Recent analyst commentary around Main Street Capital (MAIN) has drawn attention due to a negative Earnings ESP and reduced Zacks Rank. This has sparked new discussions about the company’s earnings outlook for the September 2025 quarter.

See our latest analysis for Main Street Capital.

Main Street Capital’s share price has pulled back in recent weeks, down nearly 10% in the past month and about 11% over three months. Even so, its 12-month total shareholder return stands at an impressive 21%. Despite recent caution from analysts and softer momentum, the long-term performance remains exceptional with an 87% total return over three years and 189% over five years. This suggests that Main Street still finds strong support among long-term investors.

If you’re looking for your next opportunity beyond Main Street’s moves, now’s a great moment to discover fast growing stocks with high insider ownership.

With the price now trailing its recent highs and analysts sounding more cautious, the question is whether Main Street Capital represents an undervalued opportunity for investors, or if the market has already factored in every bit of future growth.

Most Popular Narrative: 8% Undervalued

According to the most widely watched narrative, Main Street Capital’s fair value is set at $62 per share, with the last close at $56.92. This fair value is not only above recent trading levels but also stands in contrast to the more bearish sentiment currently circulating among some analysts.

The company reported significant growth in both its lower middle market and private loan investment portfolios, along with an attractive investment pipeline, suggesting potential for continued growth in earnings and asset value. This can contribute positively to its share price.

Curious how the narrative justifies Main Street Capital’s premium? The real surprise lies in bold forward projections for growth and profit margins, fueling this higher valuation. Want to see exactly which numbers underpin the case for further upside, despite market skepticism? Unlock the details and dig into the full financial roadmap behind this valuation.

Result: Fair Value of $62 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, ongoing growth in asset management and a record NAV per share could strengthen investor confidence and help maintain share price resilience.

Find out about the key risks to this Main Street Capital narrative.

Another View: SWS DCF Suggests a Different Story

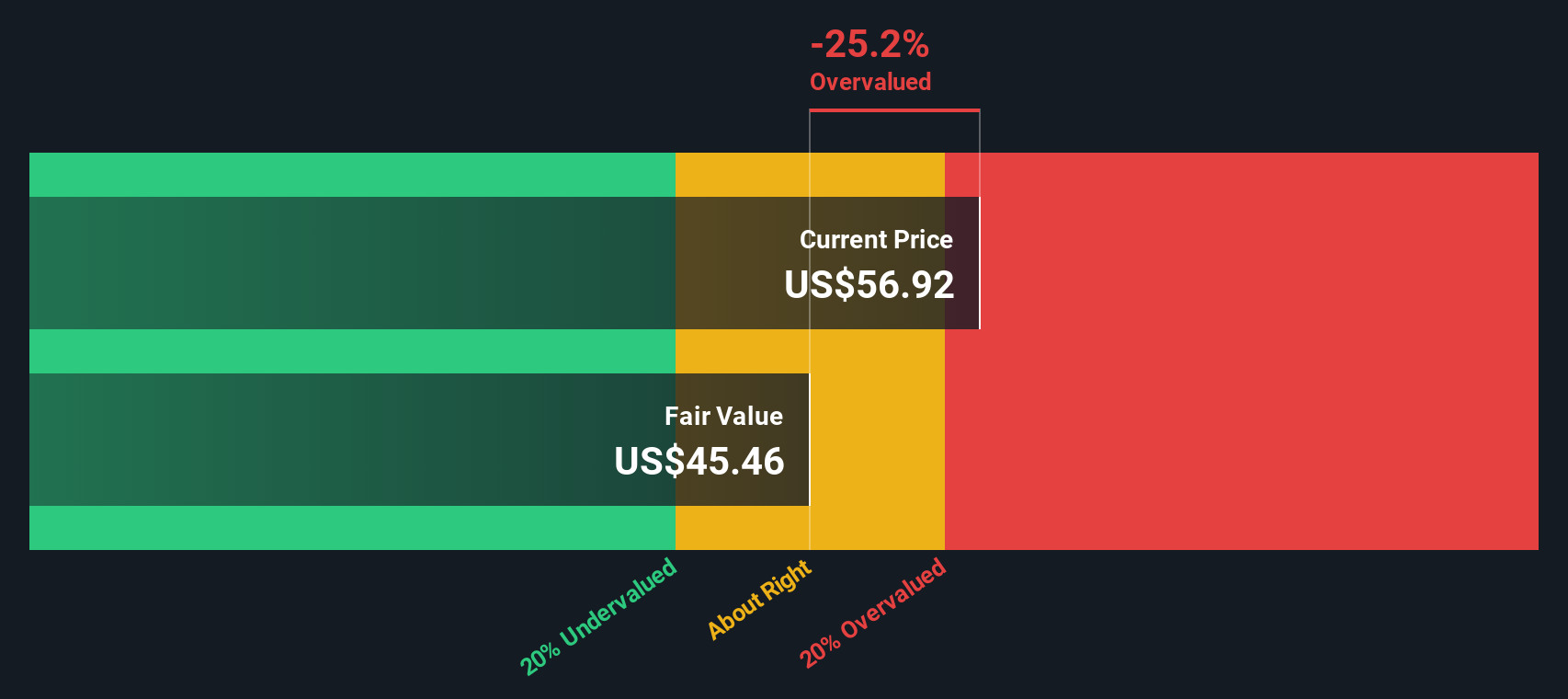

While some investors see Main Street Capital as undervalued based on its fair value estimate, our SWS DCF model paints a less optimistic picture. According to the DCF, the current share price of $56.92 is above its calculated fair value of $45.46. This signals potential overvaluation. Could analysts be overestimating future earnings potential, or is the DCF missing crucial market dynamics?

Look into how the SWS DCF model arrives at its fair value.

MAIN Discounted Cash Flow as at Nov 2025

MAIN Discounted Cash Flow as at Nov 2025

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Main Street Capital for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Main Street Capital Narrative

If you see things differently or want to take a hands-on approach, you can quickly explore the key figures and craft your own perspective in just a few minutes. Do it your way.

A great starting point for your Main Street Capital research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for one opportunity when there’s a whole universe of market winners available. Give your portfolio an edge and seize new trends before the herd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com