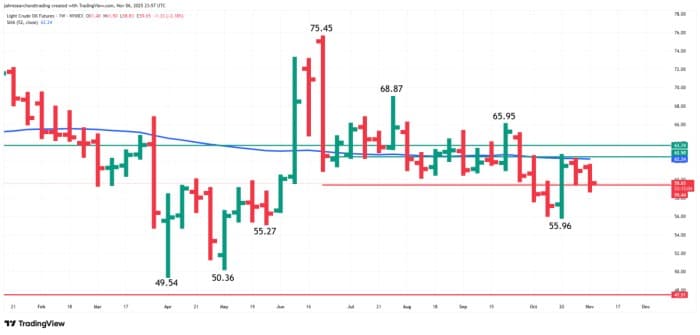

Light crude oil futures are on track to finish the week lower after failing to confirm a recent closing price reversal bottom for the second time. As of Thursday’s close, the market is trading at $59.70, down $1.28 or -2.10%. With one session remaining, traders remain focused on the fundamental backdrop, which continues to tilt bearish.

OPEC+ Output Strategy Fails to Convince Market

OPEC+ attempted to stabilize prices by confirming a modest 137,000 barrels per day (bpd) increase in December and signaling a pause on further production hikes in early 2025. While the move was designed to address oversupply concerns, it fell flat with traders. The pause was seen less as proactive supply management and more as a reluctant admission of the growing surplus expected in early 2025.

Saudi Arabia’s pricing strategy added to the downbeat mood. The kingdom cut its official selling prices for December deliveries to Asia, signaling weak regional demand and reinforcing the message of a well-supplied global market. The price reduction is widely interpreted as a competitive response to eroding refinery margins and sluggish buying interest among key Asian importers.

U.S. Production and Inventories Add to Bearish Sentiment

Adding to the supply-heavy tone, U.S. crude production remains elevated. The Energy Information Administration (EIA) confirmed that U.S. output reached a record 13.8 million bpd in August, extending a months-long streak of strong production that…