After the U.S. Eastern Time market closed on October 22, Tesla, a global leading automobile manufacturer, released its third – quarter financial report.

Although Tesla’s revenue in this quarter reached a record high of $28.095 billion, the net profit attributable to common stockholders in the same period was only $1.373 billion, a significant year – on – year decline of 37%.

Tesla said that the profit decline was mainly due to the increase in operating expenses driven by research and development projects such as sales, general administrative expenses, and artificial intelligence, the increase in expenses such as stock – based compensation (SBC), and the year – on – year decline in the recognition of one – time Full Self – Driving (FSD) revenue.

In fact, Tesla’s revenue growth in the third quarter was partly due to the consumer boom before the expiration of the U.S. electric vehicle tax credit policy.

As the policy officially ended on September 30, this pre – release of demand may put pressure on Tesla’s sales growth in the next few months. In the global market, Tesla’s market share in the first eight months of this year also dropped to third place, behind BYD and Geely.

What’s more worrying is that the progress of several technological transformation strategies that Tesla CEO Elon Musk has high hopes for has fallen short of expectations. For example, the progress of the Full Self – Driving system (FSD) has been slow, and paying customers only account for 12% of Tesla’s current fleet. Both the Robotaxi and Optimus humanoid robot projects have been postponed, and the commercialization process is lower than market expectations.

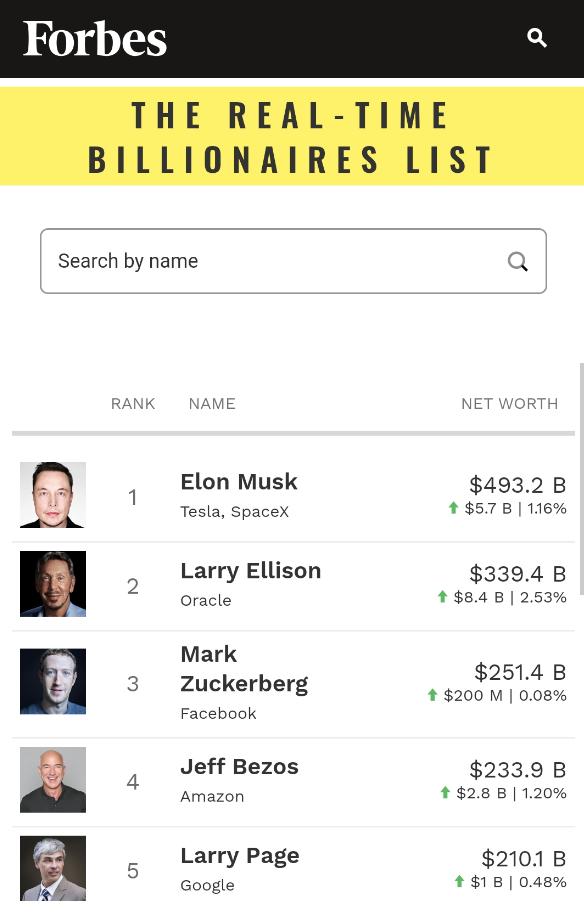

According to the Forbes Real – Time Billionaires List, as of around 16:00 Beijing Time on October 24, Musk ranked first in the world with a fortune of $493.2 billion.

It is worth mentioning that at the end of the latest earnings conference call, Musk fiercely criticized those who tried to block his $1 trillion compensation plan.

He also said: “I really can’t feel at ease building an army of robots here and then being ousted because of the stupid suggestions put forward by institutions like ISS and Glass Lewis.”

Third – quarter revenue hits a new high, net profit plunges nearly 40%

The financial report shows that in the third quarter, Tesla’s total revenue reached a record $28.095 billion, a 12% increase from $25.182 billion in the same period last year, exceeding the average Wall Street analysts’ expectation of $26.36 billion and ending the previous two – quarter decline.

Tesla’s revenue growth this quarter was mainly due to the boost in new car deliveries. In the third quarter of this year, Tesla delivered a total of 497,000 vehicles, a 7.4% year – on – year increase, setting a new quarterly delivery record and far exceeding market expectations.

Benefiting from the record – high vehicle deliveries, Tesla’s revenue from vehicle sales increased by 8% year – on – year to $20.359 billion.

The significant growth of the energy generation and storage business is also an important reason for Tesla’s sharp revenue increase. In the third quarter, the revenue of Tesla’s energy generation and storage business soared by 44% to $3.415 billion, making it the fastest – growing segment this quarter.

Meanwhile, in the third quarter, Tesla’s energy storage product installation reached 12.5 gigawatt – hours, a record high.

However, Tesla’s automotive regulatory credit revenue decreased from $739 million in the same period last year to $417 million, a year – on – year decline of 44%.

Meanwhile, Tesla’s profitability is also a cause for concern. In the third quarter, the company’s net profit attributable to common stockholders was $1.373 billion, a 37% decrease from $2.173 billion in the same period last year.

In the third quarter, Tesla’s gross profit margin was 18%, a 1.8 – percentage – point decrease from 19.8% in the same period last year. The gross profit margin of the automotive business excluding regulatory credit revenue was 15.4%, lower than the average expected 15.6%, indicating that the profitability of the company’s core automotive business is under pressure.

In the third quarter, Tesla’s operating profit was $1.624 billion, a significant 40.23% decrease from $2.717 billion in the same period last year; the operating profit margin dropped sharply from 10.8% in the same period last year to 5.8%, a decrease of 5 percentage points.

In the third quarter, Tesla’s operating expenses reached $3.43 billion, a significant increase of about 50% from $2.28 billion in the same period last year. Tesla said that the increase in operating expenses was mainly used for artificial intelligence and other research and development projects, restructuring expenses, etc.

Tesla Chief Financial Officer Vaibhav Taneja revealed in the earnings conference that the impact of tariffs this quarter exceeded $400 million.

Tesla admitted in the financial report: “Against the background of changes in global trade and fiscal policies, it is difficult to quantitatively assess the impact on the automotive and energy supply chains, cost structures, and the demand for durable consumer goods.”

The decrease in the recognition of one – time FSD revenue is also an important factor affecting Tesla’s profit. As an important profit – growth point, the fluctuation of the revenue recognition of Tesla’s Full Self – Driving system directly affects the company’s quarterly profitability.

Market performance is under pressure, global share declines

Against the background of increasingly fierce competition in the global electric vehicle market, Tesla’s market position is currently facing severe challenges, and its global market share has been continuously declining.

According to data released by SNE Research, from January to August 2025, Tesla’s global sales volume was 985,000 vehicles, a 10.9% year – on – year decrease, and its market share dropped to 7.7%, being surpassed by BYD and Geely and falling to third place globally.

For reference, during the same period, BYD’s sales volume reached 2.556 million vehicles, a 14.1% year – on – year increase, and its market share reached 19.9%, ranking first globally.

Geely Automobile, ranked second, had a cumulative sales volume of 1.315 million vehicles in the first eight months, a 67.8% year – on – year increase, and a market share of 10.2%.

Regionally, according to Cailian Press, data released by the European Automobile Manufacturers Association (ACEA) showed that in August, the registrations of Tesla electric vehicles in Europe (a measure of sales) decreased by about 23% year – on – year, marking the eighth consecutive month of decline.

ACEA said that in the first eight months of this year, the registrations of Tesla electric vehicles in Europe decreased by 32.6%. In contrast, the total registrations of electric vehicles in the European region increased by about 26% compared with the same period in 2024.

Some analysts believe that Tesla’s sales difficulties in the European market may be due to European consumers’ dissatisfaction with Musk himself, his remarks and positions, as well as the fierce competition from electric vehicle manufacturers such as Volkswagen and BYD.

In China, the world’s largest electric vehicle market, Tesla is also facing fierce attacks from many local brands such as BYD, XPeng, Li Auto, and NIO.

Tianyancha shows that Tesla (Shanghai) Co., Ltd. is located at No. 5000 Jiangshan Road, Lingang New Area, China (Shanghai) Pilot Free Trade Zone.

Even in the United States, its traditional stronghold, Tesla’s market position has been shaken. According to data from research firm Cox Automotive obtained by the media, in August this year, Tesla’s share of total U.S. electric vehicle sales dropped to 38%.

To cope with the impact of factors such as the expiration of the U.S. electric vehicle subsidy policy, Tesla played the “price card”. At the beginning of this month, Tesla launched two low – cost models, named “Standard Model Y” and “Standard Model 3” respectively.

Among them, the starting price of the “Standard Model Y” is $39,990, and the starting price of the “Standard Model 3” is $36,990, about $5,000 and $5,500 cheaper than the previous versions respectively.

Although Tesla hopes that the low – cost models can boost sales, this move may further squeeze its profit margin.

Progress of multiple projects falls short of expectations, future is uncertain

Tesla’s technological transformation strategy is the core factor supporting its high valuation. However, judging from the current progress, the advancement speed of several key technological projects of Tesla has fallen short of expectations, and there is great uncertainty about its future growth prospects.

After the release of the financial report, Tesla CEO Elon Musk and CFO Vaibhav Taneja attended the conference call. Musk said that Tesla is at a critical turning point in its development. The Full Self – Driving system (FSD) and autonomous taxis will transform the transportation industry, and Tesla vehicles can achieve full self – driving capabilities with just one software update. He also plans to expand production capacity as soon as possible within Tesla’s capabilities.

However, the progress of Tesla’s Full Self – Driving system (FSD) has been relatively slow. Tesla Chief Financial Officer Vaibhav Taneja said that customers who pay for FSD Supervised only account for 12% of Tesla’s current fleet.

For the much – anticipated Robotaxi project, Musk adjusted the expected target. He said that by the end of 2025, Tesla will remove the safety drivers from Robotaxis in some areas of Austin and expand the service to 8 to 10 cities, significantly narrowing the previous target of covering 50% of the U.S. population.

Currently, Tesla operates the Robotaxi service in Austin and the San Francisco Bay Area, but still has safety drivers on board, and the former can use the emergency shutdown device at any time as a safety guarantee.

As for the Cybercab, a taxi designed specifically for full self – driving, production is planned to start in the second quarter of 2026. This vehicle “has no steering wheel or pedals” and is engineered to achieve the lowest unit – mile operating cost.

The timeline for the Optimus humanoid robot, which Musk calls “possibly the most ambitious product ever,” has been postponed. Musk expects mass production of Optimus to start before the end of 2026, and the V3 version of Optimus will be ready to “debut” in the first quarter of 2026.

Musk admitted that manufacturing Optimus is an “extremely difficult task.” Tesla originally planned to produce 5,000 Optimus robots this year and 50,000 in 2026, but it is reported that Musk abandoned this year’s goal.

Some analysts are cautious, Musk blasts opponents of compensation plan

Facing the decline in Tesla’s profitability indicators and the increasing future uncertainty, Wall Street institutions hold different views on Tesla.

For example, Dan Ives, an analyst at investment bank Wedbush, who has always been bullish on Tesla, believes that Tesla has made important incremental progress in its artificial intelligence strategy. Its FSD (Full Self – Driving) fleet drove more than 1.3 billion miles this quarter, bringing its cumulative FSD driving mileage to 6 billion miles and establishing a large database that helps improve FSD capabilities.

Dan Ives said: “We still believe that in the most optimistic scenario, Tesla’s market value could reach $2 trillion in early 2026 and exceed $3 trillion by the end of 2026. By then, Tesla will enter its ‘golden AI era’.”

However, Garrett Nelson, a senior equity research analyst at CFRA, said: “We are entering a period full of doubts about Tesla’s short – and medium – term profit – growth trajectory.”

Colin Langan, an analyst at Wells Fargo, said that given the continuous deterioration of Tesla’s core business, he maintained a “sell” rating on the stock.

He pointed out that the commercialization and scaling – up process of robotaxis and humanoid robots (Optimus) is expected to be slower than previously thought. “There was very little discussion about the core automotive business in the financial report. The growth and operating leverage of this business are surprisingly limited, mainly affected by pricing, tariffs, and product mix. Overall, we think there is a lack of impetus to continue driving the stock price up.”

Haris Khurshid, the chief investment officer of Karobaar Capital, pointed out: “Although some investors in the market and Musk’s followers realize that Tesla is like an all – around artificial intelligence platform, the earnings report still shows it as an automobile manufacturer, and one that is in a downward trend.”

Dec Mullarkey, the managing director of SLC Management, said: “There isn’t much here to inspire investors. Tesla’s profitability and profit margins are still below average and may stagnate for some time. Currently, Tesla seems to lack a reliable growth narrative and plan, making its stock price vulnerable to rapid market adjustments and negative earnings data.”

In addition, Musk currently manages multiple companies, and some investors have worried that he may not be able to fully focus on Tesla’s operation and management.

It is worth mentioning that at the end of Tesla’s latest earnings conference call, Musk fiercely criticized those who tried to block his $1 trillion compensation plan.

Musk said that he doesn’t even want to call this compensation a “salary” and insisted that the real core issue is whether he can retain enough voting rights to control Tesla’s development in the fields of artificial intelligence, autonomous taxis, and humanoid robots.

“I really can’t feel at ease building an army of robots here and then being ousted because of the stupid suggestions put forward by institutions like ISS and Glass Lewis,” Musk said at the meeting, and he denounced these two proxy advisory firms as “corporate terrorists.”

Musk emphasized that he needs about “25%” of the voting rights to maintain a “strong influence” at Tesla, and at the same time, he can still be removed if he “goes crazy.”

As of the U.S. Eastern Time market close on October 23, Tesla’s market value was about $1.49 trillion, more than 20 times that of traditional automotive giant General Motors. However, in terms of profitability, Tesla’s net profit attributable to shareholders in the third quarter was only slightly more than that of General Motors.

Some analysts believe that this valuation difference depends to some extent on the market’s optimistic expectations for its technological transformation. Once these expectations are not met, Tesla may face significant market – value adjustment risks.

Where will Musk, the world’s richest man, lead Tesla in the future?

This article is from the WeChat official account “Radar Finance” (ID: leidaplus), author: X Editor, published by 36Kr with authorization.