Australia’s richest person Gina Rinehart, who happens to be a fan of Donald Trump, is profiting from the push to reduce global reliance on China’s minerals supply chain.

https://www.bloomberg.com/news/features/2025-11-04/australia-s-richest-gina-rinehart-wins-big-in-china-us-rare-earth-spat

Posted by bloomberg

3 comments

*Angus Whitley, Amy Bainbridge, and Ainsley Thomson for Bloomberg News*

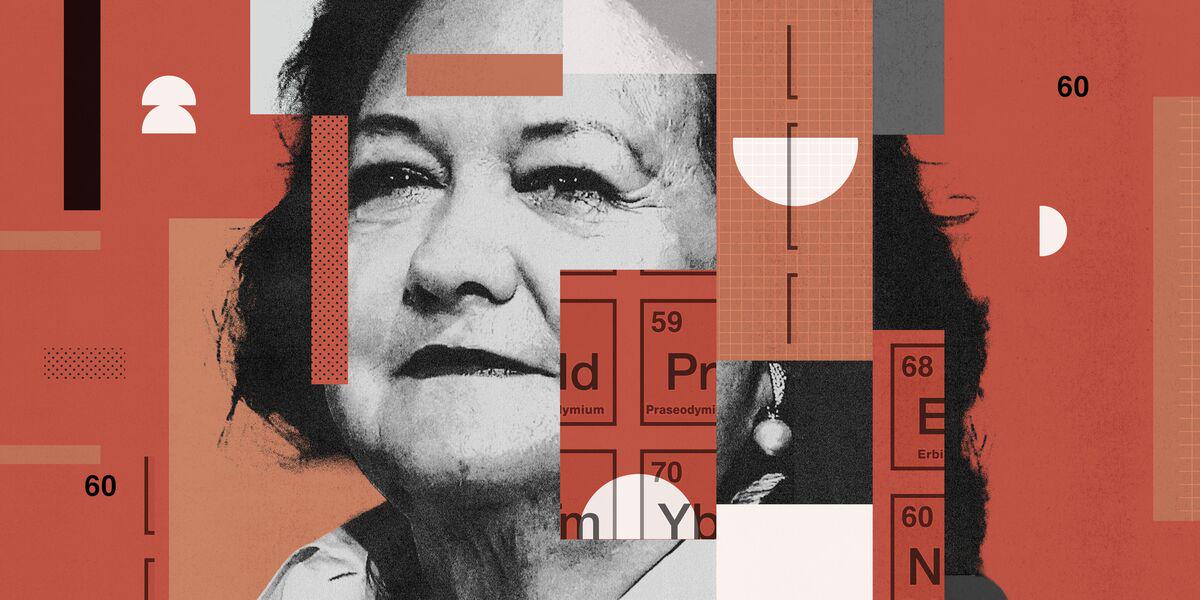

Half a world away from the White House and its strategic-minerals spat with China, an Australian Trump devotee has emerged as one of the dispute’s most emphatic winners.

From her base in Perth on Australia’s remote western seaboard, Gina Rinehart has amassed the world’s largest portfolio of rare-earth element investments outside of China, more than two decades after making her first fortune in the raw-material supply chain for steel.

The value of Rinehart’s stakes in four rare-earth companies alone has surged to $1.8 billion, lifting her net worth to $32.9 billion, an all-time high on the Bloomberg Billionaires Index. She’s now the world’s 10th-richest woman, just behind Savitri Jindal of India’s Jindal Steel dynasty and MacKenzie Scott, the ex-wife of Jeff Bezos.

Rinehart’s wealth has leapfrogged other moguls who built business empires in autos and oil, and recently pushed past Russian nickel magnate Vladimir Potanin. The reason is rare-earths: specifically, the world’s perhaps belated realization that China can and will use its control of their production as geopolitical leverage.

[Read the full story here.](https://www.bloomberg.com/news/features/2025-11-04/australia-s-richest-gina-rinehart-wins-big-in-china-us-rare-earth-spat?accessToken=eyJhbGciOiJIUzI1NiIsInR5cCI6IkpXVCJ9.eyJzb3VyY2UiOiJTdWJzY3JpYmVyR2lmdGVkQXJ0aWNsZSIsImlhdCI6MTc2MjI0NzkzOSwiZXhwIjoxNzYyODUyNzM5LCJhcnRpY2xlSWQiOiJUNTZFMjZHUFFROEUwMCIsImJjb25uZWN0SWQiOiJEMzU0MUJFQjhBQUY0QkUwQkFBOUQzNkI3QjlCRjI4OCJ9.7tVX2Nvx8PuZ_PD0qeWiZFgPOaiV2uqwVuunXsQv6UY)

What happened to that famous rare earths deal with Ukraine? Why nobody recalls it nowadays? It was claimed to be a huge win!

Here is the bit I don’t follow. By my understanding there has never been a shortage of ‘rare earth’ materials despite the name. Australia has known for some time they’re sitting on deposits. The issue is that processing them is environmentally toxic so it is offshored to China who care less about that. I can’t fathom the present government will quickly relax environmental laws, is my understanding incorrect? Or is it possible to spend money and do it more cleanly if you’re less concerned about margins (cause there’s a good trade deal)

Comments are closed.