New figures from Finance Denmark (Finans Danmark) suggest that investments in individual stocks related to the defence sector have increased 17-fold over the past three years, with Danish investment fund investments in defence and aerospace stocks up 5-fold over the past two years.

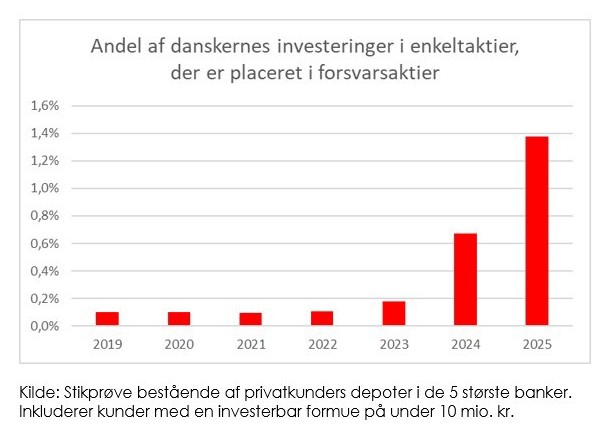

In percentage terms, this means the share of Danish investors’ investments in sector-related stocks has increased from less than 0.1% in 2019, to 1.5% in 2025. Finance Denmark equates this to DKK1,000 invested in such stocks today versus DKK60 three years ago.

The value of defence stocks in Danish funds has meanwhile jumped from about DKK2bn in 2023, to some DKK10bn in 2025.

Lars Gert Lose, CEO of Finance Denmark, commented: “There has been a clear shift in attitude. Many Danes previously had ethical concerns about putting their savings into, for example, weapons and defence stocks. But now we see a markedly increasing demand for these assets among our members’ customers – both regarding listed individual stocks and funds with exposure to defence.”

“Banks, asset managers, and pension companies are actively working to make it easier for Danes to let their savings contribute to collective security – for instance, by offering new and more targeted investment opportunities. Companies are continuously revisiting their exclusion lists and investment policies, and at the same time, we as a sector – including under the auspices of the Defence and Emergency Preparedness Partnership (Forsvars- og Bered-skabspartnerskabet) – are working to identify any unclear regulations to ensure they do not unnecessarily hinder investments in the defence industry. This is an important step towards mobilising more private capital for purposes that strengthen the resilience of Denmark and Europe.”

The chart illustrates the % share of individual investors’ exposure to defence stocks, according to data from the five biggest banks for customers with investible assets of less than DKK10m.

The chart shows the value of underlying holdings in Danish investment funds available to retail investors.