Customers Bancorp (CUBI) has caught the attention of many investors recently, with shares up over 40% in the past month and up 67% over the past 3 months. The bank’s performance is sparking fresh discussions about valuation and growth momentum.

See our latest analysis for Customers Bancorp.

After an impressive rally, Customers Bancorp’s 1-year total shareholder return now stands at nearly 47%, and its 5-year total return has soared over 430%. While there has been some volatility in the past week, momentum remains firmly on the side of long-term investors. Recent price movements reflect renewed optimism for growth.

If this run from Customers Bancorp has you rethinking your portfolio, it might be the right moment to discover fast growing stocks with high insider ownership

The big question is whether Customers Bancorp’s strong performance is a sign that shares are still undervalued, or if the recent surge means the market has already priced in future growth, leaving little room for upside.

Most Popular Narrative: 16% Undervalued

With Customers Bancorp trading at $67.12 and the most widely followed narrative setting fair value at $80.13, the stock’s recent climb still leaves upside according to analyst projections. This narrative anchors its outlook on technology-driven advantages and future earnings expectations, drawing a clear line between current price and potential value.

“Differentiation through proprietary digital banking technology and targeted talent recruitment is fueling deposit, loan, and fee income growth while enhancing revenue quality and margins. Focus on underserved verticals, operational efficiency, and regulatory leadership is diversifying revenue streams and positioning the bank for sustainable, industry-leading earnings growth.”

Want to know what’s powering this bullish price target? The narrative is built on a bold earnings projection and margin expansion normally reserved for top-tier financial disruptors. What’s the hidden assumption that could make or break this valuation? Dive into the details to find out what elevates Customers Bancorp’s story above the rest.

Result: Fair Value of $80.13 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, reliance on digital asset deposits and increased regulatory scrutiny could present challenges to Customers Bancorp’s ambitious growth story if conditions shift unexpectedly.

Find out about the key risks to this Customers Bancorp narrative.

Another View: What Do Valuation Ratios Suggest?

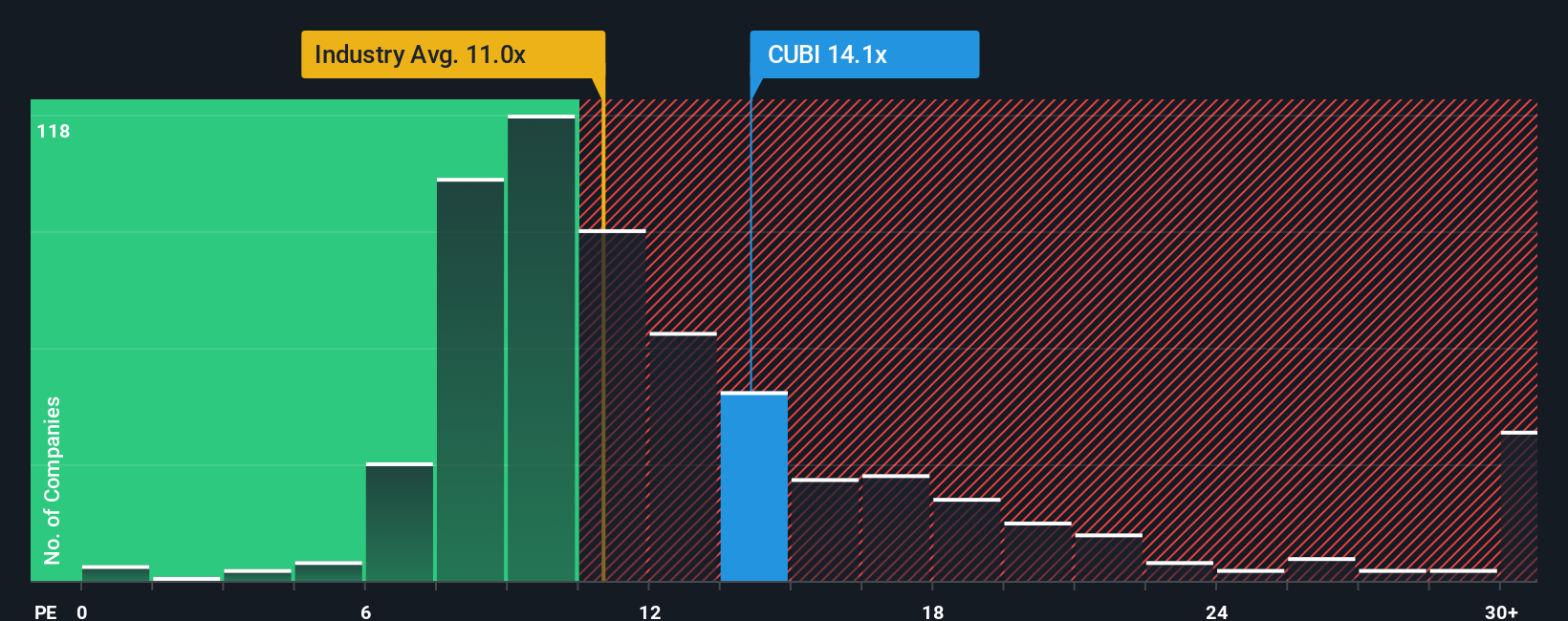

While our main narrative points to significant upside, a closer look at valuation ratios raises some caution. Customers Bancorp trades at a price-to-earnings ratio of 14.1x, notably higher than the US Banks industry average of 11x and its peer average of 10.9x. Even when compared to its estimated fair ratio of 15.6x, most of the gap has already closed. This relative premium could mean the stock is pricing in a lot of good news already. Does that raise the bar for future returns?

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:CUBI PE Ratio as at Nov 2025 Build Your Own Customers Bancorp Narrative

NYSE:CUBI PE Ratio as at Nov 2025 Build Your Own Customers Bancorp Narrative

If you see the story differently, or want to dig into the numbers for yourself, you can build your own Customers Bancorp view in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Customers Bancorp.

Looking for more investment ideas?

Don’t let great investment opportunities pass you by. Take control of your financial future with targeted ideas you can act on today, all with Simply Wall Street.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com