Oct 30, 2025

IndexBox has just published a new report: Latin America and the Caribbean – Crude Palm Oil – Market Analysis, Forecast, Size, Trends And Insights.

The Latin America and Caribbean crude palm oil market is projected to grow steadily, reaching 5.3 million tons in volume and $5.9 billion in value by 2035. Current consumption stands at 4.5 million tons valued at $4.3 billion in 2024, with Colombia being the largest consumer at 1.4 million tons. Production remains stable at 5.7 million tons, led by Colombia, Guatemala, and Honduras. The region shows significant trade activity, with Mexico as the primary importer (330,000 tons) while Guatemala, Honduras, and Colombia are the main exporters. Per capita consumption is highest in Honduras and Colombia at 28 kg per person, with Guatemala showing the fastest consumption growth rate at 13.6% annually from 2013-2024.

Key Findings

Market projected to reach 5.3M tons volume and $5.9B value by 2035Colombia leads consumption with 1.4M tons, followed by Mexico and BrazilProduction stable at 5.7M tons, dominated by Colombia, Guatemala and HondurasMexico is largest importer while Guatemala, Honduras and Colombia lead exportsHonduras and Colombia show highest per capita consumption at 28 kg per personMarket Forecast

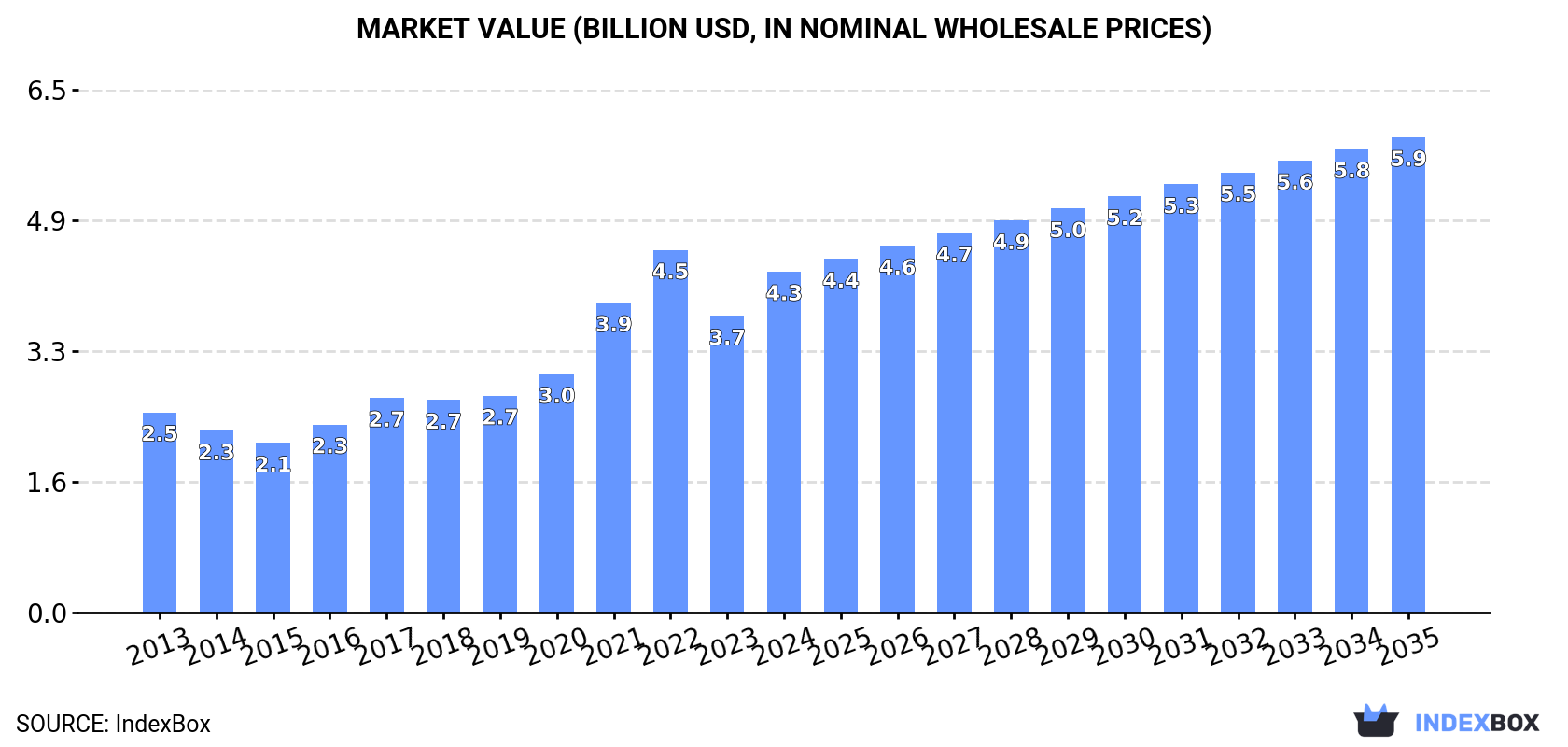

Driven by increasing demand for crude palm oil in Latin America and the Caribbean, the market is expected to continue an upward consumption trend over the next decade. Market performance is forecast to decelerate, expanding with an anticipated CAGR of +1.5% for the period from 2024 to 2035, which is projected to bring the market volume to 5.3M tons by the end of 2035.

In value terms, the market is forecast to increase with an anticipated CAGR of +3.1% for the period from 2024 to 2035, which is projected to bring the market value to $5.9B (in nominal wholesale prices) by the end of 2035.

ConsumptionLatin America and the Caribbean’s Consumption of Crude Palm Oil

ConsumptionLatin America and the Caribbean’s Consumption of Crude Palm Oil

In 2024, approx. 4.5M tons of crude palm oil were consumed in Latin America and the Caribbean; increasing by 9.3% on 2023 figures. The total consumption indicated a notable expansion from 2013 to 2024: its volume increased at an average annual rate of +3.9% over the last eleven years. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Over the period under review, consumption reached the maximum volume in 2024 and is expected to retain growth in years to come.

The size of the crude palm oil market in Latin America and the Caribbean skyrocketed to $4.3B in 2024, surging by 15% against the previous year. This figure reflects the total revenues of producers and importers (excluding logistics costs, retail marketing costs, and retailers’ margins, which will be included in the final consumer price). Overall, consumption posted a strong expansion. The level of consumption peaked at $4.5B in 2022; however, from 2023 to 2024, consumption failed to regain momentum.

Consumption By Country

Colombia (1.4M tons) remains the largest crude palm oil consuming country in Latin America and the Caribbean, accounting for 32% of total volume. Moreover, crude palm oil consumption in Colombia exceeded the figures recorded by the second-largest consumer, Mexico (678K tons), twofold. Brazil (635K tons) ranked third in terms of total consumption with a 14% share.

In Colombia, crude palm oil consumption expanded at an average annual rate of +3.6% over the period from 2013-2024. In the other countries, the average annual rates were as follows: Mexico (+3.2% per year) and Brazil (+6.3% per year).

In value terms, Colombia ($1.4B) led the market, alone. The second position in the ranking was taken by Brazil ($640M). It was followed by Mexico.

From 2013 to 2024, the average annual growth rate of value in Colombia stood at +5.1%. The remaining consuming countries recorded the following average annual rates of market growth: Brazil (+7.9% per year) and Mexico (+4.5% per year).

The countries with the highest levels of crude palm oil per capita consumption in 2024 were Honduras (28 kg per person), Colombia (28 kg per person) and Guatemala (21 kg per person).

From 2013 to 2024, the biggest increases were recorded for Guatemala (with a CAGR of +13.6%), while consumption for the other leaders experienced more modest paces of growth.

ProductionLatin America and the Caribbean’s Production of Crude Palm Oil

In 2024, the amount of crude palm oil produced in Latin America and the Caribbean amounted to 5.7M tons, therefore, remained relatively stable against the year before. The total production indicated perceptible growth from 2013 to 2024: its volume increased at an average annual rate of +4.9% over the last eleven-year period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, production decreased by -0.7% against 2022 indices. The growth pace was the most rapid in 2017 with an increase of 14%. Over the period under review, production attained the maximum volume at 5.7M tons in 2022; afterwards, it flattened through to 2024.

In value terms, crude palm oil production rose notably to $5.6B in 2024 estimated in export price. Overall, production posted a buoyant expansion. The pace of growth appeared the most rapid in 2021 when the production volume increased by 39% against the previous year. Over the period under review, production hit record highs at $6.4B in 2022; however, from 2023 to 2024, production remained at a lower figure.

Production By Country

The countries with the highest volumes of production in 2024 were Colombia (1.8M tons), Guatemala (905K tons) and Honduras (650K tons), with a combined 58% share of total production. Brazil, Ecuador, Mexico, Costa Rica and Peru lagged somewhat behind, together comprising a further 34%.

From 2013 to 2024, the most notable rate of growth in terms of production, amongst the main producing countries, was attained by Mexico (with a CAGR of +14.7%), while production for the other leaders experienced more modest paces of growth.

ImportsLatin America and the Caribbean’s Imports of Crude Palm Oil

In 2024, overseas purchases of crude palm oil increased by 2.6% to 516K tons, rising for the second year in a row after two years of decline. In general, imports, however, showed a noticeable setback. The pace of growth appeared the most rapid in 2016 with an increase of 21%. Over the period under review, imports reached the peak figure at 908K tons in 2018; however, from 2019 to 2024, imports remained at a lower figure.

In value terms, crude palm oil imports reached $533M in 2024. Over the period under review, imports, however, showed a mild curtailment. The pace of growth was the most pronounced in 2020 with an increase of 35%. The level of import peaked at $618M in 2017; however, from 2018 to 2024, imports stood at a somewhat lower figure.

Imports By Country

Mexico was the key importer of crude palm oil in Latin America and the Caribbean, with the volume of imports reaching 330K tons, which was approx. 64% of total imports in 2024. The Dominican Republic (52K tons) took a 10% share (based on physical terms) of total imports, which put it in second place, followed by Brazil (9.7%). The following importers – Colombia (21K tons), El Salvador (18K tons), Guatemala (8.4K tons) and Honduras (7.9K tons) – together made up 11% of total imports.

From 2013 to 2024, average annual rates of growth with regard to crude palm oil imports into Mexico stood at -1.8%. At the same time, Guatemala (+60.0%) and the Dominican Republic (+7.6%) displayed positive paces of growth. Moreover, Guatemala emerged as the fastest-growing importer imported in Latin America and the Caribbean, with a CAGR of +60.0% from 2013-2024. Brazil experienced a relatively flat trend pattern. By contrast, Honduras (-2.6%), El Salvador (-4.6%) and Colombia (-9.8%) illustrated a downward trend over the same period. From 2013 to 2024, the share of the Dominican Republic, Mexico, Guatemala and Brazil increased by +6.7, +4.2, +1.6 and +1.6 percentage points, respectively. The shares of the other countries remained relatively stable throughout the analyzed period.

In value terms, Mexico ($339M) constitutes the largest market for imported crude palm oil in Latin America and the Caribbean, comprising 64% of total imports. The second position in the ranking was taken by the Dominican Republic ($59M), with an 11% share of total imports. It was followed by Brazil, with a 10% share.

From 2013 to 2024, the average annual rate of growth in terms of value in Mexico was relatively modest. In the other countries, the average annual rates were as follows: the Dominican Republic (+7.9% per year) and Brazil (+1.0% per year).

Import Prices By Country

The import price in Latin America and the Caribbean stood at $1,033 per ton in 2024, reducing by -2.2% against the previous year. Import price indicated a mild increase from 2013 to 2024: its price increased at an average annual rate of +1.3% over the last eleven-year period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. Based on 2024 figures, crude palm oil import price decreased by -24.3% against 2022 indices. The pace of growth appeared the most rapid in 2021 an increase of 39% against the previous year. Over the period under review, import prices attained the peak figure at $1,365 per ton in 2022; however, from 2023 to 2024, import prices stood at a somewhat lower figure.

Prices varied noticeably by country of destination: amid the top importers, the country with the highest price was Honduras ($1,333 per ton), while Guatemala ($87 per ton) was amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by Honduras (+7.2%), while the other leaders experienced more modest paces of growth.

ExportsLatin America and the Caribbean’s Exports of Crude Palm Oil

After two years of growth, overseas shipments of crude palm oil decreased by -14.9% to 1.7M tons in 2024. Total exports indicated tangible growth from 2013 to 2024: its volume increased at an average annual rate of +4.4% over the last eleven-year period. The trend pattern, however, indicated some noticeable fluctuations being recorded throughout the analyzed period. The most prominent rate of growth was recorded in 2015 when exports increased by 25% against the previous year. The volume of export peaked at 2.3M tons in 2018; however, from 2019 to 2024, the exports stood at a somewhat lower figure.

In value terms, crude palm oil exports reduced to $1.8B in 2024. Overall, exports, however, continue to indicate a buoyant increase. The pace of growth was the most pronounced in 2021 with an increase of 38% against the previous year. Over the period under review, the exports attained the peak figure at $2.3B in 2022; however, from 2023 to 2024, the exports remained at a lower figure.

Exports By Country

Guatemala (534K tons), Honduras (366K tons) and Colombia (354K tons) represented roughly 72% of total exports in 2024. Costa Rica (182K tons) ranks next in terms of the total exports with a 10% share, followed by Nicaragua (5.1%) and Peru (5%). Ecuador (72K tons) followed a long way behind the leaders.

From 2013 to 2024, the most notable rate of growth in terms of shipments, amongst the key exporting countries, was attained by Nicaragua (with a CAGR of +14.0%), while the other leaders experienced more modest paces of growth.

In value terms, the largest crude palm oil supplying countries in Latin America and the Caribbean were Guatemala ($491M), Honduras ($400M) and Colombia ($399M), with a combined 71% share of total exports. Costa Rica, Peru, Nicaragua and Ecuador lagged somewhat behind, together accounting for a further 26%.

In terms of the main exporting countries, Nicaragua, with a CAGR of +19.5%, recorded the highest growth rate of the value of exports, over the period under review, while shipments for the other leaders experienced more modest paces of growth.

Export Prices By Country

The export price in Latin America and the Caribbean stood at $1,049 per ton in 2024, with an increase of 9.1% against the previous year. In general, the export price posted a pronounced expansion. The pace of growth was the most pronounced in 2021 when the export price increased by 53% against the previous year. Over the period under review, the export prices reached the peak figure at $1,206 per ton in 2022; however, from 2023 to 2024, the export prices failed to regain momentum.

Average prices varied somewhat amongst the major exporting countries. In 2024, major exporting countries recorded the following prices: in Peru ($1,207 per ton) and Nicaragua ($1,183 per ton), while Guatemala ($921 per ton) and Ecuador ($1,008 per ton) were amongst the lowest.

From 2013 to 2024, the most notable rate of growth in terms of prices was attained by Nicaragua (+4.8%), while the other leaders experienced more modest paces of growth.