Bloom Energy (BE) shares saw modest movement this week, catching investor attention as the company’s stock performance continued to show momentum over the past month. Let’s take a closer look at what is fueling interest.

See our latest analysis for Bloom Energy.

Bloom Energy’s impressive 372% share price return so far this year has put it firmly on the radar for growth-focused investors, and the company’s 987% total shareholder return over the past 12 months suggests that optimism is solidly backed by long-term gains. With this kind of momentum building, it is clear Bloom’s story remains an attention-grabber amid recent breakthroughs in the clean energy space.

If Bloom’s remarkable run has you reconsidering your portfolio, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

Yet with the stock’s rapid rise and optimistic outlook, the question lingers: is Bloom Energy undervalued at current levels, or is the market already factoring in every bit of future growth potential?

Most Popular Narrative: 43.7% Overvalued

While Bloom Energy’s last close of $110.38 signals bullish sentiment, the most popular narrative suggests the stock is trading well above its estimated fair value of $76.83. This difference highlights the need to examine what is driving such high expectations.

Surging demand for AI and cloud data center power is driving urgent capacity needs, and Bloom’s proven partnerships with hyperscalers (Oracle, AWS, Coralogix) are accelerating adoption of its fuel cell technology as a resilient, on-site alternative, supporting sustained revenue growth and improving overall earnings visibility.

Want to know what’s really fueling this premium price tag? The narrative is built on bold growth bets and a future profit profile that could rewrite industry norms. Curious what underlying assumptions power this valuation leap? Find out which precise financial drivers underpin this attention-grabbing fair value.

Result: Fair Value of $76.83 (OVERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, persistent reliance on natural gas and rapid advancements in competing zero-emissions technologies could quickly undermine Bloom Energy’s impressive growth story.

Find out about the key risks to this Bloom Energy narrative.

Another View: Discounted Cash Flow Offers a Different Perspective

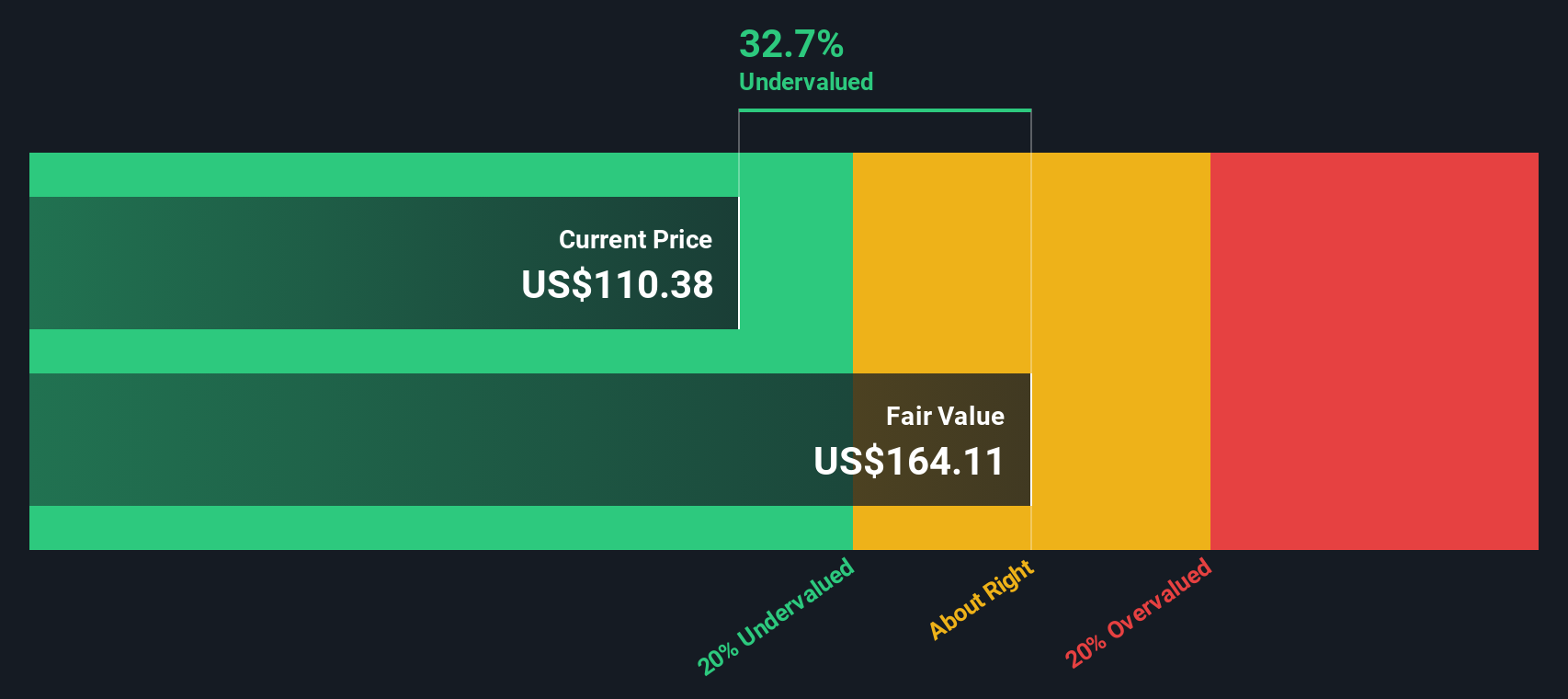

While the narrative-driven fair value pegs Bloom Energy as overvalued, our SWS DCF model presents a strikingly different picture. According to this method, Bloom is actually trading 32.7% below its estimated fair value of $164.11. This suggests considerable potential upside if cash flows materialize as forecast.

Look into how the SWS DCF model arrives at its fair value.

BE Discounted Cash Flow as at Oct 2025

BE Discounted Cash Flow as at Oct 2025

Does this opposite result mean the market is being overly cautious, or is it a flashing warning about big assumptions baked into future growth? Only time will tell which view wins out.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bloom Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Bloom Energy Narrative

If you see the numbers differently or want to dig deeper yourself, it takes just a few minutes to craft your own perspective on Bloom Energy, so Do it your way.

A great starting point for your Bloom Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know the best opportunities are found before they become headlines. Uncover unique growth potential across global markets with these handpicked screeners from Simply Wall Street. You do not want to let these gems pass you by.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if Bloom Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com