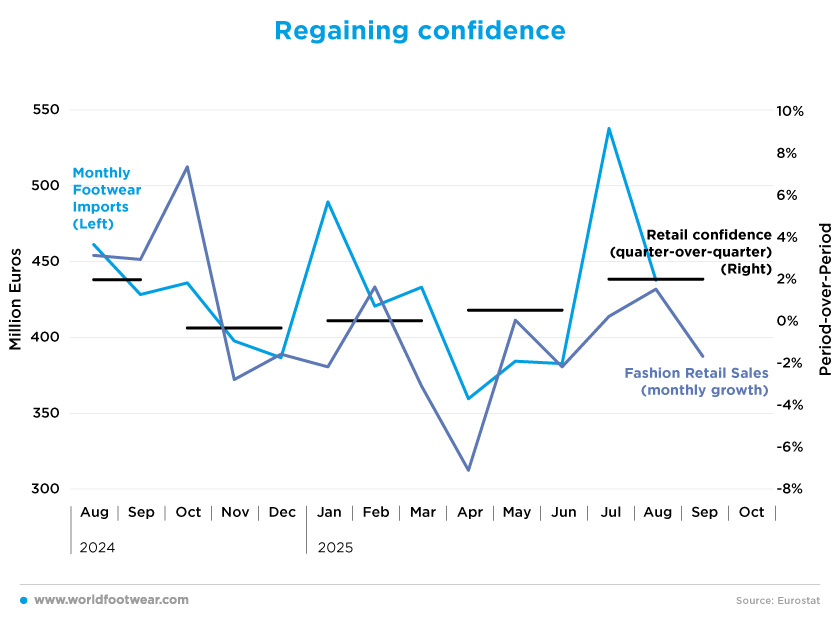

The Spanish fashion retail sector is experiencing contradictory cycles. Sales for physical textile and footwear retailers plummeted by 1.8% in the first eight months of 2025, exacerbated by an unusual deflationary environment. E-commerce retail, however, seems to be in a league of its own. Despite negative trends, retailers appear to be betting on a recovery, as evidenced by a 5.4% surge in fashion imports up to August, as well as an unusual peak in shoe imports in July. This suggests that retailers are now focusing on the final quarter of the year, hoping for a return of consumer spending at key events such as Black Friday and Christmas

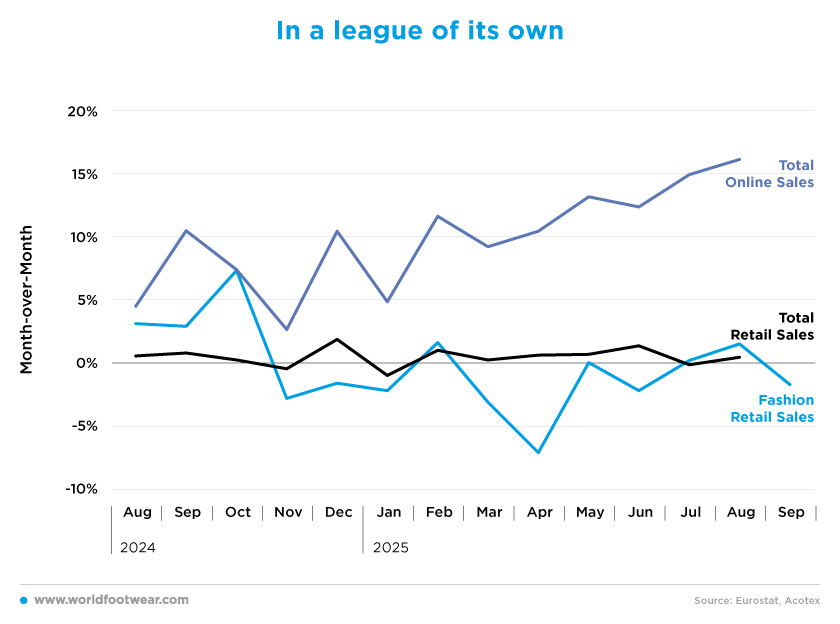

In a league of its ownThe Spanish retail sector is growing at the same pace as last year. In the first three quarters of 2025, the average monthly growth of retail sales was 0.4%, which is positive but barely.

The textile trade association Acotex asserts that “the fashion distribution sector is unable to recover sales or mark an upward trend”. The remaining months of the year are therefore completely uncertain: “There is a very important quarter ahead for the sector, when the highest percentage of annual sales is concentrated, including the Christmas campaign. Let’s hope that the weather is appropriate for the time of year and that there are no external events that undermine consumer confidence, enabling us to end the year on a positive note”, says the association (revistadelcalzado.com).

The number of specialised physical points of sale has declined in recent years, reaching around 7,850 in June 2025, employing around 20,000 people. The majority of these were part of chains, which now account for 54% of the total, at the expense of independent retailers (revistadelcalzado.com).

On the contrary, e-commerce is in a league of its own. From January to August, online sales grew by 11.57%, as compared to the same period last year. The average monthly growth this year is 11.6%, with January being the worst month (up by 4.8%) and August being the best (up by 16.1%). Contrary to expectation, when the weather improved, consumers appeared to increase their online shopping rather than visiting physical retail outlets.

This trend is also evident in online sales of footwear and leather goods. According to the latest data published by the National Commission for Markets and Competition (CNMC), online sales of shoes and leather goods in Spain reached 191.6 million euros in the first quarter of 2025, marking a 14.2% increase (23.8 million euros), as compared to the same period in 2024 (revistadelcalzado.com).

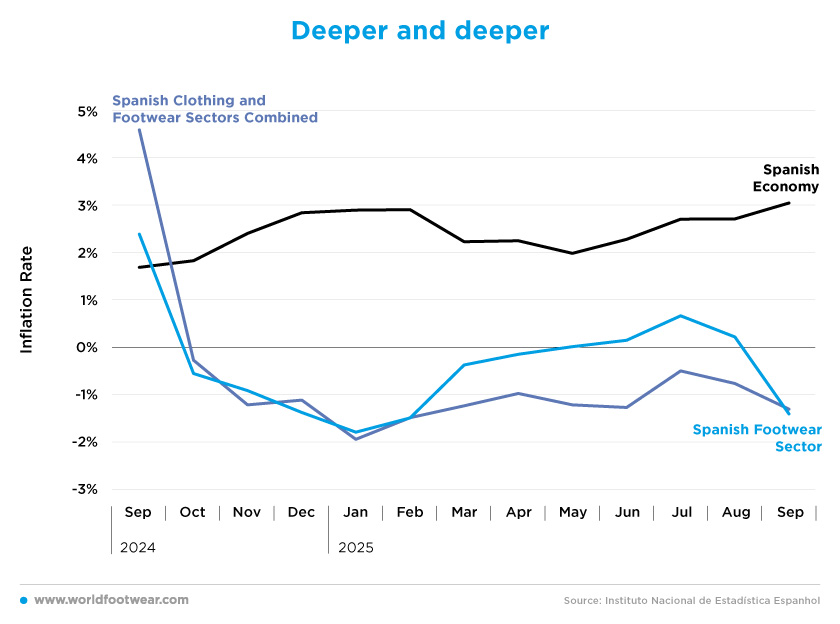

Deeper and deeperAfter reaching the European Central Bank’s inflation target of 2% in May, it seems that the Spanish economy is struggling against the increase in this economic variable once again.

Spain’s EU-harmonised 12-month inflation rate was 3% in September, up from 2.7% in August, according to final data released by the National Statistics Institute (INE). Core inflation, which excludes volatile food and energy prices, was 2.4% in the 12 months to September, unchanged from August, according to the INE (reuters.com).

This was the highest rate in 15 months, partially resulting from the current economic momentum. Since 2021, Spain has outperformed Europe’s other major economies, boosted by household spending, a tourism rebound and lower energy prices.

The Bank of Spain has also slightly increased its year-end prediction to 2.5%. This is due to rising energy and food prices, although it is expected that services will be lower than anticipated. Inflation is expected to moderate to 1.7% by 2026 (Bloomberg.com).

Inflation in clothing and footwear reached its lowest value in January at a striking minus 1.9%. After that, it seemed that the fashion sector was gaining momentum and returning to positive numbers, indicating an increase in shopping activity. But as we saw previously, sales were negative again in September and this was reflected in the inflation rate. Although clothing and footwear inflation hasn’t been above 0% since October 2024, footwear alone had a brighter summer, with the three summer months registering above-zero rates. However, it seems that the bad weather has returned in September.

A more detailed analysis of INE data reveals that baby and children’s footwear saw the highest inflation last month, with prices rising by 2.6%. Men’s footwear followed with an increase of 0.2%. By contrast, prices for women’s footwear fell by 0.4% (revistadelcalzado.com).

Regaining confidenceIn the first eight months of 2025, Spain imported shoes worth 3.45 billion euros, totalling 259 million pairs. This resulted in an average price of 13.28 euros per pair. These figures represented a 5.9% increase in value and an 8.4% increase in volume, resulting in a 2.3% decrease in the average price.

This phenomenon has been observed repeatedly among most European countries and may help to explain why inflation in the footwear sector has been negative in Spain. Some believe this is linked to Chinese low-value products being redirected to Europe due to trading tensions with the USA, but this remains uncertain.

Examining the import value per month, we can see that an unusually high number of shoes entered the country in July, just before the peak sales months of August. It seems that importers and retailers timed this perfectly.

Overall, Spanish fashion purchases abroad recorded their largest increase in January, at 22.8%, followed by rises of 5.5% in February and 9.8% in March. This figure then rose again in May by 4.8%, accelerating to an 11% increase in June. After this, growth stabilised at 3.8% in July. The annual cumulative figure is also positive, with imports totalling 24.59 billion euros between January and August 2024, a 5.4% increase (modaes.com).