Catherine Mann is expected to vote to keep rates unchanged. File image: Pound Sterling Live and Bank of England.

Lloyds Bank offers a useful explainer on who will vote for what.

The Bank of England’s Monetary Policy Committee (MPC) will deliver its penultimate interest rate decision of the year, and there’s a real sense of uncertainty on the outcome.

“The market vibe around today’s MPC meeting seems to be that it feels more like a 50/50 call,” say economists at Lloyds Bank.

Judging by recent voting patterns and speeches, we can divine how a number of MPC members will respond to recent data and the forward-looking survey results they have at hand.

“The case for the hold is that there are four hawks (Mann, Pill, Greene, Lombardelli) who seem very unlikely to vote for a cut this time,” says Lloyds.

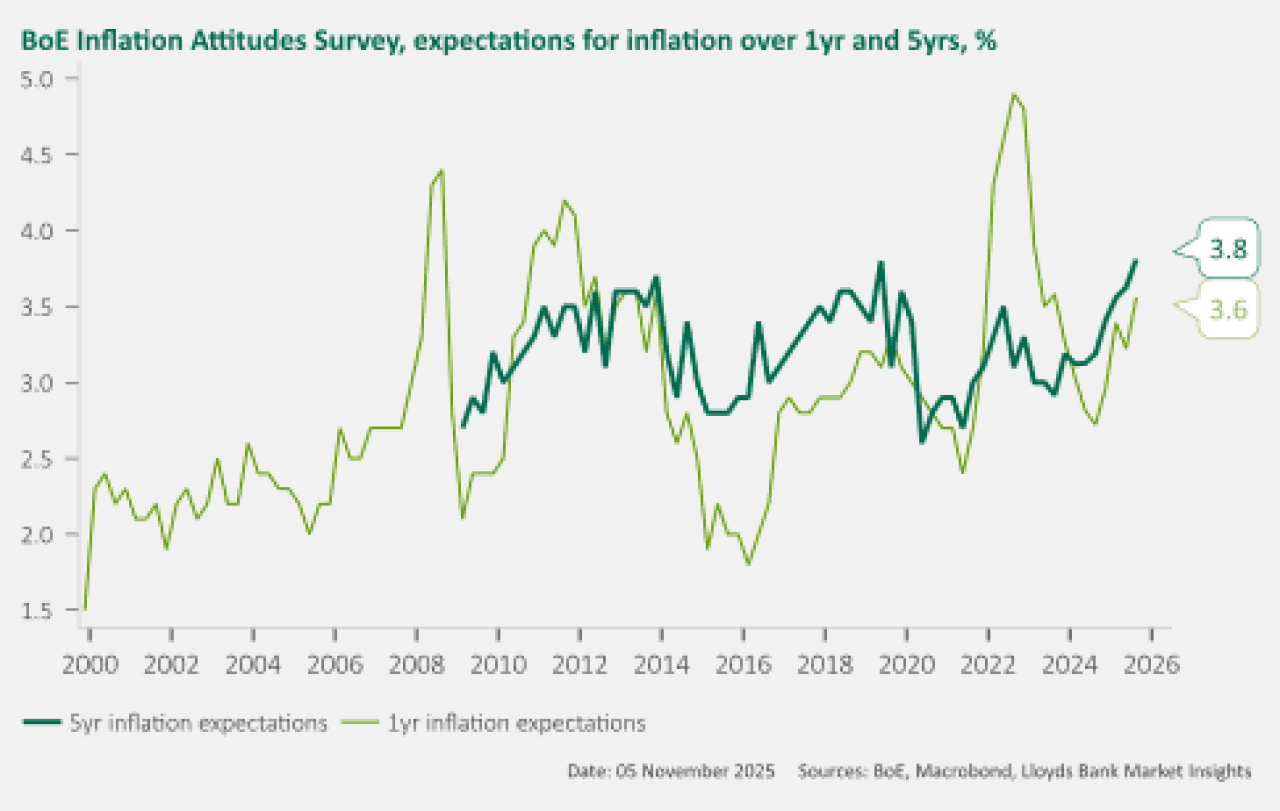

Economists warn this bloc will be especially nervous about the latest quarterly Inflation Attitudes survey. Key findings of the latest survey showed that the public’s median expectation for the current inflation rate was 4.8% (up from 4.7% in May 2025) and median expectations for the coming year rose to 3.6% (up from 3.2% in May 2025). Long-term inflation expectations also rose to 3.8%

None of these projections is consistent with a sustained return of inflation to the Bank’s 2.0% target at any point.

“So all five of the other members will be needed to bring about a cut,” says Sam Hill, Head of Market Insights at Lloyds.

Hill reckons Alan Taylor is the only one with recent comments that support the view of inking him in to vote for a cut.

Taylor said in a recent speech the Bank has already “braked too hard” when it comes to interest rates and “I see the upside risks to inflation as low compared to the downward trajectory in output and inflation fundamentals.”

Swati Dhingra probably will vote for a cut too, “but justified only on the basis that she usually does,” says Hill.

Ramsden is the next most likely dove.

“But Breeden and Bailey are real unknowns,” says Hill.

On balance Lloyds Bank expects the Governor at least to come down on the side of no change this time in a nod to the hawks’ inflation persistence concerns with the hope of keeping them onside to support further Bank Rate reductions in 2026 when CPI ought to have come off its recent peak.

“It is though a close call. Note also that in a reformatting of the BoE comms each MPC member will have a paragraph in the minutes to explain their own view and the MPR format is being revamped,” says Hill.