Occidental Petroleum (OXY) is back in the spotlight after a combination of lower oil prices, recent U.S. sanctions on Russian oil, and a strategic Chemicals divestment shaped its near-term outlook and attracted investor interest.

See our latest analysis for Occidental Petroleum.

After hitting new 52-week lows, Occidental Petroleum’s recent 1-month share price decline of 13.7% has investors reassessing its long-term potential. While five-year total shareholder returns remain impressive at over 330%, the momentum has cooled this year. This highlights near-term volatility even as strategic moves and Berkshire Hathaway’s continued stake hint at resilience.

If you want to expand your search beyond Occidental, now’s a great moment to discover fast growing stocks with high insider ownership.

With shares trading at a notable discount to analyst targets and fresh financial moves underway, is Occidental Petroleum truly undervalued at current levels, or is the market already pricing in the company’s next phase of growth?

Most Popular Narrative: 25.2% Undervalued

Occidental Petroleum’s narrative fair value sits well above the recent closing price, highlighting a sizable gap between market caution and optimistic projections. According to Dzitkowskik, the underlying investment story is shaped by the company’s core operations, bold diversification efforts, and a push into next-generation carbon technologies.

OXY is a pioneer in CCS, investing heavily in Direct Air Capture (DAC) technology and related infrastructure (for example, the STRATOS facility in West Texas). They aim to make CCS a substantial part of their business. OXY believes CCS could be a multi-trillion-dollar global industry. Their early leadership positions them to capture a meaningful share of this market if it develops as they anticipate.

Want to know which massive new revenue stream could drive this ambitious price target? The narrative is betting on a transformative business shift and future profits powered by breakthrough carbon technologies. Could this be the key to unlocking a valuation few expect? The details behind those projections might surprise you.

Result: Fair Value of $55.05 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, persistent oil price volatility and uncertainty around scaling up carbon capture could challenge Occidental’s bullish narrative and delay profits from new ventures.

Find out about the key risks to this Occidental Petroleum narrative.

Another View: Relativity Through Multiples

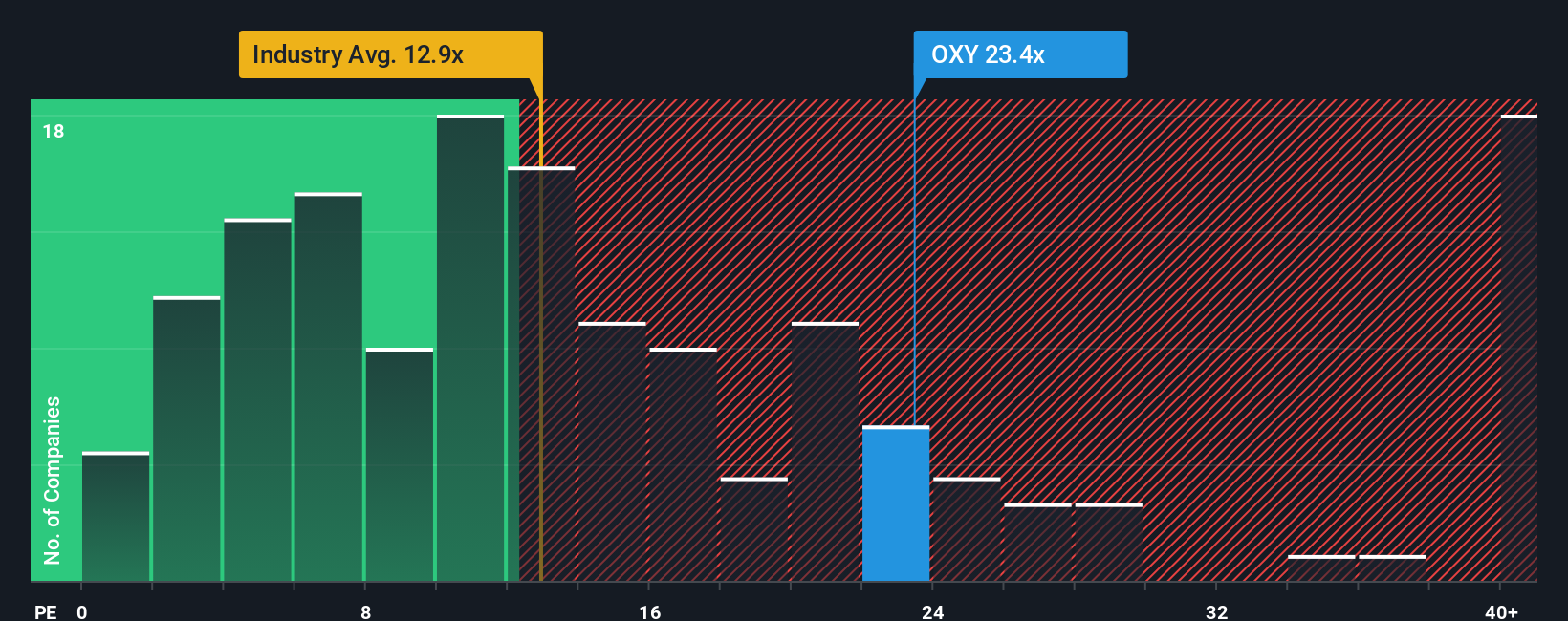

Looking at Occidental’s valuation through the lens of the price-to-earnings ratio, a different story emerges. The company trades at 23.4 times earnings, which is higher than the US oil and gas industry average of 12.9 times and even its estimated fair ratio of 18.8 times. While this signals investor optimism about future growth or stability, it also raises the risk of disappointment if the narrative around carbon capture and diversification does not deliver as strongly as hoped. Could investors be pricing in too much, too soon?

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:OXY PE Ratio as at Nov 2025 Build Your Own Occidental Petroleum Narrative

NYSE:OXY PE Ratio as at Nov 2025 Build Your Own Occidental Petroleum Narrative

Not sold on these perspectives, or want to dig into the numbers yourself? You can shape your own viewpoint in just a few minutes. Do it your way.

A great starting point for your Occidental Petroleum research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let your next big opportunity pass by. Use these smart shortcuts to uncover stocks with exciting upside and growth potential right now on Simply Wall St.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com