Canadian Highlights

Headline inflation came in stronger than expected, but core measures remained stable, supporting the case for another interest rate cut next week.

Long-term inflation expectations edged higher, but firms’ pricing power remained limited. Retail sales rose in August but declined in September, losing momentum on a three-month basis.

Attention increasingly shifts to Carney’s forthcoming budget for signs of a broader growth strategy.

U.S. Highlights

The federal government shutdown entered its 4th week, becoming the 2nd longest in history.

The CPI data release for September, delayed by the shutdown, showed inflation moderated during the month but remained elevated on aggregate.

Trade negotiations with China will ramp up over the next week in advance of the November 1st deadline for 100% additional tariffs threatened by the President.

Canada – Final Puzzle Pieces Before the Bank’s Rate Decision

This week’s Business Outlook Survey, CPI inflation and retail sales reports offered the final puzzle pieces before the Bank of Canada’s interest rate decision on October 29th. The TSX briefly wavered after the CPI release on tempered expectations for rate cuts, but quickly recovered, finishing the week 0.9% higher (as of writing). They also seem to have brushed off President Trump ending trade talks with Canada over an Ontario ad quoting President Reagan. Taken together, the data supports expectations for another Bank of Canada cut next week, while attention increasingly shifts to fiscal policy and Carney’s forthcoming budget for signs of a broader growth strategy.

The week began with the release of the Bank’s Q3 surveys on business and consumer sentiment. Both measures improved modestly but remain subdued, with roughly one-third of firms and two-thirds of consumers still expecting a recession. From a policy perspective, the most important signal was that firms reported limited pricing power amid weak demand. That should offset the slight rise in longer-term inflation expectations among consumers, especially given that the survey was conducted before the federal government announced its plan to remove counter-tariffs.

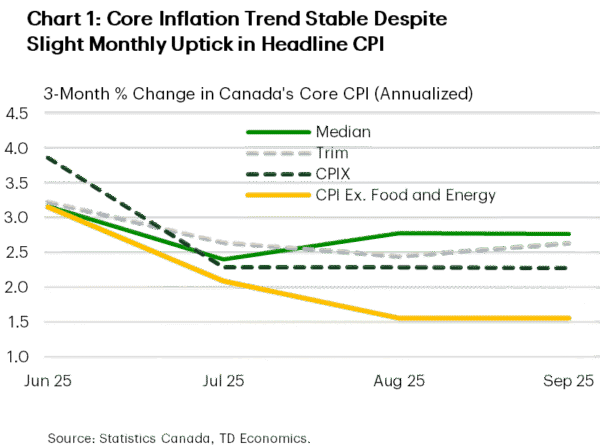

More difficult to ignore is the September inflation report, which showed headline CPI rising 2.4% year-on-year, above expectations for 2.2%. The acceleration was due to base effects, slower declines in gasoline prices, higher food prices, and a pickup in travel services prices. Still, inflation remains within the Bank’s 1-3% target range, while three-month trends in most core measures moved sideways (Chart 1). The breadth of inflationary pressure also held steady and should ease some of the Bank’s lingering concerns.

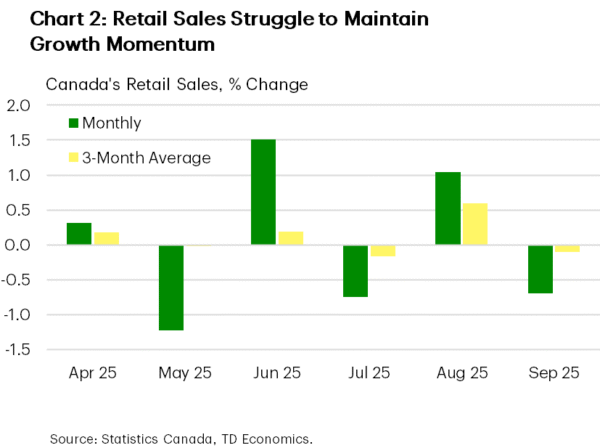

While the Bank remains laser-focused on inflation, its recent communication placed greater emphasis on economic slack, albeit with the caveat that monetary policy has limited ability to deal with tariffs. In this context, August retail sales provided some insight into consumer demand. Sales expanded in line with the flash estimate, largely driven once again by autos. However, the September flash estimate suggests demand deteriorated again. Parsing through the noise, retail sales have clearly lost momentum (Chart 2). This is particularly obvious in autos and home-related goods, which will likely weigh on durable goods spending. That said, some discretionary goods categories are still growing at a decent clip, while services spending, especially on travel, appears to have accelerated in Q3 as signalled by our internal spending data.

Beyond these mixed signals, the Bank has sufficient evidence of slack to justify one more rate cut, particularly given the subdued outlook for exports and investment. This weakness framed the Prime Minister Carney’s address to university students on Wednesday, where he announced an ambitious goal to double Canada’s non-U.S. exports over the next decade. Given the limits of monetary policy, the strategic fiscal push from November’s budget has the chance to shape Canada’s economic trajectory in the coming quarters and years. Let’s hope it proves as potent as the Prime Minister’s speech was inspiring.

U.S. – Persistent Inflation, Shutdown Pose Challenges for Federal Reserve

The ongoing government shutdown became the 2nd longest in history this week, as it stretched into week 4. With divisions in Congress largely unchanged relative to September, a resolution remains out of sight, but as the economic impacts become more material, intransigence will likely yield. Elsewhere in D.C., President Trump called off trade negotiations with Canada over the use of anti-tariff television advertisements broadcast in the U.S., forestalling a near-term trade agreement with the nation’s second largest trading partner. Despite political dysfunction in the Capitol and rising trade tensions in recent weeks, the S&P 500 still managed to rise 2% this week from a host of positive third quarter earnings reports.

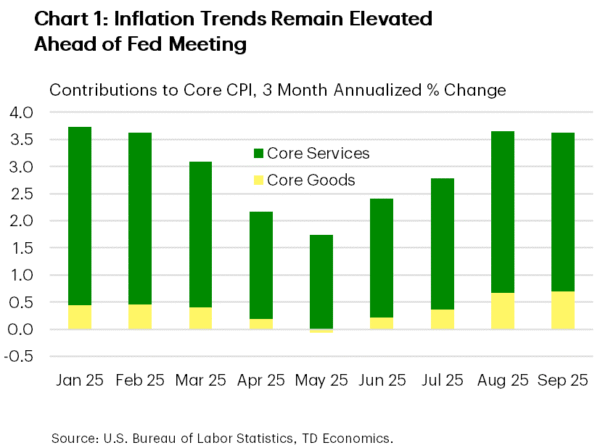

While the Department of Labor remains unfunded, the CPI data for September was released on Friday owing to its use in the annual inflation adjustment to social security payments. The data showed that recent inflationary pressures moderated slightly in September but remained elevated on aggregate, with the three-month annualized percentage change in core CPI running above 3.5% (Chart 1). With price growth still well above the Fed’s 2% target and the timing of future data releases uncertain, policy decisions are expected to be cautious moving forward.

The shift in the Federal Reserve’s stance on monetary policy over the past few months came on the heels of a slowdown in the labor market, tracking of which has been obscured by the lapse in data releases. As the FOMC begins deliberations next week, they will likely assume that the slowdown persisted through September and opt to meet financial market expectations for a quarter-point rate cut. Chair Powell’s press conference will be closely watched for insights into how the policy response function of the Federal Reserve will adapt to a prolonged government shutdown, as inference becomes more difficult the further we are from the last official data release.

On the trade front, U.S. Treasury Secretary Bessent will be meeting with a Chinese delegation in Malaysia over the weekend. The deadline to reach some form of agreement is becoming tight, with President Trump’s threat of 100% tariffs on China starting November 1st. The President will also be travelling to Asia Friday night, with plans to visit Malaysia, Japan, and South Korea, culminating with the Asia Pacific Economic Cooperation (APEC) summit where he is expected to meet with his Chinese counterpart. Amid rising trade tensions in recent weeks, financial markets will be watching for any signs of de-escalation.

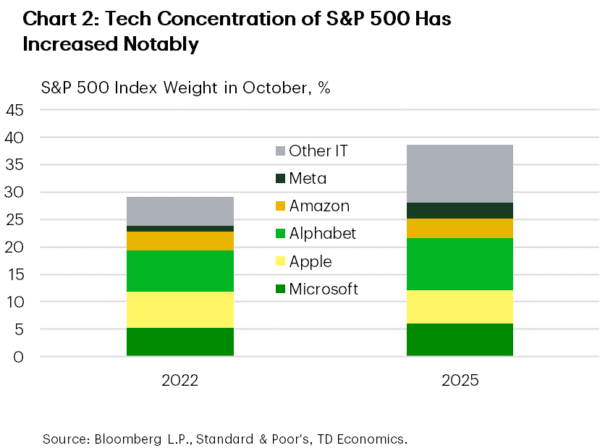

Markets will also be watching for several big tech earnings reports next week, including Microsoft, Apple, Alphabet, Amazon, and Meta, which collectively account for nearly a quarter of the S&P 500 (Chart 2). Given the high level of concentration in equity markets, growing concerns about elevated valuations, and the influence of these trends on the economy, these results will be monitored closely on the heels of Wednesday’s Federal Reserve decision.