Colorado faces mounting pressure on its electrical grid as data centers and advanced manufacturing drive up power needs, even as the state moves away from coal and natural gas, in favor of wind and solar energies, and battery systems.

At the same time, Colorado is competing with surrounding states to attract data centers and technology companies that are projected to increase electrical loads on the power grid, which some see as heading for a clash given that Gov. Jared Polis is pushing for 100% carbon-free power in just a few decades.

The big question, many said, is whether Colorado can deliver the power demands of an energy-intensive industry as it prioritizes “renewable” sources over oil and gas.

A report from the Consumer Energy Alliance cautioned that overly restrictive policies on fossil fuel energy development might erode jobs, affordability and blunt Colorado’s competitive edge against neighbors like Wyoming, where abundant energy resources have attracted tech investments.

The report emphasized the contributions of natural gas, including supplying 30% of Colorado’s electricity and heating three-quarters of homes, while providing households with about $1,100 in annual savings and adding billions to state revenues.

“We need all of it — solar, wind, oil, gas,” said Matthew Gonzales of the Consumer Energy Alliance, adding he is advocating for an approach that safeguards the governor’s goals of maintaining competitiveness in the high-tech marketplace while meeting the state’s climate targets.

The governor’s office has maintained that “renewable” energy, such as wind and solar, provides better options for Coloradans and that the state can both attract high-tech firms and maintain its push for “renewable” sources.

“In Colorado, we are focused on cutting red tape that disadvantages clean technologies and creating opportunities to deploy solutions that save consumers money while improving air quality and building comfort and safety,” said Ari Rosenblum, spokesperson for Polis said.

The competition is fierce

Research shows Wyoming surging ahead in this regional competition, with 10 data center developers, including Microsoft, expanding in Cheyenne.

Wyoming’s $1.5 billion manufacturing fund draws firms by touting reliable power provided by the state’s abundant natural gas reserves.

In May 2025, Wyoming’s largest independent gas producer, Pure West Energy, announced a partnership with Prometheus Hyperscale and Frontier Carbon Solutions to provide low-carbon natural gas for powering Prometheus’s flagship hyperscale data center campus in Evanston.

St. Louis Federal Reserve data shows Wyoming leading in job growth, while Colorado lags in gross domestic product gains over five years.

The Consumer Energy Alliance report warned that Colorado’s regulatory constraints on oil and natural gas extraction could mean forfeiting billions.

“This report highlights how crucial the oil and natural gas industry is to Colorado’s economy and communities,” said Carly West, executive director of American Petroleum Institute Colorado. “Colorado’s legislative and regulatory environment must maintain balance so the industry can continue delivering affordable energy, environmental progress, and opportunity for all Coloradans.”

The oil and gas industry in Colorado sustains 324,970 jobs and $57.5 billion in gross domestic product, which translates to 10.9% of the state’s economy, according to a 2025 American Petroleum Institute study.

Meanwhile, the American Clean Power Association said Colorado’s “clean” energy sector produces 7,000 MW, enough to power 2.5 million homes. The sector, the group said, provides jobs to more than 15,000 residents, with some $14 billion total investment into utility-scale clean energy and $48 million in annual contributions to the state economy.

Tri-State Energy and Generation’s Craig power plant (PHOTO: Scott Weiser, The Denver Gazette)

Tri-State Energy and Generation’s Craig power plant (PHOTO: Scott Weiser, The Denver Gazette)

‘Colorado is open for new business’

The governor’s office said Colorado has laid the groundwork to attract high-tech firms.

Some $2 million in state grants for artificial intelligence, quantum computing, and manufacturing back up the governor’s determination to create his high-tech vision, the office said.

“From day one of our administration, we’ve worked hard to cut pollution, address climate change, strengthen our grid, and save Coloradans money,” said the governor, who also emphasized that it’s more” important than ever before for states to step up” in pushing forward wind and solar development amid federal uncertainties.

In a statement from the Colorado Energy Office Monday, Rosenblum said: “Colorado is open for new business. And with low energy prices and a greener grid, the state remains attractive to new large loads like data centers and advanced manufacturing.”

Rosenblum added: “To help create new pathways to opportunity, Governor Polis sent a letter to state agencies earlier this year directing the Energy Office and Office of Economic Development to partner with the Public Utilities Commission and other state agencies to develop approaches that attract data centers and advanced manufacturing to Colorado in ways that create opportunities to benefit the electric system and put downward pressure on rates.”

Under Polis’ leadership, Colorado aims for 100% renewable electricity by 2040.

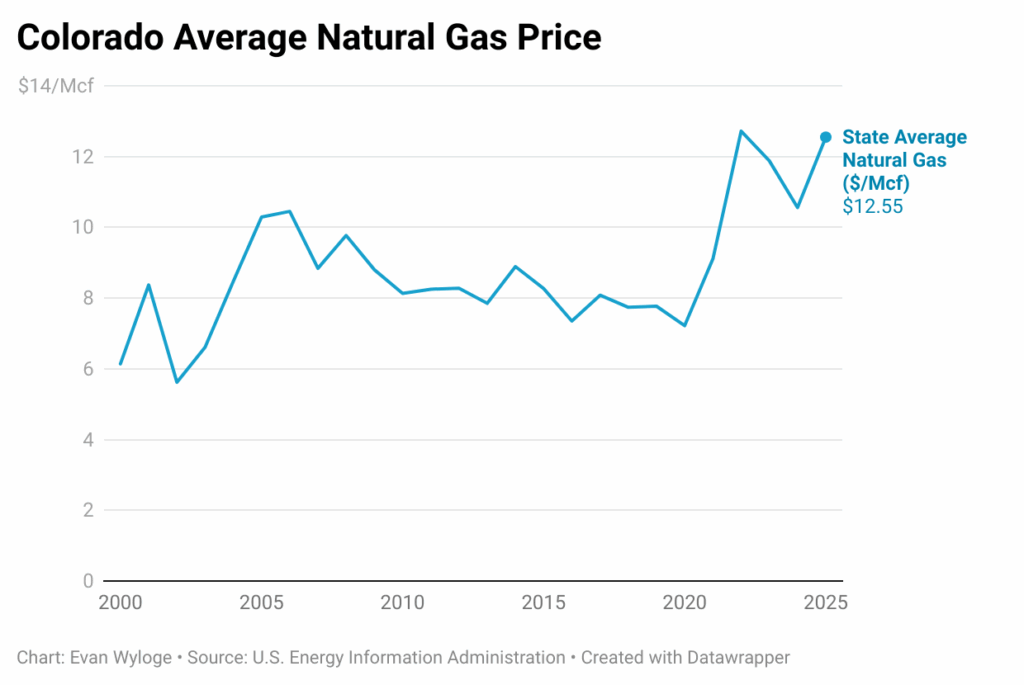

“Coloradans want to utilize low-cost clean energy, and we are proud of our nation-leading actions to save Coloradans money, improve Colorado’s air quality, and increase accessibility to clean energy options,” Rosenblum said. “Natural gas can and does play an important role in supporting reliability as utilities add more and more low cost wind, solar, and batteries, but it is also a volatile commodity that fluctuates in price and contributes to emissions.”

Some experts said surging demands from data centers, increasing state population and electrification pose challenges to that goal.

Renewable energy’s reliance on weather creates variability, and that means that dispatchable backup sources, like natural gas-fired turbine generators or small modular nuclear reactors, are essential to grid stability as existing coal-fired power plants get shut down, they said.

Replacing still-operating coal plants with renewable energy is expensive, which is reflected in energy consumer’s electric and gas bills, they noted.

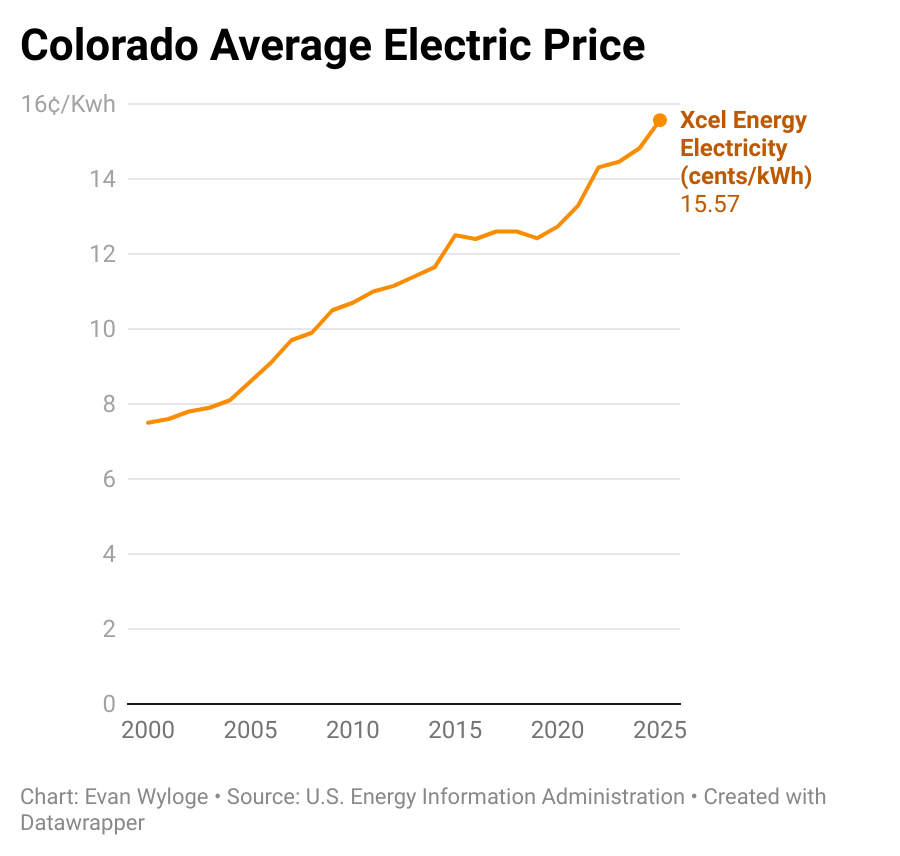

Residential electric rates in Colorado have climbed 24% since 2015, with Xcel Energy up 24%, Black Hills up 24% and Tri-State cooperatives up 26%, fueled by clean energy mandates and upgrades, according to the United States Energy Information Administration.

Xcel Energy, which serves 1.6 million customers, seeks approval for $22 billion in investments through 2029 to bolster renewables, storage, and grid enhancements, based on its submissions to the Public Utilities Commission.

Possibly taking some of the sting out of the upcoming closure of its Craig coal-fired power plant, Tri-State Generation and Transmission Association recently received the approval of state regulators for 1,350 megawatts of renewables, plus storage, as well as the greenlight for a 307-megawatt gas turbine generator intended for Moffat County, according to a company spokesperson.

Supply chain woes

U.S. Rep. Nancy Pelosi, right, and Gov. Jared Polis put on hard hats before a ribbon-cutting in front of the kiloton-scale unit used for removing carbon dioxide from the air Tuesday at Global Thermostat in Brighton.

U.S. Rep. Nancy Pelosi, right, and Gov. Jared Polis put on hard hats before a ribbon-cutting in front of the kiloton-scale unit used for removing carbon dioxide from the air Tuesday at Global Thermostat in Brighton.

Equipment bottlenecks intensify the strain, experts said. Gas turbine orders face waits of three to seven years amid market surges from artificial intelligence and electrification, according to the Rocky Mountain Institute and S&P Global. Delays in securing equipment like transformers and turbines have also sparked worries about reliability and cost spikes, according to a Common Sense Institute “Future of Electricity Costs in Colorado” report from January 2025.

Transformer shortages loom large, with Wood Mackenzie forecasting 30% deficits for power transformers and three-year delays, driven by material shortages, labor constraints, and post-pandemic backlogs, according to S&P Global and Utility Dive.

Gas turbine generators are also in short supply; Xcel Energy officials said the company is having difficulty sourcing both generators and transformers.

“We are seeing lengthy supply chain delays in the generation equipment market, as well as the transmission equipment market, both of which are critical for serving all customer load not just data centers,” Michelle Aguayo, a spokesperson for the company, said in a statement to The Denver Gazette on Monday.

And then there’s the question of new high-voltage transmission lines.

Colorado ratepayers are already on the hook for Xcel’s $1.7 billion Power Pathway project, a 650-mile high-voltage transmission line in eastern Colorado, that Xcel Energy said would strengthen Colorado’s power grid and provide a transmission backbone for renewable energy installations on the eastern plains.

While Colorado has its own transmission issues, nationally, the push for electrification is dependent on tripling the national grid’s capacity.

“Reaching the goal of net-zero greenhouse gas emissions by 2050 will require substantial investment in the U.S. transmission grid to accommodate growing electricity demand,” Jesse Jenkins, an assistant professor and energy systems engineer at Princeton and a principal author of the Princeton Net-Zero America energy study, told The Denver Gazette back in 2023.

“One scenario included in the Princeton Net-Zero America study identified a need for about 60% more transmission capacity by 2030 and tripling current capacity by 2050,” Jenkins said.

A 2023 article in Utility Dive quoted Jenkins as saying: “By 2035 alone, we’re going to need to add about 75,000 miles of high voltage transmission lines, enough to run from New York City to Los Angeles and back 15 times. That sounds like a lot for a country not used to building big things. But we have built big things in the past; this is not unprecedented and shouldn’t be viewed as impossible.”

The electric transmission advocacy group Americans for a Clean Energy Grid said only 888 miles of transmission lines were actually constructed in 2024, down from about 1,700 miles per year in the early 2010s. If construction continues at that pace, it would take more than 84 years to build out the grid nationally, the group said.

Data centers follow electricity

An entrance to the Stargate artificial intelligence data center complex in Abilene, Texas on Monday, Sept. 22, 2025. (AP Photo/Matt O’Brien)

An entrance to the Stargate artificial intelligence data center complex in Abilene, Texas on Monday, Sept. 22, 2025. (AP Photo/Matt O’Brien)

Data centers, which require effectively 100% uptime, are increasingly pursuing on-site generation with natural gas or small modular nuclear reactors, according to Xcel Energy CEO Bob Frenzel.

“If Colorado can’t meet energy demand, (data centers) are not coming here,” said Gonzales, adding that a failure to adapt to the new energy demands could undermine Polis’ high-tech vision.

Armstrong, the governor’s spokesperson, said Colorado is “very open to data center development, but wants to ensure that large new loads like data centers benefit utility customers as a whole and do not drive increased costs that get passed on to residential and small business ratepayers.”

“Data centers must also comply with state and federal regulations, helping ensure that their development does not result in air quality issues,” Armstrong said.

Xcel Energy’s Frenzel addressed the scale of the energy demand challenge in earnings discussions, noting data center deals cover half the five-year forecast and that artificial intelligence needs prompt “new large nuclear” considerations.

“Data centers are moving from front-of-the-meter generation to self-generation. They’re building on-site gas plants to get to reliability,” Frenzel added.

Xcel Energy representatives have emphasized ongoing commitments to renewables.

Frenzel explained during an earnings conference call that the $22 billion plan under consideration by Colorado’s utility commission focuses on expanding clean energy and grid resilience to reliably serve data centers, while advancing de-carbonization goals, potentially mitigating long-term costs through efficient infrastructure.

Xcel Energy Colorado is in the throes of procuring new renewable generation in order to take advantage of the federal subsidies that expire at the end of the year, but the company said this isn’t the be-all and end-all of acquiring new generation.

“The Near-Term Procurement is intended to acquire clean energy generation while the benefits of the (expiring federal tax credits) are available,” said Aguayo, the company spokesperson. “However, it is also explicitly focused on advancing some dispatchable generation and storage, which is critically needed to balance the additional renewables and service some of the load growth.”

“The Near-Term Procurement partially meets load requirements but will be supplemented by further resource plan activities in 2026 and 2027, which will be structured to fully meet all anticipated load growth, including data centers,” Aguayo added.