Quick overview

Live DOW Chart

DOW

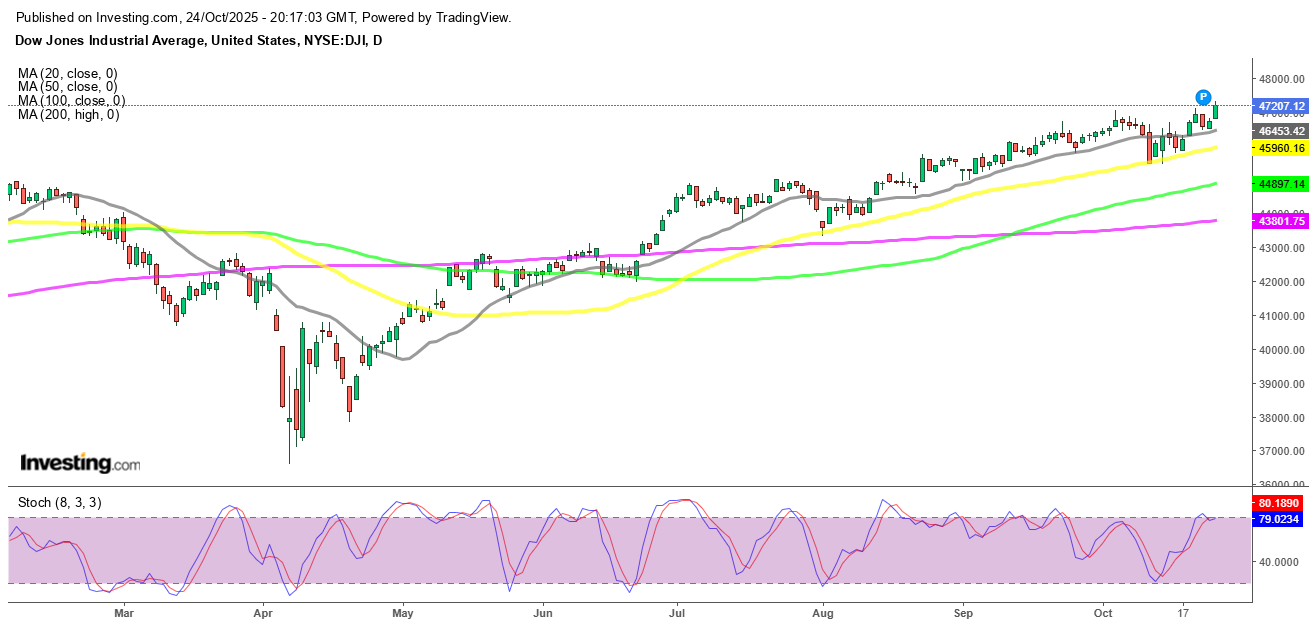

The Dow Jones Industrial Average broke all previous records on Friday, breaking beyond 47,200 for the first time ever as a strong late-week rally was driven by market optimism ahead of significant tech earnings.

Indices Push to New Highs

U.S. equities surged into the close on Friday, marking another day of broad-based strength. The NASDAQ Composite climbed 317 points, or 1.3%, while the S&P 500 advanced 1%, with both benchmarks on track to close at new record highs.

The Dow Jones Industrial Average also joined the rally, gaining 550 points, or 1.18%, to surpass the 47,200 level for the first time ever. The index is up nearly 2% for the week, reflecting strong investor appetite for blue-chip stocks and cyclical sectors.

Dow Jones Chart Daily – The Upside Momentum Continues

Technically, all three major averages remain well-supported by their moving averages, suggesting that momentum remains firmly bullish as institutional buyers continue to defend key levels.

Major Index Performance – Friday’s Close

U.S. stocks wrapped up Friday with solid gains across all major indices, extending their weekly winning streak as investor optimism returned amid easing yields and upbeat corporate sentiment.

Dow Jones Industrial Average

Closed at 47,207.12, gaining +472.51 points (+1.01%) on the day.

Posted a +1.93% weekly advance, driven by renewed strength in blue-chip and industrial names.

The Dow’s consistent rebound reflects investor rotation into value and cyclical sectors amid improving economic expectations.

NASDAQ Composite

Finished at 23,204.87, up +263.07 points (+1.15%) on Friday.

Added +1.58% for the week, supported by strong performances in semiconductor and AI-related stocks.

Tech momentum continued to dominate, helped by positive earnings and renewed optimism in innovation sectors.

S&P 500 Index

Ended the session at 6,791.69, climbing +53.25 points (+0.79%).

For the week, the benchmark gained +1.52%, with broad-based strength across energy, technology, and financials.

The index is approaching key resistance near 6,800, suggesting potential breakout momentum if earnings remain supportive.

Russell 2000 Index

Closed at 2,513.47, advancing +30.81 points (+1.24%) on Friday.

Rose +1.71% for the week, marking its strongest weekly gain in a month.

Small-cap stocks benefited from easing Treasury yields and growing speculation that the Fed could cut rates earlier than expected.

Focus Shifts to Tech Earnings

Looking ahead, the market’s attention turns to a critical week for corporate earnings, with several tech heavyweights set to report results that could define the next leg of the rally.

Meta Platforms, Microsoft, and Alphabet are scheduled to announce their quarterly earnings after the close on Wednesday, while Apple and Amazon will report on Thursday. Meanwhile, Nvidia, a central figure in the AI and semiconductor boom, will not release its results until November 19, leaving investors eager for further insights into the sector’s trajectory.

Market Outlook

The strong finish to the week underscores growing confidence that corporate earnings will validate current valuations and sustain the market’s upward trend. Despite lingering concerns over inflation and bond yields, the combination of resilient data, robust liquidity, and strong earnings expectations continues to drive U.S. equities higher.

If upcoming tech earnings deliver as anticipated, Wall Street could see another leg higher into November, solidifying this as one of the strongest quarters of 2025 so far.

Dow Jones Live Chart

DOW

Related Articles