Clean Energy Fuels (CLNE) remains unprofitable, with losses growing at an annual rate of 30.5% over the past five years. The outlook calls for continued losses for at least the next three years. Revenue is expected to grow at 7.9% per year, but this is notably slower than the 10.5% yearly growth projected for the broader US market. Despite trading below estimated fair value, the company’s persistent negative net profit margin continues to weigh on sentiment.

See our full analysis for Clean Energy Fuels.

Next, let’s see how these headline numbers hold up when compared to the narratives investors and analysts have built around CLNE. Some themes may find support, while others could be upended.

See what the community is saying about Clean Energy Fuels

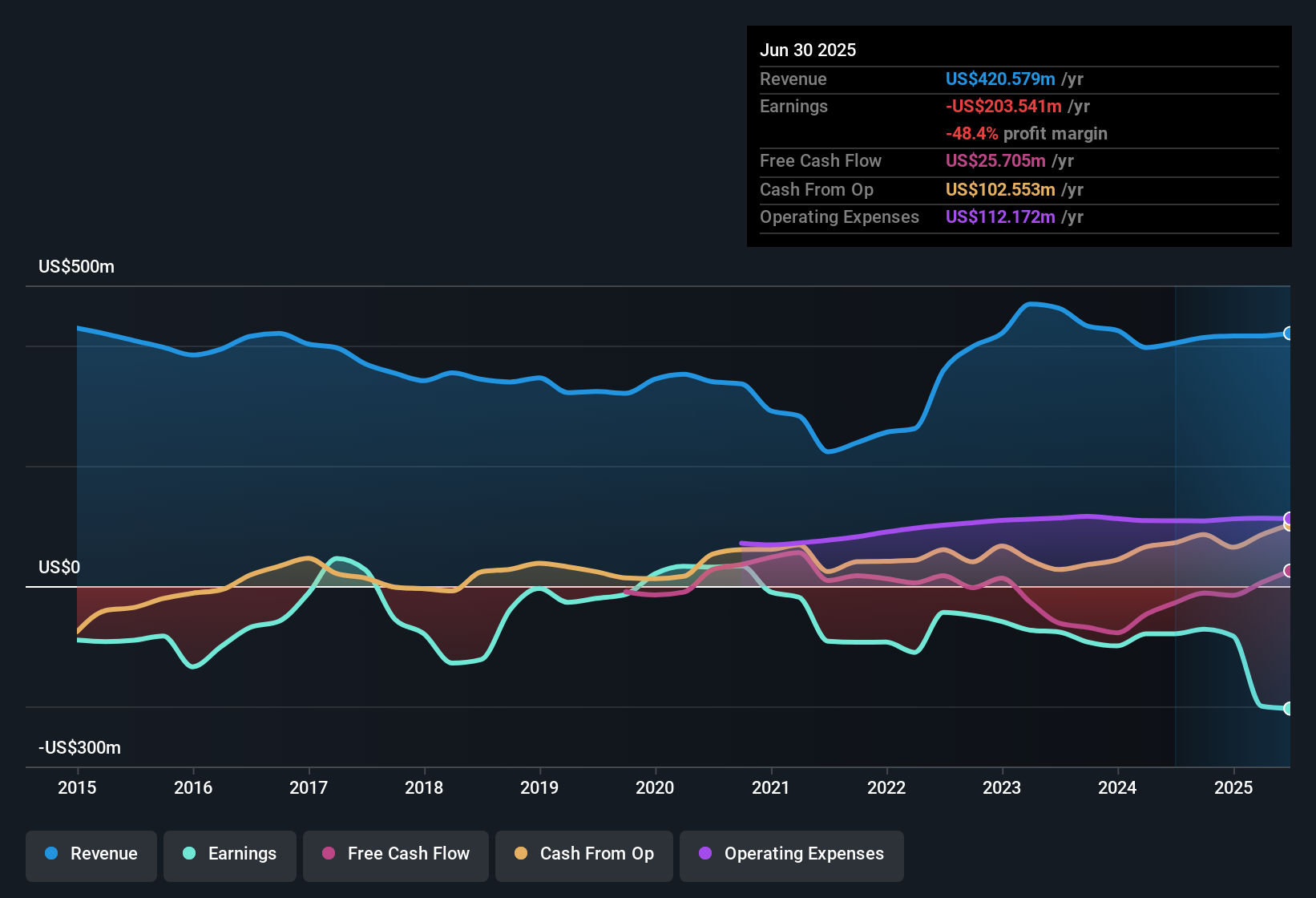

NasdaqGS:CLNE Earnings & Revenue History as at Nov 2025 Margins Remain Deep in the Red Clean Energy Fuels’ net profit margin currently sits at -48.4%, well below the US Oil and Gas industry average of 14.8%. This highlights the company’s struggle to turn sales into profits despite recurring revenue streams. According to analysts’ consensus view, regulatory developments and rising demand for renewable natural gas (RNG) could gradually boost recurring revenues and margins.

NasdaqGS:CLNE Earnings & Revenue History as at Nov 2025 Margins Remain Deep in the Red Clean Energy Fuels’ net profit margin currently sits at -48.4%, well below the US Oil and Gas industry average of 14.8%. This highlights the company’s struggle to turn sales into profits despite recurring revenue streams. According to analysts’ consensus view, regulatory developments and rising demand for renewable natural gas (RNG) could gradually boost recurring revenues and margins.

However, persistent negative margins and delays in project ramp-up, with five out of six dairy RNG sites still reporting losses, threaten longer-term earnings upside. Analysts also caution that heavy reliance on volatile credit pricing (RINs, LCFS) and government incentives means margin improvements are far from guaranteed, even if fuel volumes rise as hoped. Clean Energy Fuels’ profitability remains a key tension point, with margin recovery dependent on both policy support and successful project execution. This presents a double challenge for both bullish and cautious investors. Peer Valuation Gap Narrows CLNE trades at a price-to-sales multiple of 1.2x, below the US Oil and Gas sector average of 1.5x but above its peer group’s average of just 0.7x. As a result, shares look inexpensive compared to the industry, yet appear more expensive against direct competitors. Analysts’ consensus narrative notes this valuation gap creates a mixed picture:

The discount to the industry suggests some value support if growth initiatives succeed. However, peers trading at much lower sales multiples, combined with slow forecasted top-line growth (4.1% expected over three years), challenge the idea that CLNE is a clear bargain. Analyst Target Nearly Doubles Share Price With CLNE shares at $2.34 and the analyst consensus target at $4.49, there is a potential 92% upside if the market agrees with analysts’ long-term profit margin and growth assumptions for 2028. Examining the consensus perspective, this optimism requires a marked turnaround. Analysts build their target on a scenario where CLNE achieves $70.1 million in earnings and adopts a 16.6x PE ratio, hinging on the company moving from steep current losses to industry-average margins.

However, there is wide disagreement among analysts, with the most bullish expecting $10.00 per share and the most bearish just $2.20. This highlights the uncertainty about whether and when such a turnaround can occur. Consensus points to execution risks. For CLNE to approach the $4.49 target, it must not only grow revenue but also dramatically improve profitability, despite the current headwinds. See what’s driving the debate—analysts are split on whether CLNE can hit profitability in time to justify the target. 📊 Read the full Clean Energy Fuels Consensus Narrative. Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Clean Energy Fuels on Simply Wall St. Add the company to your watchlist or portfolio so you’ll be alerted when the story evolves.

Got a fresh angle on the data? Share your insights and shape your own interpretation in just a few minutes. Do it your way

A great starting point for your Clean Energy Fuels research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Clean Energy Fuels faces significant challenges as losses mount, profit margins remain negative, and forecasted growth trails both peers and the market.

If you want to target more reliable profit drivers, use stable growth stocks screener (2073 results) to find companies achieving steady gains regardless of economic headwinds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com