If you’ve been eyeing Antero Resources lately, you’re far from alone. Investors and analysts alike are weighing their options, especially after the stock’s recent 6.2% pop over the last week. Looking a little further back reveals a more nuanced story: a dip of 3.6% across the past month, a year-to-date slide of 8.1%, and, remarkably, a stellar 17.8% rally over the past year. Stretch the timeline even more, and it is hard to miss the significant 861.5% return over the past five years. Those kinds of numbers can quickly attract attention, raising questions not only about momentum but also about the real value behind the headline moves.

What has been driving the latest shifts? Recent industry news has spotlighted changing energy demand and a renewed public focus on US natural gas production. While these stories did not spark dramatic jumps overnight, they have added subtle momentum to the entire sector and increased interest in midsize natural gas producers like Antero. Yet, as attention grows, the big question lingers: is the stock price justified by its fundamentals, or is it getting ahead of itself?

On a standard valuation screen, Antero Resources does not clear any of the classic ‘undervalued’ hurdles. Its value score currently sits at 0 out of 6. However, the real picture might be more complex and revealing than a simple checklist can capture. Let’s examine those valuation methods next and continue for a broader perspective on how to assess what Antero is really worth at the end of the article.

Antero Resources scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Antero Resources Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to reflect today’s value. For Antero Resources, this approach looks at expected Free Cash Flow (FCF) performance over time, using analyst forecasts for the short term and extending those estimates further into the future.

Currently, Antero Resources reports Free Cash Flow of approximately $558 million. Analyst projections expect FCF to reach $560.75 million by 2029. Notably, the ten-year projections provided by the model show a step down from a peak of about $1.29 billion (expected in 2026) to lower levels toward the end of the next decade, with Simply Wall St extrapolating estimates beyond the available analyst data.

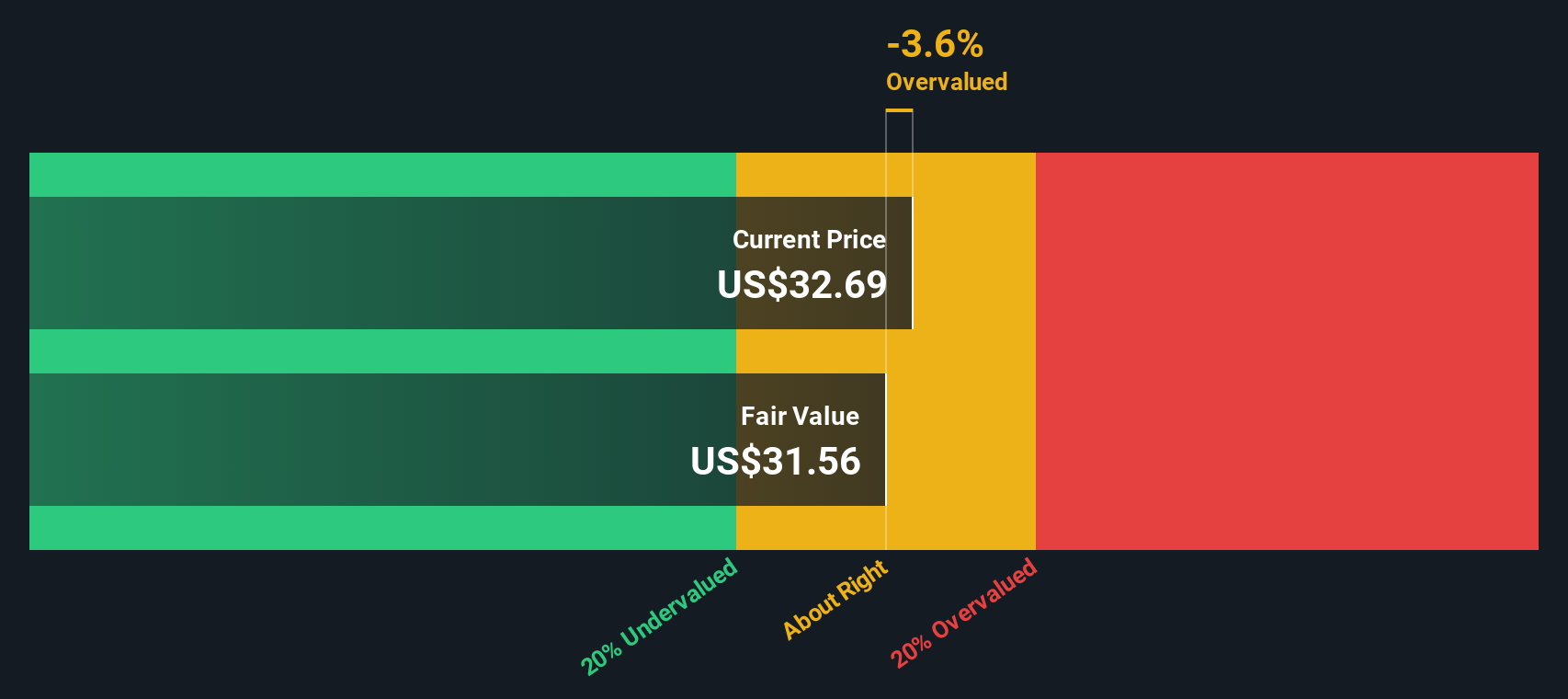

Based on this two-stage DCF analysis, the model calculates Antero Resources’ fair value at $31.56 per share. With the DCF indicating the stock is trading at about a 3.6% premium to this intrinsic value, the market is pricing shares slightly above what the discounted cash flow would justify.

Result: ABOUT RIGHT

AR Discounted Cash Flow as at Oct 2025

AR Discounted Cash Flow as at Oct 2025

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Antero Resources’s valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Antero Resources Price vs Earnings

The price-to-earnings (PE) ratio is a go-to metric for valuing profitable companies like Antero Resources. It tells us how much investors are willing to pay today for a dollar of current earnings, and it helps put Antero’s valuation in context versus its own history, sector peers, and broader industry standards.

Keep in mind that a “normal” or “fair” PE ratio is influenced by factors such as expected earnings growth and a company’s risk profile. Companies with higher growth prospects or lower risk typically command higher PE ratios, while riskier or slower-growing companies usually trade at discounted multiples.

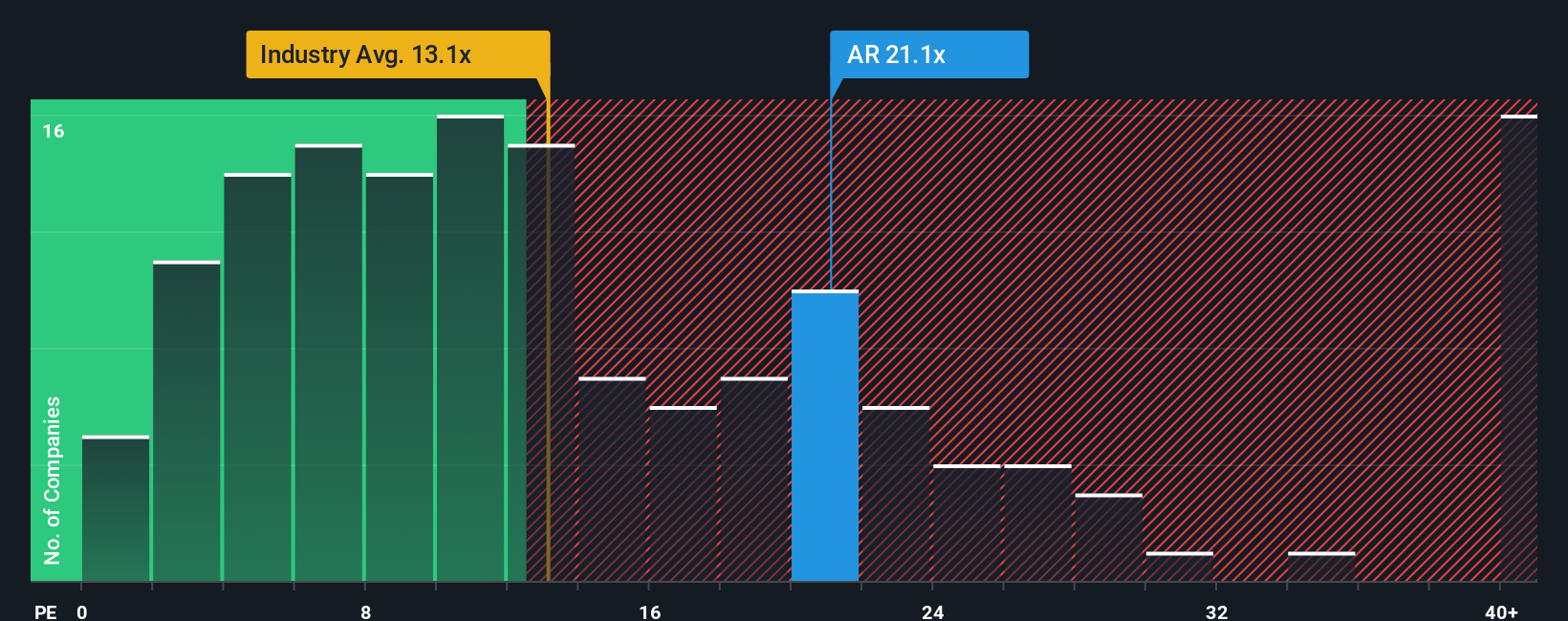

Currently, Antero Resources trades at a PE ratio of 21.1x. That is noticeably higher than both the Oil and Gas industry average of 13.1x and the average of close peers at 13.6x. At first glance, this might suggest the stock is priced at a premium, but raw comparisons can miss what makes a company distinct in terms of growth, profitability, or risk.

This is why Simply Wall St’s proprietary Fair Ratio is useful. Rather than just comparing Antero to peers or industry norms, the Fair Ratio weighs together expected earnings growth, profit margins, market cap, risk, and the company’s place in the sector to estimate what a reasonable multiple should be for this specific business. For Antero Resources, the Fair Ratio comes in at 18.2x. This is only slightly below the current PE of 21.1x, signaling that the stock is priced just about fairly considering its unique profile and outlook.

Result: ABOUT RIGHT

NYSE:AR PE Ratio as at Oct 2025

NYSE:AR PE Ratio as at Oct 2025

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Antero Resources Narrative

Earlier, we mentioned there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your investment story: the big picture behind the numbers, where you connect your own assumptions about Antero Resources’ future revenues, earnings, and profit margins to the resulting fair value you see today.

Instead of just crunching numbers, Narratives link what you believe about the company to a full financial forecast, clearly connecting ‘why you think what you think’ to a practical estimate of fair value. This empowers you to base your buy or sell decisions not just on current or consensus estimates, but on your own arguments and research, all directly within Simply Wall St’s Community page, where millions of investors share, build, and refine these stories together.

Narratives make it easy to track your investment thesis: when news or earnings change, your Narrative and its fair value update in real time, so you can always compare your unique fair value with the current price. For example, one investor may build a bullish Antero Resources Narrative expecting $1.2 billion in future earnings and a price target of $58, while another could be cautious, modeling just $527.5 million in earnings with a $24 target, all within the same easy-to-use tool.

Do you think there’s more to the story for Antero Resources? Create your own Narrative to let the Community know!

NYSE:AR Community Fair Values as at Oct 2025

NYSE:AR Community Fair Values as at Oct 2025

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com