Uncover the next big thing with financially sound penny stocks that balance risk and reward.

APA Investment Narrative Recap

To hold APA Corporation shares, investors must believe in the company’s ability to consistently execute on operational improvements and adapt to volatile oil and gas markets. The latest earnings and production news is supportive of short-term momentum, particularly around rising U.S. output, but does not materially reduce exposure to the biggest near-term risk: reliance on commodity prices and the challenge of sustaining production growth, especially amid ongoing energy transition headwinds.

Among recent updates, the decision to raise U.S. oil production guidance for the fourth quarter stands out as especially relevant, directly reflecting APA’s operational execution and cost controls. This aligns closely with key catalysts like margin improvement and capital efficiency, but does not resolve longer-term questions about resource exhaustion or capital requirements as oil fields mature.

However, investors should also be aware that if capital spending or well productivity falls short…

Read the full narrative on APA (it’s free!)

APA’s outlook projects $8.1 billion in revenue and $1.6 billion in earnings by 2028. This reflects a 6.1% per year revenue decline and a $0.5 billion increase in earnings from $1.1 billion today.

Uncover how APA’s forecasts yield a $24.93 fair value, a 5% upside to its current price.

Exploring Other Perspectives APA Community Fair Values as at Nov 2025

APA Community Fair Values as at Nov 2025

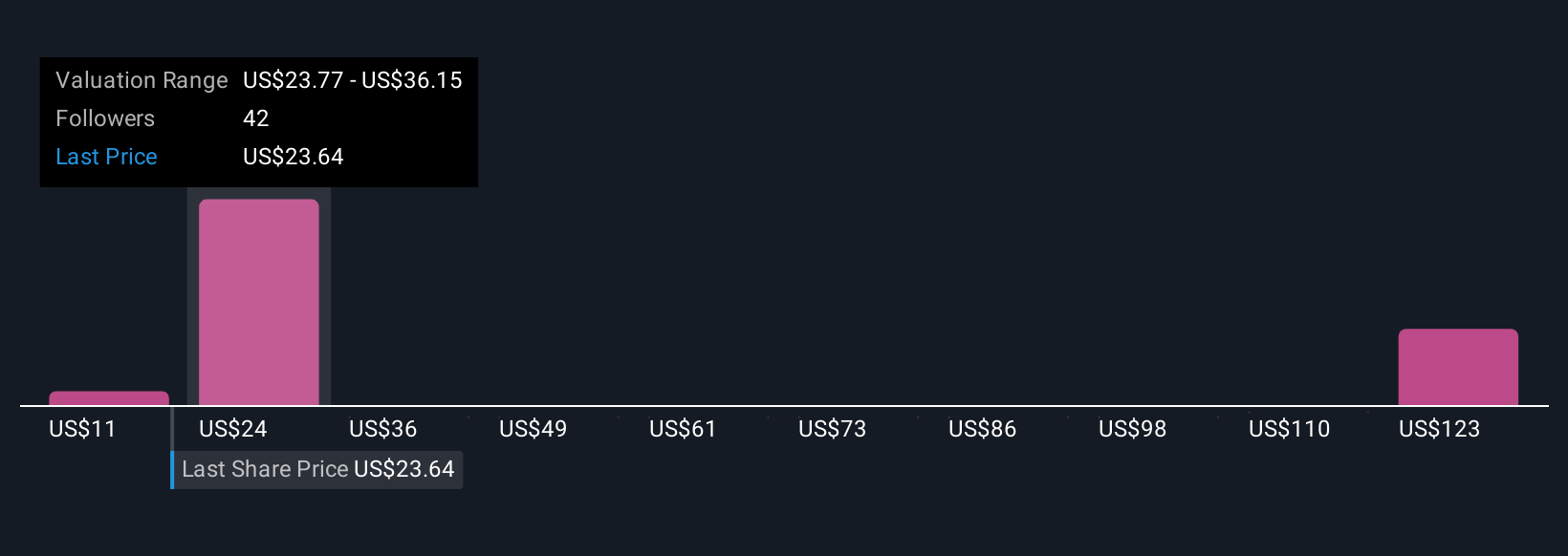

Fair value estimates from 11 Simply Wall St Community members range widely from US$11.38 to US$135.24 per share. With many seeing strong operational gains as a catalyst, you may want to compare how these diverse views relate to APA’s future cash flow and production risks.

Explore 11 other fair value estimates on APA – why the stock might be worth less than half the current price!

Build Your Own APA Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Searching For A Fresh Perspective?

The market won’t wait. These fast-moving stocks are hot now. Grab the list before they run:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com