It made perfect sense that organizers of last week’s 2025 Annual Venture Dallas Conference chose the private library of Dallas billionaire Harlan Crow as the setting for their kickoff VIP Reception. The invite-only reception, after all, was sponsored by the NYSE Texas stock exchange, which in August had leased 28,000 square feet at Crow’s swank Old Parkland office campus in Dallas’ Oak Lawn neighborhood.

Like Old Parkland, Crow’s library at his Highland Park home is all historic memorabilia and refined opulence, with bookshelves rising two stories, a coffered ceiling, inlaid wooden floors, oversized globes, and rare documents and manuscripts. Access to the library is gained through an equally impressive art gallery—for starters, it’s got an original Gilbert Stuart portrait of George Washington on display.

That’s where scores of Venture Dallas investors, founders, and key stakeholders found themselves early on the evening of Oct. 29, chatting away as they sampled hors d’oeuvres and a variety of specialty cocktails. Among them were JPMorgan Chase’s Elaine Agather, serial entrepreneur Rogers Healy, state Sen. Tan Parker (R-Flower Mound), Hubert Zajicek of Health Wildcatters, David Copps of Worlds, and Javier David, the new business editor at The Dallas Morning News. In time, the guests were asked to step into the library to listen to a conversation between Perot Jain partner Aaron Pierce—he’s the Venture Dallas co-founder and chair—and NYSE Texas president Brian Daniel.

NYSE Texas president Brian Daniel, right, in a fireside chat with Perot Jain president Aaron Pierce in Harlan Crow’s library. [Photo: Grant Miller Photography/Venture Dallas]

Their talk, and the conference that would follow, came at an opportune time for innovators and investors in North Texas. The region continues to boast strong population growth, a well-educated talent pool, government and infrastructure support, and more and more corporate relocations and expansions. The latter have been especially notable in the technology and financial sectors, with a recent proliferation of data-center developments and the advent of Y’all Street, underscored by the birth of the Texas Stock Exchange and the arrival of NYSE Texas and a new regional headquarters for Nasdaq.

Since beginning operations in March, NYSE’s Daniel told the elite crowd in the Crow library, “Nicey” Texas, as it’s come to be called, already has secured 94 dual listings. “This is just a great place to do business,” he enthused. “We came to Texas really to capitalize on the energy, the momentum, all the great things that we’re seeing in the state.”

[Photo: Grant Miller Photography/Venture Dallas]

‘People want to help each other’

Fourteen hours later, it was Pierce who welcomed attendees to the day-long Venture summit, held at the George W. Bush Presidential Center on the campus of Southern Methodist University. Pierce noted that the event has grown “bigger and bigger and bigger” since its inaugural conference in 2019. “Those of us that live here know how great this place is, but for those of you that don’t spend as much time here, I hope that you leave inspired and will say, ‘Man, Dallas is a place where I should be spending more time—maybe I’ll move my family there, or maybe I’ll start a business there,’” Pierce told the crowd.

After still more welcoming remarks by new SMU president Jay Hartzell—he said the university is eager to be the “best possible partner” for Dallas founders, investors, and corporate leaders—Pierce and Agather sat down to talk about JPMorgan’s growth in North Texas.

JPMorgan’s Elaine Agather, right, with Perot Jain’s Aaron Pierce. [Photo: Grant Miller Photography/Venture Dallas]

Agather, who leads the bank’s Dallas region, said it has grown from 4,000 employees to 33,000, which makes Dallas-Fort Worth larger than the bank’s New York market. She explained the substantial growth by citing factors including the region’s geographic location, regulatory stances, diversified economy—and collaborative spirit.

“I think when people move down here at first, they kind of think it’s fake,” she said. “And then they’re like, ‘This is real—people want to help each other,’ and that does raise the bar for everybody.”

Agather also noted JPMorgan’s recently announced Security and Resiliency Initiative, which commits the bank to invest $1.5 trillion over 10 years in supply chains and advanced manufacturing, defense and aerospace, energy independence, and strategic technologies like AI and cybersecurity.

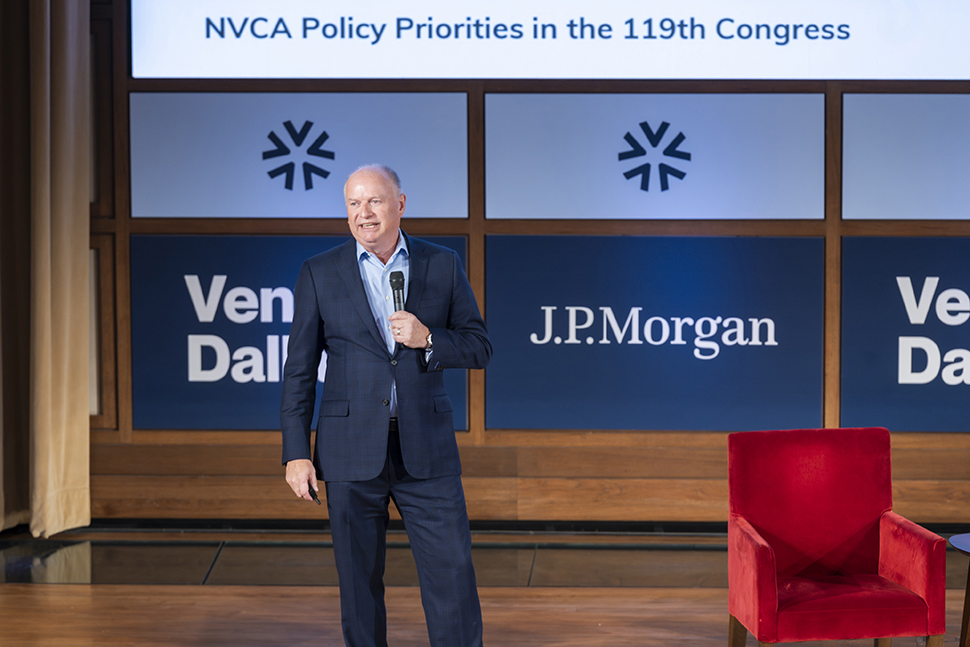

Bobby Franklin, president and CEO of the National Venture Capital Association [Photo: Grant Miller Photography/Venture Dallas]

Investments of a different sort were outlined next by Bobby Franklin, president and CEO of NCVA—the National Venture Capital Association. Citing NCVA studies, Franklin said venture-capital deals and dollars have ticked up recently, while exit activity remains below 2021’s peak liquidity levels and fundraising is tepid, despite the availability of “lots of dry powder.” But Texas investment, Franklin said, “is looking fantastic,” outstripping most states and outperforming the entire Southwest region so far this year.

The VC industry had “lots of wins” in the One Big Beautiful Bill Act, added Franklin. He stressed the need for a single federal standard for AI regulation—rather than different sets of rules in each state—“so that AI can reach its full potential.” He also said the NCVA enjoys a good relationship with new U.S. Securities and Exchange Commission Chair Paul Atkins, who “is serious about making IPOs great again.”

A cutting-edge trading engine for TXSE

Texas Stock Exchange Strategic Advisor Jeb Hensarling, left, and Penta Group managing director Ylan Mui [Photo: Grant Miller Photography/Venture Dallas]

The importance of IPOs was also referenced during a discussion of the new Texas Stock Exchange by Ylan Mui of the Penta Group, a research and consulting firm, and Jeb Hensarling, a former Dallas GOP congressman who’s now a strategic advisor to TXSE (or Tex-ee, as they’re calling it now).

With SEC approval of the Dallas-based exchange having been secured in September, Hensarling told Venture Dallas attendees to look for TXSE to announce its physical headquarters location by year’s end. The first quarter of 2026 will see training on its state-of-the-art “trading engine,” he said, and then listings of ETPs (exchange-traded products) “probably in the second quarter of next year, with listings in corporates to follow.”

TXSE’s cutting-edge trading engine—as well as its newly announced, AI-native Oculon data-analytics and compliance software platform—will give the new exchange a leg up over the NYSE and Nasdaq duopoly, Hensarling said. “I think not only will Tex-ee be great for Texas … but I also think it’s going to be great for capital markets and for those companies who choose to have the ability to have world-class trading and listing at a more competitive price, with policies that are known and stable,” he said.

Furthering the Texas Miracle at Venture Dallas [Photo: Grant Miller Photography/Venture Dallas]

Panelists at another session called Furthering the Texas Miracle agreed with Hensarling, who’d predicted that in 15 years, Texas will be “the center for capital markets in America.” Ross Perot Jr., chairman of The Perot Companies and Hillwood, cited the business-friendly groundwork laid by the state’s leaders stretching back three decades, from the development of Dallas Fort Worth International Airport and the Alliance Texas project to reforms in the legal and education fields.

“You’ve got incredible growth coming, and it’s the airports, it’s infrastructure, but what it really is, is attitude,” Perot said. “It’s a very optimistic attitude and a can-do spirit: We’re going to get it done!”

Ross Perot Jr., chairman of The Perot Companies and Hillwood, left, and Drew McKnight, co-CEO and managing partner at Dallas-based Fortress. [Photo: Grant Miller Photography/Venture Dallas]

Drew McKnight, co-CEO and managing partner at Dallas-based Fortress, a global investment group, echoed Perot’s sentiments, highlighting the proactive role of educational institutions like SMU in encouraging entrepreneurship. He also cited the region’s “civic-mindedness”—in sharp contrast to California, where McKnight had worked before relocating to North Texas.

“I wasn’t nearly this civic-minded in California, mainly because they wouldn’t return my phone calls, because they didn’t care,” McKnight said. “And here, whether it’s the mayor or the governor or any one of state representatives, they want to hear from you and they want ideas. That’s encouraging, because when you have an idea and someone actually listens to you, it encourages you to come up with more.”

Robots called ‘the space race of our time’

The idea explored in the next session—a conversation between Apptronik CEO Jeff Cardenas and investor Chris Camillo of Dumb Money—was the future of humanoid robots. Cardenas said Apptronik, a 10-year-old, AI-powered robotics company that has a strategic partnership with Google DeepMind, is reimagining a next generation of general-purpose robots that will change the way people live and work. He likened creation of the company’s latest-iteration robot to a “personal computer moment,” when robots are able to collaborate with humans to accomplish multiple tasks on a mass scale.

Apptronik CEO Jeff Cardenas and investor Chris Camillo [Photo: Grant Miller Photography/Venture Dallas]

Camillo pointed out that China is ahead of the United States in robotic investment and adoption for industrial manufacturing, and Cardenas agreed. “I’ve sort of called this the space race of our time,” said Cardenas, who’s been urging Washington to develop a national robotic strategy. “I think whoever wins it is going to define the future for us.”

He predicted there will be significant progress in making humanoid robots available for the U.S. industrial market at scale by 2027, with adoption for home uses coming a few years afterward. “I would say very confidently that, 10 years from now, it’s very likely that many of you guys have a robot in your home,” Cardenas told the attendees.

Perot Jain managing partner Anurag Jain, whose 14-year-old Access Healthcare was folded in May into a new company in a $6 billion deal by private equity firm New Mountain Capital, said he agreed that “robots are important.” But in a conversation with retired EY partner Debra von Storch, Jain said there should be limits: “I think the creativity of the human mind is something that I don’t want to ever take away.”

Perot Jain managing partner Anurag Jain, left, and retired EY partner Debra von Storch [Photo: Grant Miller Photography/Venture Dallas]

Dallas-based Access, the fourth company in Jain’s entrepreneurial journey, had become a leading player in revenue cycle management for the healthcare industry. But Jain told von Storch that the deal with New Mountain made sense because of New Mountain’s ability to keep pace with rapid change in that industry, much of it powered by artificial intelligence. Jain’s next company, he said, also will be a business process outsourcing provider—a “mostly AI native” company in the real estate industry, with far fewer workers than Access’ 27,000 or so.

Asked what “critical lessons” he’d learned during his career that might be helpful to entrepreneurs, Jain said the first is: Don’t sell yourself short. “I think we sold ourselves short many times. Number two is: Your people are the most important thing. … At this point in time, staying private is an equally good opportunity [as an IPO], depending on the company, where you are, and the capital you need,” he continued. “I think private equity is a fantastic option if you find the right partner.”

Seeking innovators and investors who are brave

Participants in another panel called Driving Growth Through Dallas Venture Capital indicated that, for too many DFW founders, securing any kind of equity is problematic. Despite the proliferation of wealthy investors in North Texas, the panelists said, startups that often are forced to fundraise elsewhere end up relocating permanently to other cities, depriving the region of entrepreneurial vitality. The culprit, the panelists agreed, is the “standardized playbooks” of traditional Dallas industries like energy and real estate, which conflict with venture’s bent toward creativity and contrarian thinking.

From left: Trevor Rees-jones, founding partner of Cubit Capital; John Redgrave,co-founder and general partner of DTX Ventures; and Rogers Healh, owner and CEO Morrison Seger Venture Capital Partners. [Photo: Grant Miller Photography/Venture Dallas]

What’s needed, they said, is a stronger bench of local CEOs and business owners as well as a cadre of so-called bravery hunters—that is, a new generation of transformative founders courageous enough to tackle truly hard problems while taking real risks. “It’s that risk calibration. Are we getting the most novel technology companies on the planet, or certainly at least in the United States, into the DFW area?” asked John Redgrave, co-founder and general partner of Dallas-based DTX Ventures. “We’ve got to be bravery hunters. We hunt for people who are brave, and we ourselves need to be brave. That means writing checks to early-stage companies who are going to go and change some ecosystem.”

Another panelist—Jun II Kwun, founder and managing director at Actium Group—made the case for Dallas as a life-sciences powerhouse, albeit one that he said still needs a critical mass of life-sciences companies and CEOs willing to relocate to North Texas. But, according to participants in a discussion called Advancing Life Sciences and Venture Innovation, that’s happening already. “The Texas life-sciences ecosystem is experiencing remarkable growth, and Dallas has really emerged as an inspiring innovation hub,” said discussion moderator Jenn Yandle, executive director, life sciences-innovation economy for JPMorgan. “In fact, we are seeing one of the fastest-growing markets in the country, and we’re seeing remarkable growth in terms of the expansion of lab space and the deepening of our talent pools and the amount of companies that are making DFW home.”

Jun II Kwun, founder and managing director at Actium Group, left, and moderator Kevin Lavelle, founder Mizzen+Main and Harbor [Photo: Grant Miller Photography/Venture Dallas]

Bridging the tech-transfer gap

A lynchpin for Dallas’ growth in the sector is Pegasus Park, a 26-acre, biotech and life-sciences development near the Dallas Design Center and the Southwestern Medical District. With tenants like Health Wildcatters, Mass Challenge, and UT Southwestern Medical Center, plus a record of incubating more than 30 companies collectively valued at $14 billion, the complex funded in part by billionaire philanthropist Lyda Hill is bridging the gap between scientific discovery and commercializing those discoveries.

“I remember, right when we were opening Pegasus Park, standing out in the parking lot with a local venture capital family office,” said Nicole Small, CEO of LH Capital. “And he said to me, ‘We really are interested in the healthcare space, but we don’t really know how to get into UT Southwestern, because it’s like over there in those buildings!’ And literally right at that time the head of tech transfer walked through the parking lot and I was like, ‘Oh, let me introduce you two.’ Those are the sort of collisions being created there.”

Advancing Life Sciences and Venture Innovation at Venture Dallas [Photo: Grant Miller Photography/Venture Dallas]

A “collision” of a different sort—one that occurred a few years ago following a board meeting of Venture Dallas—was described during a panel called Killer Brands: How Liquid Death Disrupted the Beverage Industry. Access Capital co-founder Blake Wiley said the Venture meeting was how he’d met Marissa Bertha, chief strategy officer at Liquid Death, the canned water and beverages brand that’s earned a $1.4 billion valuation thanks to its viral punk/metal marketing campaigns.

Besides Access Capital, the brand’s investors have included other investment firms, family offices, entertainment companies, and aluminum can manufacturers, Bertha said. And, after expanding its offerings from canned water to soda-flavored sparkling water and iced tea, the brand is poised to debut an energy drink in January, she added. “We’ve been able to grow as the most expensive product in every category in which we play,” Bertha said. “We’re the most expensive water, we’re the most expensive flavored sparkling, we’re the most expensive tea. But in the energy category, we will actually be able to be priced at parity.”

Liquid Death chief strategy officer Marissa Bertha and Access Capital co-founder Blake Wiley [Photo: Grant Miller Photography/Venture Dallas]

‘It’s OK to fail’

Closing out the conference, Capital Factory president and co-founder Bryan Chambers introduced the day’s final three “fireside chats” featuring Draper Associates partner Andy Tang, Keen Technologies founder John Carmack, and Colossal Biosciences co-founder and CEO Ben Lamm.

“Texas isn’t just big, it’s consequential,” Chambers told the crowd. “You may already know that if Texas were a country, it would be the eighth-largest economy in the world. That means the connections and the choices our community makes in rooms like this one ripple globally through supply chains and reach the cloud. Over the next hour and a half, you’re going to hear some more really big ideas.”

Capital Factory president Bryan Chambers [Photo: Grant Miller Photography/Venture Dallas]

Tang alone proved him right. Draper, a prominent, early-stage VC firm that’s backed startups ranging from Tesla and Skype to Robinhood, invests in the likes of AI, robotics and automation, healthcare and biotech, and crypto and blockchain. Tang said that while he’s confident AI represents the “fourth industrial revolution” over the long haul, the transition will bring short-term pain to many in the current workforce. “Better days are ahead,” he said, “but that transition? I’m not sure.”

During his talk, Tang also said he’s optimistic about the safe use of nuclear power, advocated for reasonable cryptocurrency regulation at the federal level, and urged Texas entrepreneurs to be more risk-tolerant. “Here you think big—but let me help you to not, sort of, play too tight,” Tang said. “It’s OK to fail. There’s nothing wrong with failing. That’s one thing I learned from Silicon Valley. I find that in Texas, if we combined these two things—thinking big and [taking] big risks—it could become the next big venture market.”

Draper’s Andy Tang [Photo: Grant Miller Photography/Venture Dallas]

One entrepreneur who embodies risk-taking is Carmack, the Dallas tech icon who’s now pursuing the keys to artificial general intelligence. In a riveting, “no-nonsense” conversation, Carmack explained that while the capabilities of today’s large language models are amazing, they lack the “classical reinforcement learning abilities” that are needed for continuous learning and long-term retention. As a result, he’s zeroed in at Keen on a “more obscure field of AI, which is reinforcement learning,” Carmack said. And he’s doing so largely by “running Atari simulations on modest numbers of GPUs.”

Dallas-based Keen, which has raised $20 million from various investors including Capital Factory, is grounding these experiments in the physical world, with actual Atari systems on tables with TVs, cameras, and robot controllers moving joysticks, Carmack said. The success of his experiments will be in the actual market value they create, he said, not in whether they “identify the clear bright line of AGI”—a quest he dismissed as “dorm room philosophy, arguments that are completely without value.”

“What are people willing to pay for?” he said. “How much value do they get out of this? I’m comfortable letting that drive most of the marketing investment.”

Keen Technologies founder John Carmack on stage with WSJ reporter Jennifer Hiller. [Photo: Grant Miller Photography/Venture Dallas]

A sold-out event

The summit’s final speaker was Lamm, whose Dallas-based Colossal focuses on disruptive conservation through “de-extinction efforts,” such as resurrecting the woolly mammoth, the dodo bird, and the dire wolf.

Having attained a valuation of $10.3 billion since its founding in 2021 by Lamm and geneticist George Church, Colossal is taking a “software programming” approach to de-extinction, Lamm said, stressing precision in its gene editing. Its 2024 woolly mouse project, for example, produced 36 healthy mice with exactly targeted phenotypes, making it what Lamm called the most precision-edited multicellular organism on the planet.

Colossal co-founder and serial entrepreneur Ben Lamm talks de-extinction at Venture Dallas. [Photo: Grant Miller Photography/Venture Dallas]

The company deploys artificial intelligence across multiple functions—“Without AI, our projects would take 50 years plus,” Lamm said—and has found success on the national stage after oversubscribing every one of its funding rounds. “Anybody who tells you they don’t have trouble raising money is just lying,” Lamm said. “But we’ve also worked hard.”

He added that while he obviously appreciates Colossal’s “economic returns,” he’s motivated as well by the “inspiration aspects” of the company’s work. By that, Lamm said, he means the “promise we’ve made to kids in the world—the people that are rooting for us in your random classroom in Middle America. I think that promise is as big as a promise we make to an investor that gives us $300 million.”

Toward the end of the day, Pierce, the Venture Dallas chair, said the 2025 conference showed that the North Texas startup community has made great strides in the last year or so: It’s attracted new companies like Stablecore, hosted new venture funds like DTX, and watched Colossal attain decacorn status.

“There’s clearly so much energy in our space,” Pierce told Dallas Innovates. “How do we unlock that energy and create more great companies and more good outcomes for investors? It’s clear that something’s happening, and we’re tapping into that energy.”

Venture Dallas chair and Perot Jain partner Aaron Pierce [Photo: Grant Miller Photograhy/Venture Dallas]

One indication of this enthusiasm was attendance at the conference itself, he said.

“I look 12 months from where we were last year, and this year there were people outside trying to get into a sold-out event,” Pierce said. “There was a line out the door, with people asking, ‘Hey, can I buy a ticket?’ And sadly, we had to say no. We couldn’t accept one more without violating the venue constraints on capacity. So maybe, in the future, you think about if there’s a venue that can fit even more people.”

Don’t miss what’s next. Subscribe to Dallas Innovates.

Track Dallas-Fort Worth’s business and innovation landscape with our curated news in your inbox Tuesday-Thursday.