Fed to highlight busy week for central bank decisions

BoC expected to cut too, ECB and BoJ to likely stand pat

Eurozone GDP and Australian CPI to also be important

US government shutdown to delay more crucial US data

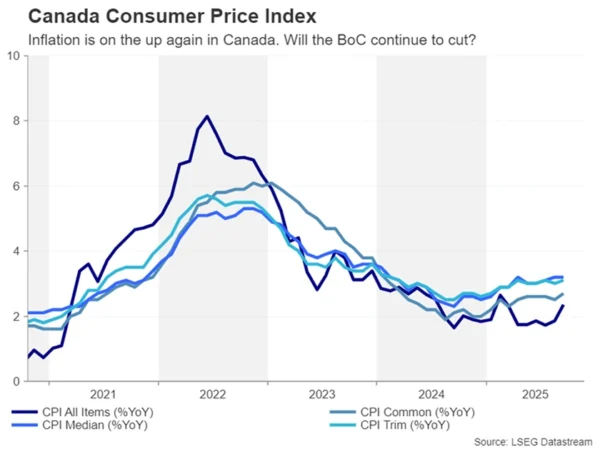

BoC to cut again despite CPI spike

Kickstarting the central bank bonanza is the Bank of Canada on Wednesday. After a six-month pause, the BoC resumed its rate-cutting cycle in September and is expected to ease again in October. Governor Tiff Macklem recently indicated that policymakers will be putting more emphasis on risks at the next decision.

Moreover, with relations between Canada and the US souring again after President Trump abruptly terminated trade talks over an anti-tariff TV ad, a deal has become elusive again.

Subsequently, an October cut seems like a done deal, although for the rest of the year and for 2026, investors have scaled back their bets following the stronger-than-expected acceleration in Canadian CPI in September.

Still, dollar/loonie’s shallow uptrend since April is safe for now and it may be some time before the BoC rules out further rate reductions.

Fed meets amid ongoing shutdown

The US government is no closer to ending the shutdown that has gripped the country since October 1 and is about to enter its fourth week. Democrats are still refusing to agree to the Republican party’s stopgap funding bill as they’re seeking guarantees from the Republicans that a vote will be held on extending the health care subsidies that are due to expire at the end of the year.

However, Donald Trump is holding firm in insisting that there will be no negotiations with the Democrats whilst the government is in shutdown. This intransigent stance of both sides increases the probability of a more material impact on the economy from a prolonged shutdown – something the Fed will likely be mindful about.

If by Wednesday, when the Fed concludes its two-day monetary policy gathering, it doesn’t look like Republican and Democratic Senators are closer to clinching a deal on a funding bill, downside risks to the economy will probably be more prominent in policymakers’ minds.

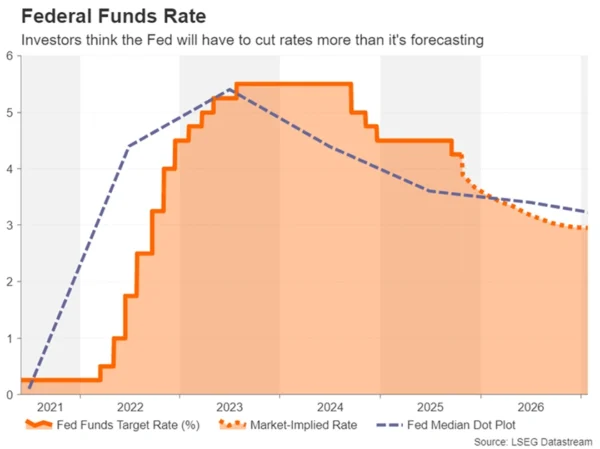

Will the Fed turn more dovish?

Back in September, FOMC members had pencilled in two more rate cuts for 2025 and one for 2026. Judging by the most recent commentary from officials, including from Chair Powell, it doesn’t seem that their views have altered much. Whilst the Fed is clearly worried about the labour market and is watching it carefully, it sees the rate cuts as more of an insurance against any unexpected spikes in unemployment rather than a necessary policy step.

On the other hand, the Fed remains vigilant about sticky price pressures and has signalled it won’t tolerate above-target inflation indefinitely. The caution about the pace of reductions in 2026 and 2027 stems from the uncertainty about what the full impact of Trump’s tariffs will be on domestic prices. Until the Fed has a clearer picture on both inflation and the jobs market, it’s unlikely that Powell will significantly change his language on the future policy path as he announces a 25-basis-points reduction.

Hence, Powell & Co. may strike a somewhat more dovish tone on Wednesday given the latest flare-up in US and China trade relations and the ongoing shutdown, but probably not by much. Even dovish members like Waller are reluctant to pre-commit to a series of rate cuts. This then raises the risk of some disappointment among traders if the Fed casts doubt on the market rate path that implies an additional 100-basis-points of cuts after October.

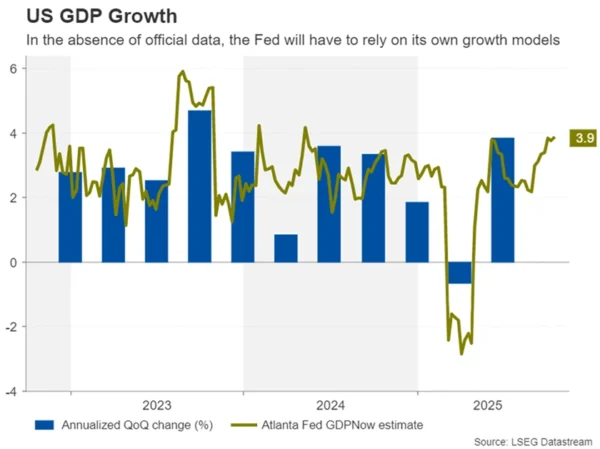

Some US data still in the pipeline

With the government shutdown continuing, more economic releases look set to be put on the backburner next week, including Monday’s durable goods orders, Thursday’s advance GDP estimate for the third quarter and Friday’s personal income and outlays report that contains consumer spending numbers and the core PCE price index.

However, investors and policymakers will have access to some data, mainly the business surveys, such as Tuesday’s consumer confidence index and the Chicago PMI on Friday.

Should the incoming surveys raise any concerns about the economy, it would give investors more reason to question the Fed’s cautious stance. Alternatively, a combination of solid indicators and a not-so-dovish Fed meeting could give the US dollar a notable leg up.

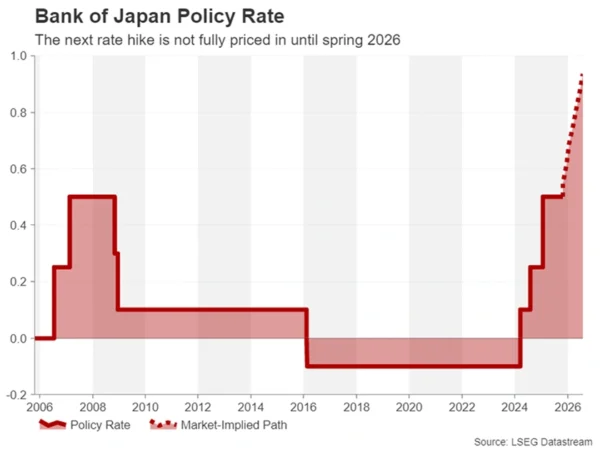

Takaichi win creates a dilemma for the BoJ

The Bank of Japan will announce its latest policy decision on Thursday less than a day after the Fed. Recent remarks from BoJ policymakers have been somewhat on the hawkish side, suggesting that a rate hike is firmly on the table for the October meeting. However, the odds of a 25-bps increase have fallen following newly elected LDP leader Sanae Takaichi’s confirmation as prime minister.

Far from toning down her Abenomics-inspired policies on massive government spending and accommodative monetary policy, Takaichi has doubled-down on the need for a fresh fiscal package to help households struggling from higher prices and for the Bank of Japan to align itself with the government’s economic policies.

This puts the BoJ in a tight spot when it comes to how soon it should raise interest rates again. Although inflation has been declining over the past few months, it remains well above the Bank’s 2% target. The Bank has also been sounding more upbeat lately about Japan’s economic outlook, as trade tensions ease with the United States, and is anticipated to revise up its growth forecasts.

The question now is how strong is the urgency to raise rates sooner rather than later? Takaichi’s appointment as PM has likely removed the immediate need for action, with investors pricing in only a 20% probability of a hike in October.

If the BoJ keeps rates unchanged as expected and simply hints that it’s moving closer to a hike without providing any explicit signals, there won’t be much of a reaction in the yen and traders will turn their attention to the Tokyo CPI figures out on Friday.

ECB meeting could be a non-event

The European Central Bank also meets on Thursday to set policy but it’s unlikely that there will be any fireworks. The Bank has been on pause since July and there seems to be a strong consensus within the Governing Council to hold rates at 2.0% for the foreseeable future.

With inflation hovering around the ECB’s 2% target and the Eurozone economy proving surprisingly resilient in the face of steep US tariffs, policymakers would prefer to preserve some firepower for a rainier day, even as some officials acknowledge that the next move is more likely to be down than up.

For the euro, however, this can only be good news for the bulls, especially as the Fed only recently resumed its easing cycle. The preliminary CPI estimates for October due Friday are also not expected to generate any significant moves even though they will be watched closely, and the bigger risk for the euro will be the flash Q3 GDP readings on Thursday.

The Eurozone economy is projected to have expanded by just 0.1% q/q in the three months to September. A weaker number could revive expectations of a further rate cut by the ECB, weighing on the euro.

Aussie eyes CPI data ahead of RBA decision

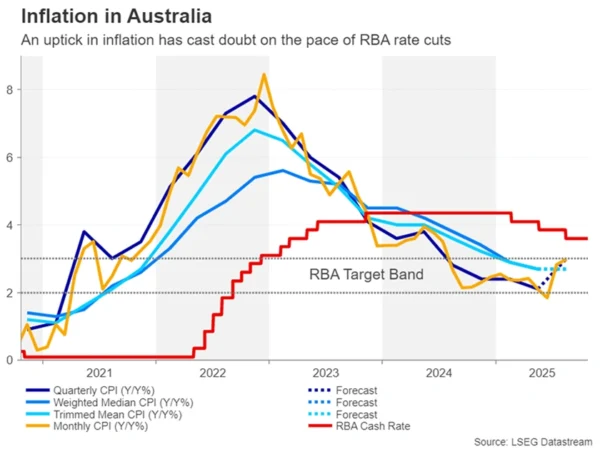

The Reserve Bank of Australia’s next policy meeting is in a little over a week’s time so the timing of Wednesday’s CPI report couldn’t be more ideal.

The report will include data for both the third quarter and September, potentially swaying the November vote as a 25-bps rate cut is less than 70% priced in. The recent economic figures out of Australia haven’t been going the RBA’s way as the unemployment rate jumped to 4.5% in September, while monthly inflation has edged up towards the upper target band of 3.0%.

However, in the quarterly readings, underlying measures of CPI have been declining and if this trend continued in Q3, the RBA is almost certain to trim the cash rate in November. That’s not to say, though, that there aren’t some upside risks for the Australian dollar should any of the CPI prints come in above forecasts.