Spot gold prices are hovering around $3979 per ounce, with gold contracts currently at $4,020.90 per ounce in the futures market. Despite the volatile week fuelled by escalation in geopolitics and policy shifts, gold has managed to find some stabilization. This is after a series of market-moving events during this week, ranging from the Federal Reserve’s interest rate settings to President Trump’s meeting Chinese President Xi Jinping in South Korea. The big question is that given the two big events are over, what is next for the shinning metal. But first lets understand what has happened.

The Fed Meeting and Its Implications on Gold

The Federal Reserve meeting yesterday witnessed the cutting of rates by 25 basis points to the range of 3.75% to 4.00%, in line with market expectations. While the outcome did provide some respite, it was the post-meeting insights of Fed Chairman Jerome Powell that took precedence.

Powell indicated that the chances of a cut in rates in December were “far from” being guaranteed, thereby disappointing some traders who were betting on a more dovish monetary policy in light of weaker economic indicators. The U.S. dollar thereby experienced support in the wake of the meeting, which has generally negative repercussions on gold prices due to the inverse correlation between the two commodities.

Nevertheless, the fact that gold prices were able to stay above the lows of this week, $3,886 indicates that it retains inherent support in terms of macroeconomic and geopolitical tensions such as trade and inflation concerns.

U.S.-China Meeting: The Change in Geopolitical Mood

The latest U.S.-China summit between President Trump and Chinese President Xi Jinping has further complicated the gold market. The U.S.-China summit saw de-escalation rhetoric, particularly on fentanyl precursor imports and rare earth supply chains, though there were nuanced undertones in it as well.

The fact that President Trump agreed to reduce tariffs on fentanyl from 20% to 10% and proposed that there should be an understanding on rare earth supplies was appreciated, with President Xi Jinping even welcoming it while calling for further healthier U.S.-China relations in the future.

But gold investors were hesitant to rely on these agreements because they are not very enforceable, resulting in them questioning the agreements’ efficiency in the end. Such agreements between the U.S. and China in the past failed to work out in the past, and until something concrete is achieved in terms of de-escalation.

Technical Analysis: RSI and Moving Averages

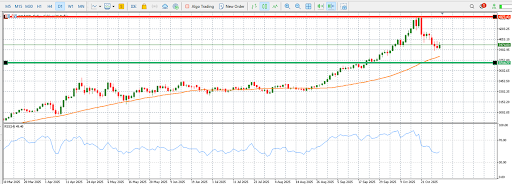

Technically, gold is in a strong position from the perspective of a long term trend. Gold being above its 50-day simple moving average (SMA) on the daily time frame indicates that the bullish trend has not weakened yet.

At the moment, gold price has eased from its overbought level of the Relative Strength Index (RSI), with values close to 55, meaning that gold has faced a pullback.

The pullback in gold to the level of the 50-day SMA with a price of $3,794 may trigger an opportunity for investors to buy as long as the price doesn’t violate the moving average by a significant amount.

Gold price chart by MH Markets

Conclusion: Managing Macro Risks with Gold

Gold remains an essential hedge in the face of an uncertain global environment. The current Federal Reserve policy of being less enthusiastic about any further reduction in rates, uncertainty over U.S.-Chinese trade policies, and political instabilities continue to make gold an option to hedge against risks in the global macroeconomic environment.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.