of the Europe cryptocurrency market. This establishes trusted digital rails that can interoperate with private protocols. As per the Eurosystem, the digital euro architecture is being designed with open standards allowing future compatibility with regulated stablecoins and tokenized deposits. This public infrastructure reduces systemic risk by providing a non speculative base layer while enabling private innovators to build compliant applications on top. For instance, the European Blockchain Services Infrastructure now supports identity verified wallets that can hold both digital euros and licensed crypto assets under a single interface. Such convergence positions Europe to avoid the binary choice between state and private money instead fostering a hybrid financial ecosystem where cryptographic tools serve public policy objectives.

MARKET CHALLENGES Cybersecurity Vulnerabilities in Decentralized Finance Protocols

Sophisticated cyber threats, particularly within decentralized finance applications, where code exploits can lead to irreversible losses, which challenges the growth of the Europe cryptocurrency market. As per Europol, cross border coordination remains hampered by jurisdictional ambiguities as many DeFi platforms operate without legal entities making attribution and asset recovery nearly impossible. These risks are amplified by composability where a flaw in one protocol can cascade through interconnected systems. MiCA mandates security audits for licensed entities. However, most DeFi activity happens outside its scope. This creates a regulatory blind spot, eroding consumer trust and deterring mainstream adoption despite technological promise.

Geopolitical Fragmentation and Divergent National Crypto Policies

Individual member states continue to advance conflicting national agendas that affect market cohesion and strategic clarity while the EU pursues regulatory harmonization, and this slows down the expansion of the Europe cryptocurrency market. As per the German Federal Financial Supervisory Authority BaFin has taken a permissive stance on security tokens but maintains rigid capital requirements that exclude smaller innovators. Meanwhile countries like Poland and Hungary resist MiCA implementation citing sovereignty concerns and maintain unregulated crypto exchanges that serve as backdoors into the single market. This policy dissonance complicates compliance for pan European operators fragments liquidity and weakens Europe’s collective bargaining power in global crypto governance forums. The region’s potential as a coherent crypto jurisdiction will remain unrealized so long as national interests are not subordinated to a unified vision.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

CAGR

13.94%

Segments Covered

By Component, Type, End Use, and Region

Various Analyses Covered

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe

Market Leaders Profiled

Xapo, Xilinx, BitGo, Binance.US, Bitfury Group, Bitmain, Advanced Micro Devices Inc, Ripple India, NVIDIA Corp, and Intel Corp, and others.

SEGMENTAL ANALYSIS By Component Insights

The software segment held the substantial share of the Europe cryptocurrency market in 2024. The dominance of the software segment is mainly driven by the region’s regulatory and institutional orientation toward secure digital services rather than physical mining infrastructure. Europe’s Markets in Crypto Assets Regulation requires that crypto asset service providers obtain authorization to operate. National regulators such as Germany’s BaFin and France’s AMF have prioritized audits of code integrity data encryption and anti money laundering protocols, all software dependent functions. This regulatory architecture disincentivizes energy intensive hardware like ASIC miners while accelerating demand for secure scalable and auditable software stacks that integrate with traditional financial systems. Furthermore, European banks and asset managers are deploying specialized software to manage crypto exposure within existing risk frameworks. Firms offer institutional grade software that supports real time transaction monitoring tax reporting and wallet segregation. This institutional anchoring ensures sustained software demand irrespective of retail market volatility.

The hardware segment is likely to experience the fastest CAGR of 12.3% from 2025 to 2033. The growth of the hardware segment is propelled by deployment of secure element devices for digital identity and cbdcs, and adoption of energy efficient validation nodes in green blockchain networks. The demand for tamper-resistant hardware has surged with the rollout of the European Union’s Digital Identity Wallet and digital euro pilots. The European Central Bank’s digital euro prototype supports offline payments via NFC enabled secure hardware to ensure accessibility during network outages. National initiatives further institutionalize hardware as a trust anchor in Europe’s digital finance ecosystem. Contrary to global mining trends Europe is developing low power hardware for proof of stake and zero knowledge validation. These devices support Ethereum Layer 2 networks and privacy preserving protocols compliant with the EU’s Green Deal. These devices enable participation in network security without violating EU sustainability mandates. This is unlike energy-intensive mining rigs. The development carves a niche for purpose-built European hardware in a software-dominated landscape.

By Type Insights

The bitcoin segment remained the largest segment in the Europe cryptocurrency market by occupying a 42.4% share in 2024. Institutional recognition and macroeconomic positioning majorly propel the growth of the bitcoin segment. European asset managers and corporations increasingly treat Bitcoin as a reserve asset. Firms offer physically backed ETPs traded on Xetra and Euronext providing regulated exposure without self-custody. Besides, corporate treasuries hold Bitcoin on balance sheets, which influences peer behavior. This institutional embedding transforms Bitcoin from a speculative instrument into a recognized component of diversified portfolios. In an environment of persistent, inflation and currency volatility Bitcoin serves as a non-sovereign store of value. According to Eurostat annual inflation in the Eurozone averaged 5.2 percent in 2023 well above the European Central Bank’s 2 percent target. This macroeconomic utility cements its dominance despite competition from more technologically advanced protocols.

The ether segment is on the rise and is expected to be the fastest growing segment in the global market by witnessing a CAGR of 18.7% from 2025 to 2033. The rapid expansion of the ether segment is fueled by its foundational role in decentralized applications. Ether’s utility extends far beyond currency as the native fuel for smart contracts powering Europe’s tokenization economy. This deep institutional integration ensures sustained demand irrespective of price speculation. Post merge Ethereum’s shift to proof of stake has created a compliant income stream attractive to European investors. Regulators in France and Luxembourg have issued clear guidelines allowing staking under MiCA’s asset reference framework. This transforms Ether from a volatile asset into a yield bearing instrument aligned with Europe’s preference for regulated return generation, and thereby driving structural adoption beyond trading.

By End Use Insights

The trading segment dominated the Europe cryptocurrency market by capturing 56.8% share in 2024. The dominance of the trading segment is attributed to the proliferation of regulated crypto exchanges and brokerage platforms, and retail speculation driven by digital literacy and mobile access. Europe hosts some of the world’s most compliant trading venues operating under MiCA transitional rules. Platforms offer fiat on ramps in euros with integrated tax reporting satisfying EU anti money laundering directives. Furthermore, institutional market makers provide liquidity on European venues ensuring tight spreads and low slippage. This regulated infrastructure makes trading the default entry point for new users. High smartphone penetration and financial app usage enable widespread trading participation. According to Eurostat, 86.3% percent of Europeans aged 16 to 74 used mobile devices for online activities in 2023 with 67 percent engaging in financial transactions. Trading apps offer fractional purchases as low as one euro lowering barriers to entry. As per the European Commission’s Digital Economy and Society Index, 31 percent of young adults have traded crypto at least once. Social media and influencer culture further amplify engagement with trading viewed as a form of financial self education. This behavioral trend ensures trading remains the dominant use case despite efforts to promote utility based adoption.

The remittance segment is expected to exhibit a noteworthy CAGR of 22.4% during the forecast period owing to cost efficiency and diaspora needs. Sending money across borders in Europe remains expensive through conventional channels. Migrant communities from Eastern Europe North Africa and Latin America increasingly use stablecoins like USDC to bypass these fees. Platforms offer euro to stablecoin conversions with near zero fees and instant settlement. This economic rationality makes crypto remittance particularly attractive for low income households where every percentage point saved matters. Regulated on-ramps are making crypto remittance compliant, which contrasts with informal channels. National authorities have partnered with licensed crypto firms to monitor flows while preserving privacy. This regulatory alignment transforms what was once a gray market activity into a transparent efficient and scalable alternative, and thereby accelerating mainstream adoption among diaspora populations.

REGIONAL ANALYSIS United Kingdom Market Analysis

The United Kingdom outperformed other regions in the European cryptocurrency market in 2024 by capturing 29.8% of the regional market share. The prominence of the United Kingdom is driven by a mature fintech ecosystem and proactive regulatory evolution. Despite Brexit, the UK maintains strong alignment with global standards through its Financial Conduct Authority which introduced a tailored crypto asset regime in 2023. London remains a talent magnet. The Bank of England’s digital pound exploration and partnerships with firms like Ripple for cross border payments support institutional engagement. Apart from these, UK consumers exhibit high digital finance literacy. This blend of regulatory clarity innovation density and consumer readiness sustains the UK’s prominence despite its non EU status.

Germany Market Analysis

Germany is another significant region in the European cryptocurrency market and held 21.5% share in 2024. The growth of Germany is propelled by strong institutional adoption and engineering driven infrastructure development. The country’s emphasis on data privacy and security has spurred demand for self custody solutions with hardware wallet sales growing, as per sources. Besides, Germany hosts important Ethereum infrastructure. The combination of regulatory rigor technical expertise and corporate participation positions Germany as Europe’s institutional crypto hub.

France Market Analysis

France is likely to grow in the European cryptocurrency market during the forecast period, with state led digital finance initiatives and strategic regulatory incentives. The Banque de France has been a pioneer in central bank digital currency trials completing 12 interbank settlement experiments using tokenized assets in 2020. Paris is also emerging as a Web3 startup capital with blockchain ventures receiving state backed funding. This top down support combined with grassroots innovation cements France’s role as a policy laboratory for European crypto integration.

Switzerland Market Analysis

Switzerland grew steadily in the European cryptocurrency market due to its crypto friendly legal framework and concentration of blockchain foundations. The Swiss National Bank completed a wholesale CBDC trial with SIX Digital Exchange in 2023 settling tokenized bonds in real time. Furthermore, Switzerland’s decentralized governance model allows cantons to tailor regulations fostering experimentation. This unique blend of legal certainty technical infrastructure and financial tradition makes Switzerland a magnet for global crypto capital operating within European time zones.

Netherlands Market Analysis

The Netherlands is also a significant region in the European cryptocurrency market, which is driven by digital openness progressive regulation and strong logistics for digital finance. Amsterdam is a hub for sustainable blockchain innovation with green validator node farms powered by wind energy as reported by the Netherlands Enterprise Agency. The country also leads in crypto tax automation. This combination of regulatory pragmatism environmental consciousness and digital fluency positions the Netherlands as a scalable gateway for crypto services across Northwestern Europe.

COMPETITIVE LANDSCAPE KEY MARKET PLAYERS

Some of the notable key players in the European cryptocurrency market are

Xapo Xilinx BitGo Binance.US Bitfury Group Bitmain Advanced Micro Devices Inc Ripple India NVIDIA Corp Intel Corp TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Leading players in the Europe cryptocurrency market prioritize regulatory compliance by obtaining national licenses and aligning operations with MiCA requirements to ensure long term viability. They invest in localized fiat on and off ramps denominated in euros to enhance user accessibility and reduce friction. Strategic partnerships with traditional banks payment processors and identity verification providers strengthen trust and interoperability. Companies also develop institutional grade custody staking and reporting tools to attract asset managers and corporate treasuries. Apart from these, they engage proactively with policymakers to shape favourable regulatory outcomes and launch educational campaigns to build consumer literacy. These strategies collectively foster sustainable growth within Europe’s structured and compliance oriented digital asset environment.

COMPETITION OVERVIEW

The Europe cryptocurrency market features intense yet structured competition shaped by regulatory clarity and institutional participation. Unlike regions dominated by speculative retail activity Europe’s landscape is defined by licensed exchanges custodians and fintech firms operating under stringent anti money laundering and consumer protection rules. Competition centers on compliance depth product sophistication and integration with traditional finance rather than trading volume alone. Major global players like Coinbase and Kraken compete alongside homegrown platforms such as Bitstamp and Bitpanda each vying for institutional mandates and regulatory goodwill. Differentiation arises through localized services euro stablecoin support tax automation and staking infrastructure compliant with MiCA. The entry barrier is high due to capital and operational requirements yet rewards are substantial given Europe’s affluent investor base and policy influence. As the regulatory framework supports competition is expected to consolidate around trust security and utility rather than price or hype.

TOP PLAYERS IN THE MARKET Bitstamp is one of Europe’s oldest and most trusted cryptocurrency exchanges headquartered in Luxembourg with operational roots in Slovenia. It serves institutional and retail clients across the continent offering euro denominated trading pairs and regulated custody services. The company played a pivotal role in establishing compliance standards early in the European crypto ecosystem and maintains licenses from multiple EU regulators. It also expanded its API infrastructure to support algorithmic trading desks and partnered with European banks to streamline fiat on ramps strengthening its position as a bridge between traditional finance and digital assets. Coinbase maintains a significant presence in the European cryptocurrency market through its Dublin based entity which holds regulatory approvals in Ireland and operates under the EU’s passporting framework. The company provides a full suite of services including spot trading custodial wallets and institutional prime brokerage tailored to European investors. Coinbase has actively engaged with European policymakers during the MiCA consultation process advocating for clear rules on stablecoins and custody. These initiatives demonstrate its commitment to compliant long term growth within the region. Kraken operates a robust European business anchored by its regulated entity in the Netherlands and additional registrations in France and Italy. Known for deep liquidity and advanced trading features Kraken caters to both retail enthusiasts and institutional participants seeking exposure to a wide range of digital assets. The company has invested heavily in localizing its compliance infrastructure including real time transaction monitoring and identity verification aligned with EU anti money laundering directives. It also launched educational initiatives in partnership with universities to promote blockchain literacy further embedding its brand in Europe’s evolving digital finance landscape. MARKET SEGMENTATION

This research report on the European cryptocurrency market has been segmented and sub-segmented based on categories.

By Component

Hardware FPGA ASIC GPU Others (Paper Wallet, Web Wallet, Etc.) Software Mining Software Exchanges Software Wallet Payment Others (Vaults, Encryption, Etc.)

By Type

Bitcoin Ether Litecoin Ripple Ether Classic Others (Dogecoin, Monero, Dash, Etc.)

By End-Use

Trading E-commerce and Retail Peer-to-Peer Payment Remittance

By Country

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe