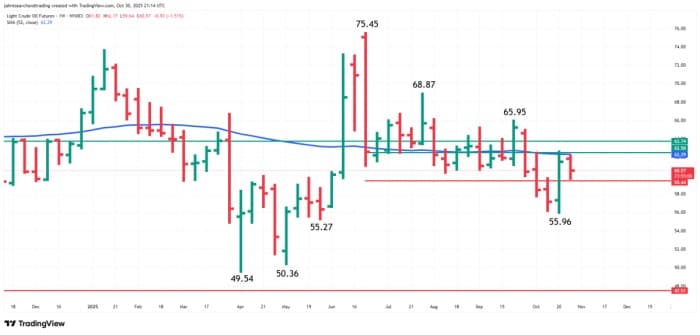

WTI crude oil futures remained under pressure this week, as bearish fundamental forces overshadowed temporary bullish drivers. Despite a larger-than-expected U.S. inventory draw and de-escalating U.S.–China trade tensions, crude failed to hold gains as traders priced in persistent oversupply risks, diminishing geopolitical risk premiums, and cautious macroeconomic signals. Heading into Friday’s session, WTI is on track to post a weekly decline unless a fresh catalyst emerges.

US Crude Inventory Draws Offer Bullish Data, But Traders Shrug

A major bullish input arrived midweek when both the American Petroleum Institute (API) and the U.S. Energy Information Administration (EIA) reported sharp draws in crude and product inventories. API data pointed to a 4.02 million-barrel decline in crude stocks, while the EIA confirmed an even steeper 6.86 million-barrel draw — far above expectations. Gasoline and distillate inventories also dropped significantly.

In a vacuum, such data would normally ignite buying interest, particularly as tight product inventories suggest firm demand heading into year-end. However, price action told a different story. The market responded tepidly, underscoring the weight of broader supply concerns and signaling that short-term inventory shifts are not enough to reset sentiment.

OPEC+ Output Strategy Continues to Pressure Market Tone

Bearish pressure intensified as it became increasingly likely that OPEC+ will move forward with…