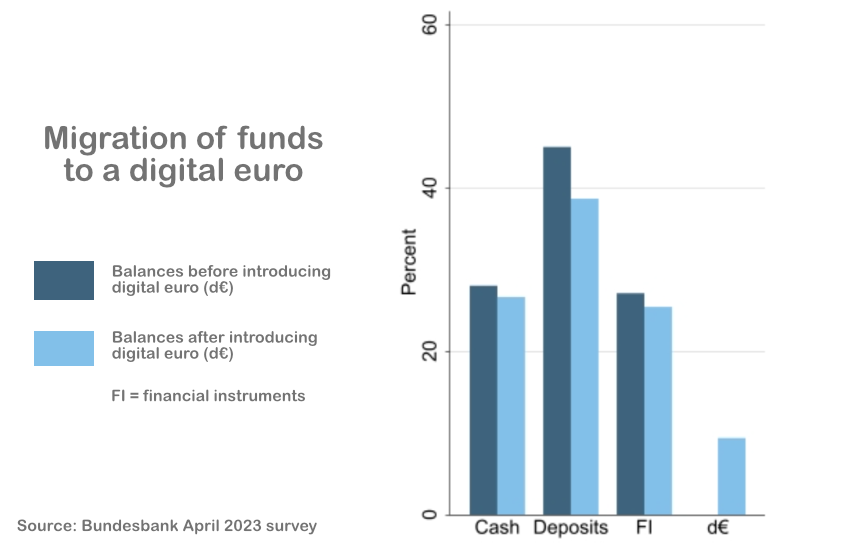

Last week, the Deutsche Bundesbank unveiled the results of a comprehensive digital euro survey that explored how households might react to the introduction of a central bank digital currency (CBDC). It combined the data with an econometric model to measure disintermediation – the impact of consumers shifting from bank deposits to the digital euro.

The findings, while expected in some aspects, offered nuanced details that added depth to the analysis. While there were many caveats, the work recommended holding limits of €1,500 – €2,500, less than the current expected limit of €3,000.

Only just over a quarter of survey participants had heard of a CBDC, so the basic concept was explained. It’s worth remembering that Germany is a relatively cash-favoring economy compared to others.

Article continues …

Want the full story? Pro subscribers get complete articles, exclusive industry analysis, and early access to legislative updates that keep you ahead of the competition. Join the professionals who are choosing deeper insights over surface level news.

Image Copyright: Bundesbank