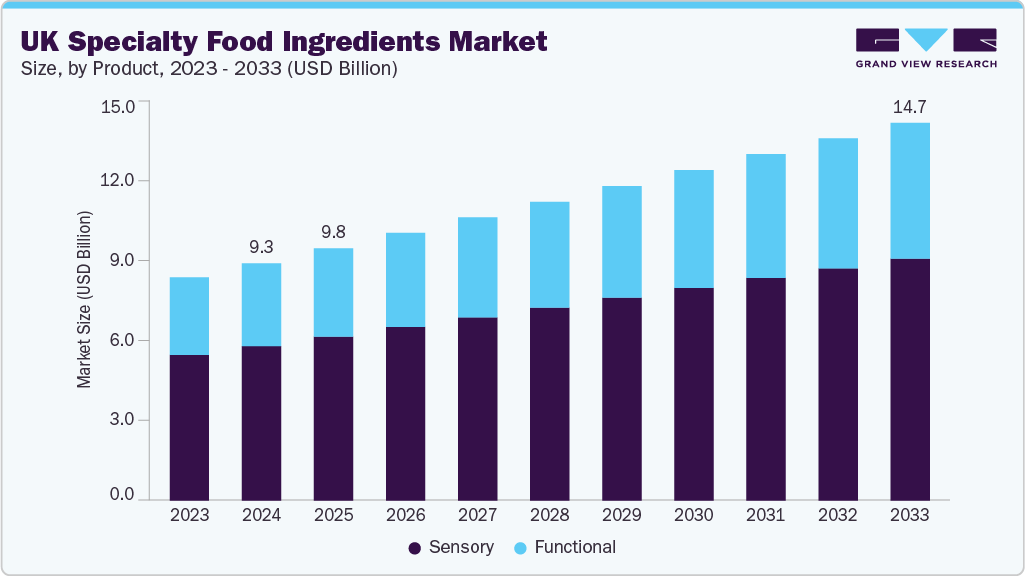

The UK specialty food ingredients market size was estimated at USD 9,257.1 million in 2024 and is projected to reach USD 14,749.6 million by 2033, growing at a CAGR of 5.2% from 2025 to 2033. The industry is primarily driven by rising consumer demand for healthier, functional, and natural food products.

The UK is expected to grow at a CAGR of 5.2% from 2025 to 2033.

By product, sensory segment led the market and accounted for the largest revenue share of 65.1% in 2024.

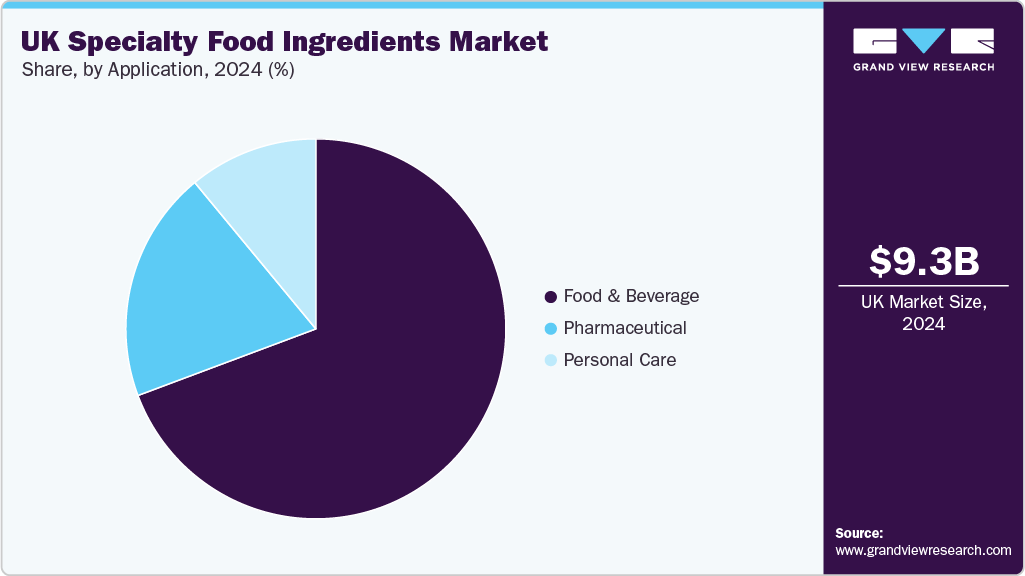

By application, the food & beverage segment dominated the market with a revenue share of 69.3% in 2024.

Market Size & Forecast

2024 Market Size: USD 9,257.1 Million

2033 Projected Market Size: USD 14,749.6 Million

CAGR (2025-2033): 5.2%

Increasing awareness about nutrition and wellness has encouraged manufacturers to incorporate specialty ingredients such as plant-based proteins, natural sweeteners, probiotics, and dietary fibers into their product formulations. The ongoing shift toward clean-label and transparent ingredient sourcing has further accelerated demand, as consumers increasingly scrutinize ingredient lists and favor products with recognizable, natural, and minimally processed components.

Another major driver is the growth of the functional and fortified foods sector across the UK. With consumers adopting proactive approaches to health management, there is a rising interest in foods that offer specific health benefits, such as improved digestion, enhanced immunity, or cardiovascular support. This has boosted the use of bioactive compounds, omega-3 fatty acids, and other nutraceutical ingredients.

Additionally, the country’s aging population and growing focus on preventive healthcare are supporting the demand for ingredients that promote longevity and overall well-being, positioning specialty food ingredients as a critical enabler of health-oriented innovation.

Furthermore, the expansion of the plant-based and alternative protein market is a key catalyst for growth. The UK has seen rapid adoption of vegan and flexitarian diets, prompting food manufacturers to explore specialty ingredients that enhance taste, texture, and nutrition in meat and dairy alternatives. Technological advancements in ingredient processing, such as precision fermentation and microencapsulation, are helping improve product stability and functionality.

Alongside these trends, the government’s sustainability initiatives and the food industry’s commitment to reducing carbon footprints are encouraging the use of eco-friendly, sustainably sourced specialty ingredients. Together, these factors are reinforcing long-term market expansion.

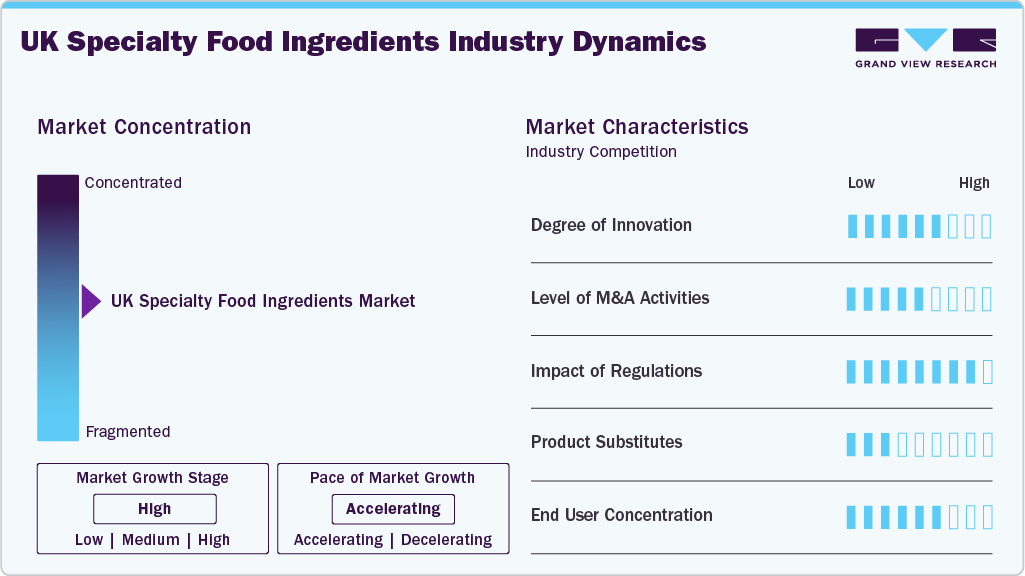

Market Concentration & Characteristics

The industry is moderately concentrated, characterized by the presence of a few major multinational players alongside several regional and niche producers. Leading companies such as DSM-Firmenich, Kerry Group, Tate & Lyle, Cargill, and Ingredion dominate a significant portion of the market through extensive product portfolios, strong R&D capabilities, and global distribution networks. These players continuously invest in innovation to develop functional, natural, and sustainable ingredient solutions that cater to evolving consumer preferences. However, regional manufacturers and startups are increasingly capturing market share by focusing on organic sourcing, clean-label solutions, and customization for local food producers.

In terms of characteristics, the industry is defined by high levels of innovation, stringent regulatory compliance, and growing emphasis on sustainability. The market operates within a value chain that is closely linked to the food and beverage manufacturing sector, with demand strongly influenced by health and wellness trends, technological advancements, and consumer awareness. Entry barriers are moderate due to the need for specialized processing technologies, quality certifications, and adherence to food safety standards. Moreover, partnerships and acquisitions are common strategies among key players aiming to expand product portfolios and penetrate emerging categories such as plant-based and functional foods, further shaping the market’s competitive dynamics.

Product Insights

The sensory segment led the market and accounted for the largest revenue share of 65.1% in 2024. This segment dominates due to its established supply chains and consistent performance in industrial bio-based end uses. It is widely used in the automotive, construction, and furniture industries because of its cost-effectiveness and reliability. Steady demand from large-scale manufacturing supports its market leadership. Despite the rise of bio-based alternatives, conventional isocyanates remain the backbone of the industry.

Functional ingredients are gaining traction in the UK due to growing health awareness and consumer preference for foods offering nutritional and physiological benefits. Ingredients such as probiotics, fibers, proteins, and omega-3s are being widely incorporated into beverages, dairy, and fortified snacks. The shift toward preventive health and wellness lifestyles is fueling demand for these bioactive compounds.

Application Insights

The food & beverage segment dominated the market with a revenue share of 69.3% in 2024, driven by the growing demand for healthier, natural, and functional products. Manufacturers are increasingly incorporating clean-label flavorings, stabilizers, and nutritional enhancers to meet evolving consumer preferences. The rise of plant-based foods, low-sugar beverages, and fortified snacks is further propelling ingredient innovation.

The pharmaceutical segment is the fastest-growing segment with a CAGR of 6.2% during the forecast period. This growth is due to the increased use of their functional and bioactive properties that support drug formulation and nutraceutical development. Ingredients such as proteins, polysaccharides, and vitamins are utilized for their role in improving stability, absorption, and therapeutic efficiency. The growing overlap between nutrition and medicine, particularly in dietary supplements and functional foods, is expanding ingredient usage.

Key UK Specialty Food Ingredients Companies Insights

Key players operating in the UK specialty food ingredients market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Cargill, Incorporated’s Animal Nutrition segment provides various nutrition products and services to commercial producers across sectors such as beef, swine, dairy, aqua, and poultry. The company’s offerings include premixes, base mixes, concentrates, and specialized feed additives under renowned brands such as Diamond V, Delacon, EWOS, Purina, and Provimi. These products enhance animal health and performance, aligning with Cargill’s commitment to supporting sustainable agriculture and food production. The company operates in around 70 countries, with a sales presence in nearly 125 countries across North America, Asia Pacific, Latin America, Europe, the Middle East, and Africa. Cargill’s extensive global network ensures that its feed premix products are effectively distributed to a diverse customer base.

ADM is engaged in the feed additives market through its Nutrition segment, focusing on health and wellness products. This segment produces various animal nutrition products, including amino acids, protein meals, and feed ingredients, contributing to the company’s extensive offerings in the feed additives market. The company operates through 46 innovation centers, 271 processing plants, 450 crop procurement facilities, and 200 bulk storage facilities in nearly 200 countries across regions. Its global operations enable it to cater to a wide range of markets and customer needs in the feed premixes sector.

Naturex

Givaudan

Eli Fried Inc.

KF Specialty Ingredients

Ingredion

Associated British Foods Plc

Kerry Group

Agropur Co-operative

Ashland Inc.

Archer Daniels Midland Company

Cargill Inc.

Wild Flavors GmbH

DSM

Diana Group SA

Tate & Lyle

CHR. Hansen

Recent Developments

In October 2025, Brenntag announced the opening of a new food and nutrition innovation application center in the UK. This center aims to enhance services related to formulation guidance, ingredient selection, and application. It will specifically focus on bakery products, meat, and plant-based foods. Additionally, the center will support ready meals, sauces and dips, beverages, and nutritional products for clients from UK and Irish food manufacturers and other industry stakeholders.

UK Specialty Food Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9,848.7 million

Revenue forecast in 2033

USD 14,749.6 million

Growth rate

CAGR of 5.2% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 – 2023

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application

Key companies profiled

Naturex; Givaudan; Eli Fried Inc.; KF Specialty Ingredients; Ingredion; Associated British Foods Plc; Kerry Group; Agropur Cooperative; Ashland Inc; Archer Daniels Midland Company; Cargill Inc.; Wild Flavors GmbH; DSM; Diana Group SA; Tate & Lyle; CHR. Hansen

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

UK Specialty Food Ingredients Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the UK specialty food ingredients market report based on product and application:

Product Outlook (Revenue, USD Million, 2021 – 2033)

Sensory

Enzymes

Emulsifiers

Flavors

Colorants

Other Sensory

Functional

Vitamins

Minerals

Antioxidants

Preservatives

Other Functional

Application Outlook (Revenue, USD Million, 2021 – 2033)

Food & Beverage

Pharmaceuticals

Personal Care