Market Overview

Natural gas prices are expected to stay comparatively high into late 2025 and 2026, before easing mid-year as seasonal demand fades. This trend is largely tied to constrained global output, expanding export commitments, and ongoing geopolitical uncertainty. Latest US storage reports indicate slight improvements but inventories in several regions still trail their long-term norms, suggesting that the market continues to operate under a delicate supply-demand balance.

With global energy markets facing persistent instability, natural gas has once again become a critical commodity reflecting both energy security concerns and industrial demand recovery.

Storage and Supply Dynamics

National natural gas inventories display uneven regional outcomes according to the most recent storage data EIA:

Storage levels in the South-Central and Pacific zones sit beneath their five-year norms, leaving these areas with less buffer capacity during high-demand winter periods.

Midwest and Eastern regions maintain moderate inventory buffers but expected heating requirements may accelerate drawdowns.

The overall US storage picture reflects adequate but fragile balances, leaving the market highly sensitive to both weather variations and export fluctuations. Any unplanned disruptions or cold spells could quickly tighten conditions further.

Price Trends and Futures Outlook

Futures pricing for natural gas continues to trade at the upper end of the yearly range:

Current reporting week prices are in the $4.0–$4.4 per million British thermal units (MMBtu) range, up significantly from $1.83/MMBtu (EIA) during the same period last year.

Pricing for contracts extending into late 2026 suggests investors expect continued market strength and only minor potential for price softening.

Compared to the prior reporting week, the market shows continued firmness, signalling investor confidence in a persistently tight supply scenario.

Geopolitical and Export Factors

Global market sentiment continues to be shaped by several macro-level influences:

Ongoing unrest across Eastern Europe and the Middle East has complicated international gas movement and introduced additional risk premiums into the market.

The US continues to record vigorous LNG shipment volumes, reinforcing steady trade links with Asia and Europe.

Weather driven demand remains a key wildcard, especially given early indicators of a colder-than-normal winter season across the Northern Hemisphere.

These factors collectively reinforce a bullish pricing environment, where traders anticipate potential supply constraints through early 2026.

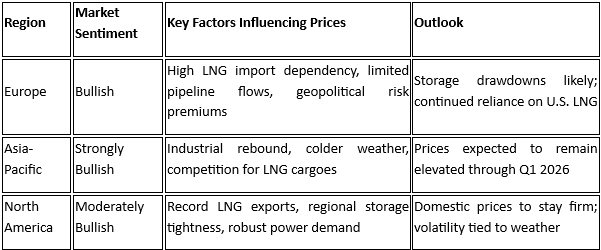

North America

Domestic supply remains constrained as LNG exports continue to absorb a growing share of output. The South-Central region home to major LNG terminals shows below average storage levels, reflecting persistent outbound flows. Industrial and power sector demand remains firm, further tightening balances.

Europe

European natural gas markets remain highly sensitive to global price movements and geopolitical risks. Despite improved storage levels compared to 2022–2023 crisis years, gas inventories are being drawn down faster due to cold weather and reduced pipeline inflows from Russia and North Africa.

To safeguard winter supply, European buyers are increasing US LNG purchases, at times accepting higher prices to guarantee timely deliveries. This sustained import pull continues to elevate European benchmark prices and indirectly supports US price strength.

Asia-Pacific

Asia remains the key driver of global LNG demand growth. Rising consumption in China, Japan, South Korea, and India has intensified competition for LNG supplies, especially as industrial activity rebounds.

Asian spot LNG prices continue to climb, buoyed by weather-related consumption spikes and scarce new liquefaction capacity coming online. Several buyers have increased long-term contract purchases to hedge against future volatility, tightening the overall seaborne balance.

The region’s seasonal demand surge is expected to peak between December 2025 and February 2026, coinciding with potential cold waves and contributing to global price firmness.

Short-Term Outlook (Q4 2025 – Q1 2026)

Natural gas markets are expected to remain tight and volatile into early 2026. Key watch factors include:

Colder than expected temperatures across North America, Europe, and East Asia.

Potential shipping bottlenecks at major LNG export terminals and routes.

Escalating geopolitical tensions, particularly those affecting LNG transit through the Suez Canal or key choke points.

Exchange rate fluctuations influencing energy import costs for Asian buyers.

Overall, the market’s short-term direction is likely to stay upward biased, with limited downside until new supply capacity or warmer weather conditions emerge.

Regional Impact Summary: Asia and Europe